Calculate North Carolina Income Tax

Understanding the intricacies of North Carolina's income tax system is crucial for individuals and businesses operating within the state. The tax structure is designed to contribute to the state's revenue while ensuring compliance and fairness. This comprehensive guide aims to provide an in-depth analysis of North Carolina's income tax, offering insights into its calculation, rates, deductions, and more.

The Landscape of North Carolina’s Income Tax

North Carolina, like many states, employs a progressive income tax system, meaning that higher incomes are taxed at higher rates. This approach aims to maintain a balance between individual financial obligations and state revenue generation. The state’s tax structure is unique in several aspects, which we will explore in detail.

Income Tax Rates and Brackets

As of the 2023 tax year, North Carolina imposes a flat tax rate of 5.25% on all taxable income. This is a significant change from previous years, as the state previously had a graduated tax system with multiple brackets. The flat rate simplifies the tax calculation process, providing a consistent percentage for all taxpayers.

However, it's important to note that the taxable income for individuals and corporations is calculated after certain deductions and exemptions are applied. These deductions can significantly reduce the tax liability, making the effective tax rate lower than the flat 5.25%.

| Taxable Income Range | Tax Rate |

|---|---|

| $0 - $35,000 | 5.25% |

| $35,001 and above | 5.25% |

Calculating Taxable Income

The first step in calculating your North Carolina income tax is determining your taxable income. This is derived from your gross income after certain adjustments and deductions.

Gross income includes all income sources such as wages, salaries, bonuses, tips, self-employment income, dividends, interest, rental income, and more. It's important to note that certain income types, like some government benefits, may be exempt from taxation.

From your gross income, you can deduct specific expenses and adjustments to arrive at your taxable income. These deductions may include business expenses, contributions to retirement plans, and certain medical and dental expenses.

Deductions and Exemptions

North Carolina offers a standard deduction, which is a set amount that taxpayers can subtract from their income, reducing their taxable income. For the 2023 tax year, the standard deduction for individuals is 12,950</strong>, while for married couples filing jointly, it's <strong>25,900. Taxpayers can choose to itemize their deductions if their individual expenses exceed the standard deduction.

Additionally, North Carolina provides several tax credits that can further reduce your tax liability. These credits include the Low-Income Tax Credit, Child and Dependent Care Credit, and the Earned Income Tax Credit. Each credit has specific eligibility criteria and documentation requirements.

Taxable Income Example

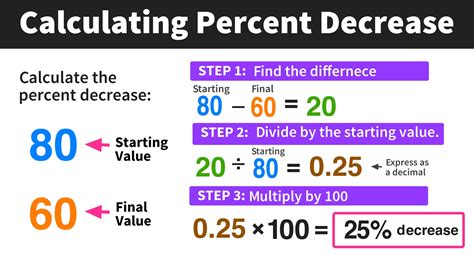

Let’s consider an example to illustrate the calculation process. Suppose an individual has a gross income of 60,000 for the year. After deducting a standard deduction of 12,950 and eligible business expenses of 3,000, their taxable income would be 44,050.

Applying the flat tax rate of 5.25%, the individual's income tax liability would be calculated as follows:

$44,050 x 0.0525 = $2,312.63

This calculation provides a basic understanding of the income tax calculation process. However, it's important to note that this is a simplified example and does not account for potential tax credits or additional deductions that may be applicable.

Filing Requirements and Deadlines

North Carolina residents and businesses are required to file their income tax returns annually. The due date for filing is typically April 15th of the following year. However, in the event that this date falls on a weekend or holiday, the deadline is extended to the next business day.

Filing your income tax return can be done online through the North Carolina Department of Revenue's website, or you can choose to file a paper return. It's crucial to ensure that your return is accurate and complete to avoid penalties and interest charges.

Extensions and Payment Options

If you’re unable to file your tax return by the deadline, you can request an extension. The extension allows you to postpone the filing deadline by six months, giving you until October 15th to submit your return. However, it’s important to note that an extension does not extend the deadline for paying your taxes.

North Carolina offers several payment options, including electronic funds transfer, credit card, and direct debit. You can also pay by check or money order, but ensure that you include the correct remittance voucher with your payment.

Special Considerations for Businesses

Businesses operating in North Carolina have specific tax obligations and requirements. The state imposes various taxes on businesses, including income tax, franchise tax, and sales and use tax. The income tax rate for corporations is 2.5%, which is applied to the corporation’s net income.

Corporations are required to file their income tax returns on a fiscal year basis, with the due date being the 15th day of the third month following the close of their fiscal year. For example, if a corporation's fiscal year ends on December 31st, their tax return would be due by March 15th.

Corporate Income Tax Example

Consider a corporation with a net income of $200,000 for the fiscal year. Applying the corporate income tax rate of 2.5%, the corporation’s income tax liability would be calculated as follows:

$200,000 x 0.025 = $5,000

This calculation provides a basic understanding of the corporate income tax calculation. However, corporations may have additional deductions and credits that can impact their tax liability.

Resources and Support

Calculating and filing your North Carolina income tax can be complex, especially for individuals with diverse income sources or businesses with unique tax obligations. Fortunately, the North Carolina Department of Revenue offers a wealth of resources and support to assist taxpayers.

The Department's website provides detailed guides, forms, and instructions for various tax scenarios. Additionally, taxpayers can access tax calculators and estimators to get an idea of their potential tax liability. For more complex tax situations, it may be beneficial to consult a tax professional or accountant.

Conclusion

North Carolina’s income tax system, with its flat rate structure and various deductions and credits, provides a framework for individuals and businesses to contribute to the state’s revenue while managing their financial obligations. Understanding the tax landscape and staying informed about the latest changes and regulations is crucial for compliance and effective financial planning.

What is the difference between gross income and taxable income in North Carolina?

+Gross income includes all income sources, such as wages, salaries, bonuses, and investments. Taxable income is derived from gross income after specific deductions and adjustments are applied. These deductions can significantly reduce your tax liability.

Are there any tax credits available for North Carolina taxpayers?

+Yes, North Carolina offers several tax credits, including the Low-Income Tax Credit, Child and Dependent Care Credit, and the Earned Income Tax Credit. These credits can reduce your tax liability based on specific eligibility criteria.

What is the due date for filing North Carolina income tax returns?

+The due date for filing North Carolina income tax returns is typically April 15th of the following year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

How can I obtain tax forms and instructions for filing my North Carolina income tax return?

+You can access tax forms and instructions on the North Carolina Department of Revenue’s website. They provide detailed guides and resources to assist taxpayers in completing their returns accurately.

Can I file my North Carolina income tax return electronically?

+Yes, North Carolina offers electronic filing options through their online portal. This method is convenient, secure, and often provides a faster processing time compared to paper returns.