San Jose Tax Rate

Welcome to the comprehensive guide to understanding the San Jose tax rate and its implications for individuals and businesses in the region. This article aims to provide an in-depth analysis of the tax structure, offering valuable insights and expert advice. As we delve into the intricate world of taxation, we'll explore the various components that make up the San Jose tax landscape, ensuring you have the knowledge to navigate it effectively.

Unraveling the San Jose Tax Rate

The city of San Jose, nestled in the heart of Silicon Valley, boasts a dynamic economy fueled by technological innovation and entrepreneurship. With its thriving business environment, understanding the local tax rate becomes crucial for both residents and businesses alike. Let’s embark on a journey to demystify the tax system and uncover the key factors that influence the financial obligations in this vibrant city.

Income Tax: A Core Component

Income tax forms the backbone of San Jose’s tax structure, with residents and businesses contributing to the city’s revenue through their earnings. The income tax rate in San Jose is determined by a combination of federal, state, and local regulations, each playing a vital role in shaping the overall tax burden.

At the federal level, the Internal Revenue Service (IRS) sets the marginal tax rates for individuals and corporations. These rates are progressive, meaning they increase as taxable income rises. For instance, as of the 2023 tax year, the highest marginal tax rate for individuals is 37%, applicable to taxable income above 578,126. On the other hand, the corporate tax rate stands at a flat <strong>21%</strong>, offering a simpler structure for businesses.</p> <p>California, the state in which San Jose is located, imposes its own income tax rates, adding another layer of complexity. The <em>California Franchise Tax Board</em> (FTB) administers these taxes, with rates ranging from <strong>1%</strong> to <strong>12.3%</strong> for individuals and <strong>8.84%</strong> for corporations. This progressive state tax system takes into account factors such as filing status and taxable income, ensuring a fair distribution of tax obligations.</p> <p>Now, let's turn our attention to the local level, where San Jose plays a crucial role in determining the tax landscape. The city imposes its own <strong>local income tax</strong>, adding a <strong>1%</strong> surcharge to the state income tax rate for residents and businesses. This additional tax, known as the <em>City of San Jose Local Tax</em>, funds essential services and infrastructure projects, contributing to the city's overall development.</p> <p>To illustrate the impact of these tax rates, consider a hypothetical scenario where an individual with a taxable income of 100,000 resides in San Jose. By applying the federal, state, and local tax rates, their total income tax liability would amount to approximately 21,788</strong>, including the <strong>1,000 local tax surcharge. This calculation demonstrates the cumulative effect of various tax jurisdictions on an individual’s financial obligations.

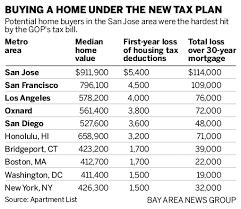

Property Tax: A Local Perspective

Property tax is another significant component of the San Jose tax system, particularly for homeowners and businesses with real estate holdings. California’s Proposition 13, a landmark tax reform initiative, sets the framework for property taxation in the state. This proposition, passed in 1978, introduced a 1% tax rate on the assessed value of properties, with assessments limited to a 2% annual increase unless the property changes ownership.

In San Jose, the Santa Clara County Assessor’s Office is responsible for assessing property values and calculating tax liabilities. While the base tax rate remains 1%, additional assessments and special taxes may be levied by local government entities, such as school districts or special purpose districts. These supplemental taxes fund specific projects or services, further contributing to the overall property tax burden.

Let’s consider a residential property in San Jose with an assessed value of 500,000</strong>. Applying the <strong>1%</strong> tax rate results in an annual property tax bill of <strong>5,000. However, if there are supplemental taxes in place, such as a 0.25% assessment for a local school district, the total property tax liability would increase to $5,125. This example highlights the potential impact of various tax jurisdictions on property owners in San Jose.

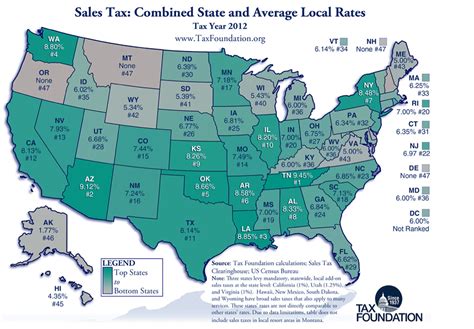

Sales and Use Tax: Consumer Considerations

Sales and use tax is an essential part of the San Jose tax structure, impacting both consumers and businesses engaged in sales activities. The state of California imposes a 7.25% sales and use tax rate, which is applied to the sale of tangible personal property and certain services. This rate is composed of a 6% state rate and additional local rates, which vary across cities and counties.

In San Jose, the local sales and use tax rate stands at 1.25%, bringing the combined rate to 8.5%. This means that when you purchase goods or certain services in San Jose, you pay a 8.5% tax on the total purchase amount. For instance, buying a laptop for 1,000</strong> would result in a sales tax liability of <strong>85, with 72.50</strong> going to the state and <strong>12.50 to the city.

Businesses operating in San Jose must collect and remit this sales tax to the California Department of Tax and Fee Administration (CDTFA). Failure to comply with sales tax regulations can lead to penalties and interest, underscoring the importance of accurate tax collection and reporting.

Business Taxes: Navigating the Landscape

For businesses operating in San Jose, understanding the tax obligations is crucial for financial planning and compliance. In addition to income and sales taxes, businesses may be subject to various other taxes, depending on their industry and activities.

- Franchise Tax: Corporations and certain business entities are required to pay a minimum franchise tax of 800</strong> annually to the <em>California Franchise Tax Board</em>. This tax is separate from income tax and is designed to support the administration of business regulations.</li> <li><strong>Employment Taxes</strong>: Employers in San Jose must navigate a range of employment taxes, including <em>Federal Insurance Contributions Act</em> (FICA) taxes, <em>Federal Unemployment Tax Act</em> (FUTA) taxes, and state employment taxes. These taxes fund social security, Medicare, and unemployment benefits, impacting both the employer and employee.</li> <li><strong>Business License Tax</strong>: San Jose requires businesses to obtain a business license and pay a corresponding tax. The tax rate varies based on the type of business and its gross receipts. For instance, a retail business with annual gross receipts exceeding <strong>100,000 may be subject to a 0.3% tax on the excess amount.

Navigating the business tax landscape requires careful planning and compliance with various tax regulations. Businesses should stay informed about their tax obligations to avoid penalties and ensure smooth financial operations.

Tax Incentives and Credits: Opportunities for Growth

Amidst the tax obligations, San Jose offers a range of tax incentives and credits to encourage economic growth, job creation, and community development. These incentives provide opportunities for businesses and individuals to reduce their tax liabilities while contributing to the city’s prosperity.

One notable tax incentive is the California Competes Tax Credit (CCTC), a state program designed to attract and retain businesses. The CCTC offers tax credits to businesses that create jobs and invest in California. Eligible businesses can apply for credits through a competitive application process, with awards ranging from 100,000</strong> to <strong>45 million. This program has proven successful in attracting major corporations and fostering economic growth.

Additionally, San Jose provides local tax incentives, such as the Small Business Incentive Program (SBIP). This program offers tax credits to small businesses that create jobs and invest in the city. Eligible businesses can receive a 10% tax credit on their local income tax liability, providing a significant incentive for business expansion and job creation.

Individuals and businesses should explore these tax incentives and credits to take advantage of the opportunities they present. Staying informed about eligibility criteria and application processes can lead to substantial tax savings and contribute to the city’s economic development.

Tax Compliance and Filing: A Step-by-Step Guide

Navigating the tax landscape requires a systematic approach to ensure compliance and minimize errors. Here’s a step-by-step guide to help individuals and businesses navigate the tax filing process in San Jose:

- Gather Documentation: Collect all relevant tax documents, including W-2 forms, 1099 forms, business records, and property tax assessments. Ensure that you have accurate and up-to-date information for a smooth filing process.

- Determine Tax Liability: Calculate your tax liability based on your income, property holdings, and business activities. Use tax software or seek professional assistance to ensure accuracy.

- Prepare Tax Returns: Fill out the appropriate tax forms, such as Form 1040 for individuals or Form 1120 for corporations. Double-check your calculations and ensure all required information is included.

- File and Pay Taxes: Submit your tax returns to the relevant tax authorities, including the IRS, California Franchise Tax Board, and the City of San Jose. Pay any outstanding taxes by the due date to avoid penalties.

- Keep Records: Maintain organized records of your tax filings, payments, and documentation. This ensures easy access for future reference and simplifies the process for future tax years.

Staying organized and proactive throughout the tax filing process is essential. By following these steps and seeking professional guidance when needed, individuals and businesses can navigate the tax landscape with confidence and ensure compliance.

Expert Insights and Tips

As a tax expert, here are some valuable insights and tips to help you navigate the San Jose tax landscape more effectively:

- Stay Informed: The tax landscape is dynamic, with frequent changes in regulations and incentives. Stay updated on tax news and legislation to ensure you’re aware of any changes that may impact your tax obligations.

- Utilize Tax Software: Tax software can simplify the tax filing process, reducing the risk of errors and providing accurate calculations. Consider using reputable tax software to streamline your tax preparations.

- Seek Professional Advice: Tax laws can be complex, especially for businesses with unique circumstances. Engaging a tax professional or accountant can provide specialized guidance and ensure compliance with all applicable tax regulations.

- Explore Tax Credits and Incentives: Don’t miss out on potential tax savings. Research and apply for tax credits and incentives that align with your business or personal circumstances. These opportunities can significantly reduce your tax burden.

- Plan for the Future: Tax planning is an essential component of financial management. Work with a financial advisor or tax professional to develop a long-term tax strategy that aligns with your goals and helps you optimize your tax position.

By staying informed, leveraging technology, and seeking professional guidance, you can navigate the San Jose tax landscape with confidence and maximize your financial opportunities.

Conclusion: Embracing the San Jose Tax Landscape

Understanding the San Jose tax rate is a critical aspect of financial planning and compliance for individuals and businesses alike. By unraveling the intricacies of income tax, property tax, sales tax, and business taxes, we’ve gained a comprehensive understanding of the tax obligations in this vibrant city.

As we’ve explored, the tax landscape in San Jose is influenced by a combination of federal, state, and local regulations, each contributing to the overall tax burden. From income tax rates to property assessments and sales taxes, every component plays a vital role in shaping the financial landscape of the city.

However, amidst the tax obligations, San Jose offers a range of tax incentives and credits that provide opportunities for growth and development. These incentives, aimed at attracting businesses and fostering economic prosperity, present a unique advantage for those who take the time to understand and utilize them effectively.

As you navigate the tax landscape, remember that knowledge is power. By staying informed, seeking professional guidance when needed, and embracing the opportunities presented by tax incentives, you can optimize your financial position and contribute to the vibrant economy of San Jose.

| Tax Type | Rate |

|---|---|

| Federal Income Tax | Marginal rates up to 37% |

| California State Income Tax | 1% - 12.3% |

| City of San Jose Local Income Tax | 1% |

| Property Tax | 1% base rate, with potential supplemental taxes |

| Sales and Use Tax | 8.5% (7.25% state rate + 1.25% local rate) |

What is the overall tax burden for individuals in San Jose compared to other cities in California?

+

San Jose’s tax burden for individuals is generally considered moderate compared to other major cities in California. While the city imposes its own local income tax and sales tax, the overall rates are competitive. However, factors such as property values and personal circumstances can influence the actual tax liability for individuals.

Are there any tax breaks or deductions available for homeowners in San Jose?

+

Yes, homeowners in San Jose may be eligible for various tax breaks and deductions. One notable example is the California Homeowner’s Property Tax Exemption, which provides a property tax exclusion for eligible homeowners. Additionally, energy-efficient home improvements may qualify for tax credits, further reducing the property tax burden.

How can businesses reduce their tax liabilities in San Jose?

+

Businesses in San Jose can explore a range of strategies to reduce their tax liabilities. This includes taking advantage of tax incentives like the California Competes Tax Credit and the Small Business Incentive Program. Proper tax planning, such as optimizing business structures and expenses, can also lead to significant tax savings.