Does Arizona Have Sales Tax

When considering the fiscal landscape of any state, understanding its tax structure is crucial, especially for businesses and consumers alike. In the case of Arizona, a state known for its vibrant desert cities and diverse landscapes, the question of sales tax is an important one. This article delves into the specifics of Arizona's sales tax system, providing a comprehensive guide to help navigate the financial intricacies of doing business or making purchases within the state.

The Arizona Sales Tax: An Overview

Arizona, like many other states in the US, imposes a sales tax on various goods and services. This tax is a crucial revenue generator for the state, contributing significantly to its overall budget. The sales tax is a type of consumption tax, which means it is charged on the sale of tangible personal property and certain services. It is an important source of income for the state, helping fund essential services and infrastructure development.

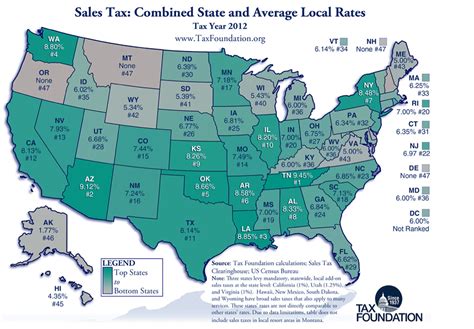

The sales tax rate in Arizona is not a flat rate across the state. Instead, it is composed of a state-level sales tax rate and additional local rates that may vary by jurisdiction. This means that the total sales tax rate can differ from one area to another within Arizona. Understanding this variation is key for businesses operating in multiple locations and for consumers planning their budgets.

State-Level Sales Tax Rate

As of the latest available information, the state-level sales tax rate in Arizona stands at 5.6%. This rate is a general tax applied to most retail sales within the state. It is an important revenue stream for the state government, contributing to a range of public services and projects.

Local Sales Tax Rates

In addition to the state-level sales tax, Arizona also allows for the imposition of local sales taxes by counties and municipalities. These local rates can add up significantly, often increasing the total sales tax rate above the state-level rate. For instance, some cities in Arizona may have a local sales tax rate of 2%, bringing the total sales tax rate to 7.6% in those areas.

The specific local sales tax rates can vary widely, with each county or municipality setting its own rate. This can lead to a complex web of different tax rates across the state. For businesses, especially those with multiple locations, keeping track of these variations is essential for accurate pricing and compliance.

Sales Tax Exemptions and Special Rates

While the general sales tax rate in Arizona applies to most goods and services, there are certain exceptions and special rates to be aware of. Some items, such as certain foods, prescription drugs, and some medical devices, are exempt from sales tax. These exemptions are designed to ease the financial burden on specific sectors and provide relief to consumers.

Additionally, there are special sales tax rates for specific industries. For instance, the sale of aircraft parts is subject to a 2.25% sales tax rate, while the sale of certain construction materials may be subject to a 1.5% rate. These special rates are an important consideration for businesses operating in these sectors.

| Item | Sales Tax Rate |

|---|---|

| General Merchandise | 5.6% |

| Food | 0% (Exempt) |

| Prescription Drugs | 0% (Exempt) |

| Aircraft Parts | 2.25% |

| Construction Materials | 1.5% |

Sales Tax Collection and Remittance

The process of collecting and remitting sales tax in Arizona is an important responsibility for businesses. Here’s a simplified breakdown of the process:

Collection at Point of Sale

When a sale is made, the business is responsible for collecting the applicable sales tax from the customer. This tax is calculated based on the total purchase amount and the relevant sales tax rate(s) for that jurisdiction.

Remittance to Tax Authorities

Once the sales tax is collected, businesses are required to remit this tax to the appropriate tax authorities. In Arizona, this typically involves filing periodic sales tax returns and paying the collected tax to the Arizona Department of Revenue.

The frequency of filing sales tax returns can vary. Some businesses may file monthly, while others file quarterly or annually, depending on their sales volume and other factors. It's important for businesses to understand their filing requirements to ensure timely and accurate remittance.

Compliance and Audits

Compliance with sales tax regulations is crucial to avoid penalties and legal issues. The Arizona Department of Revenue conducts audits to ensure businesses are accurately collecting and remitting sales tax. These audits can cover a range of areas, including tax rates, exemptions, and reporting accuracy.

Being prepared for audits involves maintaining accurate records, including sales data, tax calculations, and any exemptions applied. It's also beneficial to stay updated on any changes to sales tax regulations to ensure ongoing compliance.

The Impact of Sales Tax on Consumers and Businesses

The sales tax system in Arizona has a direct impact on both consumers and businesses. For consumers, the sales tax adds to the cost of goods and services, influencing purchasing decisions and overall spending habits.

Businesses, on the other hand, face the challenge of incorporating sales tax into their pricing strategies. They must also ensure they are compliant with tax regulations, which can be complex with varying tax rates and exemptions. Accurate sales tax management is crucial for maintaining a healthy bottom line and avoiding legal issues.

Sales Tax and Online Sales

With the rise of e-commerce, the sales tax landscape has become even more complex. Arizona, like many other states, has regulations in place to ensure that online sales are also subject to sales tax. This includes sales made by out-of-state retailers to Arizona residents.

For online businesses, especially those operating in multiple states, understanding and implementing these regulations can be a significant challenge. It often involves utilizing tax calculation software and staying updated on the latest tax laws to ensure compliance.

Conclusion

Arizona’s sales tax system, with its varying rates and exemptions, presents a complex but essential aspect of the state’s financial landscape. For businesses, staying informed and compliant is key to success. This involves understanding the tax rates, exemptions, and regulations, as well as utilizing tools and resources to simplify the process.

For consumers, being aware of the sales tax rates can help with budgeting and making informed purchasing decisions. Whether it's a local business owner or a consumer planning their next purchase, understanding Arizona's sales tax is an important step toward financial literacy and compliance.

What is the state-level sales tax rate in Arizona?

+

The state-level sales tax rate in Arizona is currently 5.6%.

Are there local sales taxes in Arizona?

+

Yes, Arizona allows for local sales taxes to be imposed by counties and municipalities. These local rates can vary, and they are added on top of the state-level sales tax rate.

What items are exempt from sales tax in Arizona?

+

Certain items are exempt from sales tax in Arizona, including certain foods, prescription drugs, and some medical devices. These exemptions are designed to provide relief to consumers and specific sectors.

How often do businesses need to file sales tax returns in Arizona?

+

The frequency of filing sales tax returns in Arizona can vary based on factors such as sales volume. Some businesses may file monthly, while others file quarterly or annually. It’s important for businesses to understand their specific filing requirements.

How does Arizona regulate sales tax for online sales?

+

Arizona has regulations in place to ensure that online sales are subject to sales tax, including sales made by out-of-state retailers to Arizona residents. This often involves the use of tax calculation software and staying updated on the latest tax laws.