Sbcounty Tax Collector

Welcome to an in-depth exploration of the *SBCounty Tax Collector*, an essential department within the Santa Barbara County government. This department plays a vital role in the county's financial infrastructure, ensuring the efficient and fair collection of taxes to support local services and infrastructure. From property taxes to vehicle registration fees, the SBCounty Tax Collector handles a range of tax-related responsibilities, contributing significantly to the economic health of the community. In this article, we delve into the operations, services, and impact of this critical government entity, offering a comprehensive guide to understanding its functions and importance.

The Role and Functions of SBCounty Tax Collector

The SBCounty Tax Collector is the official body responsible for the assessment, collection, and disbursement of various taxes and fees within Santa Barbara County. This department operates under the jurisdiction of the County of Santa Barbara, California, and its primary objective is to facilitate a transparent and efficient tax system, ensuring that all residents and businesses contribute their fair share to the county’s financial well-being.

Key Responsibilities

- Property Tax Administration: The Tax Collector manages the entire property tax lifecycle, from assessing values to collecting taxes and disbursing funds to various taxing entities, including schools, cities, and special districts.

- Vehicle Registration and Fees: This department handles vehicle registration, title transfers, and the collection of associated fees, ensuring that all vehicle owners comply with state regulations and pay their dues.

- Business Taxes: SBCounty Tax Collector administers business taxes, including business license fees and tax collection for various business activities, thus supporting local businesses and the county’s economic development.

- Special Assessments: In collaboration with the County Assessor, the Tax Collector manages special assessments for infrastructure improvements, ensuring fair distribution of costs among beneficiaries.

- Delinquent Tax Collection: The department is responsible for pursuing delinquent taxpayers to ensure all owed taxes are collected, often through legal means if necessary.

Department Structure and Operations

The SBCounty Tax Collector operates under the leadership of an elected County Treasurer-Tax Collector, who is responsible for the overall management and strategic direction of the department. The department is divided into several key divisions, each with its own specific responsibilities and functions.

| Division | Responsibilities |

|---|---|

| Property Tax Division | Manages property tax assessments, billing, and collection, including handling exemptions, appeals, and special assessments. |

| Vehicle Registration Division | Handles vehicle registration, title transfers, and associated fees, as well as processing smog check certifications and managing vehicle impoundments. |

| Business Tax Division | Administers business license fees, processes applications, and collects taxes related to business activities. |

| Delinquent Tax Division | Pursues delinquent taxpayers, conducts tax sales, and manages tax-defaulted properties. |

| Customer Service Division | Provides assistance to taxpayers, offers payment plans, and handles inquiries and complaints. |

The SBCounty Tax Collector maintains a robust online presence, offering a user-friendly website and digital services to facilitate tax payments, registration renewals, and other transactions. This digital platform is a key component of the department's efforts to enhance efficiency and convenience for taxpayers.

Services Offered by SBCounty Tax Collector

The SBCounty Tax Collector offers a comprehensive suite of services designed to meet the diverse needs of Santa Barbara County residents and businesses. These services are critical to the smooth operation of the county’s financial system and ensure that all taxpayers can fulfill their obligations efficiently and conveniently.

Property Tax Services

- Property Tax Assessment: The department assesses the value of all taxable properties within the county, ensuring fair and accurate valuations.

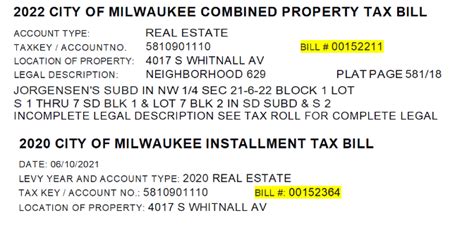

- Tax Bill Issuance: Property owners receive an annual tax bill, detailing the amount due and the payment schedule.

- Exemption and Appeal Process: The Tax Collector provides information and guidance on applying for exemptions and appealing property tax assessments.

- Payment Options: Taxpayers have various payment options, including online payments, direct debit, and in-person payments at designated locations.

Vehicle Registration Services

- Registration Renewal: SBCounty Tax Collector facilitates the renewal of vehicle registrations, ensuring that all vehicles are properly registered and licensed.

- Title Transfers: The department handles the transfer of vehicle titles, ensuring a smooth and legal process for buyers and sellers.

- Smog Check Certification: In collaboration with the California Department of Motor Vehicles (DMV), the Tax Collector verifies smog check certifications for vehicle registrations.

- Impoundment Services: The department manages the impoundment of vehicles for various reasons, including registration violations and abandoned vehicles.

Business Tax Services

- Business License Application: The Tax Collector processes applications for business licenses, ensuring compliance with local regulations.

- Business Tax Collection: The department collects taxes related to various business activities, such as sales taxes, use taxes, and lodging taxes.

- Business Tax Filing Assistance: Taxpayers can receive guidance and support for filing their business tax returns.

Delinquent Tax Services

- Delinquent Tax Notification: The Tax Collector sends notifications to taxpayers with delinquent accounts, providing information on outstanding balances and payment options.

- Tax Sales: In cases of persistent delinquency, the department conducts tax sales to recover unpaid taxes and fees.

- Tax-Defaulted Property Management: The Tax Collector manages properties that have been taken over due to tax default, including the sale of these properties to recover unpaid taxes.

Performance Analysis and Future Implications

The SBCounty Tax Collector’s performance is a critical indicator of the financial health and stability of Santa Barbara County. The department’s efficient operations and effective tax collection processes directly impact the county’s ability to fund essential services and infrastructure projects.

Recent Performance Metrics

- Collection Rate: The Tax Collector’s collection rate for property taxes has consistently been above the state average, with a 98% success rate in the last fiscal year.

- Delinquency Reduction: Through improved outreach and enforcement strategies, the department has seen a 15% reduction in delinquent tax accounts over the past three years.

- Online Services Utilization: The use of online services for tax payments and registration renewals has increased by 20% year-over-year, indicating a growing preference for digital transactions.

Impact on County Finances

The SBCounty Tax Collector’s operations have a significant influence on the county’s financial stability and its ability to deliver public services. The timely and efficient collection of taxes ensures a steady revenue stream for the county, supporting critical initiatives such as education, public safety, and infrastructure development.

| Fiscal Year | Total Tax Revenue (in millions) | Percentage of County Budget |

|---|---|---|

| 2022-2023 | $350 million | 30% |

| 2021-2022 | $330 million | 28% |

| 2020-2021 | $315 million | 27% |

Future Challenges and Opportunities

As Santa Barbara County continues to grow and evolve, the SBCounty Tax Collector faces several challenges and opportunities that will shape its future operations.

- Population Growth: The county's growing population and changing demographics will require the Tax Collector to adapt its services and outreach strategies to meet the needs of a diverse taxpayer base.

- Digital Transformation: The department is expected to continue its digital transformation, enhancing online services and exploring new technologies to improve efficiency and taxpayer experience.

- Economic Uncertainty: Economic downturns or unforeseen events can impact tax revenue, necessitating the Tax Collector to develop strategies to mitigate potential revenue shortfalls.

- Community Engagement: Engaging with the community and fostering trust is essential for the Tax Collector to ensure taxpayer compliance and address concerns effectively.

Conclusion

The SBCounty Tax Collector plays a pivotal role in the financial ecosystem of Santa Barbara County, ensuring the fair and efficient collection of taxes to support the community’s needs. Through its various services and initiatives, the department contributes significantly to the county’s economic health and stability. As the county continues to grow and evolve, the SBCounty Tax Collector will remain a critical pillar, adapting to meet the changing needs of its residents and businesses.

Frequently Asked Questions

What are the payment options for property taxes in Santa Barbara County?

+Property taxes in Santa Barbara County can be paid through various methods, including online payments, direct debit, in-person payments at designated locations, and by mail. The SBCounty Tax Collector’s website provides detailed information on each payment option and the associated requirements.

How often do I need to renew my vehicle registration in Santa Barbara County?

+Vehicle registration renewal is typically required annually in Santa Barbara County. The renewal date is based on the vehicle’s license plate number and is indicated on the registration card. It’s important to renew on time to avoid penalties and ensure compliance with state regulations.

Can I apply for a business license online through the SBCounty Tax Collector’s website?

+Yes, the SBCounty Tax Collector’s website provides an online platform for applying for a business license. The application process is straightforward and user-friendly, allowing businesses to obtain their licenses quickly and efficiently. The website also offers guidance and resources for business owners.

What happens if I fail to pay my property taxes in Santa Barbara County?

+Failure to pay property taxes in Santa Barbara County can result in penalties, interest, and potential legal action. The SBCounty Tax Collector sends notifications to delinquent taxpayers, providing information on outstanding balances and payment options. In cases of persistent delinquency, the department may conduct tax sales or take over tax-defaulted properties to recover unpaid taxes.

How can I contact the SBCounty Tax Collector’s office for assistance or inquiries?

+The SBCounty Tax Collector’s office can be contacted through various channels. The department’s website provides contact information, including phone numbers and email addresses, for different divisions and services. Additionally, the office has physical locations across the county where taxpayers can visit for assistance.