Tax Alcohol

In the world of finance and accounting, understanding the intricacies of tax regulations is paramount, especially when it comes to unique sectors like the alcohol industry. This article aims to delve into the complex realm of taxation on alcoholic beverages, offering a comprehensive guide for professionals and enthusiasts alike.

The Complex Landscape of Alcohol Taxation

Taxation in the alcohol industry is a multifaceted subject, influenced by a myriad of factors including government policies, economic trends, and societal norms. It involves a delicate balance between revenue generation and regulating the consumption of alcoholic beverages.

This article will navigate through the various aspects of alcohol taxation, exploring the underlying principles, specific tax rates, and the implications for both producers and consumers. By the end of this guide, readers should gain a comprehensive understanding of the role and impact of taxation in the alcohol sector.

Principles of Alcohol Taxation

At its core, the taxation of alcohol is rooted in the principle of excise taxation, a type of indirect tax levied on the production, sale, or consumption of specific goods. In the context of alcohol, excise taxes are typically imposed based on the volume or alcohol content of the beverage.

The rationale behind these taxes is twofold: to generate revenue for the government and to potentially influence consumer behavior by making alcoholic beverages more expensive. This dual purpose of excise taxes makes them a powerful tool for both fiscal and public health policy.

However, the implementation of alcohol excise taxes is not uniform across the globe. Each country or jurisdiction has its own set of regulations, often influenced by cultural norms, economic considerations, and health initiatives.

Taxation by Alcohol Type

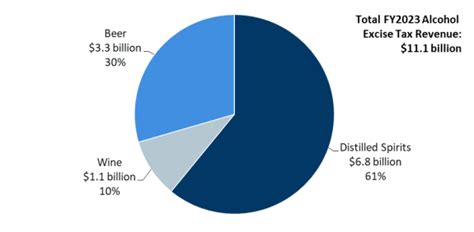

Within the alcohol industry, different types of beverages are often subject to distinct tax rates. For instance, beer, wine, and spirits may each have their own tax classifications and rates. This variation is influenced by factors such as the perceived social acceptability of the beverage, its alcohol content, and the complexity of its production process.

For example, spirits, often with higher alcohol content and more intricate production processes, may be subject to higher excise taxes compared to beer or wine. This differentiation in tax rates can have significant implications for producers, influencing their pricing strategies and market positioning.

Taxation and Alcoholic Beverage Strength

In many jurisdictions, the taxation of alcoholic beverages is directly tied to their alcohol by volume (ABV) content. This means that beverages with higher ABV percentages are typically taxed at a higher rate. This practice aims to encourage moderation by making stronger beverages more expensive.

| Beverage Type | Average ABV Range | Typical Tax Rate |

|---|---|---|

| Beer | 3-12% | Low to Moderate |

| Wine | 8-15% | Moderate |

| Spirits (Whiskey, Vodka) | 30-50% | High |

The table above provides a simplified overview of the typical tax rates for different alcoholic beverages based on their average ABV ranges. However, it's important to note that these rates can vary significantly depending on the specific jurisdiction and other factors such as production volume or brand reputation.

The Impact of Alcohol Taxation

The implementation of alcohol taxes has far-reaching implications, affecting not only the financial health of producers and retailers but also the broader economy and public health landscape.

Financial Impact on Producers

For producers of alcoholic beverages, the impact of taxation is twofold. Firstly, they must bear the initial burden of paying the excise taxes on their products, which can significantly impact their profit margins, especially for smaller producers or those with lower-priced products.

Secondly, producers must consider the potential price sensitivity of consumers. Higher taxes may lead to increased prices, which could deter consumers from purchasing, especially in competitive markets. As such, producers often face a delicate balance between passing on tax increases to consumers and maintaining competitive pricing.

Consumer Behavior and Price Sensitivity

From a consumer perspective, the price of alcoholic beverages is a significant factor in their purchasing decisions. Studies have shown that price increases due to tax hikes can indeed influence consumer behavior, potentially leading to reduced consumption or a shift towards lower-priced alternatives.

However, the price sensitivity of consumers can vary widely. For example, consumers of premium spirits or craft beers may be less price-sensitive compared to those who purchase more inexpensive, mass-produced beers or wines. This variability in consumer behavior further complicates the impact assessment of alcohol taxation.

Economic and Social Considerations

On a broader scale, alcohol taxation has economic and social implications. The revenue generated from these taxes can significantly contribute to a country’s fiscal health, providing funds for various public services and initiatives. Additionally, the potential impact on public health, such as reduced alcohol-related harm, is a key consideration in the implementation of these taxes.

However, there are also concerns about the potential negative economic impacts, particularly on smaller businesses in the alcohol industry and on tourism-reliant economies where alcohol sales play a significant role. Balancing these various considerations is a complex task for policymakers.

Future Implications and Trends

As society evolves and public health initiatives gain prominence, the landscape of alcohol taxation is likely to continue evolving. Here are some key trends and implications to consider for the future:

- Increasing Focus on Public Health: With growing concerns about alcohol-related harm, there may be a trend towards higher taxes on alcoholic beverages, particularly those with higher alcohol content. This could be coupled with increased funding for public health campaigns and initiatives.

- Technological Advances in Tax Collection: The implementation of new technologies, such as blockchain or AI-powered systems, could revolutionize tax collection processes, making them more efficient and potentially reducing administrative burdens for producers.

- Regional Variations and International Trade: Differences in tax rates across regions can influence international trade patterns. As such, understanding and navigating these variations will become increasingly important for global alcohol producers and distributors.

- Sustainability and Environmental Considerations: With a growing focus on sustainability, there may be a shift towards taxing beverages based on their environmental footprint, encouraging producers to adopt more sustainable practices.

In conclusion, the taxation of alcoholic beverages is a complex and multifaceted topic, influenced by a myriad of factors. This article has aimed to provide a comprehensive guide to this intricate subject, offering insights into the principles, rates, and implications of alcohol taxation. As the landscape continues to evolve, staying informed is key for professionals and enthusiasts alike.

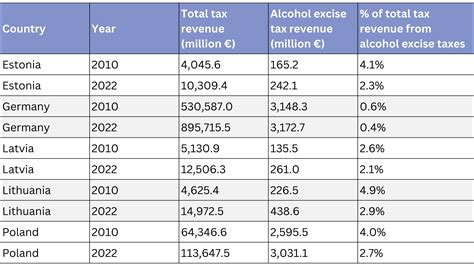

How do alcohol taxes compare across different countries or regions?

+

Alcohol tax rates can vary significantly across countries and regions. Factors such as economic development, cultural norms, and public health priorities influence these variations. For instance, Scandinavian countries often have higher alcohol taxes compared to Mediterranean countries where wine consumption is deeply ingrained in the culture.

What are the potential social benefits of higher alcohol taxes?

+

Higher alcohol taxes can lead to reduced alcohol consumption, which in turn can result in lower rates of alcohol-related harm, such as drunk driving, violence, and health issues. The revenue generated can also be directed towards healthcare, education, or other public services.

Are there any drawbacks to higher alcohol taxes?

+

While higher alcohol taxes can have social benefits, they may also have negative economic impacts, particularly on smaller businesses in the alcohol industry. There are also concerns about potential increases in illicit trade and home brewing.