Virginia Auto Tax

Welcome to a comprehensive exploration of the Virginia Auto Tax, a topic that holds significance for vehicle owners in the state of Virginia. This guide aims to demystify the intricacies of this tax, providing an in-depth analysis to assist residents in understanding their financial obligations and rights. With a focus on clarity and specificity, we delve into the essential aspects, ensuring you have the knowledge to navigate this aspect of vehicle ownership smoothly.

Understanding the Virginia Auto Tax

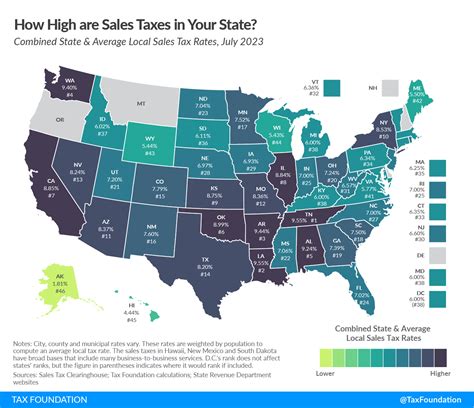

The Virginia Auto Tax, officially known as the Vehicle License Registration Tax, is a state-mandated fee that vehicle owners must pay annually to register their vehicles and obtain license plates. This tax contributes to the state’s revenue, helping to fund various public services and infrastructure development.

While the concept of vehicle registration taxes is common across the United States, each state has its unique set of regulations and rates. Virginia's Auto Tax stands out for its straightforward calculation method and transparent structure, ensuring fairness and predictability for vehicle owners.

Tax Calculation and Rates

The tax calculation in Virginia is based on the value of the vehicle and the applicable tax rate for the specific type of vehicle. Here’s a breakdown of the key factors:

- Vehicle Value: The tax is calculated based on the vehicle's assessed value, which is typically determined by the state's Department of Motor Vehicles (DMV) or a third-party assessor. This value takes into account factors such as the vehicle's make, model, year, and condition.

- Tax Rates: The tax rate varies depending on the vehicle type. For instance, passenger cars have a different rate than motorcycles or commercial vehicles. The rates are set by the state legislature and are subject to change periodically. As of the last update, the tax rates for passenger cars are as follows:

Vehicle Value Tax Rate $20,000 or less 6% $20,001 to $30,000 6.5% $30,001 to $40,000 7% $40,001 and above 7.5%

It's important to note that these rates are subject to change, and it's advisable to refer to the official Virginia DMV website or consult with a tax professional for the most current information.

Registration Process and Due Dates

Vehicle registration in Virginia follows a specific schedule, with due dates based on the vehicle’s registration number. The registration period is typically valid for one year, and owners must renew their registration annually to maintain legal compliance.

The registration process involves submitting the necessary documentation, including proof of vehicle ownership, valid insurance coverage, and payment of the applicable taxes and fees. Online renewal is available through the Virginia DMV website, making the process convenient for many residents.

To ensure timely registration, vehicle owners should be aware of their registration renewal due dates. These dates are typically staggered throughout the year, with specific months assigned for different registration numbers. For instance, vehicles with registration numbers ending in 0 may have a due date in January, while those ending in 5 might be due in June.

It's worth mentioning that Virginia offers a grace period for late registrations, typically lasting for a month after the due date. However, penalties and fees may apply for registrations renewed beyond this grace period.

Benefits and Considerations

While the Virginia Auto Tax is a financial obligation, it comes with several benefits and considerations that vehicle owners should be aware of.

Funding Public Services

The revenue generated from the Auto Tax plays a vital role in funding essential public services and infrastructure projects across Virginia. This includes road maintenance and construction, public transportation improvements, and support for law enforcement and emergency services. By paying this tax, vehicle owners contribute directly to the development and maintenance of their local communities.

Vehicle Value Assessment

The assessment of a vehicle’s value is a critical aspect of the Auto Tax calculation. While the state’s DMV aims for accuracy, it’s important for vehicle owners to understand their rights in this process. If an owner believes their vehicle’s assessed value is incorrect, they have the option to appeal the assessment. This process typically involves providing supporting documentation, such as recent sales records or professional appraisals, to challenge the initial valuation.

Additionally, the vehicle's value can impact the tax rate, as mentioned earlier. Higher-value vehicles may face a steeper tax rate, so it's beneficial for owners to be aware of this aspect when making vehicle purchase decisions.

Exemptions and Special Circumstances

Virginia recognizes that certain vehicle owners may have unique circumstances that warrant exemptions or reduced tax rates. These include:

- Veterans and Military Personnel: Active-duty military personnel and veterans may be eligible for reduced tax rates or exemption from certain vehicle taxes. This is a way for the state to show appreciation for their service.

- Electric and Hybrid Vehicles: To encourage the adoption of environmentally friendly vehicles, Virginia offers reduced tax rates for electric and hybrid vehicles. This initiative promotes sustainable transportation options and reduces the state's carbon footprint.

- Disability Exemptions: Individuals with disabilities may qualify for vehicle tax exemptions if their vehicle is specifically adapted for their disability. This exemption aims to provide financial relief and ensure equal access to transportation for those with special needs.

Expert Insights and Tips

Navigating the world of vehicle taxes can be complex, but with the right knowledge and strategies, vehicle owners can ensure compliance and make informed decisions. Here are some expert insights and tips to keep in mind:

Stay Informed

Tax regulations and rates can change over time, so it’s crucial to stay updated with the latest information. Regularly check the Virginia DMV website or subscribe to their updates to receive notifications about any changes to tax rates or registration procedures.

Plan Your Budget

Vehicle ownership involves various expenses, including the Auto Tax. Budgeting for these costs in advance can help ensure that you have the necessary funds available when it’s time to renew your registration. Consider setting aside a dedicated fund for vehicle-related expenses to avoid financial surprises.

Explore Payment Options

Virginia offers several payment methods for the Auto Tax, including online payments, in-person payments at DMV offices, and even payment plans for eligible individuals. Explore these options to find the most convenient and cost-effective method for your situation.

Keep Records

Maintaining organized records of your vehicle-related expenses, including tax payments and registration renewals, is essential. These records can come in handy for various reasons, such as tax audits, insurance claims, or when selling your vehicle. Consider using digital tools or apps to keep your records easily accessible and secure.

Seek Professional Advice

If you have complex financial circumstances or unique vehicle situations, it’s advisable to consult a tax professional or a legal expert. They can provide personalized guidance based on your specific needs and ensure that you are taking advantage of all available benefits and exemptions.

Conclusion

The Virginia Auto Tax is an essential aspect of vehicle ownership in the state, ensuring that residents contribute to the development and maintenance of their communities. By understanding the tax calculation, registration process, and available benefits, vehicle owners can navigate this obligation with confidence. With the right knowledge and strategies, vehicle ownership in Virginia can be a smooth and financially manageable experience.

What happens if I miss the registration renewal deadline in Virginia?

+If you miss the registration renewal deadline, you may be subject to late fees and penalties. However, Virginia offers a grace period for late registrations, typically lasting for a month after the due date. During this grace period, you can renew your registration without incurring additional fees. Beyond the grace period, penalties and late fees may apply, so it’s important to renew promptly to avoid unnecessary costs.

How can I appeal the assessed value of my vehicle in Virginia?

+If you believe the assessed value of your vehicle is incorrect, you have the right to appeal the assessment. To initiate the appeal process, you need to contact the Virginia Department of Motor Vehicles (DMV) and request a review. You will need to provide supporting documentation, such as recent sales records, professional appraisals, or other evidence that demonstrates the vehicle’s actual value. The DMV will review your appeal and make a determination based on the evidence provided.

Are there any exemptions or discounts available for senior citizens in Virginia’s Auto Tax?

+Yes, Virginia offers specific exemptions and discounts for senior citizens regarding the Auto Tax. Senior citizens who meet certain age and income requirements may be eligible for a reduced registration fee and a waiver of the vehicle personal property tax. To qualify, individuals must be at least 65 years old and have a total household income below a certain threshold. It’s advisable to consult the Virginia DMV website or a tax professional for the most up-to-date information on these exemptions and the specific requirements for eligibility.

Can I transfer my out-of-state vehicle registration to Virginia without paying the Auto Tax?

+When transferring an out-of-state vehicle registration to Virginia, you are typically required to pay the Auto Tax based on the vehicle’s value. However, there may be certain circumstances where you can avoid paying the tax or receive a partial refund. For instance, if you recently purchased the vehicle and already paid the sales tax in another state, you may be eligible for a tax credit or exemption. It’s crucial to consult the Virginia DMV or a tax professional to understand the specific requirements and guidelines for transferring out-of-state registrations.