How to Pay IL State Taxes Efficiently and On Time

Paying state taxes can often feel like navigating an intricate maze of deadlines, forms, and compliance intricacies—especially within Illinois, where the complexities of tax obligations reflect a blend of historic fiscal policies and evolving administrative procedures. The evolution of Illinois tax policies, from early assessments in the 19th century to the sophisticated digital approaches of today, underscores a persistent drive toward efficiency, transparency, and timely collection. Understanding this historical context is essential to mastering how to pay Illinois state taxes effectively and on schedule, ensuring compliance without unnecessary stress or penalties.

The Historical Foundations of Illinois State Taxation and Its Modern Evolution

Illinois’s tax collection history traces back to the state’s founding, where early revenue measures were primarily based on property taxes and tariffs. The abolition of slavery, the rise of industrialization, and subsequent economic shifts prompted significant reforms, culminating in the enactment of income taxes and sales taxes. The ratification of the Illinois Income Tax Act in 1969 marked a pivotal shift, establishing a modern framework for income collection. Over subsequent decades, administrative reforms aimed at streamlining collection methods, including the adoption of electronic filing and payment systems, have been driven by both technological innovation and fiscal necessity.

These structural changes reflect a broader trend toward digitization, with the Illinois Department of Revenue (IDOR) implementing tools to facilitate punctuality and ease of compliance. The transition from paper-based forms to online portals exemplifies a continuous effort to improve taxpayer experience while enhancing revenue integrity. Recognizing these historical patterns enables taxpayers and professionals alike to navigate current obligations with an appreciation of their foundational principles and future directions.

Understanding Illinois Tax Obligations: Types, Deadlines, and Compliance Strategies

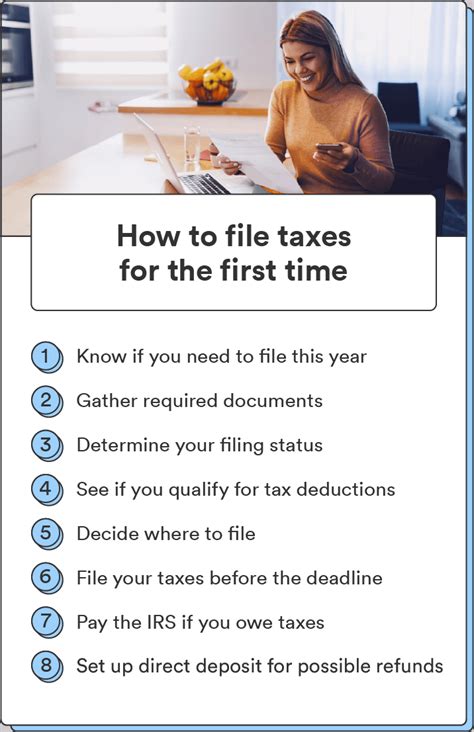

Efficient tax payment begins with comprehension of the various tax types applicable in Illinois—income tax, sales tax, use tax, and property tax, among others. Each category has specific filing deadlines and payment requirements, often intertwined with federal obligations but with notable Illinois-specific nuances.

The Role of Illinois Income Tax

The Illinois income tax, primarily a flat-rate tax currently set at 4.95%, applies to residents, part-year residents, and non-residents earning Illinois-sourced income. The filing deadline aligns with the federal Internal Revenue Service (IRS), typically April 15, with extensions granted upon request. Timely payments are vital to avoid penalties—late payments accrue interest, and failure to pay can trigger enforcement actions.

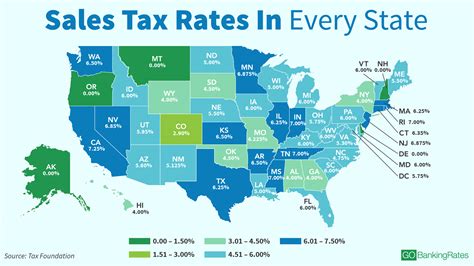

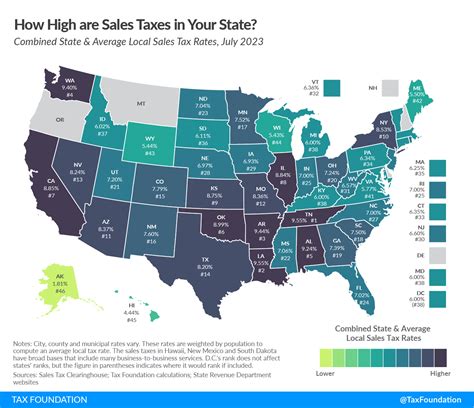

Sales and Use Taxes: Ensuring Regular Remittance

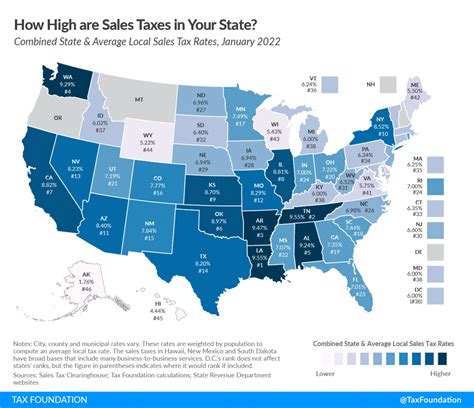

Registered businesses owe sales tax for taxable transactions, with remittances due either monthly, quarterly, or annually, depending on the volume of sales. The Illinois Department of Revenue provides electronic filing capabilities that enhance efficiency and reduce errors, fostering on-time compliance.

Property Taxes and Local Variations

Property taxes, administered locally but collected centrally by the State, follow staggered schedules dictated by county authorities. Property owners must stay informed of local deadlines, often varying significantly across jurisdictions.

| Tax Type | Common Payment Frequency | Typical Deadline |

|---|---|---|

| Income Tax | Annual (with extensions available) | April 15 |

| Sales Tax | Monthly, quarterly, yearly | Varies by filing period |

| Property Tax | Annually, semi-annually | Varies by county; often March/September |

Strategies for Paying Illinois Taxes Efficiently and On Time

Advancing from understanding obligations to implementing effective payment strategies involves leveraging modern technology, planning ahead, and maintaining precise records. The goal: minimize penalties, avoid interest accrual, and streamline the compliance process. Here are detailed approaches grounded in best practices:

Leveraging Electronic Filing and Payment Systems

The Illinois Department of Revenue’s MyTax Illinois platform epitomizes how digitization simplifies tax compliance. By registering an account, taxpayers can schedule payments, receive reminders, and access detailed transaction histories. This portal supports a variety of payment methods, including direct bank transfers, credit card payments, and electronic funds transfers, each with associated fees and processing times.

Consistent use of these platforms reduces the risk of missed deadlines. Furthermore, the integration of auto-debit features enables recurring payments aligned with expected liabilities, thus getting ahead of potential delays or oversights.

Establishing Payment Calendars and Reminders

Due dates can vary, especially for businesses with complex filing schedules. Creating detailed calendars, supplemented by digital reminders—via email or calendar apps—ensures compliance. Using tools like calendar alerts, SMS reminders from tax authorities, or dedicated compliance software can markedly decrease late payments.

Utilizing Estimated Payments and Prepayments

Particularly relevant to self-employed individuals and businesses with fluctuating income streams, estimated quarterly payments prevent year-end burdens and penalties. For Illinois income tax, making quarterly payments based on prior-year liabilities or current estimates spreads out the fiscal obligations evenly, reducing financial strain.

| Key Action | Benefit |

|---|---|

| Regularly update estimated payments | Minimizes underpayment penalties |

| Set automatic reminders for deadlines | Ensures timely submissions |

| Use direct deposit options | Speeds up processing and confirmation |

Overcoming Common Challenges in Illinois Tax Payment and Compliance

Despite sophisticated systems, taxpayers balancing multiple obligations often encounter hurdles such as misclassified income, delayed filings, or misunderstandings of local variations. Recognizing and navigating these challenges requires a nuanced understanding rooted in ongoing education and professional guidance.

Addressing Filing Errors and Record Keeping

Errors in tax filings can cause delays and penalties. Meticulous record keeping—digital or paper—facilitates accurate reporting and audit readiness. Regular reconciliation of bank statements and transaction logs favored by the Illinois Department of Revenue’s portals aids in early detection of discrepancies.

Managing Local Variance in Property Tax Deadlines

Since property taxes are administered locally, varying schedules across counties complicate compliance. Engaging with local assessors’ offices early in the tax cycle and subscribing to official notifications ensures awareness of deadlines and payment options.

Dealing with Late Payments and Penalties

When late payments are unavoidable, immediate communication with Illinois Department of Revenue can mitigate penalties and interest. Payment plans, though subject to approval, are often available for taxpayers facing hardship, reflecting a pragmatic evolution of enforcement policies.

| Common Challenge | Proposed Solution |

|---|---|

| Missed deadlines | Early alerts; automatic payments |

| Incorrect tax classification | Consultation with professional tax advisors |

| Local variation confusion | Proactive local engagement and alerts |

Future Directions: Technological Innovations and Policy Changes in Illinois Tax System

The Illinois tax system’s trajectory is clearly toward enhanced digital integration, cloud-based data management, and real-time compliance monitoring. Legislative proposals aim to introduce more automation, including blockchain verification of transactions, which could revolutionize transparency and efficiency.

Predictive analytics and artificial intelligence are likely to play significant roles in forecasting tax liabilities, prompting a shift from retrospective to proactive compliance models. Staying informed of legislative reforms and technological adaptions remains critical for practitioners and taxpayers who aim to optimize timely payments and minimize risks.

Final Considerations and Practical Recommendations for Taxpayers

The evolution of Illinois’s tax system across history underscores a move toward transparency, efficiency, and taxpayer empowerment. By leveraging digital tools, planning carefully, maintaining good records, and engaging proactively with local authorities, taxpayers can navigate the complexities of Illinois tax obligations with confidence. Staying current with technological advancements and policy shifts ensures not only legal compliance but also financial efficiency and peace of mind.

How early should I start preparing for Illinois tax deadlines?

+Beginning preparation at least one month prior to due dates allows ample time for document collection, estimate adjustments, and troubleshooting unforeseen issues, reducing last-minute errors and stress.

What are the most common penalties for late Illinois tax payments?

+Penalties generally include interest charges on overdue amounts, late filing penalties (often 5% per month up to a maximum), and potential enforcement actions. Early payments and proactive communication mitigate these consequences.

Are there benefits to setting up automatic payments for Illinois taxes?

+Yes, automatic payments reduce the risk of missed deadlines, ensure timely obligations, and can simplify cash flow management. They are especially useful for recurring obligations and estimated payments.

How has digital transformation improved Illinois tax compliance?

+Digital platforms like MyTax Illinois streamline filing, enable real-time payment tracking, reduce errors, and facilitate communication with tax authorities, significantly enhancing compliance efficiency.

What should I do if I cannot pay my Illinois taxes on time?

+Contact the Illinois Department of Revenue promptly to discuss available payment plans or hardship accommodations. Early engagement can prevent escalation of penalties and interest.