Sales And Use Tax Nc

Sales and use tax is an essential aspect of state revenue generation in the United States, with each state implementing its own set of regulations and rates. North Carolina, known as the Tar Heel State, has a unique sales and use tax structure that impacts businesses and consumers alike. This article aims to delve into the intricacies of North Carolina's sales and use tax, exploring its history, current regulations, and the implications it has on the state's economy and businesses.

Understanding North Carolina’s Sales and Use Tax

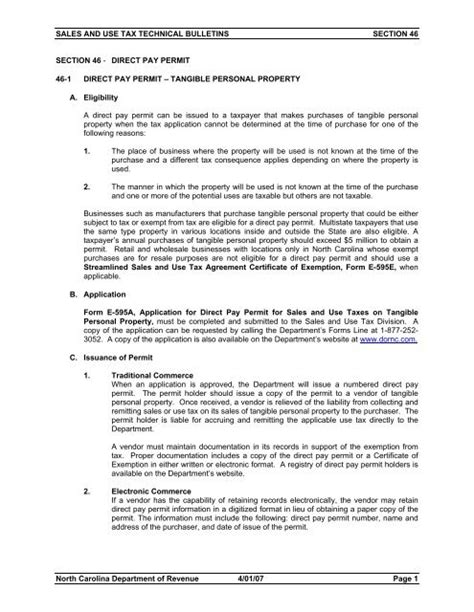

North Carolina’s sales and use tax system is a complex yet crucial mechanism for funding various state initiatives and programs. The state imposes a sales tax on the sale of tangible personal property and certain services, while the use tax applies to purchases made outside the state but used within North Carolina. This dual system ensures that businesses and consumers contribute fairly to the state’s revenue stream.

Historical Perspective

The roots of North Carolina’s sales tax can be traced back to the early 20th century. The state first introduced a sales tax in 1933 as a temporary measure to fund relief efforts during the Great Depression. However, it soon became a permanent fixture, evolving into a significant source of revenue for the state. Over the years, the sales tax rate has undergone several adjustments, with the latest change occurring in 2018, when the state implemented a unified sales and use tax rate.

Current Sales and Use Tax Structure

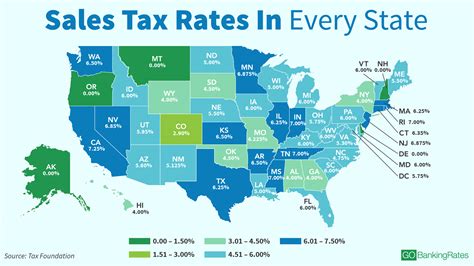

As of my last update in January 2023, North Carolina has a unified sales and use tax rate of 4.75%. This base rate is applied uniformly across the state and is combined with local government rates, resulting in a combined rate that varies depending on the county. For instance, in the city of Charlotte, the total sales and use tax rate is 7.25%, consisting of the state’s 4.75% base rate and an additional 2.5% local rate.

It's important to note that not all items are subject to the full sales tax rate. Certain items, such as unprepared food, prescription drugs, and some medical devices, are exempt from the sales tax. Additionally, North Carolina offers various tax incentives and credits to businesses, aiming to stimulate economic growth and attract new investments.

| Tax Type | Rate |

|---|---|

| State Sales and Use Tax | 4.75% |

| Charlotte (City) Sales and Use Tax | 2.5% |

| Combined Sales and Use Tax (Charlotte) | 7.25% |

Registration and Compliance

Businesses operating within North Carolina or selling goods or services to North Carolina residents are required to register with the North Carolina Department of Revenue. This registration process ensures that businesses comply with the state’s sales and use tax regulations. Failure to register or comply with tax obligations can result in penalties and interest charges.

To assist businesses in navigating the tax landscape, the state offers resources and guidance through the North Carolina Department of Revenue's website. This includes detailed information on tax rates, filing requirements, and various tax forms. Additionally, the state provides tools for businesses to calculate and remit sales and use taxes accurately.

Impact on Businesses and the Economy

North Carolina’s sales and use tax system has a significant impact on the state’s economy and businesses. It provides a stable source of revenue for the state, contributing to infrastructure development, education, and other vital public services.

Economic Growth and Development

The sales and use tax plays a pivotal role in fostering economic growth and development in North Carolina. The revenue generated from these taxes funds essential infrastructure projects, such as road construction and maintenance, which are crucial for facilitating business operations and attracting new investments. Additionally, the tax revenue supports education initiatives, ensuring a skilled workforce for the future.

Furthermore, North Carolina's competitive sales tax rate, coupled with various tax incentives, makes the state an attractive destination for businesses. This has led to the establishment of numerous companies and the creation of jobs, contributing to the overall economic prosperity of the state.

Challenges and Opportunities for Businesses

While North Carolina’s sales and use tax system offers benefits, it also presents challenges for businesses. The varying tax rates across counties can complicate tax calculations and compliance, especially for businesses operating in multiple locations. Additionally, the need to stay updated with tax regulations and file accurate returns can be time-consuming and resource-intensive.

However, businesses can leverage the state's tax incentives and credits to their advantage. By taking advantage of these opportunities, businesses can reduce their tax burden and invest more in their operations, leading to potential growth and expansion.

Remote Sales and E-commerce

The rise of e-commerce and remote sales has presented unique challenges for sales and use tax collection. North Carolina, like many other states, has implemented laws to address these issues. The state requires remote sellers to collect and remit sales tax if they meet certain economic thresholds, ensuring that out-of-state businesses contribute to the state’s revenue stream.

This shift towards remote sales taxation has had a significant impact on e-commerce businesses operating in North Carolina. It has prompted them to adapt their business models and tax compliance strategies to stay compliant with the state's regulations.

Future Outlook and Potential Changes

As the business landscape and economic conditions evolve, so too might North Carolina’s sales and use tax regulations. The state has shown a commitment to adapting its tax policies to meet the changing needs of its residents and businesses.

Potential Rate Adjustments

While the current sales and use tax rate of 4.75% is relatively stable, there is always a possibility of future rate adjustments. These changes could be influenced by various factors, including economic conditions, state budget requirements, and political considerations. Any rate adjustments would have a direct impact on businesses and consumers, potentially affecting their purchasing decisions and tax obligations.

Tax Reform and Simplification

North Carolina, like many states, is exploring ways to simplify its tax system. Simplification efforts aim to reduce the complexity of tax regulations, making it easier for businesses and consumers to understand and comply with tax obligations. This could involve streamlining tax rates, consolidating tax forms, and improving the overall tax administration process.

Simplification initiatives can benefit businesses by reducing the time and resources spent on tax compliance, allowing them to focus more on their core operations. It can also enhance transparency and fairness in the tax system, ensuring that all taxpayers contribute equitably.

Impact of Technology and Automation

The rapid advancement of technology and automation is already transforming the sales and use tax landscape. North Carolina, like other states, is leveraging technology to improve tax administration and compliance. This includes the implementation of online tax filing systems, real-time tax calculation tools, and data analytics for tax enforcement.

The use of technology can enhance the efficiency and accuracy of tax collection, benefiting both the state and taxpayers. It can also facilitate better data-driven decision-making, allowing the state to adapt its tax policies more effectively to changing economic conditions.

Conclusion

North Carolina’s sales and use tax system is a critical component of the state’s revenue generation and economic development. While it presents challenges for businesses, especially in terms of compliance and complexity, it also offers opportunities for growth and investment. By staying informed about the latest regulations, leveraging tax incentives, and adapting to changing tax landscapes, businesses can navigate the intricacies of North Carolina’s sales and use tax system successfully.

As the state continues to evolve and adapt its tax policies, businesses and consumers can expect a more streamlined and efficient tax system, fostering a thriving economic environment in North Carolina.

What is the current sales and use tax rate in North Carolina?

+As of my last update, the current sales and use tax rate in North Carolina is 4.75%. This rate is applied uniformly across the state and is combined with local government rates, resulting in varying combined rates depending on the county.

Are there any items exempt from sales tax in North Carolina?

+Yes, certain items are exempt from sales tax in North Carolina. These include unprepared food, prescription drugs, and some medical devices. It’s important for businesses to stay updated on the specific items that are exempt to ensure compliance.

How can businesses stay compliant with North Carolina’s sales and use tax regulations?

+Businesses can ensure compliance by registering with the North Carolina Department of Revenue, staying informed about tax rates and regulations, and utilizing the resources and tools provided by the state. Regularly reviewing tax obligations and seeking professional guidance when needed is also recommended.

What are the potential impacts of future changes to North Carolina’s sales and use tax system?

+Future changes to North Carolina’s sales and use tax system, such as rate adjustments or tax reform initiatives, could impact businesses and consumers. These changes may affect tax obligations, compliance requirements, and potentially influence purchasing decisions. Staying informed about potential changes is crucial for businesses to adapt their tax strategies effectively.