What Is Pre Tax Deduction

Pre-tax deductions are an essential aspect of financial planning and tax management, offering individuals and businesses an opportunity to optimize their financial strategies and reduce their tax liabilities. In this comprehensive guide, we delve into the intricacies of pre-tax deductions, exploring their definition, mechanics, benefits, and real-world applications. Whether you're an individual looking to maximize your retirement savings or a business seeking to provide attractive benefits to employees, understanding pre-tax deductions is crucial.

Unraveling the Concept of Pre-Tax Deductions

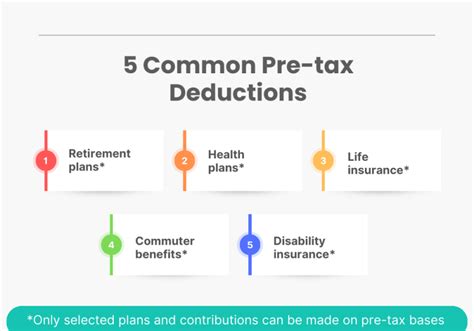

At its core, a pre-tax deduction is a financial strategy that allows individuals or businesses to set aside a portion of their income before taxes are calculated and deducted. This means that the deducted amount is not subject to income tax in the year it is contributed. Pre-tax deductions are commonly associated with retirement plans, healthcare benefits, and certain types of insurance. By utilizing pre-tax deductions, individuals can effectively reduce their taxable income, resulting in potential tax savings.

For instance, consider an individual earning $60,000 annually who contributes $6,000 to their employer-sponsored 401(k) plan. This $6,000 contribution is made on a pre-tax basis, meaning it is deducted from their gross income before calculating taxable income. As a result, their taxable income is reduced to $54,000, potentially lowering their tax liability and increasing their disposable income.

The Mechanics of Pre-Tax Deductions

Pre-tax deductions operate within a structured framework, with specific rules and limitations set by tax authorities. Here’s a breakdown of the key mechanics:

- Eligibility: Pre-tax deductions are typically available to individuals and businesses that meet certain criteria. For example, participation in a qualified retirement plan, such as a 401(k) or IRA, is often a prerequisite for pre-tax contributions.

- Contribution Limits: To prevent excessive tax avoidance, pre-tax deductions are subject to annual contribution limits. These limits vary based on the type of deduction and are set by regulatory bodies. Exceeding these limits may result in penalties.

- Tax Treatment: Pre-tax deductions reduce taxable income in the contribution year, but the funds are typically taxed when withdrawn. For retirement plans, this typically occurs during retirement, when an individual's income may be lower, resulting in a potentially lower tax rate.

- Employer-Sponsored Benefits: Many employers offer pre-tax deductions as part of their employee benefit packages. This can include contributions to retirement plans, flexible spending accounts (FSAs) for healthcare and dependent care, and transportation benefits. By offering these benefits, employers can provide a significant financial advantage to their employees.

Benefits and Real-World Applications

The advantages of pre-tax deductions extend beyond immediate tax savings. Here’s a closer look at the benefits and their real-world applications:

| Benefit | Real-World Application |

|---|---|

| Tax Savings | An individual with a 25% tax bracket contributes $6,000 to their 401(k) on a pre-tax basis. This reduces their taxable income by $6,000, resulting in potential tax savings of $1,500 (25% of $6,000). Over time, these savings can add up significantly. |

| Retirement Planning | Pre-tax deductions in retirement plans allow individuals to grow their savings tax-free until withdrawal. This can lead to substantial wealth accumulation over decades, providing a comfortable retirement. |

| Employee Benefits | Employers can attract and retain top talent by offering pre-tax deductions for healthcare and dependent care. This helps employees manage their healthcare expenses and plan for their families' needs more effectively. |

| Financial Flexibility | By reducing taxable income, pre-tax deductions provide individuals with more disposable income. This can be particularly beneficial for those with high incomes or those seeking to optimize their financial strategies. |

Maximizing Pre-Tax Deductions: Strategies and Considerations

To fully leverage the benefits of pre-tax deductions, individuals and businesses must employ strategic planning and consideration. Here are some key strategies and factors to keep in mind:

Understanding Contribution Limits

Each type of pre-tax deduction comes with specific contribution limits. For example, the annual contribution limit for a 401(k) plan is 20,500 (as of 2023), with an additional catch-up contribution of 6,500 for individuals aged 50 and above. Understanding and maximizing these limits is crucial to optimizing your financial strategy.

Employer-Sponsored Benefits

If your employer offers pre-tax deductions as part of their benefits package, it’s essential to take full advantage. This can include contributing the maximum allowed to your retirement plan, utilizing flexible spending accounts for healthcare and dependent care, and exploring transportation benefits. By doing so, you can significantly reduce your taxable income and increase your overall financial well-being.

Long-Term Financial Planning

Pre-tax deductions are a powerful tool for long-term financial planning. By contributing to retirement plans on a pre-tax basis, you can grow your savings tax-free until withdrawal. This can lead to substantial wealth accumulation over time, providing a solid foundation for your retirement. Additionally, consider the tax implications of withdrawal. In some cases, withdrawing funds prematurely may result in penalties and additional taxes.

Professional Guidance

The world of tax and financial planning can be complex, and pre-tax deductions are no exception. Consulting with a financial advisor or tax professional can help you navigate the intricacies and ensure you’re making the most of your pre-tax opportunities. They can provide personalized advice based on your financial goals, income level, and tax situation.

Staying Informed

Tax laws and regulations are subject to change. It’s crucial to stay informed about any updates or amendments that may impact your pre-tax deductions. This ensures that you’re compliant with the latest regulations and can adjust your financial strategy accordingly.

The Future of Pre-Tax Deductions

As tax landscapes evolve, the role of pre-tax deductions may also change. Here are some potential future implications and considerations:

- Tax Reform: Changes in tax policies can impact the availability and benefits of pre-tax deductions. Keeping an eye on tax reforms and their potential impact is essential for long-term financial planning.

- Retirement Planning Trends: With an aging population and evolving retirement needs, the demand for retirement planning solutions may increase. Pre-tax deductions in retirement plans could become even more crucial in meeting these demands.

- Digital Transformation: The financial industry's digital transformation may lead to more efficient and accessible pre-tax deduction processes. This could include streamlined contribution mechanisms and enhanced transparency in tax savings.

Conclusion

Pre-tax deductions are a powerful financial tool, offering individuals and businesses a strategic approach to tax management and financial planning. By understanding the mechanics, benefits, and real-world applications of pre-tax deductions, you can make informed decisions to optimize your financial well-being. Whether you’re an individual seeking to maximize your retirement savings or a business aiming to provide attractive benefits, pre-tax deductions are a key consideration in achieving your financial goals.

Can I contribute to multiple pre-tax deduction plans simultaneously?

+Yes, you can contribute to multiple pre-tax deduction plans, such as a 401(k) and a Health Savings Account (HSA), as long as you stay within the contribution limits for each plan. However, it’s important to consider the specific rules and limitations of each plan to avoid exceeding the allowed contribution amounts.

Are there any disadvantages to pre-tax deductions?

+While pre-tax deductions offer significant advantages, there are a few considerations. One potential disadvantage is that the funds are typically taxed upon withdrawal, which may result in a higher tax rate than your current income tax bracket. Additionally, there may be penalties for early withdrawal, so careful planning is essential.

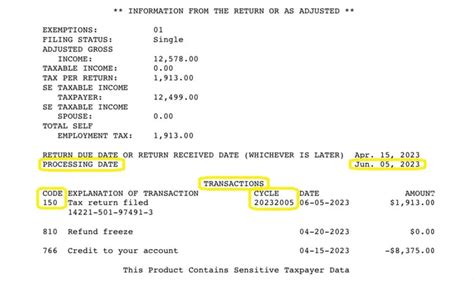

How do pre-tax deductions impact my tax refund?

+Pre-tax deductions can reduce your taxable income, potentially leading to a larger tax refund or a lower tax liability. By contributing to pre-tax plans, you effectively lower the income subject to taxation, which can result in a more favorable tax outcome.