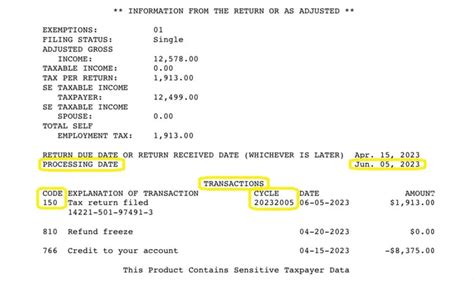

150 Tax Code

In the realm of tax legislation and financial planning, the 150 tax code is a significant aspect that influences the tax obligations and deductions for individuals and businesses. This tax code is a fundamental part of the tax system, offering a structured approach to calculating and deducting taxes, thereby impacting the financial landscape for taxpayers. This article delves into the intricacies of the 150 tax code, exploring its applications, implications, and the broader financial strategies it influences.

Understanding the 150 Tax Code

The 150 tax code, a critical component of tax legislation, is designed to streamline the process of calculating tax liabilities and deductions for taxpayers. This tax code is applicable to a wide range of taxpayers, including individuals, partnerships, and certain businesses, and is a key consideration in financial planning and tax strategy.

The 150 tax code operates on a specific set of rules and guidelines, dictating how taxable income is calculated and how deductions are applied. These rules are complex and multifaceted, taking into account various factors such as income sources, expenses, and personal circumstances. For instance, the code considers elements like salary, dividends, interest, and rental income when determining taxable income.

Key Elements of the 150 Tax Code

One of the central elements of the 150 tax code is its focus on personal allowances. These allowances, which vary based on individual circumstances, can significantly reduce taxable income. For instance, individuals may be entitled to personal allowances for themselves, their spouse, or their children, which can lead to substantial tax savings.

Another critical aspect is the treatment of various income sources. The 150 tax code differentiates between different types of income, such as employment income, pension income, or income from self-employment. Each of these income types has specific rules and rates associated with them, impacting the overall tax liability.

| Income Type | Tax Rate |

|---|---|

| Employment Income | 20% up to £37,500, 40% over £37,500 |

| Pension Income | 20% for basic rate taxpayers, 40% for higher rate taxpayers |

| Self-Employment Income | 9% Class 2 NICs, 2% Class 4 NICs up to £86,320, 2% over £86,320 |

Deductions and allowances are another crucial aspect of the 150 tax code. These include deductions for business expenses, charitable donations, pension contributions, and more. These deductions can significantly reduce taxable income, making them a critical consideration in tax planning.

Applications and Implications

The 150 tax code has broad implications for taxpayers, impacting their financial strategies and overall financial health. For individuals, understanding and utilizing the 150 tax code can lead to significant tax savings and better financial planning. For instance, effective utilization of personal allowances and deductions can substantially reduce tax liabilities, providing more disposable income.

For businesses, the 150 tax code plays a critical role in financial management and strategy. By understanding the code and its rules, businesses can structure their financial operations to minimize tax liabilities. This can involve strategic planning around income sources, expenses, and deductions, all of which are influenced by the 150 tax code.

Case Study: Effective Tax Planning with the 150 Tax Code

Consider a self-employed individual, Jane, who operates a small business. By understanding the 150 tax code, Jane can strategically plan her financial activities to minimize tax liabilities. For instance, she can maximize her personal allowances, ensuring that her taxable income is as low as possible. Additionally, she can carefully track and claim deductions for business expenses, further reducing her tax bill.

Furthermore, Jane can consider making pension contributions, which are eligible for tax relief under the 150 tax code. This not only reduces her taxable income but also provides her with a financial safety net for the future. By combining these strategies, Jane can effectively manage her tax obligations while optimizing her financial situation.

Future Outlook and Potential Changes

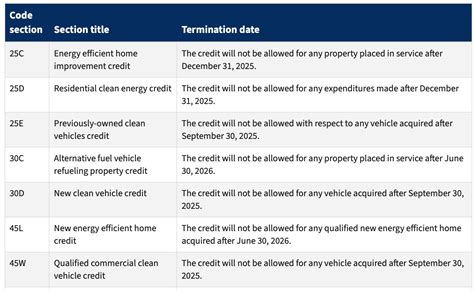

As with any aspect of tax legislation, the 150 tax code is subject to potential changes and updates. These changes can be influenced by various factors, including economic conditions, government policies, and societal needs. For instance, the code might be adjusted to accommodate changes in the tax-free personal allowance or to introduce new deductions for certain expenses.

It's crucial for taxpayers to stay informed about potential changes to the 150 tax code. These changes can significantly impact financial planning and strategy, requiring taxpayers to adapt and adjust their approaches. Staying updated on tax legislation is therefore a critical aspect of effective financial management.

Staying Informed: Resources and Expert Advice

To stay informed about the 150 tax code and its potential changes, taxpayers can leverage a range of resources. This includes government websites, which often provide the latest updates and explanations of tax legislation. Additionally, tax professionals and financial advisors can offer expert guidance, interpreting the implications of the 150 tax code and providing personalized advice.

Moreover, taxpayers can engage with online communities and forums dedicated to tax and financial planning. These platforms often provide valuable insights and updates, allowing taxpayers to stay informed and discuss potential strategies with like-minded individuals.

What is the significance of the 150 tax code for individuals and businesses?

+The 150 tax code is a critical component of tax legislation, influencing how individuals and businesses calculate their tax liabilities and deductions. It offers a structured approach to tax planning, allowing taxpayers to minimize their tax obligations and optimize their financial situation.

How does the 150 tax code impact financial planning for individuals?

+For individuals, the 150 tax code provides an opportunity to strategically reduce their tax liabilities. By understanding and utilizing the code, individuals can maximize personal allowances, claim eligible deductions, and structure their finances to minimize tax obligations.

What are some key considerations for businesses when dealing with the 150 tax code?

+Businesses need to consider the 150 tax code when structuring their financial operations. This involves understanding the rules and rates associated with different income types, claiming eligible business expenses, and potentially utilizing pension contributions to reduce taxable income.