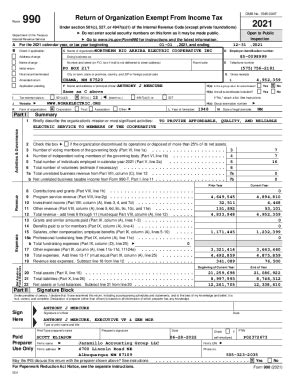

2021 Tax Return

The process of filing taxes can be a complex and often daunting task for many individuals, especially when navigating the ever-changing tax landscape. In the United States, the Internal Revenue Service (IRS) provides guidelines and forms to assist taxpayers in reporting their income and calculating their tax liabilities. This article aims to provide an in-depth analysis of the 2021 tax return process, offering valuable insights and a comprehensive guide for taxpayers.

Understanding the 2021 Tax Year and Deadlines

The 2021 tax year marked a period of economic recovery and significant tax law changes. As taxpayers navigate the complexities of the tax system, it’s crucial to understand the key dates and requirements associated with the 2021 tax return.

For U.S. taxpayers, the official deadline for filing their 2021 tax returns was April 18, 2022. However, it's important to note that certain states may have different due dates, and taxpayers with valid reasons for filing extensions may have a later deadline. For instance, taxpayers affected by natural disasters may be granted additional time to file their returns.

One notable change in the 2021 tax year was the expansion of the Child Tax Credit. This credit, which provides financial support to families with children, was temporarily increased as part of the American Rescue Plan. Taxpayers who qualify for this credit may receive advance payments throughout the year, making it essential to understand the reporting requirements to ensure accurate tax calculations.

Income Sources and Reporting

When it comes to filing taxes, accurately reporting income is crucial. Taxpayers must carefully gather and organize their income documentation to ensure they meet the IRS’s reporting requirements. Here’s an overview of common income sources and their reporting considerations:

Wages and Salaries

Wages and salaries earned from employment are typically reported on Form W-2. Employers are required to provide this form to their employees, detailing income earned and taxes withheld during the tax year. It’s essential to review and verify the accuracy of the information on the W-2 to avoid potential discrepancies.

Self-Employment Income

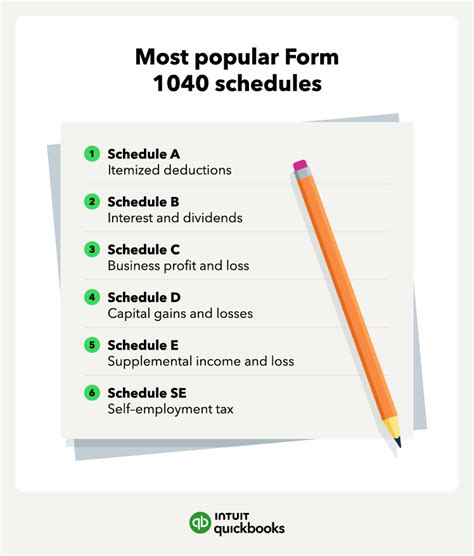

Individuals who are self-employed, including freelancers, contractors, and small business owners, must report their income and expenses on Schedule C of Form 1040. This form allows taxpayers to calculate their business income and deduct eligible expenses, ultimately determining their taxable profit.

Investment Income

Income from investments, such as dividends, interest, and capital gains, must be reported on Schedule B and Schedule D of Form 1040. Taxpayers should carefully track their investment activities throughout the year to ensure accurate reporting. It’s important to note that capital gains may be taxed at different rates depending on the duration of the investment.

Rental Income

Individuals who earn income from renting out properties must report this income on Schedule E of Form 1040. They can also deduct certain expenses associated with the rental property, such as maintenance costs, property taxes, and mortgage interest.

Tax Credits and Deductions

Tax credits and deductions are essential tools that can help reduce a taxpayer’s overall tax liability. Understanding the various credits and deductions available and determining eligibility is crucial for optimizing tax savings.

Child Tax Credit

As mentioned earlier, the Child Tax Credit underwent significant changes in 2021. This credit provides financial support to families with qualifying children under the age of 17. Taxpayers may be eligible for a credit of up to $3,600 per child, with half of this amount available as advance payments throughout the year. It’s important to note that the eligibility requirements and credit amounts may vary based on income and other factors.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit is a valuable credit for low- to moderate-income taxpayers, particularly those with children. This credit can reduce the amount of tax owed and, in some cases, result in a refund. Eligibility for the EITC is determined by income, marital status, and the number of qualifying children.

Deductions for Medical and Dental Expenses

Taxpayers who incur significant medical and dental expenses may be able to deduct these costs if they exceed a certain threshold. The threshold for deducting these expenses is 7.5% of the taxpayer’s adjusted gross income. It’s important to carefully track and document these expenses throughout the year to maximize potential deductions.

Filing Options and Tax Software

With the advancements in technology, taxpayers now have various options for filing their tax returns. The IRS offers both online and paper filing methods, allowing individuals to choose the most convenient and efficient approach for their circumstances.

Online Filing

Online filing has become increasingly popular due to its convenience and efficiency. Taxpayers can use the IRS’s official website to access and complete their tax forms digitally. Additionally, there are numerous tax preparation software options available, ranging from free basic programs to more advanced software with advanced features and guidance.

Tax preparation software often provides step-by-step guidance, helping taxpayers navigate the complexities of the tax system and ensuring they take advantage of all eligible credits and deductions. These programs can also assist in error-checking and calculating refunds or amounts owed.

Paper Filing

While online filing is the preferred method for many taxpayers, some individuals may still choose to file their tax returns on paper. The IRS provides paper forms and instructions that can be downloaded or requested by mail. It’s important to note that paper filing may take longer to process and may not offer the same level of convenience as online filing.

Tax Refunds and Payment Options

Once taxpayers have completed their tax returns, they may either receive a refund or owe money to the IRS. Understanding the refund process and available payment options is essential for managing financial obligations.

Receiving Tax Refunds

Taxpayers who are due a refund can expect to receive their money within a few weeks of filing their return. The IRS typically issues refunds via direct deposit, which is the fastest and most secure method. Taxpayers can provide their bank account information on their tax return to facilitate direct deposit.

If a taxpayer chooses to receive their refund via check, the IRS will mail the check to the address provided on the tax return. It's important to ensure that the mailing address is accurate to avoid delays in receiving the refund.

Payment Options for Taxes Owed

For taxpayers who owe money to the IRS, there are several payment options available. The IRS accepts payments made by credit or debit card, electronic funds transfer, or by mailing a check or money order.

Taxpayers who are unable to pay their tax liability in full may be eligible for a payment plan. The IRS offers short-term and long-term payment plans, allowing taxpayers to pay their taxes over an extended period. It's important to note that interest and penalties may apply to unpaid taxes.

Future Implications and Tax Planning

The tax landscape is subject to change, and taxpayers should stay informed about potential tax law modifications that may impact their financial situation. Tax planning is an essential aspect of financial management, allowing individuals to optimize their tax liabilities and take advantage of available tax strategies.

As taxpayers prepare for the upcoming tax season, it's crucial to stay updated on any changes to tax laws and regulations. The IRS provides resources and guidance to help taxpayers navigate these changes and ensure compliance. Taxpayers should also consider consulting with tax professionals or financial advisors to develop comprehensive tax planning strategies.

In conclusion, filing taxes is a critical process that requires careful consideration and accurate reporting. By understanding the key aspects of the 2021 tax return, taxpayers can navigate the complexities of the tax system and optimize their financial outcomes. With the right tools, resources, and knowledge, individuals can ensure compliance with tax laws and make informed decisions regarding their financial well-being.

What is the difference between a tax credit and a tax deduction?

+A tax credit directly reduces the amount of tax owed, while a tax deduction reduces the amount of income that is subject to taxation. In simpler terms, a tax credit provides a dollar-for-dollar reduction in tax liability, while a tax deduction lowers the taxable income, which in turn reduces the tax liability.

Can I still file my 2021 tax return if I missed the deadline?

+Yes, it is still possible to file your 2021 tax return after the deadline. However, you may be subject to penalties and interest for late filing and late payment. It is recommended to consult with a tax professional to understand your options and potential consequences.

How can I maximize my tax refunds or minimize my tax liability?

+Maximizing tax refunds or minimizing tax liability involves understanding and taking advantage of eligible tax credits, deductions, and exemptions. It is crucial to keep accurate records of income, expenses, and eligible deductions. Consulting with a tax professional can also provide valuable insights and strategies tailored to your specific circumstances.