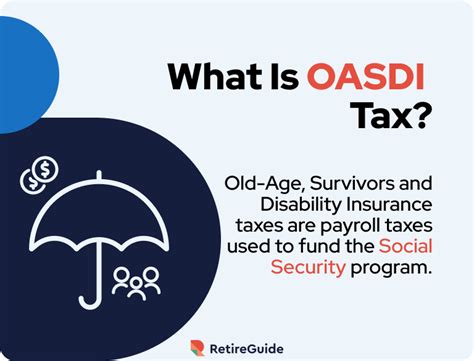

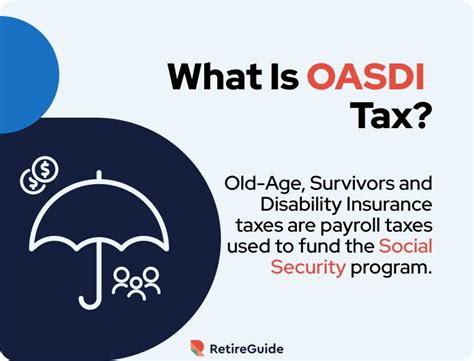

Is Oasdi Tax Mandatory

Oasdi tax, or the Old-Age, Survivors, and Disability Insurance tax, is an essential component of the United States' social insurance system. This tax plays a pivotal role in funding crucial social security benefits for millions of Americans. As such, its mandatory nature and implications are of significant interest to individuals, businesses, and policymakers alike.

In this comprehensive exploration, we delve into the intricacies of Oasdi tax, examining its purpose, mechanics, and implications for both employers and employees. By the end of this article, readers should possess a nuanced understanding of Oasdi tax, its mandatory status, and its broader impact on the American social fabric.

Understanding Oasdi Tax

Oasdi tax is a payroll tax levied on both employers and employees to finance Social Security benefits. These benefits encompass retirement income, disability coverage, and survivor benefits for eligible individuals. The tax is a critical component of the Social Security Act, a federal program that provides financial assistance to retired workers, their families, and individuals with disabilities.

The Oasdi tax rate is subject to periodic adjustments, influenced by factors such as inflation, demographic shifts, and the overall fiscal health of the Social Security Trust Funds. For the tax year 2023, the Oasdi tax rate stands at 6.2% for employers and employees, each contributing an equal share. This rate applies to the first $160,200 of an employee's earnings, with any income above this threshold being exempt from Oasdi taxation.

It's worth noting that Oasdi tax is distinct from the Medicare tax, another component of the Federal Insurance Contributions Act (FICA). While Oasdi tax contributes solely to Social Security benefits, Medicare tax funds the Medicare program, providing health insurance coverage for eligible individuals.

The Mandatory Nature of Oasdi Tax

Oasdi tax is indeed mandatory for employers and employees alike. This mandatory status is grounded in the legal and financial framework of the Social Security Act and its subsequent amendments.

For employers, the obligation to withhold and remit Oasdi tax is a statutory requirement. Failure to comply with these obligations can result in substantial penalties and legal repercussions. Employers are responsible for calculating the correct tax amount, withholding it from employees' wages, and remitting these funds to the Internal Revenue Service (IRS) on a timely basis.

Similarly, employees are legally obligated to contribute to Oasdi tax through payroll deductions. These deductions are automatically withheld from employees' wages by their employers, ensuring a steady flow of funds into the Social Security system. Employees have a vested interest in Oasdi tax, as it directly finances their future Social Security benefits.

Mechanics of Oasdi Tax Withholding and Remittance

The process of Oasdi tax withholding and remittance involves several critical steps. Employers are responsible for the following:

- Registering with the IRS: Employers must obtain an Employer Identification Number (EIN) from the IRS to identify their business for tax purposes.

- Calculating Tax Amounts: Employers must calculate the Oasdi tax amount for each employee, considering factors such as earnings and applicable tax rates.

- Withholding Taxes: Employers must deduct the appropriate tax amount from employees' wages before issuing paychecks.

- Remitting Taxes: Employers must remit the withheld Oasdi taxes to the IRS on a regular basis, typically on a quarterly or annual schedule.

- Filing Tax Returns: Employers must file annual tax returns (Form 941) with the IRS, detailing the total Oasdi taxes withheld and remitted.

Employees, on the other hand, are responsible for understanding their tax obligations and ensuring that their employers are correctly withholding Oasdi taxes from their wages. Employees can review their pay stubs to confirm the accuracy of their tax deductions and address any discrepancies with their employers.

Implications and Considerations

The mandatory nature of Oasdi tax has several important implications for both employers and employees. For employers, compliance with Oasdi tax obligations is crucial to avoid legal and financial penalties. Non-compliance can result in significant fines, interest charges, and even criminal penalties in severe cases.

Employees, while not directly responsible for remitting Oasdi taxes, have a vested interest in the accuracy of their tax withholdings. Inaccurate withholdings can lead to underpayment or overpayment of taxes, affecting employees' financial planning and eligibility for Social Security benefits.

Furthermore, the mandatory nature of Oasdi tax underscores its critical role in funding Social Security benefits. These benefits provide a safety net for millions of Americans, offering financial support during retirement, disability, or the loss of a family breadwinner. The mandatory contribution to Oasdi tax ensures the sustainability and accessibility of these vital social programs.

Conclusion

In conclusion, Oasdi tax is a mandatory payroll tax that plays a crucial role in funding Social Security benefits for American workers. Its mandatory status is rooted in federal law and is essential for maintaining the financial stability of the Social Security system. Both employers and employees have distinct responsibilities in ensuring the accurate calculation, withholding, and remittance of Oasdi taxes.

Understanding the mechanics and implications of Oasdi tax is vital for employers, employees, and policymakers alike. By comprehending the legal and financial framework surrounding Oasdi tax, stakeholders can contribute to the continued viability of Social Security benefits, ensuring a secure financial future for millions of Americans.

FAQs

What is the purpose of Oasdi tax?

+Oasdi tax, or Old-Age, Survivors, and Disability Insurance tax, is a payroll tax levied on employers and employees to fund Social Security benefits, including retirement income, disability coverage, and survivor benefits.

Is Oasdi tax mandatory for employers and employees?

+Yes, Oasdi tax is mandatory for both employers and employees. Employers are responsible for withholding and remitting the tax, while employees have their contributions deducted from their wages.

What is the current Oasdi tax rate for 2023?

+The Oasdi tax rate for 2023 is 6.2% for both employers and employees, with each contributing an equal share. This rate applies to earnings up to $160,200.

What happens if an employer fails to comply with Oasdi tax obligations?

+Employers who fail to comply with Oasdi tax obligations may face severe penalties, including fines, interest charges, and potential criminal penalties in extreme cases.

How can employees ensure accurate Oasdi tax withholdings?

+Employees can review their pay stubs to verify the accuracy of Oasdi tax withholdings. If any discrepancies are found, they should promptly address them with their employers.