Sales Tax In Nashville Tennessee

In the bustling city of Nashville, Tennessee, where the sounds of country music and bustling businesses intertwine, understanding the intricacies of sales tax is crucial for both residents and entrepreneurs alike. Sales tax in Nashville, like in many other places, is a vital source of revenue for the city and state governments, contributing to the development and maintenance of infrastructure, education, and various public services. This article aims to delve into the specifics of sales tax in Nashville, exploring its rates, exemptions, and the impact it has on the local economy.

The Complex Web of Sales Tax in Nashville

Sales tax in Nashville is a multi-layered system, comprising various tax rates and regulations. The city of Nashville itself imposes a 2.275% sales and use tax, which is added to the 7% state sales tax, resulting in a combined 9.275% sales tax rate for most goods and services. However, this is not where the story ends. Nashville, being a part of Davidson County, also levies a 0.5% county sales tax, pushing the total sales tax rate to 9.775% for certain transactions.

But wait, there's more! Nashville is renowned for its vibrant entertainment industry, and this too has its own tax implications. A 2.75% amusement tax is applicable to various forms of entertainment, including movie tickets, concerts, and sporting events. This tax is unique to Nashville and is not found in many other cities, making it a key consideration for those planning events or enjoying the city's cultural offerings.

A Breakdown of Sales Tax Rates in Nashville

| Tax Type | Rate | Description |

|---|---|---|

| City Sales Tax | 2.275% | Imposed by the city of Nashville. |

| State Sales Tax | 7% | Applies across the state of Tennessee. |

| County Sales Tax | 0.5% | Specific to Davidson County, where Nashville is located. |

| Amusement Tax | 2.75% | Unique to Nashville, applicable to entertainment activities. |

It's important to note that these tax rates are not static and can be subject to change. The city and state governments may adjust tax rates periodically to align with budgetary needs and economic conditions. Staying informed about these changes is crucial for businesses and consumers alike.

Sales Tax Exemptions: Navigating the Exceptions

While sales tax is a widespread phenomenon, not all goods and services are subject to it. Nashville, like many other jurisdictions, has a set of sales tax exemptions, which can provide significant savings for both businesses and consumers. These exemptions are designed to promote certain industries, encourage economic growth, and support essential services.

Key Sales Tax Exemptions in Nashville

- Food and Groceries: Nashville, like the rest of Tennessee, does not impose sales tax on unprepared food items and groceries. This exemption is a significant relief for households and encourages spending on essential items.

- Prescription Medications: Sales tax is waived for prescription drugs, making healthcare more accessible and affordable for residents.

- Manufacturing Equipment: To promote industrial growth, sales tax is often exempted on purchases of machinery and equipment used in manufacturing processes.

- Educational Resources: Textbooks, educational supplies, and certain school-related services are exempt from sales tax, supporting the city’s commitment to education.

- Agricultural Products: Nashville’s vibrant agricultural sector benefits from sales tax exemptions on farming equipment and certain agricultural products.

Navigating these exemptions can be a complex task, as the rules can vary based on the specific nature of the product or service. It's essential for businesses to stay updated with the latest guidelines to ensure compliance and take advantage of these exemptions where applicable.

The Impact of Sales Tax on Nashville’s Economy

Sales tax plays a pivotal role in shaping Nashville’s economic landscape. It is a significant source of revenue for the city, contributing to the funding of vital services such as education, healthcare, and infrastructure development. The revenue generated from sales tax allows Nashville to invest in its future, improving the quality of life for its residents and attracting businesses and tourists alike.

However, the impact of sales tax is not without its challenges. For businesses, particularly small and medium-sized enterprises, the burden of collecting and remitting sales tax can be substantial. The administrative costs associated with compliance can eat into profits, especially for those operating on thin margins. Additionally, the complexity of the tax system, with its various rates and exemptions, can be a hurdle for businesses just starting out or those expanding into new markets.

Case Study: The Impact on Local Businesses

Take, for instance, a small boutique in Nashville’s vibrant downtown area. The owner, Sarah, faces the challenge of managing her sales tax obligations while keeping her business competitive. With the city’s sales tax rate at 9.775%, Sarah must ensure that her pricing strategy accounts for this additional cost without pricing her products out of the market. She also needs to stay informed about any changes to tax rates or exemptions, which can impact her bottom line.

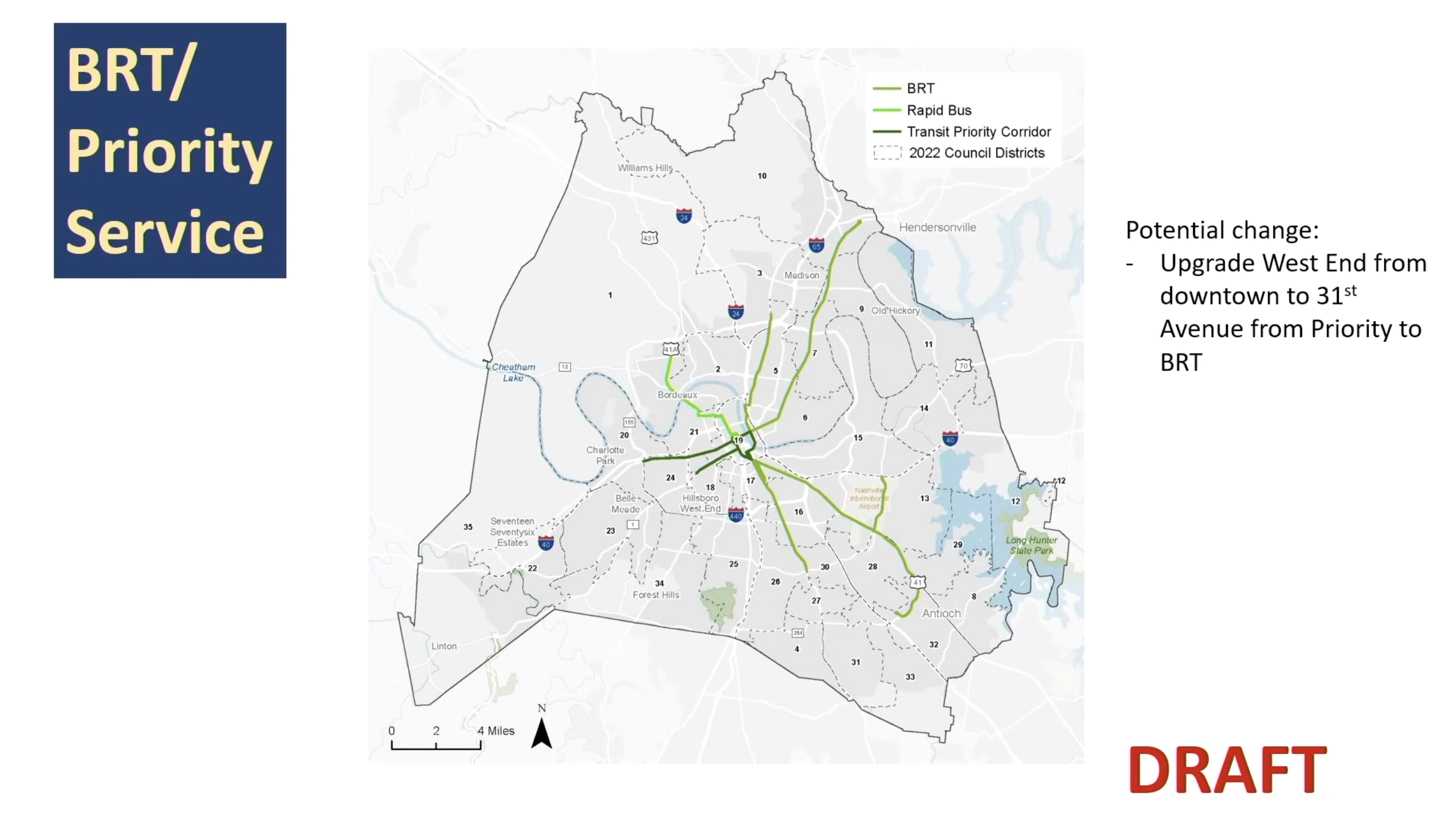

On the positive side, sales tax revenue provides Sarah with the assurance that her city is investing in the infrastructure and services that benefit her business. Well-maintained roads, a robust public transportation system, and a skilled workforce are all outcomes of the city's sales tax revenue. These factors contribute to Nashville's appeal as a business destination, attracting customers and potential partners.

Future Implications and Potential Reforms

As Nashville continues to grow and evolve, the sales tax system may also undergo changes. With advancements in technology and shifts in consumer behavior, there is a growing need for tax systems to adapt. The rise of e-commerce, for instance, has prompted discussions about the fairness and practicality of current sales tax regulations. Reform proposals, such as the introduction of a marketplace facilitator law, aim to ensure that online retailers also contribute to the city’s revenue stream.

Furthermore, as Nashville's entertainment industry thrives, there are calls to reconsider the amusement tax. While it provides a unique revenue stream, there are concerns about its impact on the affordability and accessibility of cultural events. Balancing the need for revenue with the desire to promote Nashville's vibrant culture is an ongoing challenge for policymakers.

In conclusion, understanding the intricacies of sales tax in Nashville is crucial for both businesses and residents. From navigating the various rates and exemptions to appreciating the impact on the local economy, sales tax is a complex but vital aspect of Nashville's economic landscape. As the city continues to evolve, staying informed about sales tax regulations and their potential reforms will be key to thriving in this dynamic environment.

How often are sales tax rates reviewed and updated in Nashville?

+Sales tax rates are typically reviewed and updated annually by the city and state governments. These reviews take into account economic factors, budgetary needs, and the overall financial health of the city and state.

Are there any special considerations for online sales and sales tax in Nashville?

+Yes, with the rise of e-commerce, Nashville, like many other jurisdictions, has implemented laws to ensure that online retailers also collect and remit sales tax. This is often referred to as the marketplace facilitator law, which holds online marketplaces responsible for collecting sales tax from their third-party sellers.

What happens if a business fails to remit sales tax correctly in Nashville?

+Failing to remit sales tax correctly can result in significant penalties and interest charges. Businesses are required to stay compliant with sales tax regulations to avoid these consequences and maintain a good standing with the tax authorities.