Pennsylvania Real Estate Tax Rebate

The Pennsylvania Real Estate Tax Rebate, also known as the Property Tax/Rent Rebate Program, is a valuable initiative offered by the state government to provide financial relief to eligible residents. This program aims to assist homeowners and renters by offering rebates on property taxes or rent expenses, offering a much-needed financial boost to individuals and families across the Commonwealth.

Understanding the Pennsylvania Real Estate Tax Rebate Program

The Property Tax/Rent Rebate Program has been an essential component of Pennsylvania’s commitment to supporting its residents. Established to address the financial burden of property taxes, especially for those on fixed incomes, the program has evolved to become a critical safety net for many Pennsylvanians.

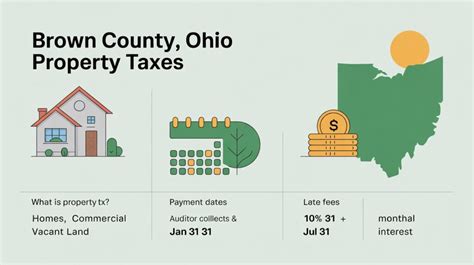

Eligible applicants can receive rebates ranging from $50 to the entire amount of property taxes or rent paid, up to a maximum of $650 for homeowners and renters. The rebate amount is determined by the applicant's income level and the total property taxes or rent expenses paid during the qualifying period.

The program's impact is significant, with over $110 million in rebates distributed annually, benefiting more than 500,000 Pennsylvanians. This initiative not only provides direct financial assistance but also boosts local economies as residents can allocate their savings toward other essential expenses or investments.

Program Eligibility and Application Process

To qualify for the Pennsylvania Real Estate Tax Rebate, applicants must meet specific criteria. Residents who were 65 or older, widows or widowers aged 50 or older, or individuals with disabilities by the end of the qualifying year are eligible. Additionally, applicants must have a yearly income of 35,000 or less if single, or 40,000 or less if married.

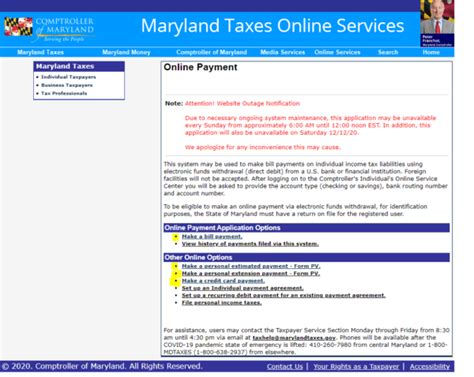

The application process is straightforward and can be completed online or through a paper application. Required documentation includes proof of identity, residency, income, and property tax or rent payment. The online application platform is user-friendly, guiding applicants through the process step by step. For those who prefer traditional methods, paper applications can be obtained from local tax authorities or the Pennsylvania Department of Revenue.

Once submitted, applications are processed within 12 weeks. Applicants can track the status of their application online, ensuring a transparent and efficient process. The rebate amount is typically issued via check or direct deposit, with the option to receive it in the form of a voucher for future property tax or rent payments.

Maximizing Benefits: Strategies for Eligible Residents

For Pennsylvanians who meet the eligibility criteria, maximizing the benefits of the Real Estate Tax Rebate program is crucial. Here are some strategies to ensure a successful application and the most substantial rebate possible:

- Understand Income Limits: The program's income limits are set annually and adjusted for inflation. Staying informed about these limits ensures that eligible applicants don't miss out due to slight income fluctuations.

- Gather Necessary Documentation: To avoid application delays, ensure you have all required documents ready. This includes recent tax returns, property tax or rent receipts, and proof of identity and residency. Having these documents organized can streamline the application process.

- Take Advantage of Early Application: The program accepts applications year-round, but it's beneficial to apply as early as possible. This ensures your application is processed promptly and increases the chances of receiving your rebate sooner.

- Explore Additional Rebate Options: The Property Tax/Rent Rebate Program is just one of several initiatives offering financial assistance. Exploring other rebate programs, such as the General Property Tax Rebate or the Homeowners' Emergency Assistance Program, can provide additional relief.

Impact and Future Outlook

The Pennsylvania Real Estate Tax Rebate program has had a profound impact on the financial well-being of countless residents. By providing direct relief from property tax burdens, the program empowers individuals to better manage their finances and invest in their communities. The program’s success is evident in the positive feedback and high participation rates among eligible residents.

Looking ahead, the program is poised for continued growth and expansion. As the cost of living rises and property taxes increase, the need for such initiatives becomes even more critical. The Pennsylvania government recognizes the program's importance and is committed to ensuring its sustainability and accessibility to all eligible residents.

In addition to maintaining the core program, there are discussions about potential enhancements. These include increasing the maximum rebate amount to better address the rising cost of living and exploring options for automated income verification to streamline the application process further.

As the program continues to evolve, it remains a vital tool for promoting financial stability and economic empowerment among Pennsylvanians. By staying informed and actively participating in the program, residents can make the most of this valuable resource and contribute to a thriving Commonwealth.

| Program Name | Rebate Type | Maximum Rebate |

|---|---|---|

| Property Tax/Rent Rebate | Property Tax/Rent | $650 |

| General Property Tax Rebate | Property Tax | Varies by County |

| Homeowners' Emergency Assistance Program | Property Tax Relief | Up to $1,000 |

How often can I apply for the Pennsylvania Real Estate Tax Rebate?

+You can apply annually for the rebate, and it is beneficial to do so as the program accepts applications year-round. By applying each year, you ensure you receive the rebate for the most recent qualifying period.

Are there any penalties for late applications?

+No, there are no penalties for late applications. However, applying early is recommended to avoid potential processing delays and ensure you receive your rebate promptly.

Can I apply for the rebate if I own multiple properties?

+Yes, you can apply for the rebate for each property you own, provided you meet the eligibility criteria for each. This can be a great way to maximize your potential rebate amount.