Sales Tax For A Car In California

Sales tax is an essential consideration when purchasing a car, and in the state of California, it plays a significant role in the overall cost of vehicle ownership. The sales tax system in California is designed to generate revenue for the state and local governments, contributing to the development and maintenance of infrastructure, education, and other public services. Understanding the sales tax implications when buying a car is crucial for both individuals and businesses, as it directly impacts their financial planning and budget management.

Unraveling the Sales Tax Structure in California

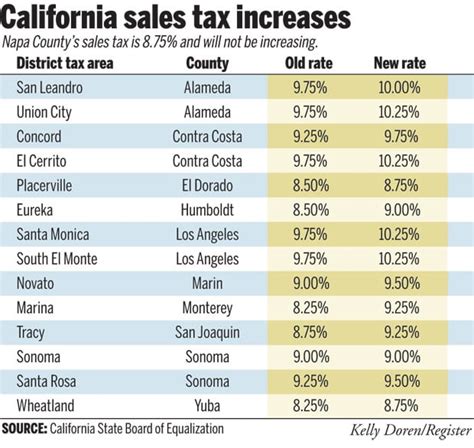

California’s sales tax system operates under a state-wide base rate, with additional local taxes applied on top of this base. The base sales tax rate in California is set at 7.25%, which is applied uniformly across the state. However, the total sales tax rate an individual pays can vary significantly depending on the specific county and city where the purchase is made. This is because California allows local governments to levy their own additional sales taxes, known as “local option taxes.”

Local option taxes can range from 0% to 2.25%, bringing the total sales tax rate to a maximum of 9.5% in certain areas. These local option taxes are used to fund specific projects or initiatives in the community, such as transportation improvements, public safety enhancements, or even cultural and recreational amenities.

To illustrate, consider the example of purchasing a car in the city of San Francisco. The sales tax rate in San Francisco consists of the state base rate of 7.25%, a county rate of 0.5%, a transportation improvement tax of 0.5%, and a local infrastructure bond tax of 0.75%. This results in a total sales tax rate of 9% in San Francisco, which is applied to the purchase price of the car.

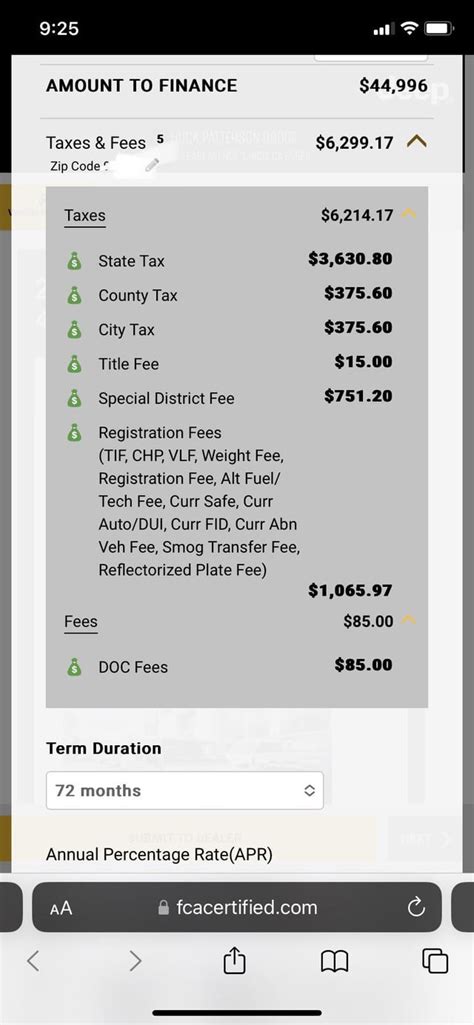

Calculating Sales Tax for a Car Purchase

When purchasing a car in California, the sales tax is typically calculated as a percentage of the vehicle’s total purchase price, including any additional fees and options. To calculate the sales tax, the buyer multiplies the purchase price by the applicable sales tax rate for their specific location. For instance, if a car is purchased for 30,000 in a city with a sales tax rate of 9%, the sales tax amount would be 2,700.

However, it's important to note that sales tax calculations can become more complex when dealing with trade-ins, rebates, and other discounts. In such cases, the sales tax is typically calculated based on the net purchase price after applying all applicable discounts and credits.

| Purchase Price | Sales Tax Rate | Sales Tax Amount |

|---|---|---|

| $25,000 | 8% | $2,000 |

| $35,000 | 9% | $3,150 |

| $40,000 | 8.25% | $3,300 |

Understanding Sales Tax Exemptions and Discounts

While sales tax is a standard obligation for most car purchases, certain circumstances can lead to exemptions or discounts. California offers a range of sales tax exemptions and discounts, which can provide significant savings for buyers.

Vehicle Trade-Ins and Sales Tax

When trading in a vehicle as part of a new car purchase, the sales tax calculation can be influenced by the value of the trade-in. In California, the trade-in value is typically subtracted from the purchase price of the new vehicle before calculating the sales tax. This means that the sales tax is applied to the net purchase price after considering the trade-in value.

For example, if an individual trades in a vehicle valued at $10,000 as part of purchasing a new car for $40,000, the sales tax would be calculated on the net purchase price of $30,000. This approach ensures that the sales tax is applied only to the portion of the purchase price that is not covered by the trade-in value.

Sales Tax Discounts and Rebates

California provides various sales tax discounts and rebates to promote specific initiatives and support certain groups. For instance, the state offers a Clean Vehicle Rebate Project (CVRP) to encourage the adoption of electric and hybrid vehicles. Under this program, eligible buyers can receive a rebate of up to $7,000, which effectively reduces the sales tax liability on the vehicle purchase.

Additionally, certain groups, such as veterans, active military personnel, and individuals with disabilities, may qualify for sales tax exemptions or discounts. These exemptions are designed to provide financial relief to these specific communities and are often administered through specialized programs or agencies.

| Rebate Program | Rebate Amount | Eligibility |

|---|---|---|

| Clean Vehicle Rebate Project (CVRP) | Up to $7,000 | Purchase of electric or hybrid vehicles |

| Military Sales Tax Exemption | Up to 100% | Active military personnel |

| Disability Sales Tax Exemption | Varies | Individuals with disabilities |

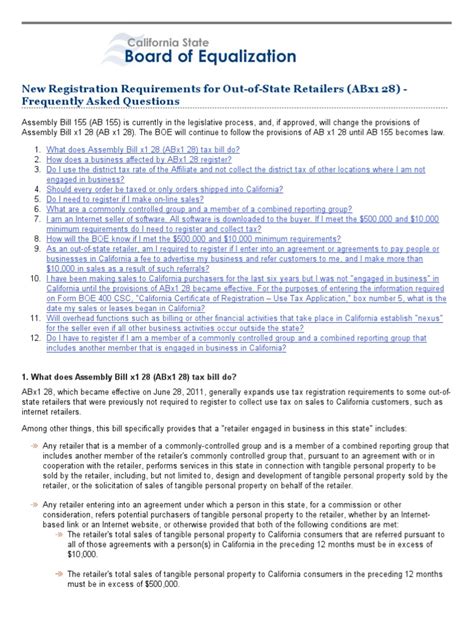

Sales Tax Implications for Businesses

For businesses operating in California, understanding sales tax obligations is crucial for accurate financial reporting and compliance with state regulations. Businesses that sell vehicles must collect and remit sales tax on behalf of their customers. The sales tax rate applied by businesses is based on the location of the customer, not the business itself. This means that businesses may need to collect varying sales tax rates depending on where their customers reside.

Furthermore, businesses should be aware of their obligations regarding sales tax exemptions and discounts. While these benefits are designed for consumers, businesses may also need to facilitate these exemptions for their customers, especially when dealing with specialized programs or specific customer groups. Proper documentation and record-keeping are essential to ensure compliance with these regulations.

Sales Tax Collection and Remittance for Businesses

Businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. This process involves accurately calculating the sales tax based on the customer’s location and the purchase price. The collected sales tax is then remitted to the appropriate tax authorities, usually on a monthly or quarterly basis.

To facilitate this process, businesses often utilize sales tax software or accounting systems that can automatically calculate and track sales tax obligations. These tools help ensure accuracy and compliance, especially when dealing with varying sales tax rates across different locations.

The Future of Sales Tax in California

The sales tax landscape in California is subject to ongoing discussions and potential changes. While the current system provides a stable revenue stream for the state and local governments, there are ongoing debates about the fairness and efficiency of the current structure.

Potential Reforms and Adjustments

Proposed reforms to California’s sales tax system often focus on simplifying the tax code and ensuring a more equitable distribution of tax burdens. One proposed change is the implementation of a uniform sales tax rate across the state, eliminating the complexity of varying local option taxes. This approach aims to reduce administrative burdens for businesses and provide a more straightforward tax system for consumers.

Additionally, there are discussions around expanding the base of taxable goods and services to include currently exempted items, such as certain digital products and services. This expansion could provide additional revenue for the state while also leveling the playing field for businesses operating in different sectors.

Impact on the Automotive Industry

Changes to the sales tax system can have significant implications for the automotive industry in California. For example, a simplification of the tax code could reduce compliance costs for dealerships and manufacturers, allowing them to redirect resources towards other areas of their business. On the other hand, expanding the base of taxable items could lead to increased costs for automotive-related services and products, potentially impacting the industry’s profitability.

It's important for automotive businesses to stay informed about potential sales tax reforms and their potential impact on the industry. Being proactive in understanding and adapting to these changes can help businesses maintain their competitive edge and financial stability.

What is the average sales tax rate in California for car purchases?

+The average sales tax rate in California for car purchases varies depending on the specific location. The state-wide base rate is 7.25%, but local option taxes can add up to 2.25%, resulting in a maximum total sales tax rate of 9.5% in certain areas.

Are there any sales tax exemptions or discounts for car purchases in California?

+Yes, California offers various sales tax exemptions and discounts. These include programs like the Clean Vehicle Rebate Project (CVRP) for electric and hybrid vehicles, as well as exemptions for veterans, active military personnel, and individuals with disabilities.

How do businesses handle sales tax collection and remittance in California?

+Businesses in California collect sales tax from customers at the point of sale, based on the customer’s location and the purchase price. The collected sales tax is then remitted to the appropriate tax authorities on a regular basis. Many businesses use sales tax software or accounting systems to automate this process.

What potential reforms are being discussed for California’s sales tax system?

+Potential reforms to California’s sales tax system include implementing a uniform sales tax rate across the state to simplify the tax code, as well as expanding the base of taxable goods and services to increase revenue and create a more equitable tax system.