Md Tax Payment

In today's fast-paced world, staying on top of your financial obligations is crucial. One such obligation that many individuals and businesses face is tax payment, particularly in the state of Maryland. Navigating the complex web of tax regulations and deadlines can be daunting, but with the right knowledge and tools, it becomes a manageable process. In this comprehensive guide, we will delve into the world of Maryland tax payment, exploring the various aspects that make it an essential and often intricate part of financial management.

Understanding the Basics of Maryland Tax Payment

Maryland, like many other states, has its own set of tax laws and regulations. These laws govern the collection of taxes on various income sources, property ownership, and business operations. The Maryland Department of Assessments and Taxation (MDOT) is the primary authority responsible for overseeing tax-related matters in the state. Understanding the fundamentals of Maryland tax payment is the first step toward ensuring compliance and avoiding potential penalties.

Income Tax in Maryland

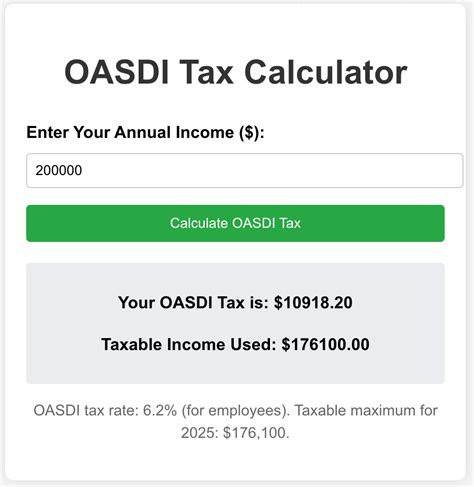

Maryland imposes an income tax on both individuals and businesses. The income tax rate varies based on the taxpayer’s income bracket and filing status. For the year 2023, the state’s income tax rates range from 2% to 5.75%, with additional local income tax rates that may apply in certain jurisdictions.

Residents of Maryland are required to file an annual income tax return, typically by April 15th of each year. Non-residents who earn income within the state may also be subject to Maryland income tax, depending on the nature of their earnings.

The Maryland income tax system follows a progressive structure, meaning that higher income levels are taxed at higher rates. This ensures that individuals and businesses with greater financial means contribute a larger share of their income toward the state’s revenue.

Property Tax and Assessment

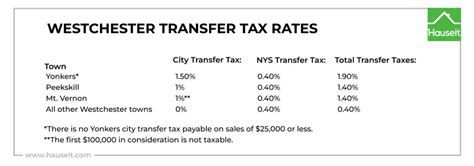

Maryland also levies property taxes on real estate and tangible personal property. The property tax rate varies across counties and municipalities, and it is typically expressed as a percentage of the property’s assessed value. The assessment process involves evaluating the property’s worth, which can be influenced by factors such as location, size, and condition.

Property owners in Maryland receive an annual assessment notice, which outlines the assessed value of their property for tax purposes. It is essential for property owners to review these assessments and understand the factors that contribute to their property’s value. Challenges to assessments can be made, but it is advisable to consult with a tax professional or the local tax assessor’s office for guidance.

Sales and Use Tax

Maryland imposes a sales and use tax on the sale of tangible personal property and certain services. The sales tax rate is generally 6%, but it can vary depending on the jurisdiction. Certain items, such as groceries and prescription drugs, are exempt from sales tax. Businesses that sell taxable goods or services are required to collect and remit sales tax to the state.

Additionally, Maryland has a use tax that applies to purchases made outside the state but used or consumed within Maryland. This ensures that individuals and businesses pay their fair share of taxes, even when purchasing goods or services online or from out-of-state vendors.

Business and Corporate Taxes

Businesses operating in Maryland are subject to various taxes, including income tax, franchise tax, and withholding tax. The tax obligations of a business depend on its legal structure, revenue, and other factors. For instance, corporations are required to pay franchise tax, which is based on their capital stock or net worth.

Small businesses may benefit from certain tax incentives and credits offered by the state to promote economic growth and job creation. Staying informed about these incentives and consulting with tax professionals can help businesses optimize their tax strategies and reduce their tax liability.

Navigating the Maryland Tax Payment Process

Now that we have a basic understanding of the different types of taxes in Maryland, let’s explore the practical steps involved in making tax payments and ensuring compliance.

Registering for Tax Accounts

Before making any tax payments, individuals and businesses must register for the appropriate tax accounts with the Maryland Department of Assessments and Taxation (MDOT). This process typically involves providing personal or business information, such as name, address, and taxpayer identification numbers.

Different types of taxes may require separate registrations. For instance, income tax and sales tax accounts are handled through the Comptroller of Maryland, while property tax assessments and payments are managed by the local county tax assessor’s office.

Filing Tax Returns

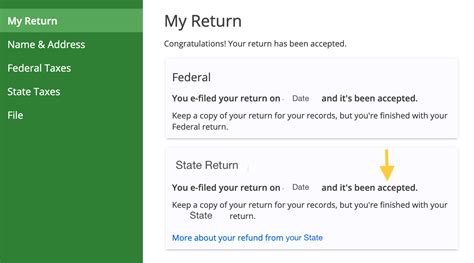

Filing tax returns is a critical step in the tax payment process. Individuals and businesses must accurately report their income, deductions, and credits to determine their tax liability. The specific forms and deadlines vary depending on the type of tax and the taxpayer’s circumstances.

For income tax returns, taxpayers typically have until April 15th of each year to file their federal and state returns. However, certain extensions may be available in exceptional circumstances.

Sales tax returns are generally due on a monthly, quarterly, or annual basis, depending on the business’s sales volume. Property tax returns, on the other hand, are often due annually, with the specific deadline set by the local tax assessor’s office.

Making Tax Payments

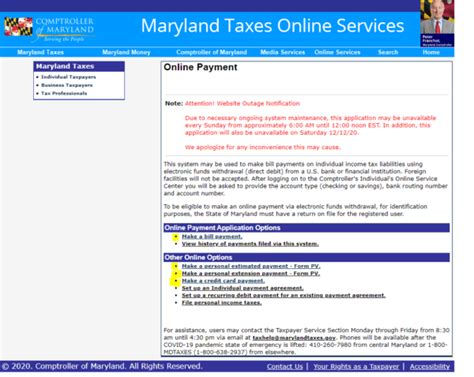

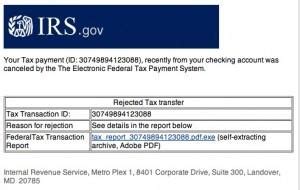

Once the tax liability has been determined through the filing process, taxpayers must make timely payments to avoid penalties and interest. Maryland offers various payment methods, including online payments, electronic funds transfer (EFT), credit card payments, and traditional methods such as checks or money orders.

Online payment portals, such as the Maryland Tax Service (MTS) website, provide a convenient and secure way to make tax payments. Taxpayers can register for an account, access their tax records, and make payments using their credit or debit cards. This method offers real-time confirmation of payments and provides a secure platform for managing tax obligations.

Managing Tax Obligations and Compliance

Staying organized and compliant with tax obligations is essential to avoid penalties and legal issues. Taxpayers should maintain accurate records, including receipts, invoices, and other documentation related to their tax payments. These records can be crucial in the event of an audit or dispute with tax authorities.

It is also advisable to stay informed about any changes in tax laws and regulations. Maryland, like other states, may periodically update its tax codes and introduce new tax incentives or requirements. Subscribing to tax newsletters, following relevant government websites, and consulting with tax professionals can help taxpayers stay up-to-date with the latest developments.

The Impact of Maryland Tax Payment on Financial Planning

Maryland tax payment is not merely a compliance requirement but also a critical aspect of financial planning and management. Understanding the tax landscape can help individuals and businesses make informed decisions about their finances and optimize their tax strategies.

Tax Planning and Strategy

Effective tax planning involves considering the impact of taxes on financial goals and objectives. Tax professionals can provide valuable guidance in developing tax-efficient strategies that align with a taxpayer’s unique circumstances.

For instance, individuals may benefit from tax-advantaged retirement accounts, such as IRAs or 401(k) plans, which offer tax deductions or tax-deferred growth. Similarly, businesses can explore tax-efficient structures, such as pass-through entities or S-corporations, to minimize their tax liability.

Additionally, taxpayers can take advantage of tax credits and deductions offered by the state of Maryland. These incentives can significantly reduce the overall tax burden and provide much-needed financial relief.

Financial Analysis and Forecasting

Incorporating tax obligations into financial analysis and forecasting is essential for long-term financial planning. By accurately estimating tax liabilities, individuals and businesses can make informed decisions about budgeting, investment strategies, and cash flow management.

For example, a business may need to allocate a certain portion of its revenue specifically for tax payments. By factoring in tax obligations, the business can ensure that it maintains sufficient cash reserves to meet its tax obligations without compromising its operational needs.

The Role of Tax Professionals

Navigating the complex world of Maryland tax payment can be challenging, especially for those who are not well-versed in tax laws and regulations. This is where tax professionals, such as certified public accountants (CPAs) and enrolled agents, play a crucial role.

Tax professionals possess in-depth knowledge of tax laws and can provide personalized advice tailored to a taxpayer’s specific circumstances. They can help identify tax-saving opportunities, ensure compliance with tax regulations, and represent taxpayers in the event of an audit or dispute.

Engaging the services of a tax professional can be particularly beneficial for individuals and businesses with complex financial situations, such as high-net-worth individuals, small businesses, or those with international tax obligations.

The Future of Maryland Tax Payment

As technology continues to advance, the landscape of tax payment is evolving. Maryland, like many other states, is embracing digital transformation to enhance the tax payment experience for taxpayers.

Digital Tax Payment Solutions

Maryland is increasingly adopting digital tax payment solutions to streamline the payment process and improve taxpayer convenience. Online payment portals, mobile apps, and electronic filing systems are becoming the preferred methods for tax payments and filings.

These digital solutions offer taxpayers real-time updates on their tax obligations, payment status, and account balances. They also provide a secure platform for managing tax-related documents and correspondence.

Data-Driven Tax Administration

The Maryland Department of Assessments and Taxation (MDOT) is leveraging data analytics and artificial intelligence to improve tax administration and compliance. By analyzing taxpayer data, MDOT can identify potential non-compliance issues, detect fraudulent activities, and enhance overall tax collection efficiency.

Data-driven tax administration not only benefits the state but also taxpayers. It allows for more accurate and efficient tax assessments, reducing the likelihood of errors and disputes.

Potential Tax Reforms and Incentives

Maryland, like other states, is constantly evaluating its tax policies to ensure fairness, competitiveness, and economic growth. Tax reforms and incentives can significantly impact the tax landscape, influencing the tax obligations of individuals and businesses.

For instance, Maryland has recently implemented tax incentives to promote renewable energy initiatives and encourage businesses to invest in sustainable practices. These incentives can provide significant tax savings for businesses that adopt environmentally friendly technologies.

Conclusion

Maryland tax payment is a critical aspect of financial management that requires careful attention and compliance. By understanding the different types of taxes, navigating the payment process, and leveraging tax planning strategies, individuals and businesses can effectively manage their tax obligations.

As Maryland continues to embrace technological advancements and data-driven tax administration, the tax payment experience is becoming more efficient and taxpayer-friendly. However, staying informed about tax laws and regulations remains essential to ensure compliance and take advantage of potential tax-saving opportunities.

What are the tax deadlines for Maryland residents?

+Maryland residents typically have until April 15th of each year to file their state and federal income tax returns. However, it’s important to note that certain tax deadlines may vary depending on the specific type of tax and individual circumstances. For instance, sales tax returns may have different due dates based on the business’s sales volume.

How can I register for a Maryland tax account?

+To register for a Maryland tax account, you can visit the official website of the Maryland Department of Assessments and Taxation (MDOT) or the Comptroller of Maryland. The registration process typically involves providing personal or business information, such as your name, address, and taxpayer identification numbers. It’s important to ensure that you register for the appropriate tax accounts based on your specific tax obligations.

Are there any tax incentives or credits available in Maryland?

+Yes, Maryland offers various tax incentives and credits to promote economic growth and support specific industries or initiatives. These incentives can include tax credits for renewable energy investments, research and development activities, and job creation. It’s advisable to consult with a tax professional or refer to the official Maryland tax publications to explore the available incentives and determine your eligibility.