Santa Clara Property Tax

Property taxes are a significant aspect of homeownership, and understanding how they work and what factors influence them is crucial for both new and experienced homeowners. In this comprehensive guide, we will delve into the intricacies of Santa Clara's property tax system, providing you with a deep understanding of the process, the calculations involved, and the various elements that impact your tax bill. Whether you're a resident of Santa Clara or considering a move to this vibrant city, this article will equip you with the knowledge needed to navigate the property tax landscape effectively.

Understanding Santa Clara’s Property Tax Assessment Process

Santa Clara, nestled in the heart of Silicon Valley, boasts a thriving real estate market, making it essential for homeowners and prospective buyers to grasp the ins and outs of property taxation. The property tax system in Santa Clara, like many other California cities, is based on the assessed value of a property, which is determined through a meticulous assessment process.

Assessed Value Determination

The assessed value of a property is a crucial factor in calculating property taxes. In Santa Clara, the Santa Clara County Assessor’s Office is responsible for evaluating properties annually. This assessment takes into account various factors, including:

- Market Value: The assessor considers the property’s market value, which is the price it would likely fetch in an open market transaction.

- Improvement Value: Any additions or improvements made to the property, such as renovations or upgrades, can impact its assessed value.

- Land Value: The value of the land on which the property sits is also assessed separately.

Assessment Dates and Cycles

Santa Clara follows a biennial assessment cycle, which means properties are typically assessed every two years. However, certain events can trigger a reassessment, such as:

- Change of Ownership: When a property is sold, it is reassessed to reflect the current market value.

- New Construction: Additions or new construction on a property may result in a reassessment.

- Major Improvements: Substantial improvements to a property may lead to a reassessment to account for the increased value.

| Assessment Cycle | Assessment Date |

|---|---|

| Odd-numbered Years | January 1st |

| Even-numbered Years | February 14th |

Calculating Property Taxes in Santa Clara

The assessed value of a property forms the basis for calculating property taxes. In Santa Clara, the process involves several steps to arrive at the final tax bill.

Tax Rate Area and Assessment Ratio

Santa Clara County is divided into different Tax Rate Areas (TRAs), each with its own unique tax rate. These rates are determined by the Santa Clara County Board of Supervisors and can vary significantly between neighborhoods. Additionally, the Proposition 13, a landmark tax reform measure, limits the assessment ratio to 1% of the property’s assessed value, ensuring that property taxes remain relatively stable.

Tax Base Calculation

To calculate the tax base, the assessed value of the property is multiplied by the assessment ratio (1%). This tax base serves as the starting point for determining the property tax amount.

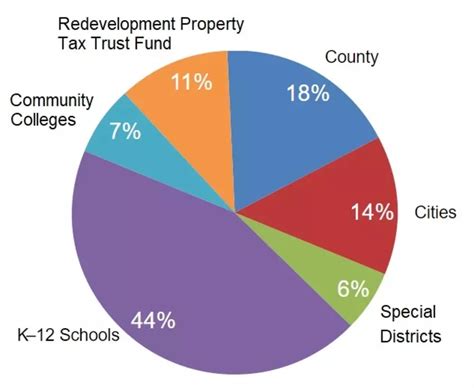

Tax Rates and Additional Levies

The tax base is then multiplied by the applicable tax rate for the specific Tax Rate Area. Santa Clara County’s tax rates include both the general tax rate set by the county and special district tax rates for services like fire protection, parks, and other local services. These rates can vary widely depending on the location within the county.

Property Tax Bill

The final property tax bill is the sum of the general tax rate and any special district tax rates. This amount is typically due in two installments, with payment deadlines falling around December and April of each year. Late payments may incur penalties and interest.

Factors Influencing Property Taxes

Several factors can impact the property tax bill for homeowners in Santa Clara. Understanding these factors can help homeowners anticipate changes and plan their finances accordingly.

Market Value Fluctuations

The real estate market in Santa Clara is dynamic, and changes in market value can directly affect property taxes. When the market value of a property increases, it may lead to a higher assessed value, resulting in increased property taxes. Conversely, a decline in market value could lead to lower taxes.

Assessor’s Office Adjustments

The Santa Clara County Assessor’s Office regularly reviews and adjusts assessed values to ensure accuracy. These adjustments can be based on market trends, sales data, and other factors. Homeowners should be aware of these potential changes and stay informed about their property’s assessed value.

Proposition 13 Benefits and Limitations

Proposition 13, passed in 1978, provides homeowners with significant property tax benefits by limiting the assessment ratio to 1% and allowing for a maximum annual increase of 2% in assessed value. However, it also means that homeowners may not see a decrease in their property taxes even if their property’s market value drops.

Special Assessments and Bond Measures

In addition to the general property tax, homeowners may also be subject to special assessments for specific services or infrastructure improvements. These assessments are often approved through bond measures voted on by the community. It’s important for homeowners to stay informed about these initiatives as they can impact their tax obligations.

Strategies for Managing Property Taxes

Homeowners in Santa Clara have several strategies at their disposal to manage and potentially reduce their property tax obligations. These strategies involve understanding the assessment process, staying informed, and taking advantage of available exemptions and relief programs.

Homeowner’s Exemption

California offers a Homeowner’s Exemption, which provides a partial reduction in the assessed value of a primary residence. This exemption can result in lower property taxes, making it an attractive benefit for homeowners. To qualify, homeowners must meet certain criteria, such as owning and occupying the property as their primary residence.

Property Tax Appeals

If a homeowner believes their property’s assessed value is inaccurate or unfair, they have the right to file a property tax appeal. This process involves providing evidence to the Santa Clara County Assessment Appeals Board to support their claim. Successful appeals can lead to a reduction in the assessed value and, consequently, lower property taxes.

Senior Citizen Exemptions

Santa Clara County offers property tax relief programs specifically for senior citizens. These programs provide exemptions or deferrals for eligible seniors, helping them manage their property tax obligations. The Senior Citizen’s Property Tax Deferment Program, for instance, allows qualified seniors to defer their property taxes until they sell or transfer the property.

Stay Informed and Engage with the Community

Staying informed about local real estate trends, assessment processes, and tax initiatives is crucial for homeowners. Engaging with the community, attending local meetings, and staying updated on proposed bond measures can help homeowners understand the potential impact on their property taxes. Additionally, building relationships with neighbors and local officials can provide valuable insights and support.

The Future of Property Taxes in Santa Clara

As Santa Clara continues to thrive and develop, the property tax landscape is likely to evolve. While Proposition 13 provides stability, there are ongoing discussions and proposals to reform the property tax system in California. Homeowners should stay vigilant and informed about any potential changes that may impact their tax obligations.

Potential Reforms and Initiatives

Several proposals have been put forth to address concerns about property taxes, including suggestions to:

- Modify Proposition 13 to allow for reassessments under certain conditions.

- Introduce a split-roll system, where commercial properties are taxed at a higher rate than residential properties.

- Implement a property tax relief program for low-income homeowners.

Impact on Homeowners

While these reforms are still in the discussion phase, they could have significant implications for homeowners in Santa Clara. It’s essential for homeowners to stay engaged with local politics and advocacy groups to understand how these potential changes may affect their property taxes.

Preparing for Future Changes

To prepare for potential future changes, homeowners can:

- Stay informed about local and state-level discussions on property tax reform.

- Build financial reserves to accommodate potential tax increases.

- Explore alternative investment strategies to mitigate the impact of rising property taxes.

Conclusion

Understanding Santa Clara’s property tax system is a critical aspect of homeownership in this vibrant city. By grasping the assessment process, calculation methods, and factors influencing property taxes, homeowners can make informed decisions and effectively manage their tax obligations. Staying engaged with the community and keeping abreast of potential reforms ensures that homeowners are prepared for any changes that may impact their financial well-being.

What is the average property tax rate in Santa Clara County?

+The average property tax rate in Santa Clara County is approximately 1.15%, but it can vary significantly depending on the Tax Rate Area. Some areas may have rates as low as 0.75%, while others can exceed 1.5%.

How often are properties reassessed in Santa Clara County?

+Properties are typically reassessed every two years as part of the biennial assessment cycle. However, certain events like a change of ownership or new construction can trigger a reassessment.

Can I appeal my property’s assessed value in Santa Clara County?

+Yes, homeowners have the right to appeal their property’s assessed value if they believe it is inaccurate or unfair. The process involves submitting an appeal to the Santa Clara County Assessment Appeals Board and providing evidence to support their case.

Are there any exemptions or relief programs for property taxes in Santa Clara County?

+Yes, California offers a Homeowner’s Exemption, which provides a partial reduction in the assessed value of a primary residence. Additionally, Santa Clara County has property tax relief programs for senior citizens, such as the Senior Citizen’s Property Tax Deferment Program.

How can I stay informed about potential changes to the property tax system in Santa Clara County?

+To stay informed, homeowners can follow local news outlets, engage with community organizations, and attend public meetings. Additionally, staying connected with local advocacy groups and subscribing to relevant newsletters can provide valuable insights into potential reforms and their impact.