What Is A W3 Tax Form

The W3 Tax Form, also known as the "Transmittal of Wage and Tax Statements," is a critical document in the US tax system, playing a pivotal role in the annual tax reporting process for employers. This form serves as a vital tool for the Internal Revenue Service (IRS) to ensure the accurate collection and processing of tax information from businesses and their employees. With its comprehensive scope, the W3 Tax Form is integral to maintaining compliance and transparency in the US tax landscape.

The Comprehensive Overview of the W3 Tax Form

The W3 Tax Form is a comprehensive document that acts as a summary of the W-2 forms an employer has issued to their employees for a given tax year. This form provides a detailed breakdown of the total wages paid, federal income tax withheld, and other pertinent tax information for each employee. It is an essential tool for employers to transmit accurate and complete tax data to the IRS, ensuring compliance with federal tax regulations.

The W3 Tax Form is typically submitted to the IRS alongside the W-2 forms, which contain the specific tax details for each employee. Together, these forms provide a complete picture of an employer's tax obligations and employee tax withholdings. This dual-form system allows for a rigorous yet efficient tax reporting process, ensuring that all parties involved—employers, employees, and the IRS—have access to the necessary information for accurate tax filing and assessment.

Key Features and Specifications

The W3 Tax Form is a complex document that requires precise and accurate completion. It is designed to provide a detailed snapshot of an employer’s tax obligations and employee tax withholdings for a specific tax year. The form includes sections for:

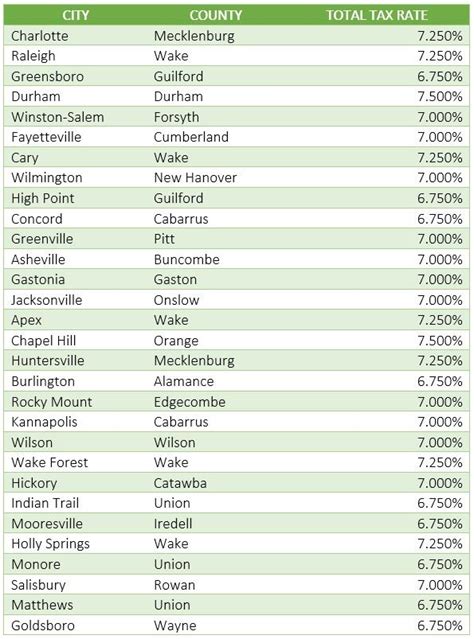

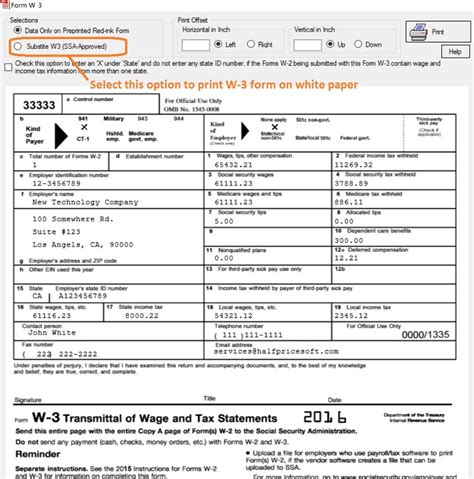

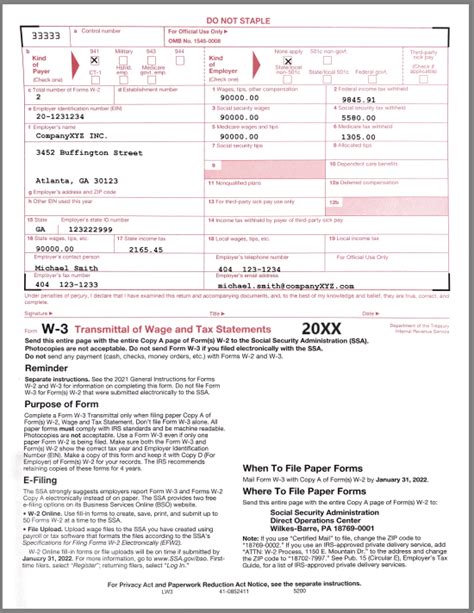

- Employer Information: This section requires the employer's name, address, Employer Identification Number (EIN), and other identifying details.

- Employee Wage and Tax Summary: Here, employers provide a summary of the total wages paid, federal income tax withheld, and other tax-related information for all employees.

- W-2 Forms Transmitted: Employers must list the total number of W-2 forms they are transmitting with the W3 form, along with the corresponding control number for each form.

- Certification: This section includes a statement where the employer certifies that the information provided is true and accurate to the best of their knowledge.

Additionally, the W3 Tax Form includes specific instructions and guidelines to ensure that employers complete the form correctly and accurately. These instructions cover various scenarios, including how to handle situations where an employer has multiple business locations, employees with multiple jobs, or employees who have moved or changed their name during the tax year.

| Form Section | Key Information |

|---|---|

| Employer Information | EIN, business name, address, and contact details |

| Employee Wage and Tax Summary | Total wages paid, federal income tax withheld, and other tax details for all employees |

| W-2 Forms Transmitted | Total number of W-2 forms submitted, along with control numbers |

| Certification | Statement confirming the accuracy of the provided information |

The Importance of Accurate W3 Tax Form Completion

The accurate completion of the W3 Tax Form is of paramount importance for several reasons. Firstly, it ensures that employers fulfill their tax reporting obligations accurately and on time. This helps maintain a positive relationship with the IRS and reduces the risk of penalties or audits due to incorrect or late filings.

Secondly, the W3 Tax Form plays a crucial role in employee tax filing. It provides employees with a comprehensive summary of their earnings and tax withholdings, which they need to complete their personal tax returns accurately. This form also helps employees identify any discrepancies in their wage and tax information, ensuring they receive the correct tax refunds or make the necessary adjustments.

Lastly, the W3 Tax Form contributes to the overall efficiency and accuracy of the US tax system. By providing a clear and detailed summary of employer tax obligations and employee tax withholdings, the form facilitates the IRS's tax assessment and collection processes. This streamlined process helps ensure that the government receives the correct tax revenue, which is vital for funding public services and infrastructure.

Best Practices for Completing the W3 Tax Form

To ensure the W3 Tax Form is completed accurately and efficiently, employers should consider the following best practices:

- Review and verify all employee data before completing the form. This includes ensuring that employee names, addresses, and tax information are correct and up-to-date.

- Use tax software or accounting systems that can generate W3 forms automatically based on employee data. These tools can significantly reduce the risk of errors and streamline the form completion process.

- Assign a dedicated team or individual responsible for tax reporting, including the completion of the W3 form. This ensures that the task is given the necessary attention and expertise.

- Set up internal processes and timelines for tax reporting, ensuring that the W3 form is completed and submitted on time. Late filings can result in penalties and interest charges.

- Stay updated with IRS guidelines and requirements. The IRS may update its forms and instructions periodically, so it's essential to use the most recent version of the W3 Tax Form and follow the latest guidelines.

The Future of Tax Reporting: Digitalization and Simplification

The world of tax reporting is evolving rapidly, with a strong focus on digitalization and simplification. The IRS and other tax authorities are increasingly embracing digital technologies to streamline tax processes and enhance compliance. This trend is expected to continue, with potential implications for the W3 Tax Form and other related tax documents.

One key development is the rise of digital tax filing systems. These systems allow employers and employees to file tax information electronically, reducing the need for paper forms like the W3 Tax Form. While the W3 form remains essential for summarizing and transmitting wage and tax data, the shift towards digital filing suggests that the form may undergo further evolution to integrate with digital tax platforms.

Additionally, tax authorities are working towards simplifying tax forms and processes. This includes efforts to reduce the complexity of tax forms, streamline instructions, and enhance user-friendliness. These initiatives aim to make tax compliance more accessible and less burdensome for taxpayers, which could lead to significant changes in the structure and requirements of the W3 Tax Form in the future.

Potential Future Developments for the W3 Tax Form

As the tax landscape continues to evolve, several potential developments could impact the future of the W3 Tax Form:

- Digital Integration: The W3 Tax Form may become more integrated with digital tax filing systems, allowing for electronic submission and reducing the need for paper forms.

- Simplified Structure: The form could be redesigned to be more user-friendly and less complex, making it easier for employers to complete and ensuring a more efficient tax reporting process.

- Real-Time Data Sharing: With advancements in technology, the W3 Tax Form might evolve to facilitate real-time data sharing between employers and the IRS, enhancing tax compliance and reducing the risk of errors.

- Enhanced Security Features: As cybersecurity becomes increasingly important, the W3 Tax Form could incorporate advanced security measures to protect sensitive tax data from potential threats.

What happens if I make a mistake on the W3 Tax Form?

+If you discover a mistake on your W3 Tax Form after submitting it, you should immediately file a corrected form. This process involves submitting a new W3 form along with a statement explaining the error and the steps taken to correct it. It’s crucial to act promptly to avoid any potential penalties or complications.

How often do I need to submit the W3 Tax Form?

+The W3 Tax Form is typically submitted annually, along with the W-2 forms, by the end of January or February following the tax year. However, certain circumstances, such as a business closing or a significant change in ownership, may require an earlier or additional submission.

Can I submit the W3 Tax Form electronically?

+Yes, the W3 Tax Form can be submitted electronically through the IRS’s Fire System. This system allows for secure online transmission of tax forms, including the W3. However, it’s essential to ensure that you meet the necessary requirements and follow the correct procedures to ensure a successful electronic filing.