Cabarrus County Tax Records

In the realm of property ownership and tax assessments, the Cabarrus County Tax Records play a pivotal role, providing an invaluable source of information for homeowners, businesses, and real estate enthusiasts alike. These records, meticulously maintained by the Cabarrus County government, offer a comprehensive insight into the property landscape, facilitating various administrative and transactional processes.

An Overview of Cabarrus County Tax Records

Cabarrus County, nestled in the heart of North Carolina, boasts a rich history intertwined with its tax records. The county’s tax system, akin to many other US counties, is a critical component of local governance, contributing significantly to the county’s revenue and resource allocation.

The Cabarrus County Tax Office is responsible for the administration and management of these records, ensuring their accuracy and accessibility. This office oversees the assessment, billing, and collection of property taxes, a process that is integral to the county's financial stability and development.

Key Components of the Tax Records

The Cabarrus County Tax Records encompass a wide array of information, each serving a specific purpose in the property ownership lifecycle.

- Property Assessment Records: These records detail the valuation process, where properties are assessed based on their characteristics and market trends. The assessment determines the property's taxable value, a crucial factor in calculating the property tax.

- Tax Bills and Payment History: Tax bills are generated annually, detailing the amount due based on the assessed value and the applicable tax rate. The payment history provides a chronological record of the property's tax payments, offering insight into the property's financial status.

- Ownership and Transfer Documents: The tax records also include ownership information, detailing the property's current and past owners. Additionally, they capture any changes in ownership, such as sales, transfers, or liens, providing a comprehensive ownership history.

- Exemptions and Deductions: Cabarrus County offers various exemptions and deductions to eligible property owners, reducing their taxable value. These records capture these exemptions, which can significantly impact the property's tax liability.

- Appeal and Dispute Records: In cases where property owners disagree with the assessed value or other tax-related matters, the tax records document any appeals or disputes. These records provide transparency and accountability in the assessment process.

| Category | Relevant Data |

|---|---|

| Property Assessments | Taxable value, assessment date, assessment criteria |

| Tax Bills | Amount due, payment due date, tax rate, penalties/interest (if applicable) |

| Ownership Information | Current and previous owners, date of acquisition, deed information |

| Exemptions | Type of exemption, exemption amount, eligibility criteria |

| Appeals | Date of appeal, grounds for appeal, outcome/resolution |

Accessing Cabarrus County Tax Records

The Cabarrus County Tax Office provides various methods for accessing these vital records, ensuring convenience and transparency for property owners and interested parties.

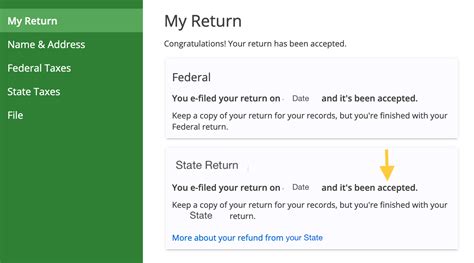

Online Access

In today’s digital age, the Cabarrus County Tax Office offers an online portal, accessible via their official website. This portal provides a user-friendly interface, allowing users to search and view tax records for specific properties. The online system is particularly beneficial for quick reference and for those who prefer digital interactions.

Users can typically search by property address, owner's name, or parcel number, making it easy to locate the desired records. The portal often provides a wealth of information, including assessment details, tax bills, ownership information, and even historical data.

In-Person Requests

For those who prefer a more traditional approach or require assistance, the Cabarrus County Tax Office welcomes in-person requests. Visitors can access the office’s physical records, which are organized systematically for easy retrieval.

Staff members are available to assist with searches, offering guidance and support. This method is particularly useful for those seeking detailed explanations or wishing to review hard copies of the records.

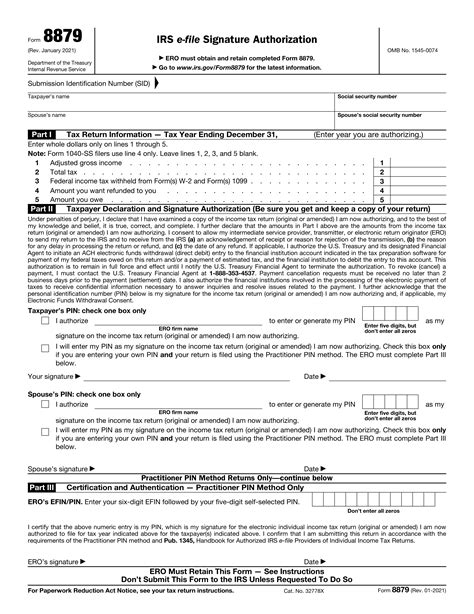

Record Requests and Copies

In some cases, property owners or interested parties may require official copies of the tax records. The Cabarrus County Tax Office accommodates such requests, providing certified copies upon request. These copies are often necessary for legal proceedings, loan applications, or other official transactions.

The office typically charges a small fee for each copy, which helps offset the costs associated with record maintenance and distribution.

Applications of Cabarrus County Tax Records

The Cabarrus County Tax Records serve a multitude of purposes, impacting various aspects of property ownership and local governance.

Property Ownership and Management

For property owners, these records provide a comprehensive overview of their property’s financial obligations and history. Owners can monitor their tax payments, assess their property’s value, and understand any applicable exemptions or deductions.

Additionally, the ownership records within the tax records offer a clear chain of title, aiding in property management and transfer processes. This information is crucial for ensuring legal compliance and facilitating smooth transactions.

Real Estate Transactions

In the realm of real estate, the Cabarrus County Tax Records are a valuable resource. Prospective buyers can access these records to gain insight into a property’s value, tax history, and potential liabilities. This information is essential for making informed purchasing decisions.

Similarly, lenders and financial institutions rely on these records to assess the financial health of a property and its owners, aiding in loan approvals and risk assessments.

Local Government and Planning

The Cabarrus County Tax Records are integral to the county’s governance and planning processes. The tax office utilizes these records to calculate the county’s revenue, ensuring adequate funding for essential services and infrastructure development.

Furthermore, the records provide data for urban planning initiatives, helping the county identify trends, assess property values, and plan for future growth and development.

Legal and Disputes

In legal matters related to property, the Cabarrus County Tax Records often serve as critical evidence. These records can resolve disputes over ownership, tax liabilities, or other property-related issues.

The appeal and dispute records within the tax system provide a transparent record of any challenges to the assessment process, ensuring fairness and accountability.

Future Implications and Technological Advancements

As technology continues to evolve, the management and accessibility of Cabarrus County Tax Records are likely to undergo significant transformations. The adoption of advanced digital systems and data management tools could enhance the efficiency and security of these records.

Potential future developments include the integration of blockchain technology, which could provide an immutable and transparent record-keeping system. This technology could enhance the security and integrity of the tax records, reducing the risk of fraud and errors.

Additionally, artificial intelligence and machine learning algorithms could be employed to analyze and interpret the vast amounts of data within the tax records, offering insights and predictions to aid in decision-making processes.

How often are the Cabarrus County Tax Records updated?

+The Cabarrus County Tax Records are typically updated annually, coinciding with the property reassessment process. However, certain changes, such as ownership transfers or exemptions, may trigger updates throughout the year.

Can I appeal my property’s assessed value in Cabarrus County?

+Yes, property owners in Cabarrus County have the right to appeal their property’s assessed value if they believe it is inaccurate or unfair. The appeal process typically involves submitting an appeal form and providing evidence to support the request.

Are there any online resources to help me understand my Cabarrus County tax bill?

+Yes, the Cabarrus County Tax Office provides online resources, including guides and FAQs, to help property owners understand their tax bills. These resources explain the components of the tax bill, the assessment process, and any applicable exemptions or deductions.