Nc Sales Tax

Welcome to this in-depth exploration of North Carolina's sales tax system, a crucial aspect of the state's revenue generation and economic framework. North Carolina, like many other states, imposes a sales and use tax on the sale of tangible personal property and certain services. This tax is a significant source of income for the state, funding various essential services and infrastructure projects. Understanding the intricacies of North Carolina's sales tax is vital for businesses and consumers alike, as it directly impacts their financial obligations and strategies.

The Fundamentals of North Carolina Sales Tax

North Carolina’s sales tax is a combined state and local tax, meaning the tax rate applied to a purchase is the sum of the state’s base rate and any applicable local taxes. The state of North Carolina levies a 4.75% sales tax on most goods and services, while counties and municipalities add their own rates on top of this, leading to varying total tax rates across the state.

Taxable Items and Exemptions

North Carolina’s sales tax applies to a wide range of tangible personal property, including most goods purchased for consumption or use. This includes items like clothing, electronics, furniture, and vehicles. Certain services, such as repairs and installations, are also subject to sales tax. However, there are several exemptions to the sales tax, including essential items like prescription medications, most non-prepared food items, and certain agricultural products.

| Taxable Items | Tax Rate |

|---|---|

| Tangible Personal Property | 4.75% (state) + Local Rates |

| Services (e.g., Repairs, Installations) | 4.75% (state) + Local Rates |

| Vehicle Sales | 3% (state) + Local Rates |

| Prepared Foods | 7% (state) + Local Rates |

It's worth noting that vehicle sales in North Carolina have a reduced state tax rate of 3%, while prepared foods carry a higher rate of 7%. These variations in tax rates reflect the state's efforts to balance revenue generation with the economic realities of different industries and consumer behaviors.

Registration and Compliance

Any business selling taxable goods or services in North Carolina must obtain a North Carolina Sales and Use Tax Permit from the North Carolina Department of Revenue. This process involves registering with the state, providing relevant business and financial information, and agreeing to comply with all sales tax regulations. Once registered, businesses are responsible for collecting, reporting, and remitting sales tax to the state on a regular basis.

The Impact of Local Variations

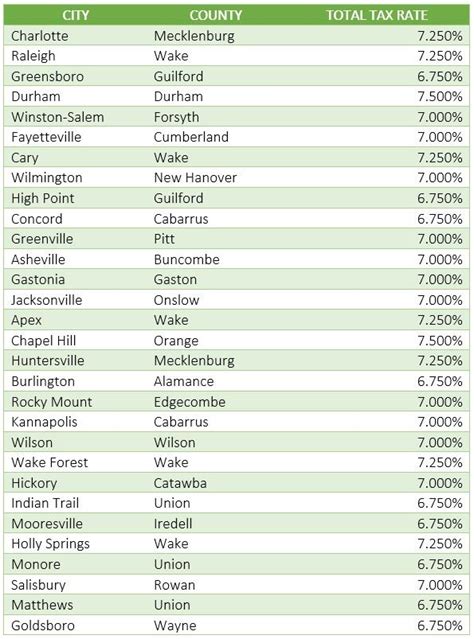

North Carolina’s system of combined state and local sales taxes results in significant variations in tax rates across the state. While the state’s base rate remains constant at 4.75%, local governments have the authority to impose additional sales taxes, leading to a wide range of total tax rates. This complexity can pose challenges for businesses operating in multiple locations within the state, as they must navigate different tax rates and compliance requirements.

Exploring Local Sales Tax Rates

To illustrate the diversity of local sales tax rates, let’s examine a few North Carolina counties and their respective tax structures:

| County | Local Sales Tax Rate | Total Tax Rate |

|---|---|---|

| Mecklenburg County | 2.25% | 7% |

| Wake County | 2% | 6.75% |

| Guilford County | 2% | 6.75% |

| Buncombe County | 2.25% | 7% |

| Durham County | 1% | 5.75% |

As the table illustrates, the total sales tax rates in these counties range from 5.75% to 7%, reflecting the varying local tax needs and priorities. These differences can have a significant impact on both consumers and businesses, affecting purchasing decisions and operational strategies.

Strategies for Businesses

For businesses operating in multiple North Carolina counties, managing these local variations in sales tax rates is crucial. Here are some strategies to consider:

- Centralized Tax Management: Establish a centralized system for tax management to ensure consistency and compliance across all locations.

- Local Rate Awareness: Stay informed about local tax rates and their variations to accurately inform pricing strategies and customer expectations.

- Software Solutions: Utilize tax management software that can automatically calculate and track varying tax rates, reducing the risk of errors.

- Customer Communication: Clearly communicate tax rates to customers, especially when they vary from the state's base rate, to maintain transparency and trust.

Sales Tax and Economic Development

North Carolina’s sales tax plays a significant role in the state’s economic development and infrastructure planning. The revenue generated from sales tax is a key component of the state’s budget, funding essential services such as education, healthcare, and public safety. Additionally, the state’s tax incentives and programs aimed at attracting and retaining businesses contribute to the state’s economic growth and job creation.

Incentives and Programs

North Carolina offers a range of tax incentives and programs to support economic development and encourage business growth. These include:

- Job Development Investment Grant (JDIG): Provides performance-based grants to businesses creating new jobs and investing in North Carolina.

- One North Carolina Fund: Offers financial assistance to companies considering locating or expanding in North Carolina, particularly in targeted industries.

- Rural Economic Development Grant (REDC): Supports economic development projects in rural areas, aiming to create jobs and improve the quality of life.

These incentives, along with the state's favorable business climate and skilled workforce, make North Carolina an attractive destination for businesses, further boosting the state's economy and contributing to its sales tax revenue.

Future Considerations and Potential Reforms

As North Carolina’s economy continues to evolve, the state’s sales tax system will likely face ongoing scrutiny and potential reforms. Here are some key considerations and potential future developments:

Modernizing Sales Tax Collection

With the rise of e-commerce and online sales, North Carolina, like many other states, is grappling with the challenge of collecting sales tax from out-of-state sellers. This issue, often referred to as the “Amazon Loophole,” has led to discussions about implementing marketplace facilitator laws, which would require online marketplaces to collect and remit sales tax on behalf of their third-party sellers.

Tax Simplification and Fairness

The complexity of North Carolina’s sales tax system, with its combined state and local rates, can be a burden for businesses and consumers. As a result, there have been calls for simplifying the tax code and ensuring a more uniform tax rate across the state. This could involve reducing or eliminating local sales taxes in favor of a more straightforward state-level tax structure.

Addressing Tax Exemptions

North Carolina’s sales tax exemptions, while beneficial for certain industries and consumers, also reduce the state’s revenue potential. As such, there may be future discussions around revising or eliminating certain exemptions to increase tax revenue. However, any such changes would need to balance the need for increased revenue with the potential impact on specific industries and consumer groups.

The Role of Technology

Advancements in technology are expected to play a growing role in sales tax management. Automated tax calculation and reporting software, for instance, can help businesses ensure compliance and accuracy, while also reducing the time and resources required for tax management. Additionally, the state could explore digital platforms to streamline the tax registration and reporting process, making it more efficient for businesses.

Conclusion

North Carolina’s sales tax system is a complex yet vital component of the state’s economic landscape. From its impact on consumer spending to its role in funding essential services and attracting businesses, the sales tax touches every aspect of the state’s economy. As North Carolina continues to evolve and adapt to changing economic realities, the sales tax system will likely undergo reforms to ensure it remains fair, efficient, and effective in supporting the state’s growth and prosperity.

What is the current sales tax rate in North Carolina?

+The current sales tax rate in North Carolina is 4.75% at the state level, but local governments can add their own rates, leading to varying total tax rates across the state.

Are there any sales tax holidays in North Carolina?

+Yes, North Carolina has sales tax holidays for specific items such as school supplies, hurricane preparedness items, and energy-efficient appliances. These holidays typically occur a few times a year.

How often do businesses need to remit sales tax in North Carolina?

+The frequency of sales tax remittance depends on a business’s tax liability. Businesses with a higher tax liability remit monthly, while those with lower liabilities remit quarterly or annually.