Maui Real Property Tax

Welcome to the ultimate guide on Maui's real property tax landscape! As an expert in Hawaii's real estate market, I'm here to break down the intricacies of property taxation on the beautiful island of Maui. Whether you're a resident, an investor, or simply curious about how property taxes work in this tropical paradise, this comprehensive article will provide you with all the insights and information you need.

Understanding Maui’s Real Property Tax System

Maui, known for its stunning beaches, lush landscapes, and vibrant culture, attracts not only tourists but also a thriving real estate market. The island’s unique natural beauty and desirable lifestyle make it a sought-after destination for homeowners and investors alike. With this popularity comes the responsibility of understanding the island’s real property tax system.

Maui's real property tax, much like any other jurisdiction, serves as a significant source of revenue for the local government, contributing to the maintenance and development of essential services and infrastructure. It is a vital component of the island's economy, ensuring the continued growth and sustainability of the community.

In this section, we will delve into the fundamental aspects of Maui's real property tax, exploring the key terms, assessment process, and tax rates to provide a comprehensive understanding of this essential aspect of island life.

Key Terms and Definitions

Before we dive into the specifics, let’s clarify some essential terms related to real property tax in Maui:

- Real Property: This term refers to land and any permanent structures attached to it, such as buildings, houses, and other improvements. In the context of taxation, real property is the basis for assessing and levying taxes.

- Property Tax Assessment: The process of determining the value of a property for tax purposes. In Maui, this assessment is conducted by the County of Maui's Property Taxation Division, which is responsible for evaluating each property's worth based on various factors.

- Assessed Value: The estimated monetary value of a property as determined by the tax assessor. This value is crucial as it forms the basis for calculating the property tax liability.

- Millage Rate: Also known as the tax rate, this is the percentage applied to the assessed value of a property to determine the annual property tax amount. Millage rates are set by the local government and can vary depending on the type of property and its location.

- Property Tax Due Date: The deadline by which property owners must pay their annual property taxes. In Maui, the specific due dates may vary, but generally, property taxes are due twice a year.

Property Tax Assessment Process

The property tax assessment process in Maui is a comprehensive and standardized procedure aimed at ensuring fairness and accuracy in tax calculations. Here’s an overview of how it works:

- Data Collection: The Property Taxation Division collects data on all real properties within Maui County. This includes information on the property's physical characteristics, such as size, location, improvements, and any recent sales or transactions.

- Market Analysis: Using the collected data, the division conducts a thorough market analysis to determine the current value of each property. This analysis takes into account factors like recent sales prices, comparable properties, and market trends.

- Assessment Calculation: Based on the market analysis, the assessed value of each property is calculated. This value represents the property's estimated worth for tax purposes. The assessment is typically conducted every two years.

- Notice of Assessment: Once the assessments are completed, property owners receive a Notice of Assessment, which informs them of the assessed value of their property and provides an opportunity for review and appeal if needed.

- Appeal Process: Property owners who believe their assessment is inaccurate or unfair can initiate an appeal. The appeal process allows for a review of the assessment, and if necessary, adjustments can be made to ensure a fair valuation.

By following this systematic process, Maui ensures that property tax assessments are fair, transparent, and based on up-to-date market values.

Tax Rates and Calculations

Understanding how property taxes are calculated is crucial for property owners and investors. In Maui, the property tax rate, or millage rate, is determined by the local government and can vary based on the type of property and its location.

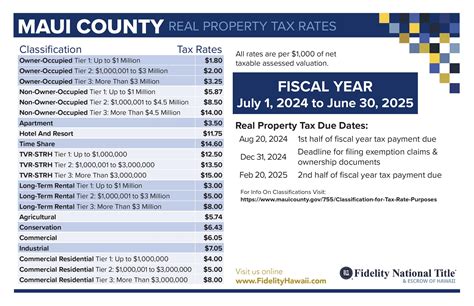

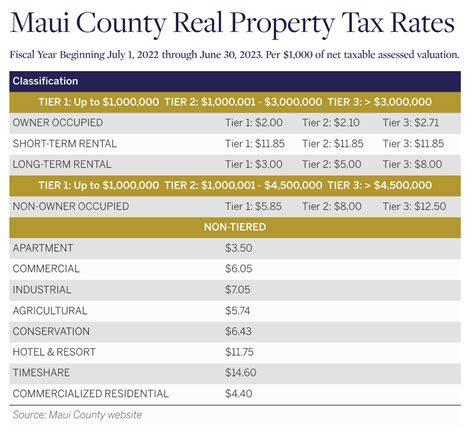

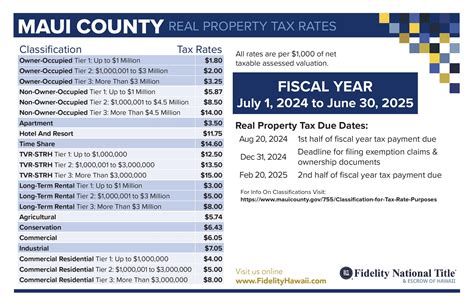

Here's a breakdown of the tax rates for different property types in Maui:

| Property Type | Tax Rate (Millage) |

|---|---|

| Residential Property | 6.35 mills |

| Commercial Property | 7.35 mills |

| Agricultural Property | 5.65 mills |

To calculate the annual property tax amount, you can use the following formula:

Property Tax = Assessed Value x Millage Rate

For example, if you own a residential property with an assessed value of $500,000, the annual property tax would be:

Property Tax = $500,000 x 0.0635 = $31,750

It's important to note that Maui County may adjust these tax rates periodically to align with budgetary needs and economic conditions. Property owners should stay informed about any changes to ensure accurate tax calculations.

Property Tax Exemptions and Credits

Maui, like many other jurisdictions, offers various property tax exemptions and credits to eligible property owners. These incentives aim to provide relief and support to specific groups or promote certain types of development.

Homestead Exemption

The Homestead Exemption is a popular tax benefit available to homeowners who use their property as their primary residence. In Maui, this exemption provides a reduction in the assessed value of the property for tax purposes. To qualify for the Homestead Exemption, property owners must meet certain criteria, including residency requirements and income limits.

By applying for the Homestead Exemption, homeowners can significantly reduce their property tax liability, making homeownership more affordable and sustainable.

Agricultural Land Tax Credit

Maui recognizes the importance of agriculture to the island’s economy and culture. To support agricultural activities, the county offers the Agricultural Land Tax Credit. This credit provides a reduction in the assessed value of agricultural lands, encouraging the preservation and development of agricultural lands.

Property owners who use their land for agricultural purposes, such as farming or ranching, may be eligible for this credit, which can result in substantial tax savings.

Other Exemptions and Credits

In addition to the Homestead Exemption and Agricultural Land Tax Credit, Maui offers various other exemptions and credits to eligible property owners. These include:

- Senior Exemption: Designed to provide tax relief to senior citizens, this exemption offers a reduction in property taxes for homeowners aged 65 or older who meet certain income and residency requirements.

- Disabled Veteran Exemption: Recognizing the sacrifices made by veterans, Maui provides a property tax exemption for disabled veterans. This exemption reduces the assessed value of the property, offering financial support to those who have served our country.

- Renewable Energy Credit: To promote the adoption of renewable energy sources, Maui offers a tax credit for property owners who install and utilize renewable energy systems, such as solar panels or wind turbines.

These exemptions and credits not only provide financial benefits to eligible property owners but also contribute to the overall well-being and sustainability of the island's community.

Property Tax Payment and Due Dates

Understanding when and how to pay your property taxes is essential to avoid penalties and maintain a good standing with the local government. In Maui, property taxes are typically due twice a year, with specific due dates set by the County of Maui.

Payment Options

Maui County offers a range of convenient payment options to accommodate different preferences and circumstances. Property owners can choose from the following methods to pay their property taxes:

- Online Payment: The most convenient option, online payment allows property owners to pay their taxes securely through the County's website. This method is available 24/7 and provides a quick and efficient way to settle tax obligations.

- Mail-In Payment: Property owners can mail their tax payments to the County's designated address. This option is ideal for those who prefer a more traditional method of payment.

- In-Person Payment: For those who prefer face-to-face interaction, Maui County provides in-person payment options at designated locations. Property owners can visit these locations during specified hours to make their payments.

- Automatic Payment Plans: To ensure timely payments without the hassle of manual transactions, Maui County offers automatic payment plans. Property owners can set up automatic payments from their bank accounts, ensuring their taxes are paid on time without any additional effort.

Due Dates and Penalties

Understanding the due dates for property tax payments is crucial to avoid late fees and penalties. In Maui, property taxes are typically due in two installments, with specific dates set by the County:

- First Installment: The first installment of property taxes is due in January or February, depending on the specific year. Property owners should receive a tax bill detailing the amount due and the payment deadline.

- Second Installment: The second installment is due approximately six months after the first installment, typically in July or August. Again, property owners will receive a tax bill with the necessary information.

Failure to pay property taxes by the due date may result in late fees and penalties. It is essential to stay informed about the payment deadlines and ensure timely payments to avoid any additional financial burdens.

Property Tax Appeals and Disputes

While Maui’s property tax assessment process aims for accuracy and fairness, there may be instances where property owners believe their assessment is incorrect or unfair. In such cases, the County of Maui provides a formal process for appealing property tax assessments.

Reasons for Appeal

Property owners may consider appealing their property tax assessment for various reasons, including:

- Overvaluation: If a property owner believes that the assessed value of their property is higher than the actual market value, they may appeal to have the assessment adjusted downward.

- Assessment Errors: Mistakes can occur during the assessment process, such as incorrect property dimensions or incorrect classification of the property. Property owners can appeal to correct these errors and have their assessment adjusted accordingly.

- Comparable Sales Discrepancies: The assessed value of a property is often based on comparable sales in the area. If a property owner believes that the assessor used outdated or inaccurate comparable sales data, they can appeal to have the assessment revised.

Appeal Process

To initiate an appeal, property owners must follow a formal process outlined by the County of Maui. Here’s a step-by-step guide to the appeal process:

- Notice of Assessment: After receiving the Notice of Assessment, property owners have a limited time frame, typically 30-60 days, to review the assessment and decide whether to appeal.

- Appeal Application: If a property owner wishes to appeal, they must complete and submit an appeal application to the County's Property Taxation Division. The application requires detailed information about the property and the reasons for the appeal.

- Appeal Hearing: Once the appeal application is received, the County will schedule a hearing date. During the hearing, the property owner can present their case, provide evidence, and argue why the assessment should be adjusted.

- Decision and Notification: After the hearing, the County's Property Taxation Division will review the evidence and make a decision on the appeal. Property owners will receive a written notification of the decision, along with an explanation of the reasoning behind it.

It's important to note that appealing a property tax assessment requires careful preparation and documentation. Property owners should gather relevant evidence, such as recent sales data, appraisals, or professional opinions, to support their case.

The Impact of Property Taxes on Maui’s Real Estate Market

Property taxes play a significant role in shaping the real estate market dynamics of any region, and Maui is no exception. The real property tax system in Maui has both direct and indirect impacts on the island’s real estate landscape.

Direct Impact on Homeownership

For homeowners in Maui, property taxes represent a significant ongoing expense. The annual property tax liability can influence a homeowner’s financial planning and budget allocation. While property taxes are necessary to fund essential services, they can also impact the affordability of homeownership.

Property taxes in Maui can vary based on the assessed value of the property, with higher-value properties facing higher tax liabilities. This can affect the decision-making process for prospective homebuyers, as they must consider not only the purchase price but also the ongoing tax obligations associated with homeownership.

Influence on Investment Opportunities

Real estate investors in Maui also closely monitor property tax rates and assessment practices. Property taxes can significantly impact an investor’s cash flow and overall return on investment. Higher tax rates may deter investors from entering the market or influence their investment strategies.

Conversely, favorable tax rates and incentives, such as the Agricultural Land Tax Credit, can attract investors who see an opportunity to develop or utilize land for specific purposes. These incentives can stimulate economic growth and promote sustainable development on the island.

Community Development and Services

Property taxes in Maui contribute to the overall economic health and development of the community. The revenue generated from property taxes funds essential services, infrastructure projects, and community initiatives.

From maintaining roads and public facilities to supporting education and social services, property taxes play a vital role in ensuring the well-being and prosperity of Maui's residents. The tax system allows the local government to invest in the community's future, fostering growth and creating a high quality of life for all.

Future Outlook and Potential Changes

As with any tax system, Maui’s real property tax landscape is subject to change and evolution. While the current system provides a stable and fair framework for property taxation, there are ongoing discussions and considerations for potential improvements and adjustments.

Potential Tax Reform

The County of Maui periodically reviews its tax policies and considers proposals for reform. These proposals may aim to address specific concerns, such as fairness, efficiency, or the promotion of certain economic goals.

Potential tax reforms could include adjustments to the tax rates, reassessment intervals, or the introduction of new incentives and exemptions. These changes would aim to ensure that the tax system remains responsive to the needs and dynamics of the island's real estate market and community.

Impact of Economic Conditions

Maui’s real property tax system is closely tied to the island’s economic health and real estate market trends. Economic downturns or fluctuations can influence property values and, consequently, tax assessments.

In times of economic challenges, the County may need to carefully manage its revenue streams and consider temporary adjustments to tax rates or assessment practices to provide relief to property owners. Conversely, during periods of economic prosperity, the County may explore opportunities to enhance revenue and invest in community development.

Community Engagement and Feedback

Maui’s local government values community engagement and feedback when making decisions related to property taxation. Public forums, town hall meetings, and online platforms provide opportunities for residents and stakeholders to voice their opinions and concerns.

By actively involving the community in the decision-making process, the County can ensure that the real property tax system remains fair, transparent, and aligned with the needs and aspirations of Maui's residents and businesses.

Conclusion: Navigating Maui’s Real Property Tax Landscape

Understanding Maui’s real property tax system is crucial for both residents and investors. From the assessment process to tax rates and exemptions, this comprehensive guide has provided an in-depth look at how property taxes work on the island.

As Maui continues to thrive as a desirable destination, its real property tax system plays a vital role in sustaining the community's growth and development. By staying informed and engaged, property owners can navigate the tax landscape effectively, ensuring their financial obligations are met while contributing to the vibrant future of Maui.

For further insights and updates on Maui's real estate and property tax landscape, stay connected with local resources and expert advisors. Together, we can ensure a bright and prosperous future for this stunning island paradise.