Nyc School Tax Credit

The New York City School Tax Credit is a valuable financial incentive aimed at supporting the education system within the city and providing relief to taxpayers. This credit, offered by the state of New York, has become an essential component of the city's tax landscape, benefiting both residents and the education sector. In this comprehensive guide, we will delve into the intricacies of the NYC School Tax Credit, exploring its origins, eligibility criteria, calculation methods, and the significant impact it has on the city's taxpayers and educational institutions.

Understanding the NYC School Tax Credit

The NYC School Tax Credit, officially known as the School Tax Relief (STAR) Program, is a property tax exemption or credit designed to alleviate the financial burden of property taxes on homeowners and renters in New York City. This credit is a crucial aspect of the state’s efforts to promote accessibility and affordability in education, particularly for those residing in high-cost urban areas like NYC.

A Brief History

The roots of the NYC School Tax Credit can be traced back to the late 20th century when the state of New York recognized the need to provide relief to taxpayers, especially in regions with high property values. The program was initially introduced as a means to ensure that property taxes did not become a prohibitive barrier to homeownership and to support local schools simultaneously.

Over the years, the STAR program has undergone various modifications to adapt to the changing needs of New York's diverse population. These adjustments have aimed to enhance the program's effectiveness, ensure fairness, and provide more targeted support to specific demographics.

Eligibility and Criteria

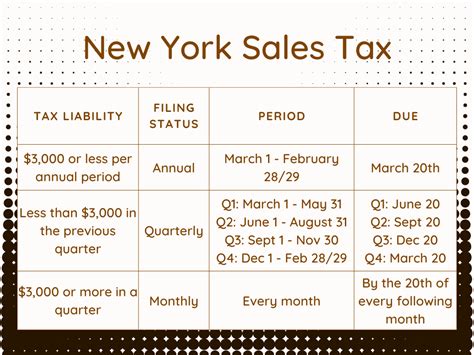

Eligibility for the NYC School Tax Credit is primarily determined by income and property ownership or rental status. Generally, homeowners and renters who meet specific income thresholds and reside in New York City are eligible for this credit. The income limits are set annually and vary based on factors such as family size and the type of property (primary residence, condominium, etc.).

Additionally, there are certain property value restrictions in place to ensure that the credit is directed towards those who need it most. Properties exceeding a certain assessed value may not qualify for the full credit, with the amount of the credit decreasing as the property value increases.

| Income Eligibility (2023) | Maximum Credit |

|---|---|

| Single Filers: Up to $150,000 | $3,179 |

| Married Filing Jointly: Up to $200,000 | $6,358 |

| Additional Requirements: Primary residence, New York State resident, etc. |

Calculation and Application

The NYC School Tax Credit is calculated based on a percentage of the school tax liability for eligible homeowners and renters. The credit amount varies depending on income and property type. For example, homeowners may receive a basic STAR credit of up to 3,179, while renters can qualify for a Renters' STAR credit of up to 2,000.

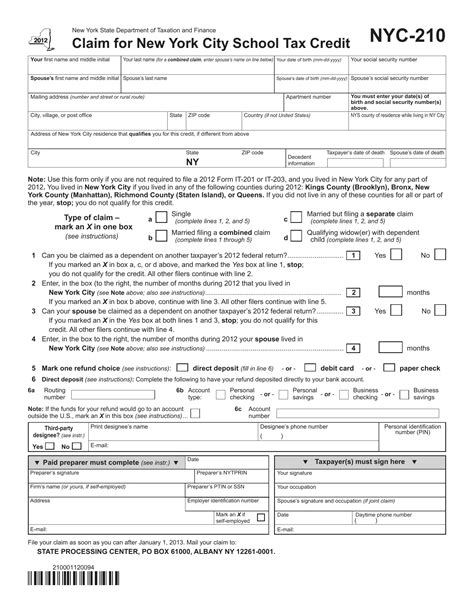

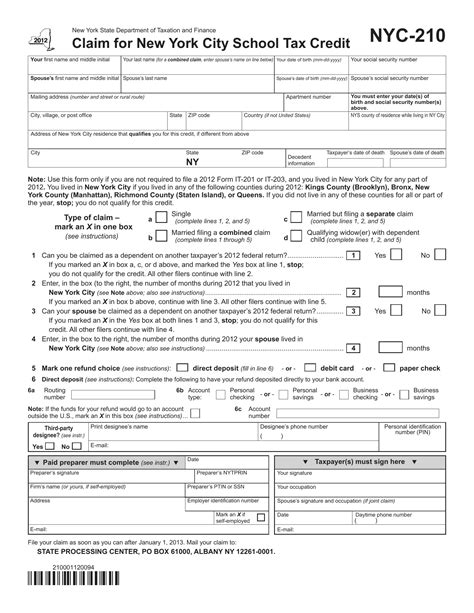

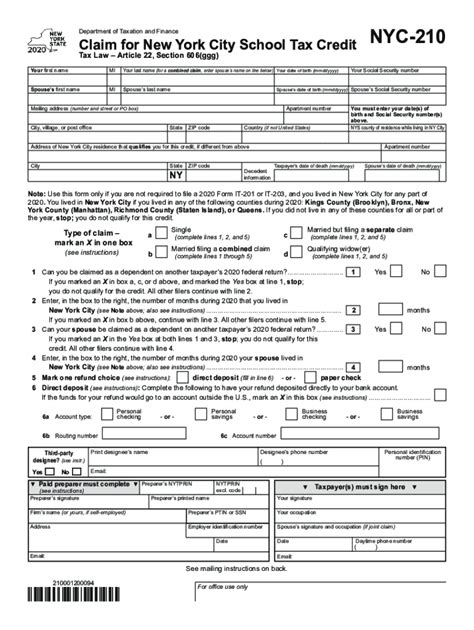

To apply for the NYC School Tax Credit, individuals must complete and submit the appropriate forms, typically during the tax filing season. The process involves providing documentation to verify income, residency, and property ownership or rental status. It's important to note that the application process may vary slightly based on whether an individual is applying for the first time or renewing their credit.

Impact and Benefits

The NYC School Tax Credit has a profound impact on both taxpayers and the city’s education system. For eligible individuals, the credit can significantly reduce their annual tax liability, making homeownership more affordable and providing financial relief to renters.

Financial Relief for Taxpayers

One of the most notable benefits of the NYC School Tax Credit is the substantial savings it offers to taxpayers. For homeowners, the credit can reduce their annual school tax bill by thousands of dollars, providing a significant boost to their household finances. Renters, too, benefit from a dedicated credit, ensuring that their living expenses remain manageable.

The financial relief provided by this credit is particularly advantageous in a high-cost city like New York, where property taxes can be a substantial portion of a household's budget. By reducing the tax burden, the NYC School Tax Credit empowers residents to allocate more of their income towards other essential expenses or savings.

Supporting Education and Community

Beyond its direct impact on taxpayers, the NYC School Tax Credit plays a crucial role in supporting the city’s education system. A portion of the school taxes collected is allocated to fund public schools and educational initiatives. By encouraging compliance with property taxes, the credit indirectly contributes to the financial stability of schools, benefiting students and the community at large.

Furthermore, the credit's eligibility criteria, which consider income levels, ensure that the benefits are directed towards those who need them most. This targeted approach helps create a more equitable distribution of resources, addressing the unique challenges faced by different socioeconomic groups within the city.

Community Engagement and Awareness

The NYC School Tax Credit also fosters community engagement and awareness regarding the importance of education and taxation. By actively encouraging residents to understand and utilize the credit, the program promotes a sense of collective responsibility towards the city’s educational institutions. This, in turn, can lead to increased participation in local school initiatives and a stronger sense of community.

Challenges and Future Prospects

While the NYC School Tax Credit has proven to be a valuable initiative, it is not without its challenges. One of the primary concerns is ensuring that the program remains accessible and effective for all eligible residents, especially in a diverse city like New York.

Addressing Accessibility

Accessibility is a key issue when it comes to tax credits and incentives. To ensure that all eligible individuals can benefit from the NYC School Tax Credit, it is essential to provide clear and comprehensive information, especially for those who may have limited access to resources or face language barriers.

Efforts should be made to streamline the application process, offer assistance to those in need, and raise awareness about the credit through targeted outreach programs. By making the process more user-friendly, the state can maximize the impact of the credit and ensure that no eligible taxpayer is left behind.

Adaptability and Long-Term Sustainability

The NYC School Tax Credit, like any tax program, must be adaptable to changing economic conditions and demographic shifts. Regular reviews and adjustments are necessary to maintain the credit’s relevance and effectiveness over time.

This includes considering factors such as inflation, changes in property values, and shifts in the city's population dynamics. By staying agile and responsive to these changes, the state can ensure that the credit continues to provide meaningful support to taxpayers and the education system.

Exploring Alternative Approaches

Additionally, exploring alternative approaches to support education and provide tax relief could be beneficial. For instance, considering targeted incentives for specific demographic groups, such as seniors or low-income families, may further enhance the program’s impact. These initiatives could include additional credits or exemptions tailored to the unique needs of these groups.

Furthermore, collaborating with local communities and schools to identify and address specific challenges could lead to innovative solutions. By working together, the state, taxpayers, and educational institutions can find mutually beneficial strategies to improve the overall effectiveness of the NYC School Tax Credit.

Conclusion: A Vital Component of NYC’s Tax Landscape

The NYC School Tax Credit is a vital component of the city’s tax landscape, providing much-needed relief to taxpayers while simultaneously supporting the education system. Through its carefully designed eligibility criteria and calculation methods, the credit ensures that benefits are directed towards those who need them most, fostering a more equitable distribution of resources.

As New York City continues to evolve and adapt to changing circumstances, the NYC School Tax Credit remains a cornerstone of its tax policy, reflecting the state's commitment to accessibility, affordability, and community well-being. By continually evaluating and enhancing this program, the state can ensure that it remains a powerful tool for promoting economic stability and educational excellence within the city.

Can I receive the NYC School Tax Credit if I rent an apartment in NYC?

+Yes, renters in NYC can qualify for the Renters’ STAR credit, which provides up to $2,000 in savings. To be eligible, you must meet specific income requirements and provide proof of residency.

How often do I need to renew my NYC School Tax Credit application?

+Renewal requirements vary, but typically, you need to renew your application annually during the tax filing season. It’s advisable to stay updated with the latest guidelines provided by the New York State Department of Taxation and Finance.

Are there any income restrictions for the NYC School Tax Credit?

+Yes, income restrictions are in place to ensure the credit is targeted towards those who need it most. Income limits vary based on factors like family size and property type. It’s crucial to review the current income eligibility criteria each year.