State Of California Tax Refund

The California tax refund process is an important aspect of financial management for residents of the Golden State. With a population of over 39 million people, California's diverse tax landscape can often lead to various refund scenarios. This guide aims to demystify the process, offering a comprehensive understanding of how California tax refunds work and what taxpayers can expect.

Understanding the California Tax System

California’s tax system is intricate, encompassing a range of taxes, including income tax, sales tax, property tax, and more. The state’s progressive income tax system means that tax rates increase as taxable income rises. For instance, for the 2023 tax year, California has 10 tax brackets ranging from 1% to 13.3%.

The state's sales tax, one of the highest in the nation, varies by jurisdiction, with a base rate of 7.25%. Additionally, property taxes in California are levied by various local jurisdictions, with the statewide average effective property tax rate standing at 0.76%.

Eligibility for a California Tax Refund

Not all Californians will be eligible for a tax refund. Generally, a refund occurs when the amount of tax withheld from an individual’s wages or estimated tax payments exceeds the actual tax liability for the year.

Various factors can influence the likelihood of receiving a refund. These include an individual's income level, tax bracket, deductions, and credits. For instance, taxpayers who claim deductions for expenses such as mortgage interest, charitable contributions, or state and local taxes may be more likely to receive a refund.

Additionally, California offers several tax credits that can reduce tax liability or increase a refund. These include the California Earned Income Tax Credit (CalEITC), the Child and Dependent Care Credit, and the Child Tax Credit. Qualifying for these credits can significantly impact an individual's tax refund.

Tax Credits and Their Impact

California’s tax credits play a significant role in determining the size of a tax refund. The CalEITC, for example, provides a refundable credit of up to 3,664 for eligible taxpayers with an annual income of less than 34,000. This credit can be a significant boost for low- to moderate-income earners, potentially increasing their refund by thousands of dollars.

Similarly, the Child and Dependent Care Credit can provide a refund of up to 35% of eligible expenses, while the Child Tax Credit offers a maximum credit of $2,000 per qualifying child under the age of 17. These credits can be particularly beneficial for families with children.

| Tax Credit | Description | Maximum Refund |

|---|---|---|

| California Earned Income Tax Credit (CalEITC) | Refundable credit for low- to moderate-income earners | $3,664 |

| Child and Dependent Care Credit | Refund of up to 35% of eligible expenses | Varies based on expenses |

| Child Tax Credit | Credit of up to $2,000 per qualifying child under 17 | $2,000 per child |

The Tax Refund Process in California

The process of claiming a tax refund in California is straightforward, although it can vary slightly depending on the taxpayer’s circumstances and the method of filing.

Filing Options

Taxpayers can choose to file their taxes either manually or electronically. Manual filing involves completing and mailing Form 540, the California Resident Income Tax Return. This method is typically more time-consuming and may result in a longer wait for a refund.

Electronic filing, on the other hand, is faster and often more convenient. Taxpayers can use online software or hire a tax professional to e-file their taxes. This method typically speeds up the refund process, with many taxpayers receiving their refunds within 2-3 weeks.

Required Documentation

To file a tax return and claim a refund, taxpayers will need various documents. These include Form W-2 from employers, 1099 forms for income not subject to withholding, and records of any deductions or credits claimed. Additionally, taxpayers may need to provide documentation for any adjustments or credits, such as receipts for eligible expenses.

Estimated Tax Refunds

Taxpayers can estimate their potential refund using the California Franchise Tax Board’s Calculator. This tool takes into account income, deductions, and credits to provide an estimate of the refund amount. However, it’s important to note that this is an estimate and the actual refund may vary.

Tracking and Receiving Your Refund

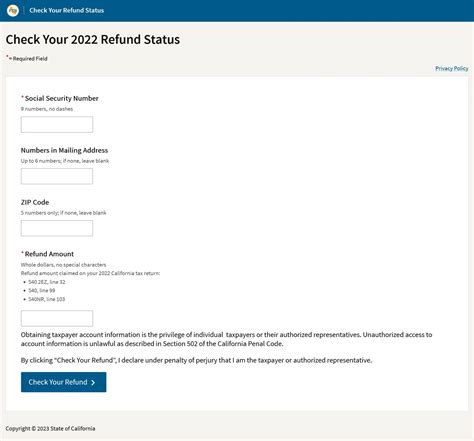

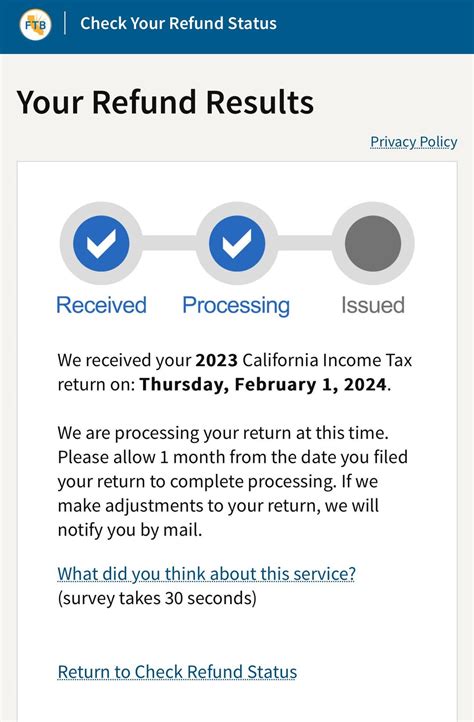

Once the tax return has been filed, taxpayers can track the status of their refund using the California Franchise Tax Board’s Where’s My Refund tool. This tool provides updates on the refund’s progress, from processing to payment.

Taxpayers have the option to receive their refund via direct deposit or by check. Direct deposit is typically faster and more secure, with the refund deposited directly into the taxpayer's bank account. Check refunds, on the other hand, are mailed to the taxpayer's address and may take longer to receive.

Direct Deposit Details

For direct deposit, taxpayers need to provide their bank account information, including the routing and account numbers. This information is typically entered during the tax filing process. It’s important to ensure the accuracy of this information to avoid delays or errors in the refund deposit.

Check Refunds

If opting for a check refund, taxpayers should allow for additional time for the check to be processed and mailed. The California Franchise Tax Board aims to issue check refunds within 60 days of receiving the tax return. However, this timeline may be affected by factors such as the complexity of the return or the volume of returns being processed.

Addressing Refund Delays and Issues

In some cases, taxpayers may experience delays in receiving their refund. This could be due to various reasons, such as errors in the tax return, missing or incorrect information, or a high volume of returns being processed.

If a refund is significantly delayed, taxpayers can contact the California Franchise Tax Board for assistance. The Board provides a dedicated phone line and email address for refund inquiries, allowing taxpayers to check the status of their refund and resolve any issues.

Common Refund Issues

Some common issues that can lead to refund delays include:

- Errors in the tax return, such as incorrect income or deduction amounts.

- Missing or incorrect taxpayer information, including name, address, or Social Security Number.

- Suspicious activity or identity theft, which may require additional verification.

- Complex returns or returns with multiple adjustments or credits, which may take longer to process.

Future Outlook and Tax Planning

Understanding the California tax refund process is not only beneficial for claiming refunds but also for effective tax planning. By comprehending the factors that influence tax liability and refunds, taxpayers can make informed decisions to maximize their refunds in future tax years.

For instance, taxpayers can consider strategies such as maximizing deductions, claiming applicable credits, and adjusting withholding to ensure they're not overpaying taxes throughout the year. These strategies can not only increase the size of the refund but also provide a more stable financial situation year-round.

Tax Planning Strategies

Here are some strategies taxpayers can consider for better tax planning:

- Maximize deductions by keeping track of eligible expenses throughout the year, such as mortgage interest, state and local taxes, and charitable contributions.

- Understand and claim applicable credits, such as the CalEITC, Child and Dependent Care Credit, and Child Tax Credit.

- Adjust withholding on Form W-4 to ensure the right amount of tax is withheld from each paycheck, avoiding overpayment.

- Consider tax-efficient investment strategies, such as contributing to tax-advantaged retirement accounts like a 401(k) or IRA.

Conclusion

The California tax refund process is an essential part of financial management for state residents. By understanding the tax system, eligibility criteria, and the refund process, taxpayers can effectively claim their refunds and plan their finances more efficiently. Whether through maximizing deductions, claiming credits, or adjusting withholding, there are numerous strategies available to optimize tax refunds and overall financial health.

Frequently Asked Questions

How long does it typically take to receive a California tax refund?

+The timeframe for receiving a California tax refund can vary. On average, it takes about 2-3 weeks for a refund to be issued if you file your taxes electronically and choose direct deposit. If you file a paper return or opt for a check refund, it may take up to 60 days or longer.

What happens if my California tax refund is delayed?

+If your California tax refund is significantly delayed, you can contact the California Franchise Tax Board to inquire about the status of your refund. Common reasons for delays include errors in the tax return, missing or incorrect information, or complex returns.

Can I check the status of my California tax refund online?

+Yes, you can check the status of your California tax refund online using the Where’s My Refund tool provided by the California Franchise Tax Board. This tool provides real-time updates on the progress of your refund.

What is the California Earned Income Tax Credit (CalEITC) and how does it affect my refund?

+The CalEITC is a refundable tax credit for low- to moderate-income earners. It can significantly increase your tax refund, providing a maximum credit of up to 3,664 for eligible taxpayers with an annual income of less than 34,000.

How can I maximize my California tax refund?

+To maximize your California tax refund, consider strategies such as maximizing deductions by keeping track of eligible expenses, claiming applicable credits like the CalEITC, and adjusting your withholding on Form W-4 to ensure you’re not overpaying taxes throughout the year.