Boston City Sales Tax

In the bustling city of Boston, Massachusetts, sales tax is an essential component of the city's revenue stream and plays a significant role in shaping the local economy. The sales tax rate in Boston, like in many other cities, is a crucial factor that impacts both residents and businesses. Understanding the intricacies of Boston's sales tax system is essential for individuals and businesses alike, as it directly influences their financial planning and operations. This article aims to provide a comprehensive overview of Boston's sales tax, delving into its rates, exemptions, and the impact it has on the city's economic landscape.

Unraveling the Boston Sales Tax: A Comprehensive Guide

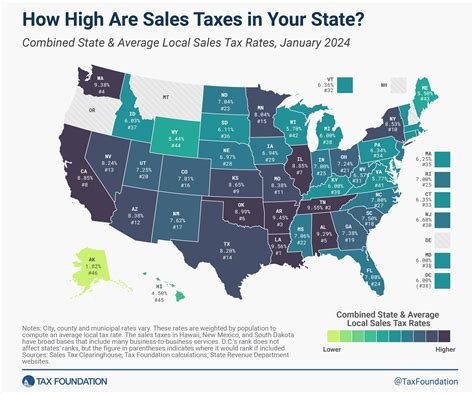

The sales tax system in Boston is a complex yet integral part of the city’s financial framework. It is a consumption tax levied on the sale of goods and services within the city limits. While the state of Massachusetts sets the base sales tax rate, Boston, being a major city, often imposes additional local sales taxes, resulting in a combined rate that businesses and consumers must navigate.

The Boston Sales Tax Structure: A Deep Dive

Boston’s sales tax structure is a delicate balance between state and local taxes. The current sales tax rate in Boston is comprised of two components: the state sales tax and the local option tax. The state sales tax is a uniform rate applied across Massachusetts, while the local option tax is an additional tax imposed by the city of Boston.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 6.25% |

| Local Option Tax (Boston) | 1.25% |

| Total Sales Tax in Boston | 7.50% |

This means that for every purchase made within Boston city limits, a 7.50% sales tax is applied, with the revenue collected split between the state and the city. The state receives the base sales tax of 6.25%, while the additional 1.25% goes directly to the city's coffers, contributing to vital city services and infrastructure projects.

Navigating Sales Tax Exemptions in Boston

While the sales tax in Boston applies to a wide range of goods and services, there are certain categories that are exempt from this tax. These exemptions are designed to alleviate the tax burden on specific industries or promote certain social or environmental initiatives. Here’s a glimpse into some of the key sales tax exemptions in Boston:

- Grocery Items: Essential food items, including fruits, vegetables, dairy products, and certain non-alcoholic beverages, are exempt from sales tax in Boston. This exemption aims to make groceries more affordable for residents.

- Prescription Medications: Sales tax is not applicable to the sale of prescription drugs, ensuring that essential healthcare items remain accessible to all.

- Clothing and Footwear: In a welcome relief for shoppers, clothing and footwear items priced under $175 are exempt from sales tax. This exemption is particularly beneficial for families and those on a budget.

- Books and Educational Materials: To promote literacy and education, sales tax is waived on the sale of books, magazines, and certain educational resources.

- Energy-Efficient Products: Boston encourages energy conservation by exempting the sale of energy-efficient appliances and products from sales tax.

These exemptions not only provide financial relief to residents but also encourage environmentally friendly practices and support local industries.

The Impact of Boston’s Sales Tax on the Local Economy

The sales tax in Boston is a significant revenue generator for the city, contributing to the overall economic health of the region. The funds collected through sales tax are allocated towards critical public services, infrastructure development, and community initiatives. Here’s a closer look at how Boston’s sales tax revenue is distributed:

- Public Education: A substantial portion of sales tax revenue is dedicated to funding public schools, ensuring that Boston's youth receive quality education.

- Transportation and Infrastructure: Sales tax revenue plays a vital role in maintaining and improving Boston's transportation network, including roads, bridges, and public transit systems.

- Public Safety: A significant amount of sales tax funds are allocated to law enforcement, fire protection, and emergency services, ensuring the safety and security of Boston's residents.

- Social Services: Boston's sales tax revenue also supports social programs, providing assistance to vulnerable populations and promoting community well-being.

- Economic Development: A portion of the sales tax revenue is invested in initiatives that foster economic growth, attract businesses, and create job opportunities.

The impact of sales tax extends beyond the city limits, as it also contributes to the state's overall fiscal health and regional development. Boston's robust sales tax system is a testament to the city's commitment to fiscal responsibility and its ability to balance revenue generation with community needs.

Sales Tax Compliance: A Shared Responsibility

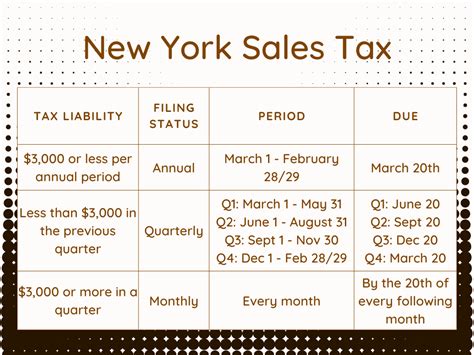

For businesses operating in Boston, sales tax compliance is a critical aspect of their financial operations. Businesses are responsible for collecting, reporting, and remitting sales tax to the appropriate authorities. This process involves accurate record-keeping, regular tax filings, and compliance with the latest tax regulations.

To assist businesses in navigating the complexities of sales tax compliance, the Massachusetts Department of Revenue provides comprehensive resources and guidance. Businesses can access online tools, workshops, and expert advice to ensure they are meeting their sales tax obligations accurately and efficiently.

For consumers, understanding their rights and responsibilities regarding sales tax is equally important. Being aware of the sales tax rate, applicable exemptions, and how to report any potential tax issues is essential for maintaining a fair and transparent tax system.

The Future of Boston’s Sales Tax: Trends and Predictions

As the economic landscape evolves, so too will Boston’s sales tax system. With advancements in technology and changing consumer behavior, the city is poised to adapt its tax policies to meet the needs of the modern marketplace.

One emerging trend is the increasing focus on e-commerce and online sales. As more businesses shift their operations online, Boston is likely to explore ways to capture sales tax revenue from these transactions, ensuring that all sales, regardless of their origin, contribute to the city's fiscal health.

Additionally, with the growing popularity of sustainable and environmentally conscious practices, Boston may explore the expansion of sales tax exemptions for green products and services. This could encourage more businesses to adopt sustainable models and promote a greener economy.

As the city continues to thrive and adapt, Boston's sales tax system will remain a dynamic and essential component of its financial framework, shaping the city's future and ensuring its continued prosperity.

How often does Boston’s sales tax rate change?

+Boston’s sales tax rate is relatively stable, with changes occurring infrequently. However, it’s important to stay updated, as any changes in tax policy can impact businesses and consumers alike.

Are there any special tax incentives for businesses in Boston?

+Yes, Boston offers various tax incentives to attract and support businesses. These incentives can include tax breaks, grants, and reduced tax rates for specific industries or initiatives. It’s beneficial for businesses to explore these opportunities.

How can I stay informed about sales tax updates in Boston?

+Staying informed is crucial. You can subscribe to official city newsletters, follow local media outlets, and utilize resources provided by the Massachusetts Department of Revenue to receive the latest updates on sales tax regulations.