Sales Tax Orange County

Welcome to our comprehensive guide on understanding the intricacies of Sales Tax in Orange County. This region, known for its vibrant economy and diverse businesses, has a unique sales tax system that impacts both residents and businesses alike. Let's delve into the specifics to provide a clear picture of how sales tax works in this dynamic part of California.

The Basics of Sales Tax in Orange County

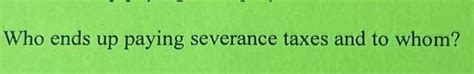

Sales tax in Orange County is a consumption tax levied on the sale of goods and certain services. It is an essential component of the county’s revenue stream, contributing significantly to its overall financial health. The tax rate is determined by a combination of state, county, and city taxes, resulting in a varied rate across different locations within the county.

As of [Current Year], the statewide sales tax rate in California stands at 7.25%, one of the higher rates in the nation. However, this base rate is just the starting point, as local jurisdictions have the authority to impose additional taxes on top of this figure. This means that the total sales tax rate can vary significantly depending on the specific location within Orange County.

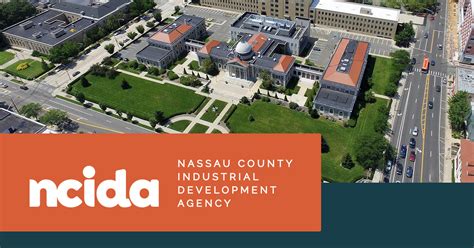

For instance, in the city of Anaheim, the sales tax rate is 9.75%, which includes the state rate, a county rate of 0.25%, and a city rate of 2.25%. In contrast, the city of Irvine has a slightly lower rate of 9.50%, with a county rate of 0.25% and a city rate of 2%. These variations are crucial for businesses and consumers to understand, as they directly impact the final cost of goods and services.

| City | Total Sales Tax Rate | State Rate | County Rate | City Rate |

|---|---|---|---|---|

| Anaheim | 9.75% | 7.25% | 0.25% | 2.25% |

| Irvine | 9.50% | 7.25% | 0.25% | 2% |

| Santa Ana | 9.25% | 7.25% | 0.25% | 1.75% |

| Newport Beach | 9.50% | 7.25% | 0.25% | 2% |

| Huntington Beach | 9.75% | 7.25% | 0.25% | 2.25% |

Understanding the Tax Structure

The sales tax in Orange County is composed of three main components: the state sales tax, the county sales tax, and the city sales tax. The state sales tax is a uniform rate across California, ensuring consistency in the base tax rate. However, the county and city rates can vary, creating a complex tax landscape for businesses operating in multiple locations.

For businesses, especially those with multiple locations or an online presence, it's crucial to stay updated on the sales tax rates in each area they serve. Missteps in sales tax collection and remittance can lead to significant penalties and legal issues. To navigate this complexity, many businesses turn to tax software and professionals who specialize in sales tax compliance.

Impact on Businesses and Consumers

The varying sales tax rates in Orange County have a direct impact on both businesses and consumers. For businesses, especially those in the retail and e-commerce sectors, understanding and managing these rates is crucial for pricing strategies and maintaining a competitive edge. Failure to accurately collect and remit sales tax can result in significant financial and legal repercussions.

Consumers, on the other hand, are directly affected by these rates when they make purchases. The sales tax adds to the cost of goods and services, impacting their purchasing power and overall spending habits. It's important for consumers to be aware of these rates, especially when comparing prices across different locations or online platforms.

Sales Tax Exemptions and Special Considerations

While sales tax is a broad-based tax applied to most transactions, there are certain exemptions and special considerations in Orange County. These exemptions are designed to promote specific economic activities or provide relief to certain sectors.

Exempt Goods and Services

Not all goods and services are subject to sales tax in Orange County. Some common exemptions include:

- Prescription medications and certain medical devices.

- Grocery items, including non-prepared food and non-alcoholic beverages.

- Clothing and footwear up to a certain value.

- Certain agricultural equipment and supplies.

- Educational materials and textbooks.

These exemptions can significantly reduce the tax burden on consumers and promote access to essential goods and services.

Special Tax Districts

Orange County also has special tax districts, often established to fund specific projects or infrastructure improvements. These districts may have additional sales taxes on top of the standard rates. For example, the Orange County Transportation Authority has a special tax of 0.5% applied to sales in certain areas to fund transportation projects.

Sales Tax Holidays

To boost economic activity and provide relief to consumers, Orange County, like many other regions, occasionally observes sales tax holidays. During these periods, certain goods are exempt from sales tax, encouraging shoppers to make purchases and businesses to promote their offerings. These holidays are typically announced in advance and apply to specific categories of goods, such as back-to-school supplies or energy-efficient appliances.

Compliance and Reporting

For businesses operating in Orange County, compliance with sales tax regulations is a critical aspect of their financial operations. This involves accurate collection of sales tax from customers, proper record-keeping, and timely remittance to the appropriate tax authorities.

Registration and Permits

To collect and remit sales tax, businesses must first register with the California Department of Tax and Fee Administration (CDTFA). This registration process involves obtaining a Seller’s Permit, which authorizes the business to collect and remit sales tax. The permit must be displayed at the business location and updated regularly to reflect any changes in the business’s operations.

Sales Tax Returns

Businesses are required to file sales tax returns periodically, typically on a monthly, quarterly, or annual basis, depending on their sales volume. These returns involve reporting the total sales made during the reporting period and calculating the sales tax due. The tax due is then remitted to the CDTFA along with the return.

Audits and Penalties

The CDTFA conducts audits to ensure compliance with sales tax regulations. Audits can be random or targeted, based on factors like sales volume, industry, or previous compliance history. If a business is found to be non-compliant, it may face penalties, interest charges, and even legal action. It’s crucial for businesses to maintain accurate records and seek professional guidance when needed to avoid such consequences.

Future of Sales Tax in Orange County

As with any tax system, the sales tax landscape in Orange County is subject to change. Future developments may include adjustments to tax rates, the introduction of new tax districts, or changes in the exemptions and special considerations. These changes can be influenced by various factors, including economic conditions, political decisions, and the evolving needs of the county’s residents and businesses.

One potential future development is the increasing role of technology in sales tax compliance. With the rise of e-commerce and online sales, tax authorities are focusing on digital solutions to ensure accurate tax collection and compliance. This may involve the use of advanced data analytics and automated systems to track sales and ensure businesses are meeting their tax obligations.

Staying Informed and Adaptive

For businesses operating in Orange County, staying informed about sales tax regulations and changes is crucial for long-term success. This involves regularly monitoring tax rate changes, understanding new exemptions or special considerations, and adapting business practices accordingly. By staying proactive and compliant, businesses can avoid penalties and maintain a positive relationship with tax authorities.

In conclusion, understanding the sales tax system in Orange County is a complex but essential task for both businesses and consumers. With varying rates across different locations and a range of exemptions and special considerations, staying informed and compliant is key. By navigating this intricate tax landscape effectively, businesses can contribute to the county's economic growth while consumers can make informed purchasing decisions.

What is the current sales tax rate in Orange County, California?

+

The current sales tax rate in Orange County, California, varies depending on the specific location within the county. It is composed of the state sales tax rate, county sales tax rate, and city sales tax rate. As of [Current Year], the statewide sales tax rate is 7.25%, but local jurisdictions can add additional taxes, resulting in a range of rates across the county.

How does the sales tax rate differ between cities in Orange County?

+

The sales tax rate can vary significantly between cities in Orange County. For example, Anaheim has a total sales tax rate of 9.75%, while Irvine has a slightly lower rate of 9.50%. These variations are due to the additional taxes imposed by local jurisdictions, such as counties and cities, on top of the statewide rate.

Are there any sales tax exemptions or special considerations in Orange County?

+

Yes, Orange County has certain sales tax exemptions and special considerations. Common exemptions include prescription medications, grocery items, clothing and footwear up to a certain value, agricultural equipment, educational materials, and more. Additionally, there are special tax districts with additional sales taxes, and the county may observe sales tax holidays for specific goods.

What happens if a business fails to comply with sales tax regulations in Orange County?

+

Non-compliance with sales tax regulations in Orange County can result in serious consequences for businesses. The California Department of Tax and Fee Administration (CDTFA) conducts audits to ensure compliance. If a business is found to be non-compliant, it may face penalties, interest charges, and even legal action. Accurate record-keeping and timely remittance of sales tax are crucial to avoid such issues.

How can businesses stay informed about sales tax changes in Orange County?

+

Businesses can stay informed about sales tax changes in Orange County by regularly monitoring tax rate changes, understanding new exemptions or special considerations, and keeping up-to-date with tax authority announcements. Utilizing sales tax software and seeking professional tax advice can also help businesses stay compliant and adapt to changing regulations.