Montana State Tax

Montana, known for its stunning natural beauty and diverse landscapes, boasts a unique tax system that is worth exploring. Understanding the state's tax structure is crucial for individuals and businesses alike, as it directly impacts their financial strategies and planning. This comprehensive guide aims to unravel the intricacies of Montana's state tax, offering a detailed analysis of its various components and implications.

The Landscape of Montana State Tax

Montana’s tax system is designed to generate revenue for the state’s operations while maintaining a balanced approach towards its residents and businesses. The state’s tax structure is characterized by a combination of taxes, including income tax, sales tax, property tax, and various other levies, each playing a distinct role in contributing to the state’s revenue.

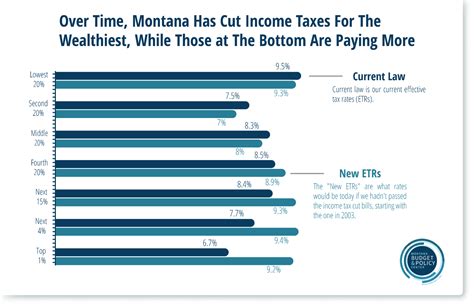

One of the key aspects of Montana's tax system is its income tax, which is levied on individuals and businesses based on their taxable income. The state follows a progressive tax rate structure, meaning that higher income brackets are subject to higher tax rates. This approach ensures that those with higher earning capacities contribute proportionally more to the state's revenue. The income tax rates in Montana range from 6.9% to 11.0%, depending on the taxable income level.

In addition to income tax, Montana imposes a sales tax on the sale of goods and certain services. The state sales tax rate is currently set at 4%, with additional local option taxes varying across different jurisdictions. These local taxes can increase the overall sales tax rate to as high as 7% in certain areas. The sales tax is an important revenue stream for the state, contributing significantly to its overall tax collections.

Property Tax: A Vital Component

Property tax is another significant component of Montana’s tax landscape. This tax is levied on the value of real estate properties, including land, buildings, and improvements. The property tax rate in Montana is set by local governments, such as counties and cities, and can vary widely across the state. The average property tax rate in Montana is approximately 0.9% of the property’s assessed value.

| Property Tax Rate | Range |

|---|---|

| Average Statewide Rate | 0.85% - 1.0% |

| Highest County Rate | 1.39% (Powell County) |

| Lowest County Rate | 0.73% (Big Horn County) |

Property tax in Montana is primarily used to fund local services and infrastructure, such as schools, roads, and emergency services. The assessed value of properties is determined by county assessors, who take into account factors like location, size, and recent sales data. Property owners have the right to appeal their assessed value if they believe it is inaccurate.

Special Taxes and Incentives

Montana’s tax system includes several special taxes and incentives aimed at supporting specific industries or initiatives. One notable example is the Coal Severance Tax, levied on the production of coal within the state. This tax contributes to the Coal Tax Trust Fund, which is used to support coal-impacted communities and fund economic diversification projects.

Additionally, Montana offers a range of tax incentives for businesses, such as the Business Incentive Program, which provides tax credits and refunds to eligible businesses based on their investments and job creation efforts. These incentives are designed to encourage economic growth, attract new businesses, and support existing industries.

Sales Tax Holidays and Exemptions

Montana also implements sales tax holidays and exemptions to promote certain industries and support consumers. For instance, the state offers a Back-to-School Sales Tax Holiday, during which certain school supplies, clothing, and computers are exempt from sales tax. This initiative helps families save money on essential items and stimulates local economies.

Furthermore, Montana exempts certain goods and services from sales tax, including prescription drugs, food products, and some agricultural inputs. These exemptions aim to reduce the tax burden on essential items and support specific sectors of the economy.

Compliance and Reporting

For individuals and businesses, understanding the compliance requirements and reporting obligations is crucial to avoid penalties and maintain a good standing with the Montana Department of Revenue. The state’s tax forms and reporting processes are designed to be user-friendly, with online filing options available for most tax types.

Income tax returns in Montana are due on April 15th each year, following the federal tax deadline. Businesses, on the other hand, may have varying due dates depending on their entity type and tax obligations. It is essential to stay informed about the specific requirements and deadlines to ensure timely and accurate reporting.

Tax Preparation and Professional Assistance

Given the complexity of Montana’s tax system, seeking professional assistance for tax preparation can be beneficial, especially for businesses and individuals with complex financial situations. Tax professionals, such as Certified Public Accountants (CPAs) and Enrolled Agents (EAs), can provide expert guidance and ensure compliance with the state’s tax laws.

Tax preparation services can help individuals and businesses navigate the intricacies of Montana's tax forms, deductions, and credits. These professionals stay updated on the latest tax regulations and can offer strategic advice to minimize tax liabilities and maximize deductions.

The Impact of Montana’s Tax System

Montana’s tax system plays a crucial role in shaping the state’s economic landscape and its overall fiscal health. The revenue generated through various taxes funds essential services, infrastructure development, and social programs. The state’s tax policies also influence investment decisions, business growth, and the overall attractiveness of Montana as a place to live and work.

By understanding the intricacies of Montana's state tax, individuals and businesses can make informed decisions, optimize their tax strategies, and contribute effectively to the state's economic ecosystem. Whether it's leveraging tax incentives, managing compliance obligations, or seeking professional guidance, a comprehensive understanding of Montana's tax system is key to financial success and responsible citizenship.

What is the current state income tax rate in Montana?

+The state income tax rate in Montana ranges from 6.9% to 11.0%, depending on taxable income levels. The state follows a progressive tax structure, where higher income brackets are subject to higher tax rates.

Are there any tax incentives for businesses in Montana?

+Yes, Montana offers various tax incentives for businesses, such as the Business Incentive Program, which provides tax credits and refunds based on investments and job creation. These incentives aim to encourage economic growth and attract new businesses.

When are income tax returns due in Montana?

+Income tax returns in Montana are due on April 15th each year, following the federal tax deadline. Businesses may have varying due dates depending on their entity type and tax obligations.

Can I file my Montana state tax return online?

+Yes, Montana offers online filing options for most tax types, including income tax returns. The state’s Department of Revenue provides user-friendly online platforms for convenient and secure tax filing.

What are some common tax deductions and credits available in Montana?

+Montana offers a range of tax deductions and credits, including deductions for mortgage interest, property taxes, charitable contributions, and business expenses. Common credits include the Child Tax Credit, Earned Income Tax Credit, and various industry-specific credits.