State Of Michigan Tax Payment

Understanding tax obligations is crucial, especially when it comes to navigating the complex world of state-specific tax systems. In the United States, each state has its own set of tax regulations, and Michigan is no exception. This article delves into the intricacies of tax payments in the State of Michigan, providing a comprehensive guide for individuals and businesses alike.

Navigating Michigan’s Tax Landscape

The State of Michigan imposes various taxes on its residents and businesses to generate revenue for essential public services. These taxes include income tax, sales tax, property tax, and more. The Michigan Department of Treasury is the primary authority responsible for tax administration and enforcement within the state.

Michigan's tax system aims to balance the need for revenue with the goal of encouraging economic growth. The state offers a range of tax incentives and credits to promote business development and attract new investments. However, staying compliant with the ever-changing tax regulations can be a challenging task for taxpayers.

Income Tax in Michigan

Michigan has a progressive income tax system, meaning that higher incomes are taxed at higher rates. The state’s income tax rates range from 4.25% to 4.6% for single filers and from 4.25% to 4.95% for married couples filing jointly. These rates are applicable to various income brackets, ensuring a fair distribution of tax burdens.

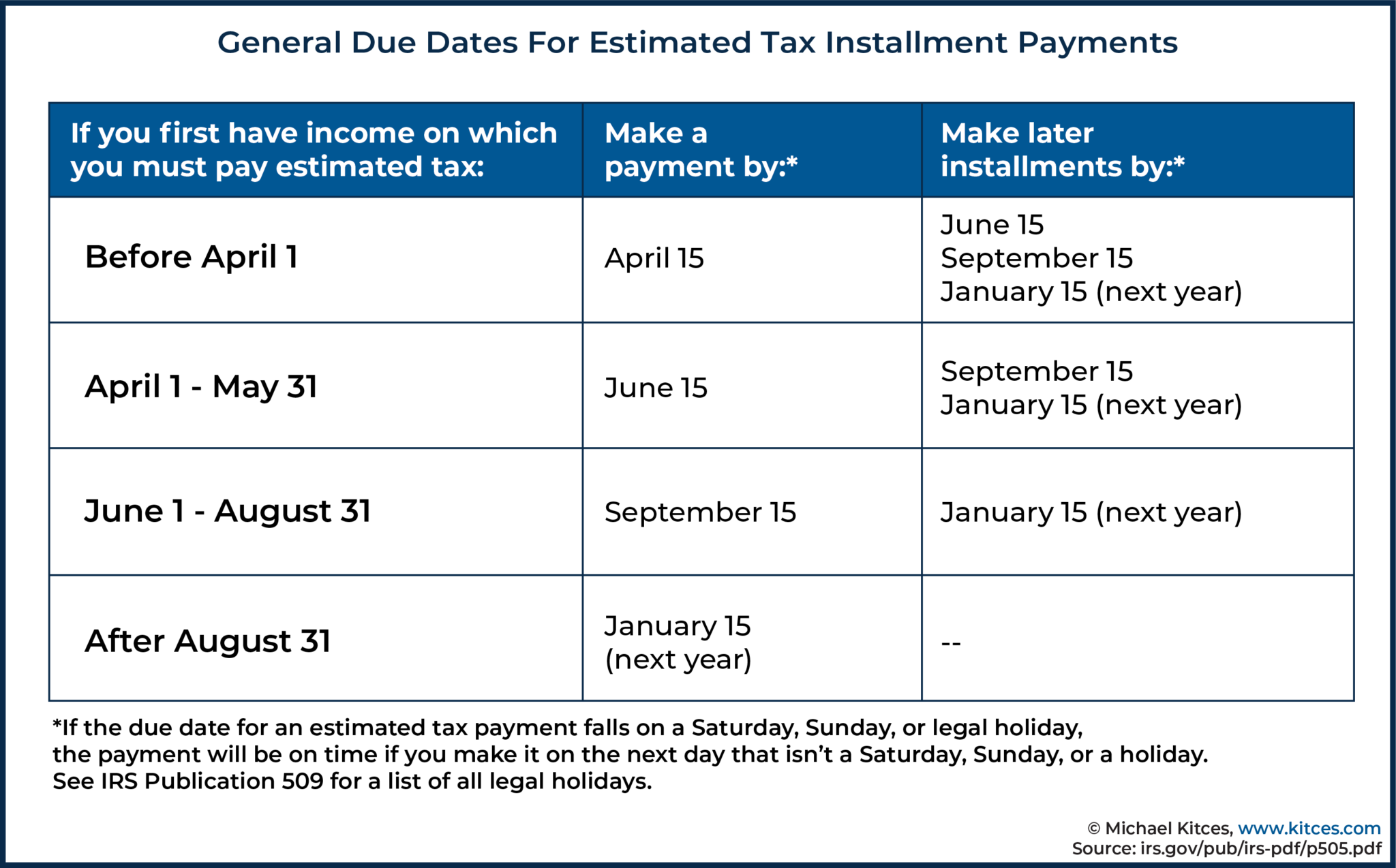

Individuals and businesses in Michigan are required to file their income tax returns annually, typically by April 15th. Late filings can result in penalties and interest charges, so it is crucial to stay on top of the filing deadlines. The Michigan Department of Treasury provides online resources and assistance to guide taxpayers through the filing process.

One unique aspect of Michigan's income tax system is the Homestead Property Tax Credit. This credit provides relief to homeowners by reducing the property tax burden. It is automatically applied to eligible homeowners' tax bills, offering a valuable benefit to Michigan residents.

| Income Bracket | Tax Rate |

|---|---|

| First $30,000 | 4.25% |

| $30,001 - $50,000 | 4.275% |

| $50,001 - $220,000 | 4.3% |

| $220,001 - $550,000 | 4.4% |

| Over $550,000 | 4.6% |

Sales and Use Tax

Michigan imposes a sales and use tax on the sale of tangible personal property and certain services within the state. The current sales tax rate is 6%, which is applicable to most retail transactions. However, certain categories of goods, such as groceries and prescription drugs, are exempt from sales tax.

Businesses operating in Michigan are responsible for collecting and remitting sales tax to the state. They must register with the Michigan Department of Treasury and obtain a sales tax license. Failure to comply with sales tax regulations can lead to significant penalties and legal consequences.

Michigan also has a use tax, which is similar to sales tax but applies to purchases made outside the state and brought into Michigan for use. This ensures that Michigan residents pay tax on goods purchased online or from out-of-state retailers, promoting fairness and revenue collection.

Property Tax in Michigan

Property tax is a significant source of revenue for local governments in Michigan. It is levied on real estate properties, including land, buildings, and other permanent structures. The property tax rates vary across different counties and municipalities, making it essential for property owners to understand the specific rates applicable to their area.

The property tax system in Michigan is based on the assessed value of the property. The assessment is typically conducted by local tax assessors, who determine the fair market value of the property. This assessed value is then multiplied by the tax rate to calculate the annual property tax bill.

Property owners in Michigan receive tax bills annually, and the payment deadlines are typically set by the local government. Late payments can result in penalties and interest, so it is crucial for property owners to stay informed about their tax obligations.

Tax Payment Options and Online Services

Michigan offers a range of convenient tax payment options to accommodate different preferences and needs. Taxpayers can choose from the following methods to make their tax payments:

- Online Payment: The Michigan Department of Treasury provides an online payment portal, allowing taxpayers to pay their taxes securely and conveniently using a credit card, debit card, or electronic check.

- Electronic Funds Transfer (EFT): This method allows businesses and individuals to transfer funds directly from their bank account to the state's treasury. It is a fast and efficient way to make tax payments, eliminating the need for physical checks.

- Check or Money Order: Traditional methods of payment are still accepted. Taxpayers can mail their checks or money orders, made payable to the Michigan Department of Treasury, to the designated address provided on the tax form.

- Credit Card Payments: Some third-party service providers offer credit card payment options for Michigan taxes. These services often charge a small convenience fee, but they provide an additional layer of convenience for taxpayers.

Michigan's online services have greatly improved the tax payment process. Taxpayers can access their tax records, view payment history, and manage their accounts through the state's secure online portal. This digital platform ensures transparency and ease of access for taxpayers, reducing the need for in-person visits to tax offices.

Electronic Filing and Benefits

Michigan encourages taxpayers to file their tax returns electronically. Electronic filing offers several benefits, including faster processing times, reduced errors, and improved security. The state’s online filing system, MiFile, provides a user-friendly interface for individuals and businesses to submit their tax returns.

By filing electronically, taxpayers can receive their refunds more quickly, often within a few weeks. Additionally, electronic filing reduces the risk of errors, as the system automatically calculates the tax due or refund amount based on the information provided. This ensures accuracy and minimizes the chances of audits or penalties due to mistakes.

Tax Incentives and Credits

Michigan understands the importance of fostering a business-friendly environment and attracting investments. To achieve this, the state offers a range of tax incentives and credits to eligible businesses and individuals.

Business Tax Incentives

Michigan provides several tax incentives to encourage business growth and job creation. These incentives include:

- Michigan Business Tax Credit: This credit is designed to support businesses that create new jobs and make significant investments in the state. It provides a tax credit for a portion of the wages paid to new employees.

- Research and Development Tax Credit: Businesses engaged in research and development activities can benefit from this credit, which offsets a portion of their tax liability. It aims to promote innovation and technological advancements.

- Brownfield Tax Increment Financing: Michigan offers tax increment financing to support the redevelopment of brownfield sites. This incentive provides a tax break for businesses investing in the cleanup and revitalization of contaminated or underutilized properties.

Personal Tax Credits

Michigan also offers tax credits to individuals, primarily aimed at supporting low- and moderate-income households. These credits include:

- Homestead Property Tax Credit: As mentioned earlier, this credit provides relief to homeowners by reducing their property tax burden. It is automatically applied to eligible homeowners' tax bills.

- Michigan Earned Income Tax Credit (EITC): This refundable tax credit is designed to benefit working individuals and families with low to moderate incomes. It helps offset federal income taxes and provides a financial boost to those in need.

- Child and Dependent Care Tax Credit: Michigan offers a credit for the expenses incurred in caring for dependent children or adults. This credit aims to support working families and encourage economic participation.

Staying Informed and Seeking Assistance

Navigating Michigan’s tax system can be complex, especially for those new to the state or individuals with unique tax situations. It is crucial to stay informed about the latest tax regulations and updates. The Michigan Department of Treasury provides a wealth of resources, including publications, guides, and frequently asked questions, to assist taxpayers.

For individuals and businesses facing complex tax scenarios or requiring expert guidance, seeking professional tax advice is recommended. Certified Public Accountants (CPAs) and tax attorneys can provide personalized advice and ensure compliance with Michigan's tax laws. They can also assist with tax planning strategies to minimize tax liabilities and maximize deductions or credits.

The Future of Michigan’s Tax System

Michigan’s tax system is constantly evolving to meet the changing needs of its residents and businesses. The state aims to strike a balance between generating sufficient revenue and promoting economic growth. As technology advances, Michigan is likely to further enhance its online services, making tax payments and filings even more accessible and efficient.

Additionally, Michigan's tax incentives and credits are expected to continue evolving to attract businesses and support economic development. The state's commitment to a fair and transparent tax system will ensure that taxpayers have the necessary resources and guidance to fulfill their tax obligations.

What are the income tax brackets for Michigan in 2023?

+For the 2023 tax year, Michigan’s income tax brackets and rates are as follows: First 30,000: 4.25%, 30,001 - 50,000: 4.275%, 50,001 - 220,000: 4.3%, 220,001 - 550,000: 4.4%, and over 550,000: 4.6%.

How do I pay my Michigan sales tax online?

+You can pay your Michigan sales tax online by visiting the Michigan Department of Treasury’s website and using their secure online payment portal. You will need to have your sales tax registration information and payment details ready.

Are there any tax incentives for renewable energy projects in Michigan?

+Yes, Michigan offers tax incentives for renewable energy projects. The state provides a renewable energy tax credit to support the development of renewable energy sources such as wind, solar, and biomass. This credit helps offset the cost of investing in renewable energy infrastructure.

How often do property taxes change in Michigan?

+Property taxes in Michigan are typically assessed and changed annually. The assessment process involves evaluating the fair market value of the property, and the resulting tax rate is applied to calculate the annual property tax bill. However, certain factors, such as changes in property values or local tax rates, can lead to variations in property taxes from year to year.