Clark County Tax Collector

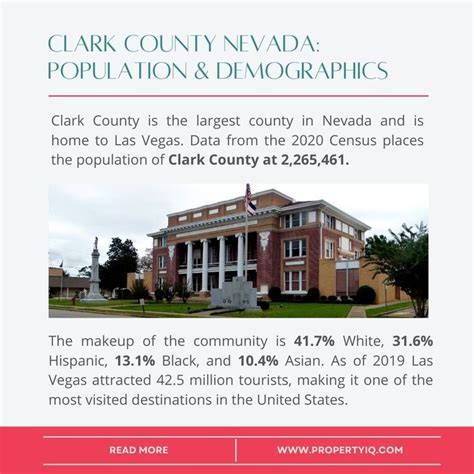

Clark County Tax Collector: Navigating Property Taxation in Southern Nevada

Welcome to an in-depth exploration of the vital role played by the Clark County Tax Collector in managing property taxes for residents and businesses within the vibrant Southern Nevada region. This comprehensive guide aims to provide an expert overview of the processes, responsibilities, and services offered by the Clark County Tax Collector's office, ensuring a clear understanding for property owners and stakeholders alike.

Understanding the Role of the Clark County Tax Collector

The Clark County Tax Collector is an essential governmental figure, responsible for overseeing the collection of property taxes within Clark County, Nevada. This role is pivotal in the county's fiscal operations, as property taxes are a significant source of revenue for the local government, funding essential services like education, public safety, infrastructure development, and more.

At the core of the Tax Collector's responsibilities is the management of the property tax lifecycle. This involves collaborating closely with the Assessor's Office to ensure accurate property assessments, setting fair tax rates, collecting taxes from property owners, and distributing these funds to various county departments and entities. The Tax Collector's office also plays a critical role in ensuring compliance with tax laws and providing support and resources to taxpayers.

Key Responsibilities and Services

- Property Assessment: The Tax Collector's office works hand-in-hand with the Assessor's Office to ensure that all properties within Clark County are accurately assessed for tax purposes. This process involves evaluating the value of properties, taking into account factors like location, size, improvements, and recent sales data.

- Tax Rate Setting: Based on the assessed values, the Tax Collector's office, in collaboration with local governing bodies, sets the tax rates for the county. These rates are determined through a careful analysis of the county's financial needs and the tax base, ensuring a fair and equitable distribution of the tax burden.

- Tax Collection: The primary function of the Tax Collector's office is to collect property taxes from homeowners, businesses, and other property owners within Clark County. This involves sending out tax bills, processing payments, and managing any delinquent accounts. The office also offers various payment options, including online payments, to enhance convenience for taxpayers.

- Tax Distribution: Once collected, the Tax Collector's office distributes the tax revenue to various county departments and entities. This distribution process is guided by the county's budget, ensuring that funds are allocated appropriately to support essential services and initiatives.

- Taxpayer Support and Education: The Tax Collector's office is committed to providing support and resources to taxpayers. This includes offering assistance with tax payments, providing information on tax rates and assessments, and educating taxpayers on their rights and responsibilities. The office also handles taxpayer inquiries, addresses concerns, and provides guidance on appealing property assessments.

Navigating Property Taxes in Clark County

Understanding and managing property taxes can be a complex process, but the Clark County Tax Collector's office aims to simplify this for taxpayers. Here's a breakdown of the key steps involved in the property tax process within Clark County.

Property Assessment and Valuation

The first step in the property tax process is the assessment and valuation of properties. The Clark County Assessor's Office is responsible for this task, utilizing a combination of physical inspections, sales data analysis, and other valuation methods. The assessed value of a property serves as the basis for calculating property taxes.

| Assessment Year | Average Property Value |

|---|---|

| 2022 | $325,000 |

| 2023 | $335,000 (estimated) |

Property owners have the right to appeal their assessed value if they believe it is inaccurate. The Tax Collector's office provides resources and guidance on the appeals process, ensuring that taxpayers can exercise their rights effectively.

Tax Rate Determination

Once the assessed values are determined, the Clark County Tax Collector, in consultation with local governing bodies, sets the tax rates for the upcoming year. These rates are expressed as a percentage of the assessed value and are used to calculate the property taxes owed by each taxpayer.

| Tax Year | Residential Tax Rate | Commercial Tax Rate |

|---|---|---|

| 2022 | 0.65% | 0.80% |

| 2023 | 0.67% (estimated) | 0.82% (estimated) |

The tax rates are determined based on the county's budgetary needs, taking into account factors like the cost of providing services, infrastructure development, and other fiscal considerations. The Tax Collector's office ensures that these rates are fair and in line with legal requirements.

Tax Billing and Payment

After the tax rates are set, the Tax Collector's office generates tax bills for all property owners within Clark County. These bills are typically sent out in two installments, with due dates in June and November. Taxpayers have the option to pay their taxes in full or in two installments, with a slight discount offered for early payment.

The Tax Collector's office provides various payment methods to accommodate different preferences and needs. Taxpayers can pay their taxes online through the county's secure payment portal, by mail, or in person at the Tax Collector's office. The office also accepts payments via credit card, debit card, and electronic checks, ensuring convenience and flexibility.

Delinquent Tax Accounts and Enforcement

In the event that a taxpayer fails to pay their property taxes by the due date, the Tax Collector's office initiates a series of enforcement actions. This process typically begins with a reminder notice, followed by penalty assessments if the taxes remain unpaid. If a property owner continues to default on their tax obligations, the Tax Collector's office may initiate legal proceedings, which could ultimately lead to the sale of the property to recover the outstanding taxes.

The Tax Collector's office strives to work with taxpayers to resolve delinquent tax issues. They offer payment plans and other options to help taxpayers get back on track with their tax obligations, ensuring that the collection process is fair and equitable.

Resources and Support for Taxpayers

The Clark County Tax Collector's office is committed to providing resources and support to taxpayers. They offer a range of services and information to assist taxpayers in understanding their tax obligations and navigating the tax process.

Online Resources

The Tax Collector's office maintains a comprehensive website that serves as a one-stop resource for taxpayers. The website provides information on tax rates, assessed values, payment options, and deadlines. It also offers online tools for taxpayers to view their tax bills, make payments, and track the status of their accounts.

In addition, the website provides educational resources, including articles and guides on various tax-related topics. These resources cover topics such as understanding property assessments, tax payment options, and the appeals process, empowering taxpayers with the knowledge they need to manage their tax obligations effectively.

In-Person Support

For taxpayers who prefer in-person assistance, the Tax Collector's office maintains a physical location where taxpayers can receive personalized support. Taxpayers can visit the office to discuss their tax concerns, seek guidance on payment options, or initiate the appeals process for their assessed values. The office staff is trained to provide accurate and up-to-date information, ensuring that taxpayers receive the support they need.

Taxpayer Workshops and Outreach

To reach a wider audience and ensure that taxpayers are informed about their rights and responsibilities, the Tax Collector's office conducts taxpayer workshops and outreach programs. These events provide an opportunity for taxpayers to engage with tax professionals, ask questions, and gain a deeper understanding of the tax process. The workshops cover a range of topics, from basic tax concepts to more complex issues, ensuring that taxpayers at all levels of understanding can benefit.

Future Outlook and Potential Changes

As with any governmental function, the role of the Clark County Tax Collector is subject to potential changes and developments. Here are some key areas to watch for in the future.

Technological Advancements

The Tax Collector's office is committed to leveraging technological advancements to enhance the tax collection process and improve taxpayer experience. This includes the continued development and refinement of the online tax payment portal, which aims to provide a secure, efficient, and user-friendly platform for taxpayers to manage their tax obligations.

The office is also exploring the use of data analytics and artificial intelligence to streamline processes, improve accuracy, and enhance efficiency. These technologies can assist in identifying potential errors or inconsistencies in tax assessments and payments, ensuring a more accurate and fair tax system.

Policy Changes and Reforms

Policy changes at the local, state, and federal levels can have a significant impact on the role and responsibilities of the Clark County Tax Collector. For instance, changes in tax laws or regulations can affect the tax rates, assessment methodologies, or collection processes. The Tax Collector's office stays abreast of these changes and works closely with local governing bodies to ensure smooth implementation and compliance.

Additionally, the Tax Collector's office actively engages in policy discussions and reform initiatives to advocate for fair and equitable tax systems. This includes participating in discussions on tax reform proposals, providing input on potential changes, and ensuring that the interests of taxpayers are represented in the policy-making process.

Community Engagement and Outreach

The Tax Collector's office recognizes the importance of community engagement and outreach in fostering a culture of tax compliance and understanding. As such, they continue to expand their outreach efforts, including hosting community forums, participating in local events, and engaging with community organizations. These initiatives aim to build trust, educate taxpayers, and address any concerns or misconceptions about the tax process.

Conclusion

The Clark County Tax Collector plays a critical role in the fiscal health and well-being of Southern Nevada. By effectively managing property taxes, the Tax Collector's office ensures that the county has the resources it needs to provide essential services and maintain infrastructure. At the same time, the office is dedicated to supporting taxpayers, providing resources and guidance to ensure a fair and equitable tax system.

As Southern Nevada continues to grow and evolve, the role of the Clark County Tax Collector will remain vital. By staying informed about tax policies, understanding their rights and responsibilities, and engaging with the Tax Collector's office, taxpayers can actively contribute to the county's fiscal stability and ensure the continued development of their community.

What is the role of the Clark County Tax Collector in property tax assessments?

+

The Clark County Tax Collector plays a collaborative role with the Assessor’s Office in determining property values for tax purposes. While the Assessor’s Office conducts the assessments, the Tax Collector’s office ensures that the assessments are accurate and fair, and sets the tax rates based on these values.

How can I pay my property taxes in Clark County?

+

You can pay your property taxes online through the Clark County Tax Collector’s secure payment portal, by mail, or in person at the Tax Collector’s office. The office accepts various payment methods, including credit card, debit card, and electronic checks, ensuring convenience and flexibility for taxpayers.

What happens if I don’t pay my property taxes on time?

+

If you fail to pay your property taxes by the due date, the Clark County Tax Collector’s office will initiate a series of enforcement actions. This typically begins with a reminder notice, followed by penalty assessments if the taxes remain unpaid. In extreme cases of non-payment, the Tax Collector’s office may initiate legal proceedings, which could lead to the sale of the property to recover the outstanding taxes.

How can I appeal my property assessment in Clark County?

+

If you believe your property assessment is inaccurate, you have the right to appeal. The Clark County Tax Collector’s office provides resources and guidance on the appeals process. This typically involves submitting an appeal application, along with supporting documentation, and participating in a hearing or review process.

Are there any resources available to help me understand my property taxes in Clark County?

+

Yes, the Clark County Tax Collector’s office offers a range of resources to help taxpayers understand their property taxes. This includes an informative website with articles and guides on various tax-related topics, taxpayer workshops, and personalized support at the Tax Collector’s office. These resources aim to empower taxpayers with the knowledge they need to manage their tax obligations effectively.