Business Tax Deadline 2025

For any business owner, understanding and adhering to tax deadlines is crucial to ensure compliance and avoid potential penalties. In this comprehensive guide, we will delve into the upcoming Business Tax Deadline for 2025, offering a detailed breakdown of what you need to know to stay on top of your tax obligations.

As we navigate the complexities of tax regulations, it's essential to have a clear understanding of the key dates, requirements, and strategies to manage your business taxes effectively. This article aims to provide valuable insights and practical tips to help you navigate the tax landscape with confidence.

The Importance of Business Tax Deadlines

Business tax deadlines are not just bureaucratic formalities; they are integral to the smooth functioning of the tax system and the economy as a whole. By adhering to these deadlines, businesses contribute to the efficient management of tax revenues, which are crucial for funding public services, infrastructure, and various government initiatives.

Furthermore, meeting tax deadlines is a legal obligation, and failure to do so can result in significant penalties and interest charges. These penalties not only impact your business's financial health but can also lead to legal repercussions and damage your business's reputation.

Beyond the legal and financial implications, staying on top of tax deadlines demonstrates a sense of responsibility and accountability. It showcases your commitment to ethical business practices and fosters trust with stakeholders, including investors, partners, and customers.

Understanding the 2025 Business Tax Deadline

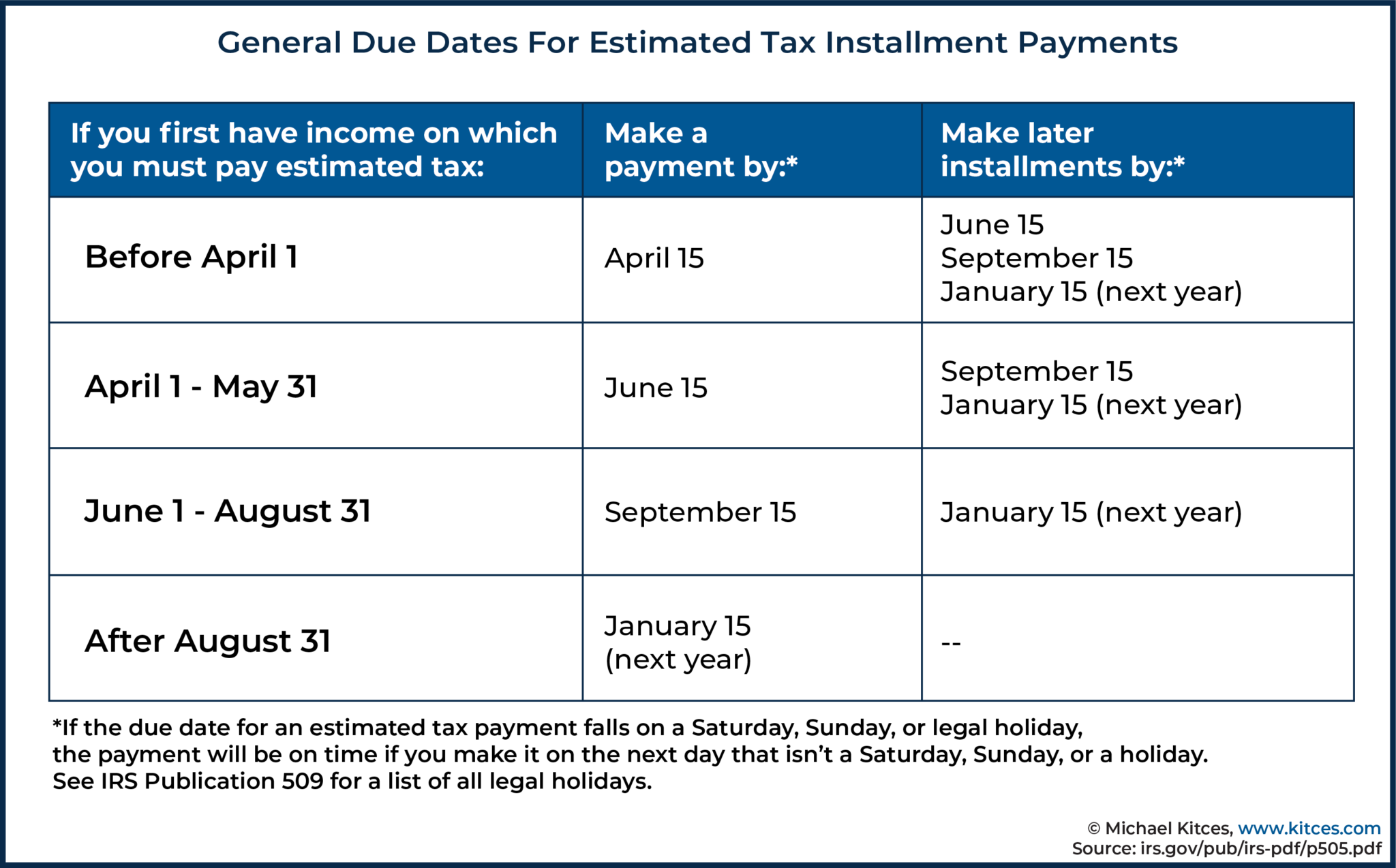

The Business Tax Deadline for 2025 is a critical date that marks the culmination of a year’s worth of financial activities and obligations. It serves as a reminder for businesses to finalize their tax calculations, prepare the necessary documentation, and submit their tax returns to the relevant authorities.

While the specific deadline may vary depending on the jurisdiction and the type of business, it is generally set to provide businesses with sufficient time to gather the required information and ensure accurate reporting.

Key Considerations for the 2025 Tax Season

-

Tax Year and Deadline Alignment: The tax year for businesses often runs from January 1 to December 31, aligning with the calendar year. This means that the 2025 tax deadline will typically fall in the early months of the following year, providing a window for businesses to wrap up their financial affairs.

-

Early Preparation: While the official deadline may be months away, it is advisable to start preparing well in advance. This allows for a thorough review of financial records, identification of potential deductions or credits, and resolution of any outstanding issues.

-

Tax Forms and Documentation: Familiarize yourself with the specific tax forms and documentation required for your business. This may include income statements, expense records, payroll information, and any other relevant financial data. Ensure that you have all the necessary documents organized and easily accessible.

The Impact of Tax Reforms and Updates

The tax landscape is subject to continuous changes and updates, driven by legislative reforms and economic policies. Staying informed about these changes is crucial to ensure compliance and optimize your tax strategy.

For the 2025 tax season, here are some key considerations:

-

Tax Rate Changes: Keep an eye on any proposed or enacted changes in tax rates, which can significantly impact your tax liability. Stay updated on the latest tax brackets and rates applicable to your business category and size.

-

New Tax Credits and Incentives: Governments often introduce new tax credits or incentives to promote specific economic activities or support certain industries. Research and identify any relevant tax credits or deductions that your business may be eligible for.

-

Regulatory Changes: Be aware of any regulatory changes that may impact your tax obligations. This includes changes in reporting requirements, thresholds for certain tax provisions, or new rules introduced to address specific economic challenges.

Strategies for Effective Tax Management

Navigating the tax landscape requires a strategic approach to ensure compliance, minimize liabilities, and maximize tax efficiency. Here are some essential strategies to consider:

1. Maintain Accurate Financial Records

The foundation of effective tax management lies in maintaining meticulous financial records. Ensure that all transactions are accurately recorded, categorized, and reconciled. This practice not only facilitates timely tax preparation but also provides valuable insights for financial planning and decision-making.

2. Stay Informed and Seek Professional Advice

Tax regulations can be complex, and staying updated with the latest changes is essential. Consider subscribing to tax-related newsletters, following reputable tax blogs, or engaging with tax professionals who can provide expert guidance tailored to your business’s needs.

3. Leverage Technology for Efficiency

Utilize accounting software and tax preparation tools to streamline your tax management processes. These technologies can automate various tasks, reduce errors, and provide real-time insights into your financial position, helping you make informed decisions throughout the year.

4. Plan for Deductions and Credits

Explore the various deductions and credits available to your business. From business expenses to tax incentives for specific activities, understanding these opportunities can significantly reduce your tax liability. Work with your tax advisor to identify and maximize these benefits.

5. Consider Tax-Efficient Strategies

Implement tax-efficient strategies to optimize your business’s financial performance. This may include structuring your business to take advantage of tax benefits, optimizing payroll and compensation strategies, or exploring tax-advantaged investment options.

Real-World Examples and Case Studies

To illustrate the practical implications of effective tax management, let’s explore a few real-world examples:

Case Study 1: Small Business Tax Savings

John, the owner of a small consulting firm, implemented a strategic tax planning approach. By optimizing his business structure and carefully tracking deductible expenses, he was able to reduce his tax liability by 15% compared to the previous year. This resulted in significant savings and provided additional funds for business growth and expansion.

Case Study 2: Large Corporation’s Tax Efficiency

ABC Corporation, a multinational enterprise, faced complex tax obligations across multiple jurisdictions. By partnering with a global tax advisory firm, they developed a comprehensive tax strategy that optimized their tax position. This included leveraging tax treaties, utilizing transfer pricing strategies, and implementing tax-efficient supply chain management.

Case Study 3: Tax Incentives for Innovation

TechStart, a cutting-edge technology startup, focused on research and development (R&D) activities. By understanding the available tax incentives for R&D expenditures, they were able to claim significant tax credits, which not only reduced their tax burden but also provided valuable funding for further innovation and growth.

Future Implications and Industry Trends

As we look ahead to the 2025 tax season and beyond, several trends and developments are shaping the tax landscape. Staying ahead of these changes is crucial for businesses to remain competitive and compliant.

1. Digitalization of Tax Processes

The trend towards digitalization is transforming tax administration. Governments are increasingly adopting digital platforms and technologies to streamline tax processes, enhance transparency, and improve taxpayer experiences. Businesses should embrace these digital tools to stay aligned with the evolving tax landscape.

2. International Tax Compliance

With the global nature of business, international tax compliance is becoming increasingly complex. Businesses operating across borders must navigate a web of tax regulations, treaties, and reporting requirements. Staying informed about these developments and seeking expert advice is essential to avoid potential pitfalls.

3. Focus on Environmental and Social Responsibility

As sustainability and social responsibility gain prominence, tax policies are reflecting these priorities. Governments are introducing tax incentives and initiatives to promote environmentally friendly practices and social impact. Businesses can leverage these opportunities to align their tax strategies with their sustainability goals.

4. Data-Driven Tax Strategies

The availability of vast amounts of data presents opportunities for businesses to optimize their tax strategies. By leveraging advanced analytics and data-driven insights, businesses can make informed decisions regarding tax planning, forecasting, and compliance. This approach enables businesses to stay agile and responsive to changing tax environments.

Conclusion

Navigating the complexities of business taxes requires a proactive and informed approach. By understanding the Business Tax Deadline for 2025 and implementing effective tax management strategies, businesses can ensure compliance, minimize liabilities, and maximize their tax efficiency. Stay tuned for further insights and updates as we approach the 2025 tax season, and remember to consult tax professionals for expert guidance tailored to your specific circumstances.

What is the specific Business Tax Deadline for 2025 in my jurisdiction?

+The exact Business Tax Deadline for 2025 can vary depending on your specific jurisdiction and business type. It is essential to consult the official tax authorities or seek professional advice to determine the precise deadline applicable to your business. Stay informed about any updates or changes to ensure compliance.

Are there any penalties for late tax filing or payment?

+Yes, failing to meet the Business Tax Deadline can result in penalties and interest charges. The severity of these penalties varies depending on the jurisdiction and the specific circumstances. It is crucial to prioritize timely filing and payment to avoid these financial repercussions and maintain compliance.

How can I optimize my tax strategy to minimize liabilities?

+Optimizing your tax strategy involves a combination of accurate record-keeping, staying informed about tax reforms, and seeking professional advice. Explore deductions, credits, and tax-efficient strategies tailored to your business. Regularly review your financial position and work with tax experts to identify opportunities for tax savings and compliance.

What are some common challenges businesses face when preparing for tax deadlines?

+Common challenges include the complexity of tax regulations, staying updated with frequent changes, and the time-consuming nature of tax preparation. Additionally, businesses may struggle with accurate record-keeping, identifying relevant tax incentives, and ensuring compliance with international tax obligations. Utilizing technology, seeking professional guidance, and starting the preparation process early can help mitigate these challenges.