Co Tax Refund Status

Welcome to this comprehensive guide on understanding the status of your Colorado state tax refund. As a taxpayer, it's important to have access to timely and accurate information regarding your refund. This article aims to provide you with an in-depth analysis of the process, including tips and insights to help you navigate the system effectively.

The Colorado Tax Refund Journey

When it comes to tax refunds, the Colorado Department of Revenue plays a crucial role. They are responsible for processing individual income tax returns and issuing refunds to eligible taxpayers. The journey of your tax refund begins with the submission of your tax return, and the status of this refund can be tracked through various channels.

Colorado's tax system operates on a calendar-year basis, with the tax year running from January 1st to December 31st. Taxpayers are typically required to file their returns by April 15th of the following year, although extensions may be granted under certain circumstances.

Understanding Refund Timelines

The timeframe for receiving a tax refund can vary, and it is influenced by several factors. Here’s a breakdown of the typical refund timeline:

- Online Filing: Taxpayers who file their returns electronically and choose direct deposit as their refund method can expect to receive their refunds within 7 to 14 business days from the date of filing. This is the fastest and most efficient way to receive your refund.

- Paper Returns: If you opt to file a paper return, the processing time may take longer. The Colorado Department of Revenue estimates that it can take up to 12 weeks to process paper returns and issue refunds. This is due to the manual handling and verification processes involved.

- Refund Holdups: There are instances where refunds may be delayed. This can occur if there are errors or discrepancies in your return, missing information, or if further verification is required. In such cases, the Department may contact you for additional documentation or clarification.

It's important to note that the Department aims to process refunds as promptly as possible, but unexpected delays can sometimes occur due to the volume of returns received or other administrative factors.

Tracking Your Refund Status

The Colorado Department of Revenue offers multiple ways for taxpayers to track the status of their tax refunds. These methods provide real-time updates and ensure transparency throughout the process.

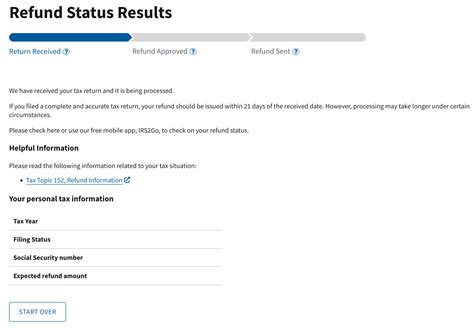

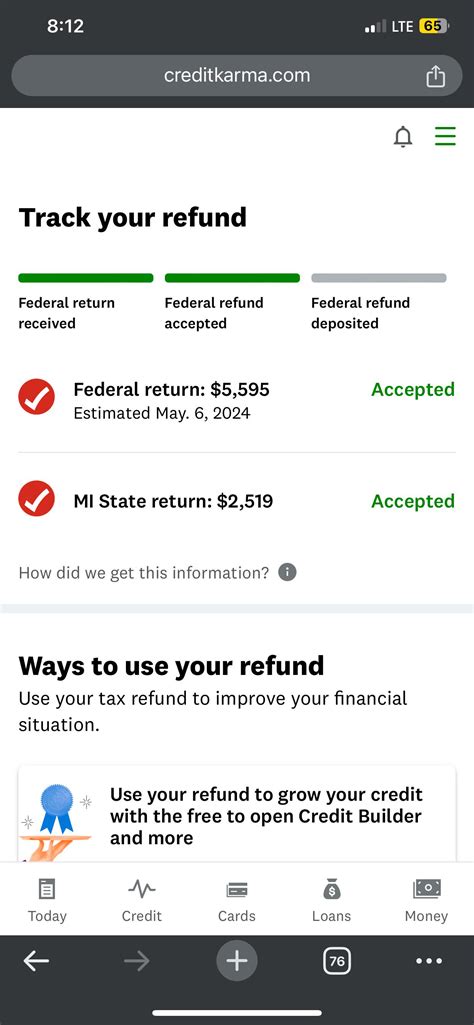

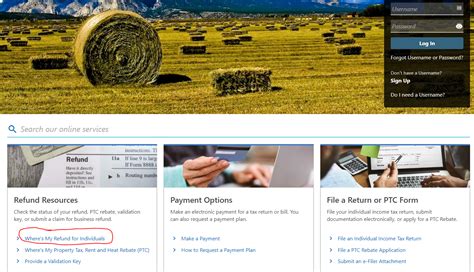

- Online Refund Status Tool: The Department provides an online tool accessible through their website. Taxpayers can use this tool by entering their Social Security Number, date of birth, and expected refund amount. The tool provides a real-time update on the status of their refund, including whether it has been approved, processed, or sent.

- Refund Hotline: For those who prefer a more direct approach, the Department operates a dedicated refund hotline. By calling the hotline, taxpayers can speak to a representative who can provide information on the status of their refund and answer any refund-related inquiries.

- Email Notifications: Taxpayers who have registered for online services with the Department can opt to receive email notifications regarding their refund status. These notifications provide timely updates, ensuring that taxpayers are aware of any changes or progress in the refund process.

By utilizing these tracking methods, taxpayers can stay informed and plan their finances accordingly.

Common Refund Issues and Solutions

While the majority of tax refunds are processed smoothly, there may be instances where taxpayers encounter issues. Understanding these common issues and their potential solutions can help streamline the process and minimize delays.

Missing or Incorrect Information

One of the primary reasons for refund delays is missing or incorrect information on the tax return. This can include errors in personal details, such as incorrect Social Security Numbers or dates of birth, or missing supporting documentation.

If the Department identifies such errors, they may send a notice to the taxpayer requesting additional information or clarification. It is crucial to respond promptly to these notices to avoid further delays. Taxpayers should ensure that they have all the necessary documents ready and provide accurate information to expedite the process.

Fraud and Identity Theft

In today’s digital age, tax refund fraud and identity theft are growing concerns. Criminals may attempt to file fraudulent returns using stolen personal information to claim refunds that do not belong to them.

The Colorado Department of Revenue has implemented robust security measures to combat such activities. They use advanced fraud detection systems and work closely with law enforcement agencies to investigate and prosecute fraudulent activities. Taxpayers can also take proactive measures by protecting their personal information and being vigilant against potential scams.

Error Corrections and Adjustments

In some cases, the Department may identify errors or discrepancies in a taxpayer’s return during the processing stage. These errors could be related to calculations, missing forms, or incorrect filing status. When such errors are detected, the Department may make adjustments to the return or request additional information to rectify the issue.

If you receive a notice regarding an error correction or adjustment, it is essential to review the notice carefully and respond promptly. The Department provides detailed instructions on how to address these issues, and taxpayers should follow the guidelines to ensure a smooth resolution.

Maximizing Your Refund: Tips and Strategies

Now that we’ve covered the basics of refund status and potential issues, let’s explore some tips and strategies to maximize your tax refund and ensure a smooth process.

Filing Early

One of the simplest ways to expedite your refund is to file your tax return early. By filing early, you reduce the chances of encountering delays caused by high volumes of returns during the peak filing season. Additionally, early filers often receive their refunds faster, as the Department can process their returns promptly.

Direct Deposit

Opting for direct deposit as your refund method is another way to speed up the process. Direct deposit is the fastest and most secure way to receive your refund, as it eliminates the risk of mail delays or potential loss of refund checks. When filing electronically, taxpayers can provide their banking information to receive their refund directly into their account.

Accurate and Complete Information

Ensuring that your tax return is accurate and complete is crucial. Double-check all personal details, income information, and deductions before submitting your return. Inaccurate or incomplete information can lead to delays and additional scrutiny from the Department. Take your time and review your return thoroughly to avoid errors.

E-File and Free File Options

The Colorado Department of Revenue encourages taxpayers to use electronic filing (e-file) as it is more secure and efficient than paper filing. E-filing reduces the chances of errors and allows for faster processing. Additionally, the Department offers a Free File program for eligible taxpayers, providing free tax preparation and e-filing services.

Future Implications and Improvements

As technology advances and taxpayer needs evolve, the Colorado Department of Revenue is continuously working to improve its tax refund processes. Here are some future implications and potential improvements to look out for:

- Enhanced Security Measures: With the increasing threat of cybercrime, the Department is investing in advanced security systems to protect taxpayer data and prevent fraud. This includes implementing multi-factor authentication, encryption protocols, and regular security audits.

- Improved Online Services: The Department is committed to enhancing its online services, making them more user-friendly and accessible. This includes streamlining the refund status tool, providing real-time updates, and offering additional features to assist taxpayers.

- Data Analytics for Fraud Detection: By leveraging data analytics and machine learning, the Department aims to enhance its fraud detection capabilities. This technology will enable them to identify potential fraud patterns and take proactive measures to protect taxpayers.

- Taxpayer Education and Outreach: The Department recognizes the importance of taxpayer education and plans to expand its outreach programs. This includes providing more comprehensive information on tax refund processes, common issues, and ways to avoid delays.

As a taxpayer, staying informed about these improvements and taking advantage of the enhanced services can further streamline your tax refund journey.

Conclusion

Understanding the status of your Colorado tax refund is an essential part of financial planning. By following the guidelines outlined in this article, taxpayers can track their refunds, address potential issues promptly, and maximize their refund potential. The Colorado Department of Revenue’s commitment to transparency and efficiency ensures a smooth process for taxpayers, and the ongoing improvements will further enhance the refund experience.

Remember, staying informed, filing accurately, and utilizing the available resources can make all the difference in a timely and hassle-free tax refund process.

How can I check the status of my Colorado tax refund?

+You can check the status of your Colorado tax refund by using the online refund status tool on the Department of Revenue’s website. Alternatively, you can call the refund hotline or opt for email notifications if you have registered for online services.

What if I encounter an error or discrepancy on my tax return?

+If you receive a notice regarding an error or discrepancy, carefully review the notice and follow the instructions provided. Provide any additional information or documentation requested by the Department to resolve the issue promptly.

How can I protect myself from tax refund fraud and identity theft?

+Protecting your personal information is crucial. Avoid sharing sensitive data online, use strong passwords, and be cautious of phishing attempts. Regularly monitor your credit reports and tax accounts for any suspicious activities. If you suspect fraud, report it immediately to the Department of Revenue and relevant authorities.

Can I speed up my refund process by filing early and choosing direct deposit?

+Yes, filing early and opting for direct deposit are effective ways to expedite your refund process. By filing early, you reduce the chances of delays, and direct deposit ensures a faster and more secure refund transfer.

What are some common mistakes that can delay my tax refund?

+Common mistakes that can delay your tax refund include missing or incorrect personal information, errors in calculations or deductions, and missing supporting documents. It’s important to review your return carefully before submission to avoid these delays.