Effective Vs Marginal Tax Rate

Understanding the difference between the effective and marginal tax rates is crucial for individuals and businesses alike. These concepts play a significant role in determining one's overall tax liability and financial planning strategies. Let's delve into the nuances of these tax rates, exploring their definitions, calculations, and real-world implications.

Unraveling Tax Complexity: Effective vs Marginal Rates

In the realm of taxation, two critical terms often emerge: effective tax rate and marginal tax rate. These rates, while related, serve distinct purposes in understanding one’s tax obligations and financial planning. This exploration aims to demystify these concepts, offering a comprehensive guide to navigate the intricacies of tax calculations.

Defining Effective Tax Rate

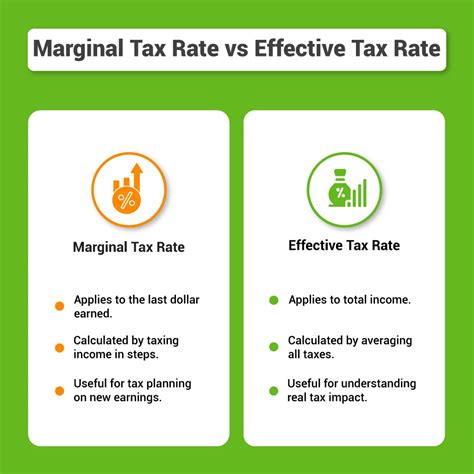

The effective tax rate represents the actual percentage of tax paid on taxable income. It is calculated by dividing the total tax paid by the taxable income and provides a clear indication of the average tax rate applied to an individual’s or entity’s earnings. This rate offers a holistic view of one’s tax liability, considering all applicable taxes and deductions.

For instance, consider a business with a taxable income of $100,000 and a total tax liability of $20,000. The effective tax rate in this case would be 20% ($20,000 / $100,000). This rate reflects the average tax applied to the business's earnings, considering all relevant tax brackets and deductions.

Marginal Tax Rate: A Closer Look

In contrast, the marginal tax rate refers to the tax rate applicable to the next dollar of income earned. It represents the additional tax liability incurred when an individual or business moves into a higher tax bracket. This rate is crucial for understanding the potential tax implications of increased earnings or changes in financial circumstances.

To illustrate, let's consider an individual with a taxable income of $80,000 and a marginal tax rate of 25%. If this individual receives a bonus that pushes their income to $85,000, the additional $5,000 would be taxed at the marginal rate of 25%. This concept is particularly relevant when strategizing financial decisions, as it highlights the potential tax burden of increased earnings.

The Impact on Tax Planning

Understanding the distinction between effective and marginal tax rates is essential for effective tax planning. While the effective tax rate provides a comprehensive view of overall tax liability, the marginal tax rate focuses on the tax implications of incremental income. This knowledge allows individuals and businesses to make informed decisions regarding investments, savings, and overall financial strategies.

For instance, an individual with a high marginal tax rate may benefit from exploring tax-efficient investment options or retirement savings plans. These strategies can help minimize the impact of the marginal tax rate, optimizing overall tax efficiency. Similarly, businesses can leverage this understanding to structure their financial operations, ensuring tax obligations are managed effectively.

| Tax Rate Type | Definition |

|---|---|

| Effective Tax Rate | Actual percentage of tax paid on taxable income |

| Marginal Tax Rate | Tax rate applicable to the next dollar of income earned |

Real-World Applications

In practice, these tax rates play a pivotal role in various financial scenarios. For individuals, understanding the marginal tax rate can influence decisions such as accepting a higher-paying job or negotiating salary increases. It also impacts investment choices, as capital gains and dividends are often taxed at different rates.

For businesses, the marginal tax rate can guide decisions on expansion, hiring, and investment strategies. Understanding the tax implications of these decisions can help optimize financial performance and ensure compliance with tax regulations. Effective tax planning, considering both effective and marginal rates, is essential for long-term financial success.

Conclusion: Navigating Tax Complexity

The effective and marginal tax rates are fundamental concepts in understanding one’s tax obligations and financial planning. By grasping the nuances of these rates, individuals and businesses can make informed decisions, optimize tax efficiency, and ensure compliance with tax regulations. This knowledge empowers financial planning, offering a clearer path to long-term financial success.

FAQ

How is the effective tax rate calculated?

+

The effective tax rate is calculated by dividing the total tax paid by the taxable income. This provides a clear indication of the average tax rate applied to one’s earnings.

What does the marginal tax rate represent?

+

The marginal tax rate represents the tax rate applicable to the next dollar of income earned. It indicates the additional tax liability when an individual or business moves into a higher tax bracket.

How do effective and marginal tax rates impact financial planning?

+

Understanding these rates is crucial for financial planning. The effective tax rate provides a holistic view of tax obligations, while the marginal rate highlights the tax implications of increased earnings. This knowledge guides decisions on investments, savings, and overall financial strategies.

Can these tax rates change over time?

+

Yes, tax rates can change due to various factors, including legislative changes, economic conditions, and personal circumstances. It’s essential to stay updated with tax regulations to ensure accurate financial planning.