Columbus Ohio City Tax

The city of Columbus, Ohio, is a bustling metropolitan hub and the state's capital, offering a diverse range of attractions, a vibrant cultural scene, and a thriving business environment. As with many cities, Columbus imposes a local tax, known as the Columbus City Tax, to fund essential services and infrastructure development. Understanding the intricacies of this tax is crucial for residents, businesses, and visitors alike.

Overview of the Columbus City Tax

The Columbus City Tax is a municipal tax levied on various transactions and activities within the city limits. It serves as a primary source of revenue for the city government, enabling the provision of vital public services and the maintenance of Columbus' infrastructure.

The tax is administered by the Columbus Department of Finance, which is responsible for collecting and managing the revenue generated. The city tax is applied in addition to state and federal taxes, forming part of the overall tax burden for individuals and businesses operating in Columbus.

It's important to note that the Columbus City Tax is subject to regular reviews and adjustments, reflecting the city's evolving needs and economic landscape. These adjustments may impact tax rates, exemptions, and the types of transactions subject to taxation.

Tax Rates and Categories

The Columbus City Tax consists of several components, each with its own rate and applicable categories. The primary categories of the city tax include:

- Income Tax: This tax is levied on the income of individuals and businesses operating within the city limits. The income tax rate in Columbus is currently 2%, making it an essential consideration for taxpayers.

- Sales and Use Tax: Columbus imposes a sales tax on the purchase of goods and certain services. The rate for the sales and use tax is 5.75%, which is applied to the total purchase amount. This tax is collected by businesses and remitted to the city government.

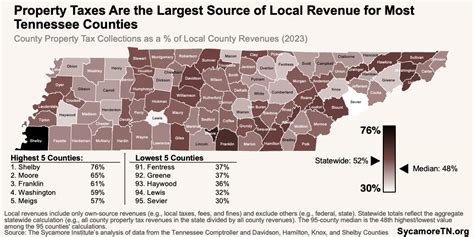

- Property Tax: Property owners in Columbus are subject to a property tax, which is based on the assessed value of their real estate holdings. The property tax rate varies depending on the type of property and its location within the city. The tax revenue supports local services and infrastructure projects.

- Excise Tax: This tax is levied on specific activities and transactions, such as utility services, admissions to entertainment events, and the operation of certain types of businesses. The excise tax rates vary depending on the specific activity or transaction.

| Tax Category | Rate |

|---|---|

| Income Tax | 2% |

| Sales and Use Tax | 5.75% |

| Property Tax (Residential) | 2.5% |

| Property Tax (Commercial) | 3% |

| Excise Tax (Utility Services) | 5% |

| Excise Tax (Entertainment Admissions) | 3% |

It's crucial to understand that these tax rates are subject to change and may be influenced by factors such as economic conditions, budget requirements, and legislative decisions. Residents and businesses should stay informed about any updates to ensure compliance with the latest tax regulations.

Tax Exemptions and Special Considerations

While the Columbus City Tax applies to a wide range of transactions and activities, certain exemptions and special considerations are in place to alleviate the tax burden on specific groups or situations.

Income Tax Exemptions

The income tax levied by the city of Columbus offers exemptions to certain individuals and entities. These exemptions are designed to provide relief to eligible taxpayers, ensuring that the tax system remains fair and equitable.

Some common income tax exemptions in Columbus include:

- Military Personnel: Active-duty military personnel stationed in Columbus may be exempt from paying the city income tax. This exemption recognizes the service and sacrifices made by those serving their country.

- Senior Citizens: Columbus offers income tax exemptions to senior citizens who meet specific age and income criteria. This exemption aims to support the financial well-being of the city's older residents.

- Students: Students attending educational institutions within Columbus may be eligible for income tax exemptions. This exemption encourages academic pursuits and supports the city's commitment to education.

- Nonprofit Organizations: Nonprofit organizations operating within Columbus may be exempt from paying the income tax. This exemption recognizes the valuable contributions of nonprofits to the community and encourages their continued operations.

Sales and Use Tax Exemptions

The sales and use tax in Columbus also includes exemptions to reduce the tax burden on specific goods and services. These exemptions are designed to promote economic growth, support essential industries, and provide relief to consumers.

Some notable sales and use tax exemptions in Columbus include:

- Groceries and Food Items: The purchase of groceries and certain food items is often exempt from the sales tax, providing a much-needed relief to households and promoting healthy eating habits.

- Prescription Medications: Sales tax exemptions are commonly applied to prescription medications, ensuring that essential healthcare needs are not burdened by additional costs.

- Educational Materials: The city of Columbus exempts sales tax on the purchase of educational materials, including textbooks, school supplies, and certain electronic devices used for educational purposes.

- Manufacturing Equipment: Sales tax exemptions are available for businesses purchasing manufacturing equipment, encouraging investment in the local manufacturing sector and promoting economic development.

Property Tax Exemptions

Property owners in Columbus may be eligible for property tax exemptions, which can provide significant relief on their tax obligations. These exemptions are typically granted to promote specific public policies or support vulnerable groups.

Common property tax exemptions in Columbus include:

- Homestead Exemption: This exemption provides a reduction in property taxes for primary homeowners, helping to make homeownership more affordable and encouraging long-term residence in the city.

- Senior Citizen Exemption: Similar to the income tax exemption, the property tax system in Columbus offers relief to senior citizens who meet certain age and income requirements.

- Veterans' Exemption: Military veterans may be eligible for property tax exemptions, recognizing their service and supporting their financial well-being in retirement.

- Agricultural Exemption: Property used for agricultural purposes may be eligible for tax exemptions, encouraging the development and maintenance of farmland within the city limits.

It's important for taxpayers to stay informed about the specific criteria and requirements for these exemptions. Understanding the eligibility criteria and the application process is crucial to ensure that eligible individuals and entities can take advantage of these tax relief measures.

Tax Filing and Payment

Understanding the process of filing and paying the Columbus City Tax is essential for individuals and businesses to ensure compliance with the city's tax regulations.

Income Tax Filing and Payment

For individuals and businesses subject to the Columbus income tax, filing and payment are typically conducted annually. The due date for filing income tax returns is aligned with the federal and state tax deadlines, providing a consistent and familiar framework for taxpayers.

The Columbus Department of Finance provides a user-friendly online platform for taxpayers to file their income tax returns electronically. This platform offers a secure and convenient way to submit the necessary tax information, calculate the tax liability, and make payments.

Additionally, the department offers resources and guidance to assist taxpayers in navigating the filing process. This includes detailed instructions, tax forms, and access to tax professionals who can provide support and answer questions.

Sales and Use Tax Filing and Payment

Businesses operating in Columbus that are responsible for collecting and remitting the sales and use tax must adhere to specific filing and payment requirements. These businesses are typically required to file sales tax returns on a monthly, quarterly, or annual basis, depending on their sales volume and other factors.

The Columbus Department of Finance provides an online portal for businesses to file their sales tax returns electronically. This portal allows businesses to calculate their tax liability, report sales data, and make payments in a secure and efficient manner.

To ensure compliance, businesses must maintain accurate records of their sales transactions, including the amount of tax collected from customers. These records are essential for accurate reporting and may be subject to audit by the city's tax authorities.

Property Tax Filing and Payment

Property owners in Columbus are responsible for paying property taxes based on the assessed value of their properties. The due date for property tax payments is typically aligned with the city's fiscal year, providing a predictable schedule for taxpayers.

The Columbus Department of Finance sends property tax bills to property owners, detailing the assessed value of the property, the applicable tax rate, and the total amount due. Property owners have the option to pay their taxes in full or through installment plans, depending on their financial circumstances.

To facilitate timely payments, the department offers various payment methods, including online payments, direct debit, and in-person payments at designated locations. Property owners are encouraged to familiarize themselves with the payment options and choose the most convenient method for their needs.

Compliance and Enforcement

The city of Columbus takes compliance with its tax regulations seriously and has established robust mechanisms to ensure that taxpayers fulfill their obligations. The Columbus Department of Finance plays a pivotal role in enforcing tax compliance and addressing instances of non-compliance.

Tax Audits and Investigations

The Columbus Department of Finance conducts tax audits and investigations to verify the accuracy of tax returns and ensure compliance with tax laws. These audits may be selected based on risk assessment, random sampling, or specific concerns raised by taxpayers or third parties.

During a tax audit, the department's auditors review the taxpayer's financial records, tax returns, and supporting documentation. The aim is to verify the correctness of the reported income, expenses, and tax liabilities. Auditors may request additional information or clarification from taxpayers to ensure a thorough assessment.

Taxpayers undergoing an audit are expected to cooperate fully and provide the necessary documentation in a timely manner. It's crucial for taxpayers to understand their rights and responsibilities during an audit and to seek professional advice if needed.

Penalties for Non-Compliance

Non-compliance with the Columbus City Tax regulations can result in various penalties and consequences. These penalties are designed to deter tax evasion and encourage voluntary compliance among taxpayers.

Common penalties for non-compliance include:

- Late Payment Penalties: Taxpayers who fail to pay their taxes by the due date may be subject to late payment penalties, which are typically calculated as a percentage of the outstanding tax liability.

- Interest on Unpaid Taxes: Unpaid taxes may accrue interest over time, further increasing the taxpayer's financial burden.

- Failure to File Penalties: Taxpayers who fail to file their tax returns by the due date may face penalties, which can be substantial and may result in additional legal consequences.

- Criminal Charges: In cases of deliberate tax evasion or fraud, taxpayers may face criminal charges, which can result in fines, imprisonment, or both.

It's important for taxpayers to understand that penalties can significantly increase the financial burden of non-compliance. To avoid these penalties, taxpayers should prioritize timely filing and payment of their taxes and seek professional advice if they have any concerns or questions.

Future Outlook and Potential Changes

The Columbus City Tax, like any tax system, is subject to ongoing review and potential changes to adapt to the evolving economic landscape and the city's evolving needs. Understanding the future outlook and potential adjustments is crucial for taxpayers to stay informed and plan their financial strategies accordingly.

Economic Factors and Budgetary Considerations

The city of Columbus, like many municipalities, faces budgetary challenges and must carefully balance its revenue sources to fund essential services and infrastructure projects. Economic factors, such as the overall health of the local economy, population growth, and changes in tax policy, can significantly impact the city's financial landscape.

As the city's economic conditions fluctuate, the need for revenue may drive discussions about adjusting tax rates, introducing new taxes, or modifying existing exemptions. These changes aim to ensure that the tax system remains sustainable and able to support the city's long-term goals.

Legislative and Policy Developments

The Columbus City Tax is subject to legislative and policy developments at both the local and state levels. Changes in tax laws, regulations, and policies can have a direct impact on the tax system and its administration.

For example, the city council may propose amendments to the tax code, introducing new tax incentives, modifying existing tax rates, or expanding tax exemptions to promote specific economic sectors or address social concerns.

Additionally, state-level tax reforms or changes in federal tax policies can have a ripple effect on the Columbus City Tax system, necessitating adjustments to maintain consistency and compliance with higher-level regulations.

Potential Tax Reform Initiatives

In an effort to improve tax fairness, simplify the tax system, or address specific policy goals, the city of Columbus may embark on tax reform initiatives. These initiatives can take various forms and may involve:

- Broadening the Tax Base: The city may explore options to broaden the tax base by introducing new taxes or expanding the scope of existing taxes to capture a larger share of the economy.

- Reducing Tax Rates: In response to economic conditions or to stimulate economic growth, the city may propose reducing tax rates, making the tax system more attractive to taxpayers.

- Simplifying Tax Administration: Reform initiatives may focus on streamlining the tax filing and payment processes, making it easier for taxpayers to comply with their obligations and reducing the administrative burden on taxpayers and the city government.

- Addressing Social Equity: Tax reforms may aim to promote social equity by introducing or expanding tax exemptions for vulnerable groups or providing relief to taxpayers facing financial hardships.

It's important for taxpayers to stay engaged and informed about these potential changes. By understanding the future outlook and participating in the public discourse surrounding tax reforms, taxpayers can influence the direction of the tax system and ensure that their interests and concerns are considered.

Frequently Asked Questions

What is the Columbus City Tax rate for income tax?

+

The income tax rate in Columbus is currently 2%. This rate applies to individuals and businesses operating within the city limits.

Are there any exemptions for the Columbus City Income Tax?

+

Yes, Columbus offers income tax exemptions to certain individuals and entities. These exemptions include military personnel, senior citizens, students, and nonprofit organizations. Each exemption has specific eligibility criteria that taxpayers must meet.