Georgia Sales Tax Auto

Welcome to this comprehensive guide on understanding the intricacies of Georgia's sales tax policies, specifically tailored for the automotive industry. Georgia, like many other states, has a unique set of rules and regulations when it comes to sales tax, and navigating these can be crucial for both businesses and consumers. In this article, we will delve into the specifics of Georgia's sales tax for automobiles, exploring the rates, exemptions, and procedures involved, and offering expert insights to ensure a smooth and compliant transaction process.

Understanding Georgia’s Sales Tax Structure

Georgia’s sales tax system is a combination of state and local taxes, with rates varying depending on the location of the sale. The state sales tax rate in Georgia is currently set at 4%, which is applied uniformly across the state. However, it’s important to note that counties and municipalities can also impose additional sales taxes, leading to varying total sales tax rates throughout the state.

For instance, consider the city of Atlanta, which applies a 3% local sales tax on top of the state rate, resulting in a combined sales tax rate of 7% for purchases made within the city limits. These local taxes can significantly impact the final cost of a vehicle, making it crucial for buyers to be aware of these variations.

| Location | State Sales Tax Rate | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| Atlanta | 4% | 3% | 7% |

| Athens | 4% | 2% | 6% |

| Savannah | 4% | 1% | 5% |

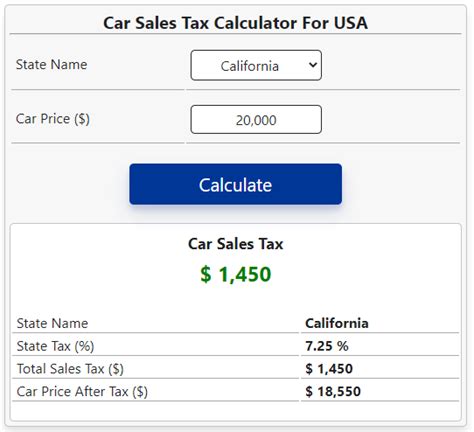

Sales Tax Calculation for Automobiles

When purchasing a vehicle in Georgia, the sales tax is typically calculated based on the gross sale price of the vehicle, including any additional fees and charges. This means that any options, accessories, and even delivery charges can be subject to sales tax.

Let's take an example to illustrate this. If you're purchasing a new car in Atlanta with a gross sale price of $35,000, the sales tax calculation would be as follows:

State Sales Tax: $35,000 x 4% = $1,400

Local Sales Tax: $35,000 x 3% = $1,050

Total Sales Tax: $1,400 + $1,050 = $2,450

So, the total sales tax for this purchase would amount to $2,450, making the final cost of the vehicle $37,450. It's important to note that this calculation doesn't include any potential dealer fees or registration fees, which can further add to the overall cost.

Exemptions and Special Considerations

While the standard sales tax rate applies to most vehicle purchases in Georgia, there are certain exemptions and special considerations that can impact the tax liability.

Trade-In Vehicles

When trading in an old vehicle as part of the purchase of a new one, the sales tax in Georgia is calculated based on the difference between the trade-in value and the gross sale price of the new vehicle. This is known as the trade-in allowance.

For example, if you're trading in a vehicle with a value of $10,000 towards the purchase of a new vehicle with a gross sale price of $40,000, the trade-in allowance would be $10,000. The sales tax would then be calculated on the remaining $30,000 (gross sale price minus trade-in allowance). This can significantly reduce the sales tax liability for the buyer.

Vehicle Lease Agreements

Leasing a vehicle in Georgia is subject to a different set of rules. Instead of paying sales tax upfront, lease payments are typically subject to a monthly sales tax based on the value of the lease payment. This means that each monthly payment includes a portion of the sales tax, calculated as a percentage of the lease payment.

For instance, if your monthly lease payment is $500 and the sales tax rate is 7%, the monthly sales tax would be $35. This amount is then included in your lease payment, ensuring that the full sales tax liability is covered over the course of the lease term.

Specialty Vehicles and Exemptions

Georgia offers certain exemptions for specific types of vehicles, including:

- Electric Vehicles (EVs): Georgia provides a sales tax exemption for the purchase of new EVs, encouraging the adoption of environmentally friendly transportation. This exemption can significantly reduce the upfront cost of purchasing an EV.

- Disabled Individuals: Vehicles modified for disabled individuals are eligible for a sales tax exemption in Georgia. This exemption is designed to provide accessibility and financial relief to those with disabilities.

- Military Personnel: Active-duty military personnel and their spouses can qualify for a sales tax exemption on vehicle purchases in Georgia, as a token of appreciation for their service.

Sales Tax Procedures and Compliance

Understanding the sales tax procedures and maintaining compliance is essential for both automotive businesses and consumers in Georgia. Here’s an overview of the key steps and considerations:

Registration and Permits

For automotive businesses, obtaining the necessary sales tax permits is crucial. This involves registering with the Georgia Department of Revenue and obtaining a unique sales tax number. This number is then used to report and remit sales tax on a regular basis.

Record-Keeping and Reporting

Accurate record-keeping is vital for sales tax compliance. Automotive businesses should maintain detailed records of all vehicle sales, including the gross sale price, any trade-in allowances, and the applicable sales tax rates. These records are essential for accurate reporting and potential audits.

Sales tax returns must be filed regularly, typically on a monthly or quarterly basis. The due dates and reporting requirements can vary depending on the business's sales volume and other factors. Late filing or non-compliance can result in penalties and interest charges.

Consumer Awareness

For consumers, it’s important to be aware of the sales tax implications when purchasing a vehicle. Understanding the applicable rates and any potential exemptions can help in budgeting and negotiating the final purchase price. It’s always advisable to discuss sales tax with the dealership or seller to ensure a clear understanding of the final cost.

Expert Insights and Future Considerations

As an industry expert, I’d like to offer a few key insights and considerations for those navigating Georgia’s sales tax landscape for automobiles.

Future Trends and Implications

Georgia’s sales tax policies are subject to change, and keeping up with these changes is crucial for both businesses and consumers. Here are some potential future considerations:

- Tax Rate Changes: While the current sales tax rates are stable, there is always the possibility of future rate adjustments. Keep an eye on legislative changes and proposed bills that could impact sales tax rates in the state.

- Online Sales: With the rise of online vehicle sales platforms, the state may consider implementing specific regulations and tax policies for these transactions. Understanding these rules will be essential for both online dealerships and consumers.

- Electric Vehicle Incentives: Georgia's EV sales tax exemption is a significant incentive for consumers. However, as the adoption of EVs increases, there may be discussions around the continuation or modification of this exemption. Stay informed about any potential changes.

Conclusion

Georgia’s sales tax landscape for automobiles is a complex but crucial aspect of the automotive industry in the state. By understanding the rates, exemptions, and procedures involved, both businesses and consumers can navigate this landscape with confidence and ensure compliance. As an industry expert, staying informed and adapting to any future changes will be key to success in this dynamic environment.

How often do sales tax rates change in Georgia?

+Sales tax rates in Georgia can change periodically, typically through legislative action. While the state sales tax rate has remained stable for some time, local tax rates can vary and may be adjusted more frequently. It’s important to stay updated with any changes to ensure compliance.

Are there any other fees or charges besides sales tax when purchasing a vehicle in Georgia?

+Yes, there are additional fees and charges associated with vehicle purchases in Georgia. These can include title fees, registration fees, documentary fees, and dealer preparation fees. These charges can vary depending on the dealership and the specific vehicle being purchased.

How do I apply for a sales tax exemption as a disabled individual in Georgia?

+To apply for a sales tax exemption as a disabled individual in Georgia, you will need to obtain a Vehicle Identification Card for Persons with Disabilities from the Department of Driver Services. This card provides proof of eligibility for the sales tax exemption and is valid for a period of five years.

Can I negotiate the sales tax rate when purchasing a vehicle in Georgia?

+The sales tax rate is a statutory requirement and cannot be negotiated. However, you can negotiate the gross sale price of the vehicle, which can indirectly impact the sales tax liability. Additionally, understanding the sales tax rate in different locations can provide opportunities for strategic purchasing decisions.

Are there any online resources to help calculate sales tax for vehicle purchases in Georgia?

+Yes, the Georgia Department of Revenue provides an online Sales and Use Tax Calculator that can help estimate the sales tax for a vehicle purchase. This tool takes into account the state and local tax rates, providing a useful estimate for budgeting purposes.