Luzerne County Tax Claim Bureau

The Luzerne County Tax Claim Bureau, a vital component of the county's fiscal machinery, plays a critical role in managing property taxes and enforcing tax delinquency processes. Located in the heart of northeastern Pennsylvania, this bureau is an integral part of the county's administrative framework, ensuring the timely collection of taxes and facilitating the sale of delinquent properties.

About the Luzerne County Tax Claim Bureau

The Luzerne County Tax Claim Bureau, established with the primary objective of upholding the county's fiscal responsibilities, operates under the jurisdiction of the Luzerne County government. Its core mandate is to administer the collection of real estate taxes and to oversee the legal processes associated with delinquent tax payments.

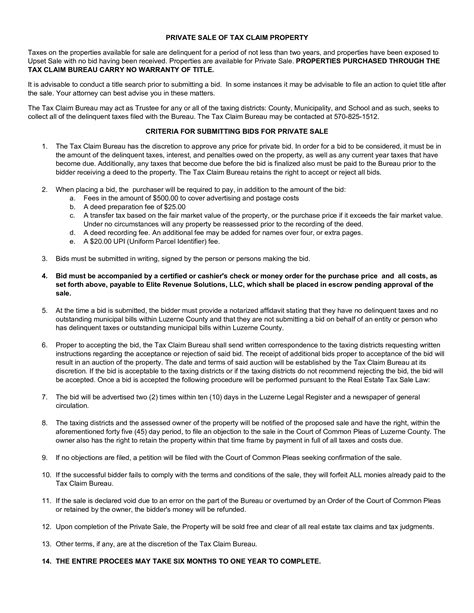

One of the key functions of the bureau is the Annual Tax Sale, an event that significantly contributes to the county's revenue stream. This sale, typically held annually, involves the auctioning of properties whose owners have failed to pay their taxes for a minimum of two years. The proceeds from these sales not only help to recoup the county's lost tax revenue but also serve as a deterrent to future tax delinquency.

The bureau's operations are guided by a team of dedicated professionals, including tax claim officers, administrative staff, and legal experts. Together, they ensure that the tax collection process is efficient, fair, and in compliance with the county's regulations and state laws.

Tax Delinquency Process: A Comprehensive Overview

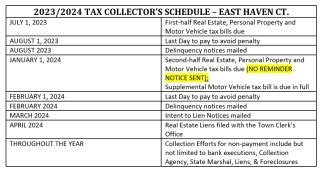

The journey towards a tax sale begins with the identification of delinquent properties. Properties that have outstanding tax debts are carefully monitored by the bureau, with notifications and reminders sent to property owners to encourage timely payment. If the taxes remain unpaid, the bureau initiates a series of legal actions, which may include the following steps:

- Lien Placement: The bureau records a lien against the delinquent property, a legal claim that gives the county a right to the property as security for the debt.

- Publication of Notice: The bureau publishes a notice of the impending tax sale in local newspapers, providing public notice of the sale and the opportunity for property owners to rectify their tax delinquency.

- Annual Tax Sale: If the taxes remain unpaid after the publication period, the property is included in the annual tax sale. During the sale, interested buyers bid on the properties, with the highest bidder becoming the new owner.

- Redemption Period: After the sale, the original property owner has a redemption period, typically one year, to reclaim the property by paying the full amount of the bid, plus accrued interest and penalties.

This process, while necessary for the county's financial stability, also presents opportunities for investors and homebuyers seeking properties at potentially discounted rates.

Impact and Benefits

The operations of the Luzerne County Tax Claim Bureau have a profound impact on the county's fiscal health and its property market dynamics. By enforcing tax payments, the bureau ensures a steady revenue stream for the county, which is vital for funding public services and infrastructure projects.

For the real estate market, the bureau's activities introduce an element of stability and fairness. The threat of tax sales encourages property owners to maintain their tax payments, preventing a backlog of delinquent taxes that could disrupt the market. Additionally, the sales provide an avenue for investors to acquire properties at potentially advantageous prices, contributing to market liquidity.

From an economic perspective, the bureau's role in tax collection and property sales can stimulate local economic activity. The influx of investors, coupled with the potential for property redevelopment, can bring new life to communities and contribute to local economic growth.

Future Outlook and Innovations

Looking ahead, the Luzerne County Tax Claim Bureau is committed to exploring innovative strategies to enhance its operations. One key area of focus is digitization, which can streamline the tax payment and delinquency management processes. By leveraging technology, the bureau aims to improve efficiency, reduce administrative burdens, and provide a more accessible platform for taxpayers and potential buyers.

Furthermore, the bureau is dedicated to educating taxpayers about their rights and responsibilities. Outreach programs and community engagement initiatives are being developed to ensure that property owners understand the implications of tax delinquency and the steps they can take to avoid it. By fostering a culture of tax compliance, the bureau aims to reduce the number of properties that enter the tax sale process.

In conclusion, the Luzerne County Tax Claim Bureau is an indispensable component of the county's administrative and fiscal framework. Its operations not only ensure the collection of vital tax revenues but also contribute to the stability and dynamism of the local property market. With a forward-thinking approach and a commitment to innovation, the bureau is poised to continue its vital role in shaping the county's fiscal and economic landscape.

FAQs

How often does the Luzerne County Tax Claim Bureau hold its Annual Tax Sale?

+The Annual Tax Sale is typically held once a year. The exact date varies, but it is usually scheduled for a specific day in the fall, with a consistent timing each year.

<div class="faq-item">

<div class="faq-question">

<h3>What happens if a property owner redeems their property after the Annual Tax Sale?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If a property owner redeems their property during the redemption period, they must pay the full amount of the winning bid, plus accrued interest and penalties. The property then reverts back to their ownership, and the sale is considered nullified.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any advantages for investors who participate in the Annual Tax Sale?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, investors can benefit from the Annual Tax Sale by acquiring properties at potentially discounted prices. However, it's important to note that these properties may require significant repairs or renovations, and there may be legal complexities involved.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can property owners avoid having their properties included in the Annual Tax Sale?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Property owners can avoid the Annual Tax Sale by staying current with their tax payments. If they receive a notice of delinquency, they should contact the Luzerne County Tax Claim Bureau promptly to make arrangements to pay the outstanding taxes.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Does the Luzerne County Tax Claim Bureau offer any assistance to property owners facing financial difficulties?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, the bureau recognizes that financial difficulties can arise, and they aim to work with property owners to find solutions. They may offer payment plans or provide information on other assistance programs that can help property owners get back on track with their tax payments.</p>

</div>

</div>

</div>