City Of New Haven Ct Tax Collector

Welcome to the comprehensive guide on the City of New Haven, CT, Tax Collector's Office. In this article, we will delve into the crucial role of the Tax Collector in managing the city's finances and explore the various services and responsibilities they undertake. With a focus on accuracy and transparency, we aim to provide an insightful overview of this essential municipal department.

Understanding the Role of the Tax Collector

The Tax Collector’s Office is an integral part of the City of New Haven’s administrative machinery. It serves as the custodian of the city’s financial health, ensuring the efficient collection and management of taxes and fees. Led by the appointed Tax Collector, this department plays a pivotal role in sustaining the city’s operations and services.

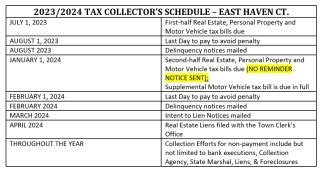

The Tax Collector's responsibilities encompass a wide range of tasks, including the collection of property taxes, motor vehicle taxes, and various fees associated with city services. They work closely with the city's Assessor's Office to determine tax assessments and ensure equitable taxation. Additionally, the Tax Collector's Office is responsible for maintaining accurate records, processing payments, and providing timely and transparent financial information to residents and stakeholders.

Services Offered by the Tax Collector’s Office

The Tax Collector’s Office offers a range of services to New Haven residents and businesses. These services are designed to facilitate tax payment processes, provide assistance, and ensure compliance with tax regulations.

- Online Tax Payment Portal: Residents can conveniently pay their taxes online through a secure portal. This platform allows users to view their tax bills, make payments, and access payment history.

- In-Person Payments: For those who prefer traditional methods, the Tax Collector's Office accepts in-person payments at their designated locations. Residents can visit the office to pay their taxes, obtain receipts, and seek assistance from the staff.

- Payment Plan Options: Recognizing that financial circumstances may vary, the Tax Collector's Office offers payment plan options for taxpayers facing temporary financial challenges. These plans provide flexibility and ensure that residents can fulfill their tax obligations without undue hardship.

- Tax Bill Information and Assistance: The Tax Collector's Office provides detailed information about tax bills, including due dates, assessment details, and payment instructions. Their staff is available to assist residents with any inquiries or concerns regarding their tax obligations.

- Penalty and Interest Calculations: The office calculates and applies penalties and interest on overdue tax payments. They ensure that taxpayers are aware of the consequences of late payments and provide accurate information on these additional charges.

Performance Analysis and Transparency

The City of New Haven takes pride in its commitment to transparency and accountability in financial matters. The Tax Collector’s Office plays a vital role in upholding these values by providing accessible and accurate financial information to the public.

The office publishes regular financial reports, including annual reports and quarterly updates. These reports provide detailed insights into the city's financial health, tax revenue, and expenditure patterns. By making this information readily available, the Tax Collector's Office fosters trust and allows residents to understand how their tax contributions are being utilized.

In addition to financial reporting, the Tax Collector's Office actively engages with the community through various outreach initiatives. They participate in town hall meetings, community forums, and educational events to address taxpayer concerns, provide updates, and gather feedback. This two-way communication ensures that the office remains responsive to the needs and challenges faced by New Haven residents.

Technical Specifications and Innovations

To enhance efficiency and improve the taxpayer experience, the Tax Collector’s Office has embraced technological advancements. Here are some notable technical specifications and innovations implemented by the department:

| Technical Specification | Description |

|---|---|

| Secure Online Payment Platform | The Tax Collector's Office has developed a robust and secure online payment platform. This platform utilizes advanced encryption protocols to ensure the safety of taxpayer information and financial transactions. |

| Tax Bill Generation System | The office employs an automated tax bill generation system that integrates data from the Assessor's Office. This system ensures accuracy and timeliness in issuing tax bills, reducing the potential for errors and delays. |

| Payment Reminder System | To assist taxpayers in meeting their tax obligations, the Tax Collector's Office has implemented a payment reminder system. This system sends automated reminders to taxpayers approaching their due dates, reducing the likelihood of late payments and associated penalties. |

| Data Analytics and Reporting | The office utilizes data analytics tools to gain insights into tax collection trends, identify potential issues, and improve operational efficiency. These analytics help the Tax Collector's Office make informed decisions and enhance their services. |

Community Engagement and Education

The Tax Collector’s Office understands the importance of engaging with the community and fostering a culture of financial literacy. They actively participate in educational initiatives to ensure that residents are well-informed about their tax obligations and the impact of their contributions.

One notable program is the "Tax Talk" series, where the Tax Collector and their team host informative sessions in various neighborhoods. These sessions provide an opportunity for residents to ask questions, clarify misconceptions, and gain a better understanding of the tax system. The Tax Collector's Office also collaborates with local schools and community organizations to deliver financial literacy workshops, empowering residents to make informed decisions regarding their finances.

Future Implications and Ongoing Initiatives

Looking ahead, the Tax Collector’s Office of New Haven, CT, is committed to continuous improvement and adaptation. They are actively exploring new technologies and strategies to enhance their services further.

One area of focus is the development of a comprehensive tax management app. This app aims to provide residents with a centralized platform for accessing tax information, making payments, and tracking their financial contributions. By leveraging mobile technology, the Tax Collector's Office aims to make tax management more accessible and convenient for residents on the go.

Additionally, the office is collaborating with local businesses and organizations to streamline the tax payment process for commercial entities. They are working towards implementing electronic filing and payment systems, reducing the administrative burden on businesses and improving efficiency.

The Tax Collector's Office is also dedicated to fostering a culture of financial responsibility and transparency. They plan to expand their outreach efforts, engaging with community leaders and organizations to address specific tax-related concerns and provide tailored support.

Conclusion

The City of New Haven’s Tax Collector’s Office is a vital pillar of the city’s administrative structure. Through their dedicated work, the office ensures the efficient collection and management of taxes, contributing to the overall financial stability of the city. With a focus on transparency, innovation, and community engagement, the Tax Collector’s Office strives to provide excellent service and support to New Haven residents and businesses.

How can I pay my taxes in New Haven, CT?

+

You can pay your taxes in New Haven, CT, through the online tax payment portal, in-person at the Tax Collector’s Office, or by utilizing the payment plan options available. The office accepts various payment methods, including credit cards, checks, and cash.

What happens if I miss the tax payment deadline?

+

If you miss the tax payment deadline, penalties and interest will be applied to your outstanding balance. It’s important to note that late payments can accumulate additional charges over time. The Tax Collector’s Office recommends reaching out to discuss payment options to avoid further penalties.

How can I obtain a copy of my tax bill or payment history?

+

You can access your tax bill and payment history through the online tax payment portal. Simply log in to your account, and you’ll find all the necessary information. If you require further assistance, you can contact the Tax Collector’s Office directly.

Are there any discounts or exemptions available for certain taxpayers?

+

Yes, the City of New Haven offers various discounts and exemptions to eligible taxpayers. These may include senior citizen exemptions, veteran discounts, and property tax abatements. It’s advisable to consult the Tax Collector’s Office or refer to their website for specific eligibility criteria and application processes.

How can I stay updated on tax-related news and announcements in New Haven?

+

The Tax Collector’s Office regularly updates its website with important news, announcements, and reminders. You can also subscribe to their email newsletter or follow their social media accounts to receive timely updates. Additionally, they publish notices in local newspapers and community bulletins.