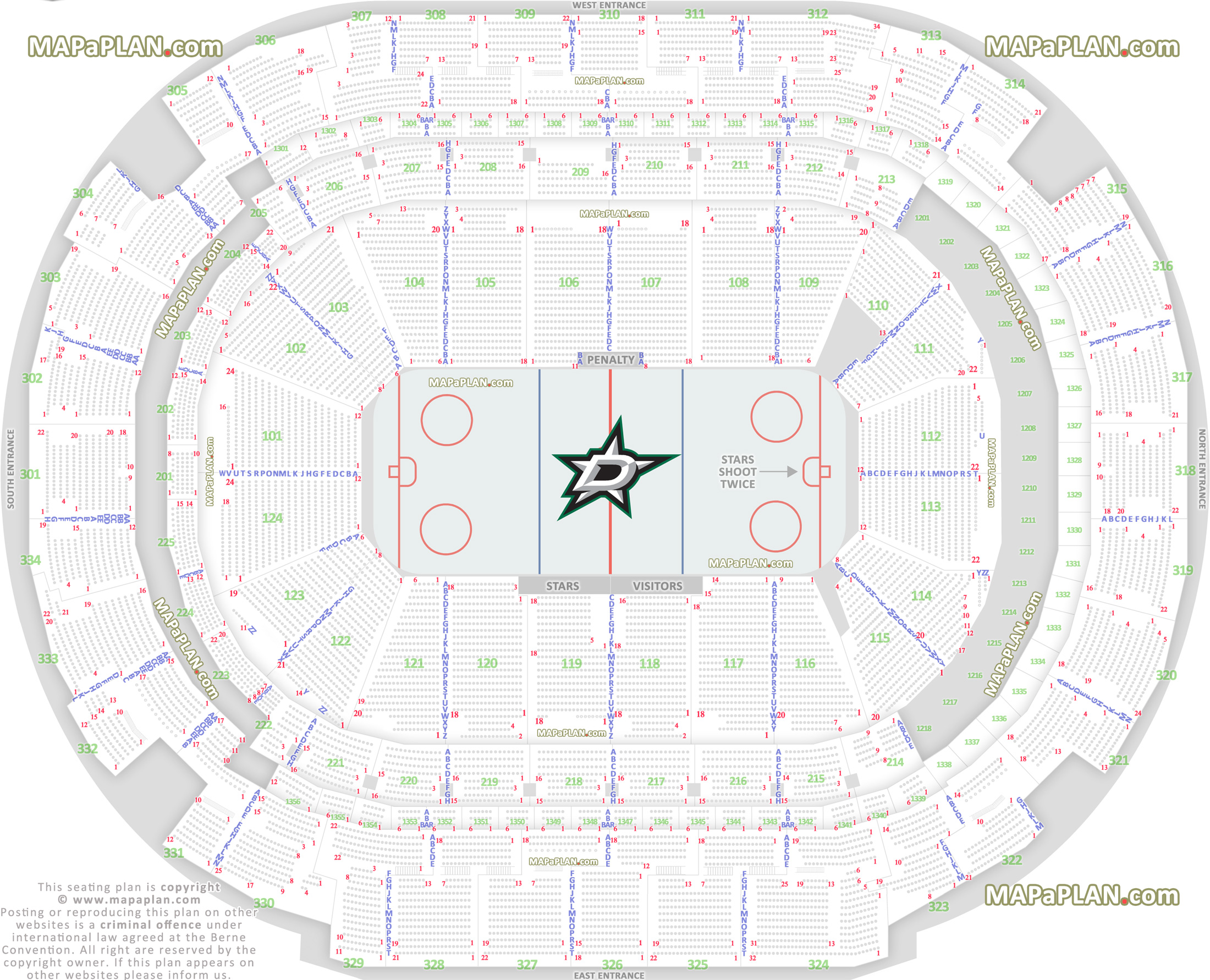

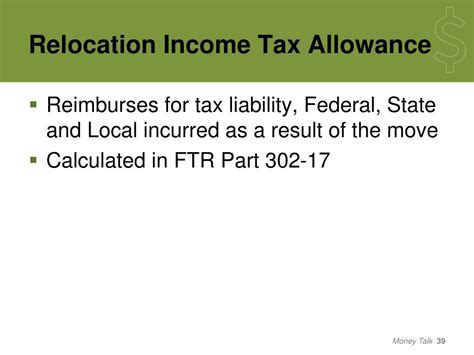

Relocation Income Tax Allowance

The Relocation Income Tax Allowance is a beneficial tax provision that can significantly impact individuals and businesses undergoing a move, whether across borders or within a country. This allowance, designed to ease the financial burden associated with relocation, offers a unique opportunity to optimize tax strategies and reduce the overall tax liability. As an expert in the field, I will delve into the intricacies of this allowance, providing a comprehensive guide to understanding its scope, eligibility, and effective utilization.

Understanding the Relocation Income Tax Allowance

The Relocation Income Tax Allowance, often referred to as RITA, is a specific provision within tax laws that allows individuals and entities to claim a deduction or exemption on certain expenses incurred during a relocation process. This allowance is particularly advantageous for those facing substantial financial obligations due to moving, such as purchasing new property, shipping costs, temporary accommodation, and various other relocation-related expenses.

The concept of RITA is rooted in the recognition that relocation can be a significant financial strain, often resulting in unforeseen costs. By offering a tax relief mechanism, governments aim to encourage mobility, both for individuals seeking better opportunities and for businesses expanding their operations. This allowance not only eases the financial burden but also contributes to the overall economic growth by facilitating movement and change.

Eligibility and Qualifying Criteria

Understanding the eligibility criteria is crucial for individuals and businesses aiming to leverage the Relocation Income Tax Allowance. While the specific qualifications may vary based on the jurisdiction, there are some common factors that generally apply:

- Distance of Relocation: In most cases, the allowance is applicable when the move involves a substantial distance. This distance requirement ensures that the relocation is not merely a local move but a significant change in residence or business location.

- Nature of Move: The allowance typically covers permanent or long-term relocations. Temporary moves, such as those for a specific project or short-term assignment, may not qualify.

- Reason for Relocation: The move should be justified by a valid reason, such as a job transfer, promotion, or business expansion. Personal reasons, although understandable, may not always meet the eligibility criteria.

- Documentation: Adequate documentation is essential to support the relocation claim. This includes proof of residence, employment contracts, and detailed records of expenses incurred during the move.

It is crucial to consult with tax professionals or refer to official tax guidelines to ensure a clear understanding of the eligibility criteria specific to your jurisdiction.

Types of Expenses Covered

The Relocation Income Tax Allowance encompasses a wide range of expenses associated with relocation. These expenses can be broadly categorized into several key areas:

Property-Related Expenses

When relocating, the purchase or sale of a new property often involves significant costs. The allowance typically covers expenses such as:

- Real estate agent fees

- Legal fees for property transactions

- Moving and storage costs for household goods

- Stamp duty or transfer taxes on property purchases

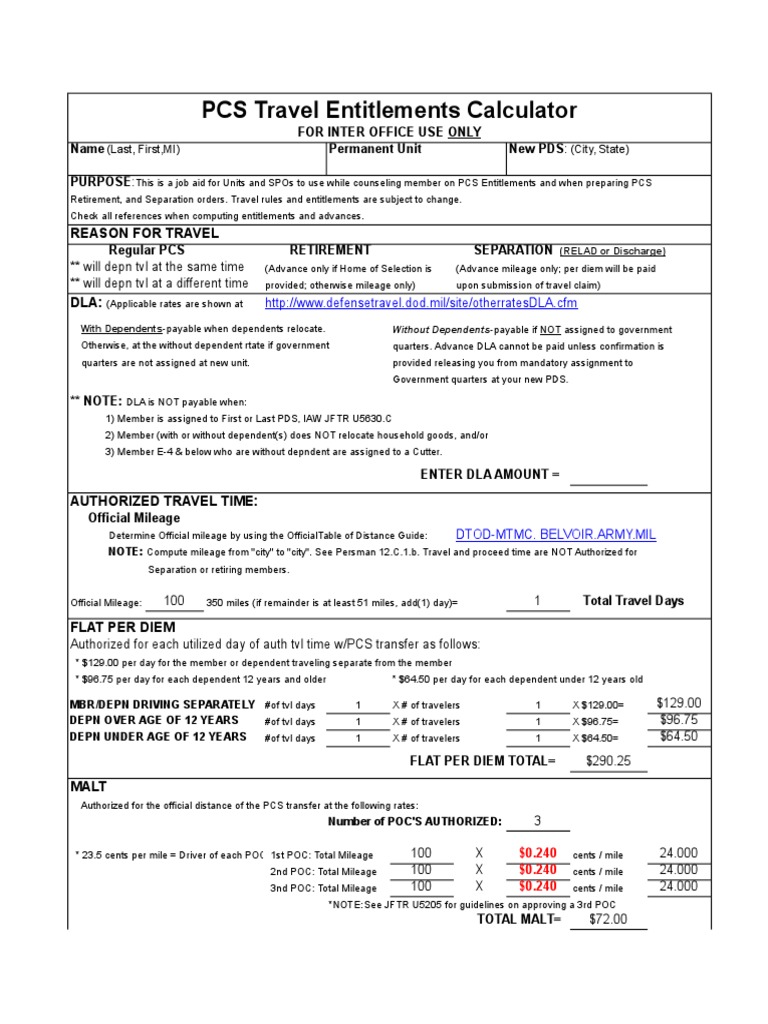

Travel and Accommodation

The process of relocation often requires multiple trips and temporary accommodation. The following expenses are generally eligible for the allowance:

- Airfare, train tickets, or other transportation costs for the move

- Hotel stays during the transition period

- Meal expenses incurred during the move

Miscellaneous Relocation Costs

In addition to the above, there are several other expenses that can be claimed under the Relocation Income Tax Allowance:

- Pet relocation expenses

- Vehicle transportation or purchase costs

- Connection fees for utilities such as electricity, water, and internet

- Storage costs for personal belongings during the transition

It is important to note that specific expenses may vary based on the jurisdiction and the individual's unique circumstances. Consulting with tax experts is recommended to ensure a comprehensive understanding of what can be claimed.

Maximizing the Benefits: Strategic Planning

To fully leverage the Relocation Income Tax Allowance, strategic planning is essential. Here are some key considerations to optimize the benefits:

Timing of the Move

The timing of the relocation can impact the allowance’s applicability. In some cases, there may be specific windows of opportunity, such as a financial year-end, that offer more favorable tax outcomes. Planning the move to align with these periods can maximize the tax benefits.

Documentation and Record-Keeping

Maintaining meticulous records is crucial. All expenses should be documented with receipts, invoices, and other supporting evidence. This ensures a smooth process when it comes to claiming the allowance and provides a clear audit trail.

Tax Advice and Professional Guidance

Engaging with tax professionals who specialize in relocation tax strategies can be immensely beneficial. They can provide tailored advice, ensuring that all eligible expenses are considered and that the process aligns with the latest tax regulations.

| Expense Category | Qualifying Expenses |

|---|---|

| Property-Related | Real estate agent fees, legal fees, moving costs |

| Travel and Accommodation | Airfare, hotel stays, meal expenses |

| Miscellaneous | Pet relocation, vehicle costs, utility connections |

Case Study: Real-World Application

To illustrate the practical application of the Relocation Income Tax Allowance, let’s consider the case of Sarah, a senior executive who was offered a promotion and a transfer to a new city. Sarah’s relocation involved a significant move across the country, and she faced various expenses during the process.

Sarah's relocation expenses included:

- Property Expenses: She sold her current home and purchased a new property in the new city, incurring real estate agent fees, legal costs, and stamp duty.

- Travel and Accommodation: Sarah made multiple trips to the new city for job interviews and house hunting. She also had to stay in a hotel during the transition period, incurring travel and accommodation expenses.

- Miscellaneous Costs: Sarah had to ship her furniture and belongings across the country, and she also paid connection fees for utilities in her new home.

By understanding the eligibility criteria and the types of expenses covered, Sarah was able to claim a substantial amount under the Relocation Income Tax Allowance, reducing her overall tax liability and easing the financial burden of the move.

Future Implications and Trends

The Relocation Income Tax Allowance is a dynamic provision that continues to evolve with changing economic and social landscapes. As global mobility increases, governments are likely to adapt and enhance these allowances to encourage talent movement and business expansion.

Looking ahead, we can expect to see:

- Expansion of Eligibility: With an increasing focus on remote work and digital nomads, there may be a broadening of eligibility criteria to accommodate more flexible work arrangements.

- Enhanced Support for Remote Relocations: As businesses embrace remote work, there could be specific allowances introduced to support employees relocating to different regions or countries while working remotely.

- Integration with Digital Tax Systems: The integration of relocation allowances with digital tax platforms and systems will likely streamline the claiming process, making it more accessible and efficient.

Staying informed about these developments is crucial for individuals and businesses planning relocations, as it ensures optimal tax strategies and a smooth transition process.

What is the maximum amount that can be claimed under the Relocation Income Tax Allowance?

+

The maximum amount varies based on jurisdiction and individual circumstances. It is essential to refer to the specific tax guidelines of your country or consult with a tax professional for an accurate assessment.

Are there any income thresholds for eligibility?

+

Some jurisdictions may have income thresholds that determine eligibility. It is crucial to review the tax guidelines or seek professional advice to understand if your income level meets the criteria.

Can businesses claim the Relocation Income Tax Allowance for their employees’ relocations?

+

Yes, businesses can often claim expenses related to employee relocations. However, the specific rules and regulations may vary, so consulting with a tax advisor is recommended to ensure compliance.

Are there any time limits for claiming the allowance?

+

Time limits for claiming the Relocation Income Tax Allowance vary by jurisdiction. It is crucial to understand the specific timeframes and deadlines to ensure timely submission of claims.

Can I claim the allowance if I am relocating temporarily for a project?

+

Temporary relocations for specific projects may not qualify for the allowance. However, it is advisable to consult with tax professionals to assess your specific circumstances and eligibility.