Pay Delaware Franchise Tax

The state of Delaware is renowned for its business-friendly environment, with a long history of accommodating corporate structures and a robust legal framework. One of the key responsibilities for businesses registered in Delaware is the payment of the franchise tax, an annual fee that maintains the entity's good standing and ensures compliance with state regulations.

This article aims to provide a comprehensive guide on how to effectively pay the Delaware franchise tax, exploring the various methods, deadlines, and potential consequences of non-compliance. By understanding the process and best practices, businesses can navigate this essential task with ease and maintain their legal standing in the state.

Understanding the Delaware Franchise Tax

The Delaware franchise tax is an annual levy imposed on all corporations, limited liability companies (LLCs), and limited partnerships registered in the state. It is distinct from income tax, as it is calculated based on the authorized capital stock of the entity, not its revenue or profits. The tax serves as a critical source of revenue for the state, funding essential services and infrastructure.

The calculation of the franchise tax involves a complex formula that takes into account the entity's capital structure, including the number of authorized shares, the par value of those shares, and any outstanding debts or liabilities. The state provides a Franchise Tax Calculator on its official website, which simplifies the process and ensures accurate tax assessments.

The Delaware Division of Corporations oversees the franchise tax process, offering clear guidelines and resources to assist businesses in understanding their obligations. Entities are required to pay the franchise tax annually, with specific deadlines depending on the type of business and its formation date.

Key Points to Note:

- The franchise tax is mandatory for all registered entities, regardless of their operational status or revenue generation.

- Failure to pay the franchise tax can result in penalties, interest, and potential revocation of the entity’s certificate of incorporation or organization.

- Delaware offers various payment methods, including online, by mail, or in person, providing flexibility for businesses.

Methods of Paying the Franchise Tax

Delaware provides a range of options for businesses to pay their franchise tax, catering to different preferences and circumstances. Here’s an overview of the primary methods:

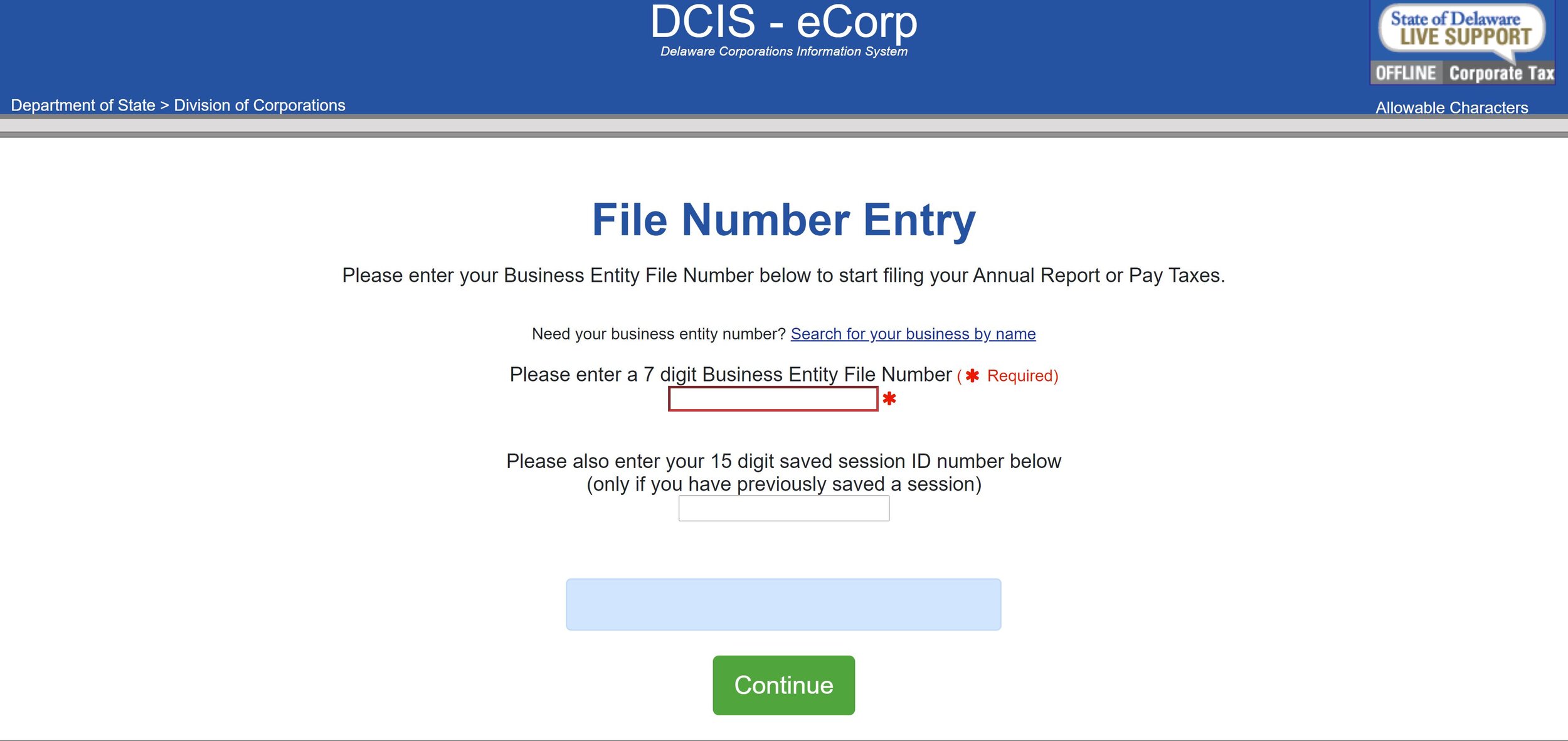

Online Payment

The most convenient and popular method is online payment through the Delaware Division of Corporations’ official website. The online system offers a secure platform for businesses to input their tax information, calculate the exact amount due, and make the payment using a credit or debit card, electronic check, or electronic funds transfer (EFT). The system provides real-time confirmation of the payment, ensuring immediate processing.

To make an online payment, businesses need to have their entity number, which can be found on their certificate of incorporation or organization, and a valid payment method. The online system is user-friendly and provides step-by-step instructions, making it accessible for entities of all sizes and technical capabilities.

Mail-In Payment

For businesses that prefer a more traditional approach, the state accepts mail-in payments. Entities can download and print the appropriate franchise tax forms from the Division of Corporations’ website, fill them out, and send them along with a check or money order to the designated address. The forms require detailed information about the entity, including its name, address, and tax year.

Mail-in payments should be sent well in advance of the deadline to ensure timely processing. It's crucial to include the correct amount and clearly write the entity's name and tax year on the check or money order to avoid any processing delays.

In-Person Payment

Delaware also accommodates in-person payments at the Division of Corporations’ office in Dover. Businesses can visit the office during regular business hours and make payments using cash, check, money order, or credit/debit card. This method is ideal for those who prefer face-to-face interactions and immediate confirmation of payment.

It's essential to note that in-person payments may be subject to longer wait times, especially during peak periods. Businesses should plan their visit accordingly and bring the necessary documentation to expedite the process.

Franchise Tax Deadlines and Extensions

Understanding the franchise tax deadlines is crucial to avoid late fees and potential penalties. The state of Delaware has a clear schedule for tax payments, with specific dates based on the entity’s formation month. Here’s a breakdown of the deadlines:

| Formation Month | Franchise Tax Due Date |

|---|---|

| January | March 1 |

| February | March 1 |

| March | April 1 |

| April | May 1 |

| May | June 1 |

| June | July 1 |

| July | August 1 |

| August | September 1 |

| September | October 1 |

| October | November 1 |

| November | December 1 |

| December | January 1 |

It's important to note that these deadlines are non-negotiable, and late payments may incur penalties and interest. To avoid any issues, businesses should aim to pay their franchise tax well before the due date, especially if using mail-in or in-person methods, which may require additional processing time.

In exceptional circumstances, entities can request an extension for paying their franchise tax. The state typically grants extensions for valid reasons, such as unforeseen circumstances or natural disasters. To request an extension, businesses must submit a written application to the Division of Corporations, outlining the reasons for the delay and providing supporting documentation.

Penalty for Late Payment

Failing to pay the franchise tax by the deadline can result in significant penalties and interest charges. The state imposes a 1.5% monthly penalty on the unpaid tax amount, which can quickly accumulate over time. Additionally, interest accrues on the unpaid tax balance at a rate of 0.75% per month, compounding the financial burden.

To illustrate the potential impact of late payments, consider the following example: An entity with a franchise tax liability of $1,000 fails to pay by the due date. After one month, the penalty and interest charges amount to $22.50 ($1,000 x 1.5% x 1 month), bringing the total due to $1,022.50. If the entity continues to delay payment, the penalties and interest will continue to accumulate, potentially reaching substantial amounts.

Strategies for Effective Franchise Tax Management

Proper franchise tax management is crucial for businesses to maintain their good standing and avoid unnecessary penalties. Here are some strategies to ensure efficient and timely tax payments:

Set Reminders

Create a calendar reminder for your franchise tax due date, ensuring that you have ample time to prepare and pay the tax. Consider setting multiple reminders, including one a month before the deadline and another a week before, to avoid any last-minute rushes.

Utilize Automatic Payment Systems

If your business utilizes accounting software or banking platforms with automatic payment features, consider setting up recurring payments for your franchise tax. This ensures that the tax is paid on time, every time, without manual intervention.

Stay Informed

Keep abreast of any changes in franchise tax laws, regulations, or deadlines. The state of Delaware may occasionally update its tax policies, and staying informed ensures that your business remains compliant with the latest requirements.

Engage Professional Assistance

If you’re unsure about the franchise tax process or have complex corporate structures, consider engaging the services of a tax professional or corporate lawyer. They can provide expert guidance and ensure that your tax obligations are met accurately and efficiently.

The Impact of Non-Compliance

Non-compliance with franchise tax obligations can have severe consequences for businesses. Beyond the financial penalties and interest charges, entities may face administrative dissolution, which revokes their right to conduct business in the state. This can lead to significant legal and operational challenges, impacting the entity’s reputation and ability to function.

Additionally, non-compliance can hinder future business opportunities. Many potential partners, investors, and clients conduct thorough due diligence, and a history of non-compliance can raise red flags, potentially leading to lost opportunities and damaged relationships.

Potential Outcomes of Non-Compliance:

- Administrative dissolution of the entity

- Revocation of the certificate of incorporation or organization

- Inability to conduct business in Delaware

- Legal and financial penalties

- Damage to the entity’s reputation and credibility

Conclusion: A Commitment to Compliance

The payment of franchise tax is a critical aspect of maintaining a business’s good standing in Delaware. By understanding the process, deadlines, and potential consequences, businesses can navigate this responsibility with confidence and efficiency. Whether through online, mail-in, or in-person methods, timely payment ensures compliance and allows entities to focus on their core operations.

As a business owner or manager, it's essential to prioritize franchise tax obligations and integrate them into your annual financial planning. By doing so, you demonstrate a commitment to compliance, uphold your entity's legal standing, and avoid unnecessary complications that could impact your business's growth and success.

What happens if I forget to pay the franchise tax on time?

+If you miss the franchise tax deadline, you will incur penalties and interest charges. The state imposes a 1.5% monthly penalty on the unpaid tax amount, and interest accrues at 0.75% per month. It’s crucial to pay the tax as soon as possible to minimize these additional costs.

Can I pay the franchise tax in installments?

+No, the franchise tax is an annual payment and cannot be paid in installments. However, if you are facing financial difficulties, you may be able to request an extension or explore alternative payment plans with the Division of Corporations.

Are there any tax breaks or incentives for paying the franchise tax early?

+Delaware does not offer specific tax breaks or incentives for early payment of the franchise tax. However, paying the tax promptly demonstrates your commitment to compliance and can help avoid potential penalties and interest charges.