Whats The Property Tax In Orlando

Property taxes in Orlando, Florida, are an important aspect of homeownership and financial planning. The property tax system in Florida is unique and differs from many other states. Understanding how property taxes work and what factors influence them is crucial for homeowners and prospective buyers. In this comprehensive guide, we will delve into the intricacies of property taxes in Orlando, shedding light on the assessment process, tax rates, exemptions, and strategies to manage your tax obligations effectively.

Understanding Property Taxes in Orlando

In Orlando and throughout Florida, property taxes are primarily levied by local governments, including counties and municipalities. These taxes are a significant source of revenue for local services, such as schools, roads, emergency services, and other public amenities. The property tax system in Florida is known for its complex nature, with various factors influencing the final tax bill.

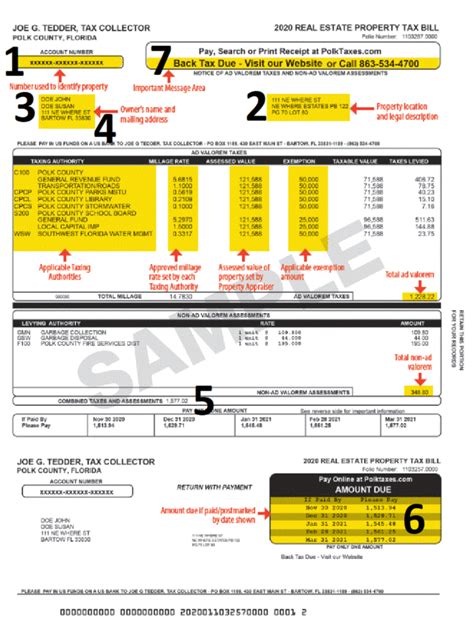

The property tax rate in Orlando is determined by a combination of factors, including the millage rate set by local authorities and the assessed value of the property. The millage rate represents the tax rate per $1,000 of assessed value. It is expressed in mills, where one mill equals $1 for every $1,000 of assessed value. The assessed value of a property is typically based on its market value, taking into account factors like location, size, and condition.

The property tax calculation in Orlando can be summarized as follows:

Property Tax = Assessed Value x Millage Rate

For example, if your property has an assessed value of $250,000 and the millage rate is 10 mills, your property tax would be calculated as:

Property Tax = $250,000 x 0.010 = $2,500

Property Tax Assessment Process

The property tax assessment process in Orlando involves several key steps. The Orange County Property Appraiser’s Office is responsible for assessing the value of properties within the county. This office conducts regular appraisals to determine the market value of properties, which forms the basis for the assessed value.

The assessment process typically includes the following stages:

- Property Inspection: Property appraisers may physically inspect your property to assess its condition, size, and any improvements made. This inspection helps determine the property's fair market value.

- Market Analysis: The appraiser's office compares your property to similar properties that have recently sold in the area. This analysis helps establish a benchmark for your property's value.

- Assessment Notice: Once the assessment is complete, you will receive a notice from the property appraiser's office. This notice will include the assessed value of your property and any changes from the previous year.

- Appeal Process: If you disagree with the assessed value, you have the right to appeal. The appeal process allows you to present evidence and arguments to support a lower assessed value.

It's important to note that property assessments are typically conducted annually, and the assessed value may change based on market conditions and improvements made to your property.

Property Tax Rates in Orlando

The property tax rate in Orlando is determined by the local government, specifically the Orange County Commission. The millage rate is set annually and can vary depending on the needs and budget of the county. Here is an overview of the property tax rates in Orlando as of the latest available information:

| Taxing Authority | Millage Rate (Mills) |

|---|---|

| Orange County | 6.7736 |

| Orange County School Board | 7.7992 |

| Orlando Fire Department | 0.4360 |

| Orlando Utilities Commission | 1.6732 |

| Total Millage Rate | 17.2710 |

It's important to note that the total millage rate may vary depending on the specific location of your property within Orlando and any additional taxing authorities that may apply. It's advisable to consult with local authorities or tax professionals for the most accurate and up-to-date information on property tax rates.

Property Tax Exemptions and Relief

Florida offers several property tax exemptions and relief programs to eligible homeowners. These exemptions can significantly reduce the assessed value of your property, resulting in lower property taxes. Here are some of the key exemptions available in Orlando:

Homestead Exemption

The Homestead Exemption is one of the most widely utilized property tax exemptions in Florida. It provides a reduction in the assessed value of your primary residence. To qualify for the Homestead Exemption, you must meet the following criteria:

- You must own and occupy the property as your primary residence.

- You must be a Florida resident.

- The property must be your permanent residence.

The Homestead Exemption reduces the assessed value of your property by up to $50,000, resulting in lower property taxes. Additionally, Florida offers a portable Homestead Exemption, allowing you to transfer the exemption to a new primary residence if you move within the state.

Senior Exemption

Florida also offers a Senior Exemption for homeowners who are 65 years of age or older. This exemption provides a reduction in the assessed value of your property, further lowering your property taxes. To qualify for the Senior Exemption, you must meet the following requirements:

- You must be at least 65 years old.

- You must have owned and occupied the property as your primary residence for at least five consecutive years.

Other Exemptions

Florida provides additional exemptions for certain circumstances, including:

- Total and Permanent Disability Exemption: For homeowners who are permanently and totally disabled.

- Widow/Widower Exemption: For surviving spouses of deceased homeowners.

- Low-Income Senior Exemption: For low-income seniors who meet specific income criteria.

It's important to consult with the Orange County Property Appraiser's Office or a tax professional to determine your eligibility for these exemptions and understand the application process.

Managing Your Property Taxes

Effective property tax management is essential for homeowners in Orlando. Here are some strategies to consider:

Stay Informed

Keep yourself updated on any changes in property tax rates, exemptions, and assessment procedures. Attend local government meetings or follow official websites for announcements and updates.

Understand Your Assessment

Carefully review your property assessment notice. Ensure that the assessed value accurately reflects the current market value of your property. If you disagree with the assessment, gather evidence and consider appealing the decision.

Explore Exemptions

Research and apply for property tax exemptions for which you may be eligible. The Homestead Exemption and other exemptions can provide significant savings on your property taxes.

Consider Payment Options

Explore payment options to manage your property tax obligations. Many counties offer convenient payment plans or the option to pay in installments. Additionally, consider setting aside funds specifically for property taxes to avoid unexpected expenses.

Consult a Professional

If you have complex tax situations or need expert advice, consider consulting a tax professional or accountant who specializes in property taxes. They can provide personalized guidance and help you optimize your tax strategy.

Future Implications and Conclusion

Property taxes in Orlando are subject to change, and local governments may adjust millage rates and assessment procedures over time. It’s important to stay informed about any proposed changes and their potential impact on your tax obligations. Additionally, the real estate market in Orlando is dynamic, and fluctuations in property values can influence your assessed value and subsequent property taxes.

Understanding the property tax landscape in Orlando empowers homeowners to make informed decisions and effectively manage their tax obligations. By staying proactive, exploring exemptions, and seeking professional guidance when needed, you can navigate the complexities of property taxes with confidence. Remember, property taxes are a vital component of homeownership, and staying informed is key to ensuring a stable and secure financial future.

What is the average property tax rate in Orlando, Florida?

+

As of the latest information, the average property tax rate in Orlando is approximately 1.25% of the assessed value of the property. However, it’s important to note that the rate can vary based on the location and specific taxing authorities within Orlando.

Are property taxes in Orlando higher or lower compared to other cities in Florida?

+

Property taxes in Orlando are generally considered average compared to other cities in Florida. However, it’s important to consider the specific location and any additional taxing authorities that may apply, as this can impact the overall tax rate.

How often are property taxes assessed in Orlando?

+

Property taxes in Orlando are typically assessed annually. The Orange County Property Appraiser’s Office conducts regular appraisals to determine the market value of properties, which forms the basis for the assessed value used to calculate property taxes.

Can I appeal my property tax assessment in Orlando?

+

Yes, you have the right to appeal your property tax assessment if you believe the assessed value is inaccurate or unfair. The appeal process allows you to present evidence and arguments to support a lower assessed value. It’s important to follow the guidelines and timelines set by the Orange County Property Appraiser’s Office for appealing your assessment.

Are there any property tax relief programs available in Orlando for low-income homeowners?

+

Yes, Florida offers the Low-Income Senior Exemption for homeowners who meet specific income criteria and are 65 years of age or older. This exemption provides a reduction in the assessed value of the property, resulting in lower property taxes. It’s important to consult with the Orange County Property Appraiser’s Office or a tax professional to understand the eligibility requirements and application process for this exemption.