Loudoun Taxes Personal Property

Understanding the intricacies of personal property taxes is crucial for every property owner, as it directly impacts their financial planning and overall tax obligations. In this comprehensive guide, we will delve into the world of personal property taxes in Loudoun County, shedding light on the processes, rates, and exemptions that affect residents and business owners alike.

The Fundamentals of Loudoun County Personal Property Taxes

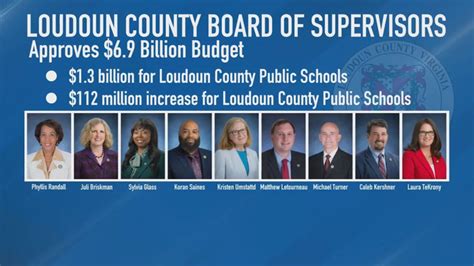

Loudoun County, located in Virginia, imposes personal property taxes on various assets owned by individuals and businesses within its jurisdiction. These taxes are a significant source of revenue for the county, contributing to the maintenance of public services and infrastructure. Let’s explore the key aspects of Loudoun County’s personal property tax system.

Taxable Property Categories

Loudoun County classifies personal property into several categories, each with its own assessment and taxation rules. The primary categories include:

- Vehicles: All privately owned vehicles, such as cars, trucks, motorcycles, and recreational vehicles, are subject to personal property taxes. The tax rate is determined by the vehicle’s make, model, and age.

- Boats and Aircraft: Owners of boats, planes, and other vessels must pay personal property taxes based on their assessed value and usage.

- Business Equipment and Machinery: Businesses operating in Loudoun County are required to declare and pay taxes on their tangible assets, including office equipment, machinery, and tools.

- Furniture and Fixtures: Certain types of furniture and fixtures used in commercial spaces may be taxable. However, residential furniture is generally exempt.

- Rental Properties: Personal property taxes may apply to rental properties, including furnishings and appliances provided by the landlord.

Assessment and Taxation Process

The Loudoun County Commissioner of the Revenue is responsible for assessing and collecting personal property taxes. Here’s an overview of the process:

- Assessment: Each year, property owners receive a notice of assessment, which details the taxable value of their personal property. The assessment is based on the property’s fair market value as of January 1st of the current tax year.

- Tax Rate Determination: The assessed value is multiplied by the applicable tax rate, which is set by the Loudoun County Board of Supervisors. The tax rate varies depending on the property type and its location within the county.

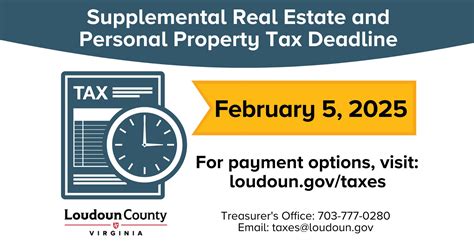

- Tax Bill: Property owners receive a tax bill, typically in July or August, detailing the amount due and the payment deadline. The bill includes information on payment options and any available exemptions or credits.

- Payment: Property owners have the option to pay their taxes in full or in installments. Late payments may incur penalties and interest charges.

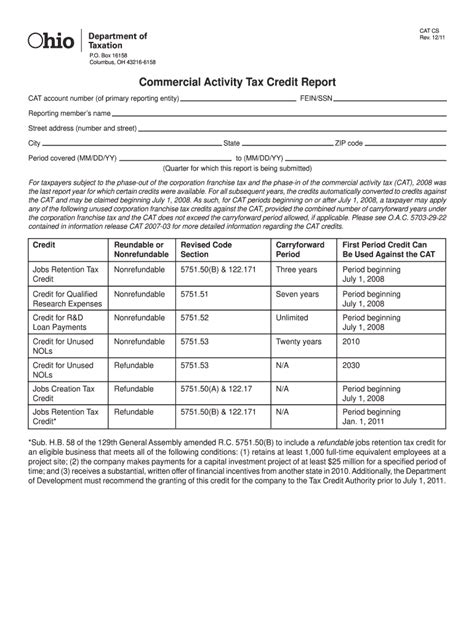

| Property Type | Assessment Ratio | Tax Rate (per $100 of Assessed Value) |

|---|---|---|

| Vehicles | 100% | Varies by jurisdiction |

| Boats and Aircraft | 50% | Varies by jurisdiction |

| Business Equipment | 100% | Varies by jurisdiction |

Exemptions and Credits

Loudoun County offers several exemptions and credits to alleviate the tax burden on certain property owners. Here are some notable exemptions:

- Vehicle Exemptions: Certain vehicles, such as historic vehicles, classic cars, and military vehicles, may be eligible for reduced tax rates or exemptions.

- Senior Citizen and Disabled Person Exemptions: Property owners who are 65 or older or permanently and totally disabled may qualify for reduced personal property taxes.

- Homestead Exemption: Loudoun County provides a homestead exemption, which reduces the assessed value of a primary residence by up to $500, resulting in lower property taxes.

- Military Exemptions: Active-duty military personnel stationed outside of Virginia may be exempt from personal property taxes on their vehicles.

Tax Relief Programs

Loudoun County recognizes the financial challenges that some property owners face and offers tax relief programs to provide assistance. These programs include:

- Land Preservation Tax Relief: Property owners who voluntarily place their land under a conservation easement may be eligible for reduced property taxes, encouraging the preservation of open spaces and natural resources.

- Senior Citizen and Disabled Person Tax Relief: Qualifying individuals may receive a reduction in their personal property taxes or have their taxes deferred until the property is sold or transferred.

- Low-Income Tax Relief: Low-income individuals and families may be eligible for tax relief based on their income and property value.

Staying Informed and Seeking Assistance

Navigating the intricacies of personal property taxes can be complex, but Loudoun County provides resources to assist property owners. The Commissioner of the Revenue’s office offers guidance and support, including:

- Online tax calculators to estimate tax liabilities.

- Detailed explanations of assessment processes and tax rates.

- Information on exemption eligibility and application procedures.

- Assistance with tax payment plans and resolving tax-related issues.

Conclusion

Understanding and managing personal property taxes is a critical aspect of financial responsibility for Loudoun County residents and business owners. By staying informed about the tax rates, assessment processes, and available exemptions, property owners can ensure they meet their tax obligations accurately and take advantage of any eligible tax relief programs. With a comprehensive understanding of the personal property tax system, individuals and businesses can contribute effectively to the community while maintaining their financial well-being.

When are personal property taxes due in Loudoun County?

+Personal property taxes in Loudoun County are typically due by August 31st of each year. However, it’s important to check the specific due date on your tax bill, as it may vary slightly from year to year.

How can I appeal my personal property tax assessment?

+If you believe your personal property tax assessment is incorrect, you have the right to appeal. The first step is to contact the Loudoun County Commissioner of the Revenue’s office to discuss your concerns. If an agreement cannot be reached, you can file a formal appeal with the Loudoun County Board of Equalization. The process involves submitting documentation to support your claim and attending a hearing to present your case.

Are there any penalties for late personal property tax payments?

+Yes, Loudoun County imposes penalties for late personal property tax payments. The penalty is typically 10% of the unpaid tax amount for the first month and an additional 10% for each subsequent month, up to a maximum of 100%. It’s important to pay your taxes on time to avoid these penalties and potential interest charges.

How can I estimate my personal property tax liability?

+Loudoun County provides an online tax calculator on its official website. You can use this calculator to estimate your personal property tax liability by inputting information about your property and its assessed value. This tool can help you plan your finances and understand your potential tax obligations.