Medicare Tax Limit 2025

In the world of healthcare and taxation, understanding the intricacies of Medicare is essential, especially when it comes to the Medicare tax limit. As we navigate through the year 2025, it's crucial to explore the latest updates and implications of this limit. The Medicare tax limit, often referred to as the "Medicare wage base" or "Social Security tax limit," is a significant factor in determining the contributions made by individuals and employers to support the Medicare program.

The Significance of the Medicare Tax Limit in 2025

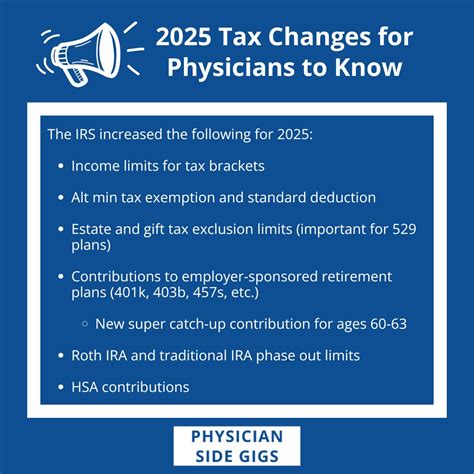

The Medicare tax limit serves as a critical benchmark for calculating the amount of tax that individuals and employers are required to pay towards Medicare coverage. This limit is adjusted annually, taking into account various economic factors and the need to sustain the Medicare program. As we step into 2025, let’s delve into the specific details and explore how this limit impacts individuals and the healthcare system as a whole.

Understanding the 2025 Medicare Tax Limit

For the year 2025, the Medicare tax limit has been set at $151,000. This means that any wages or self-employment income earned above this threshold are exempt from the Medicare tax. It’s important to note that this limit applies to both employees and self-employed individuals, ensuring fairness and consistency in tax contributions.

The 2025 Medicare tax limit marks a slight increase from the previous year, reflecting the need to adapt to changing economic conditions. This adjustment ensures that the Medicare program remains adequately funded while minimizing the tax burden on individuals with higher earnings.

Impact on Individuals and Employers

The Medicare tax limit directly affects individuals’ tax obligations and their contribution to the Medicare program. For those earning wages or self-employment income below the limit, the Medicare tax rate of 1.45% applies to their entire earnings. However, for individuals earning above the limit, the tax rate remains the same for the first $151,000 of income, and any additional income is exempt from the Medicare tax.

Employers also play a crucial role in contributing to Medicare through the Medicare tax. They are responsible for matching the employee's contribution, resulting in a combined tax rate of 2.9% on wages up to the limit. This shared responsibility ensures that the Medicare program is supported by both employees and employers, fostering a sustainable healthcare system.

The Role of Social Security Wage Base

It’s worth noting that the Medicare tax limit is closely tied to the Social Security wage base. The Social Security Administration sets the wage base, which serves as the maximum amount of earnings subject to Social Security taxes. In 2025, the Social Security wage base is set at $151,000, aligning with the Medicare tax limit.

The alignment of these limits simplifies the tax calculation process for individuals and employers. It ensures consistency in the tax treatment of earnings, providing clarity and ease in managing tax obligations.

Exemptions and Special Considerations

While the Medicare tax limit applies to most individuals and employers, there are certain exemptions and special considerations to be aware of. For instance, individuals who are self-employed and pay both the employee and employer portions of the Medicare tax may be eligible for a deduction on their tax returns.

Additionally, certain types of income, such as investment income or pension benefits, are not subject to the Medicare tax. Understanding these exemptions is crucial for individuals to accurately calculate their tax obligations and maximize their financial planning.

Future Outlook and Implications

As we move forward into 2025 and beyond, the Medicare tax limit will continue to play a vital role in shaping the financial landscape of the healthcare system. The annual adjustments to the limit reflect the dynamic nature of the economy and the need to adapt to changing demographics and healthcare costs.

Looking ahead, policymakers and healthcare experts will closely monitor the impact of the Medicare tax limit on the sustainability of the program. The limit's effectiveness in generating adequate revenue while maintaining fairness for individuals and employers will be a key focus. Balancing the need for sufficient funding with the financial well-being of taxpayers is a delicate task that requires ongoing evaluation and adjustments.

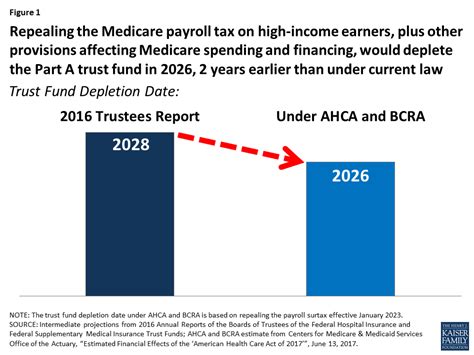

The Importance of Medicare Tax Reform

Discussions surrounding Medicare tax reform are likely to gain momentum as healthcare costs continue to rise. While the current Medicare tax limit provides a stable foundation for funding the program, there may be calls for alternative approaches to ensure long-term sustainability. Reform proposals could include adjustments to the tax rate, expansion of the tax base, or the introduction of new funding mechanisms.

The impact of any potential reforms on individuals and employers will be a critical consideration. Striking the right balance between generating sufficient revenue and minimizing the tax burden on taxpayers will be a complex challenge for policymakers.

Exploring Alternative Funding Models

Beyond tax reforms, there is also a growing interest in exploring alternative funding models for Medicare. These models aim to diversify the revenue streams and reduce the reliance on traditional tax contributions. For instance, some proposals suggest leveraging investments or implementing value-based healthcare models to generate additional funding.

However, the transition to alternative funding models requires careful consideration and planning. Ensuring the stability and accessibility of Medicare for all individuals, regardless of their financial circumstances, remains a top priority. Striking a balance between innovation and maintaining the core principles of the Medicare program will be a key challenge in the years to come.

Conclusion

The Medicare tax limit for 2025, set at $151,000, plays a pivotal role in shaping the financial landscape of the healthcare system. As we navigate through this year, it’s crucial to understand the impact of this limit on individuals, employers, and the overall sustainability of the Medicare program. With ongoing economic changes and evolving healthcare needs, the Medicare tax limit will continue to be a topic of discussion and analysis, shaping the future of healthcare funding.

How is the Medicare tax limit determined each year?

+The Medicare tax limit is adjusted annually by the Social Security Administration based on economic factors and the need to maintain adequate funding for the Medicare program. The limit is typically announced in the fall of the previous year to allow for proper planning.

What happens if an individual’s income exceeds the Medicare tax limit in 2025?

+If an individual’s income exceeds the Medicare tax limit of 151,000 in 2025, any earnings above this threshold are exempt from the Medicare tax. However, it's important to note that the individual is still responsible for paying the Medicare tax on the first 151,000 of income.

Are there any penalties for underpaying or overpaying the Medicare tax?

+Yes, there can be penalties for underpaying or overpaying the Medicare tax. Underpaying may result in additional taxes and interest, while overpaying may lead to a refund or a credit against future tax obligations. It’s crucial to accurately calculate and report the Medicare tax to avoid any penalties.