Tax Exempt Interest Income On 1040

Understanding the nuances of tax-exempt interest income is crucial for anyone filing their taxes, especially when it comes to reporting on Form 1040. This comprehensive guide will delve into the intricacies of tax-exempt interest, its implications for your tax return, and how to navigate this often-confusing topic with ease.

Tax-Exempt Interest Income: An Overview

Tax-exempt interest income refers to the earnings from investments that are not subject to federal income tax. This unique type of income is derived from specific types of investments, often associated with government entities or municipalities, which offer tax-free benefits to investors.

The primary purpose of tax-exempt interest is to encourage investment in public projects and services by making the returns more attractive to investors. This incentive structure has been a key driver in the development of various public infrastructures and has played a significant role in shaping the investment landscape for individuals and institutions alike.

While the concept of tax-exempt interest might seem straightforward, there are numerous complexities and considerations when it comes to reporting this income on your tax return. From determining the tax-exempt status of your interest income to calculating the appropriate deductions and credits, it's essential to have a comprehensive understanding of the process.

Key Considerations for Tax-Exempt Interest Income

When dealing with tax-exempt interest income, there are several critical factors to keep in mind. Firstly, not all interest income is created equal; only specific types of investments qualify for tax-exempt status. These typically include municipal bonds, certain government-issued securities, and some private activity bonds.

Secondly, the tax treatment of these investments can vary depending on various factors, including the investor's tax bracket, the duration of the investment, and the specific regulations governing the investment type. This variability underscores the importance of careful planning and understanding when dealing with tax-exempt interest.

Lastly, while tax-exempt interest provides significant benefits, it's essential to recognize that these advantages come with certain restrictions and limitations. For instance, the tax-exempt status may not apply to all investors, and there might be caps or limitations on the amount of tax-exempt interest one can earn in a given tax year.

Reporting Tax-Exempt Interest on Form 1040

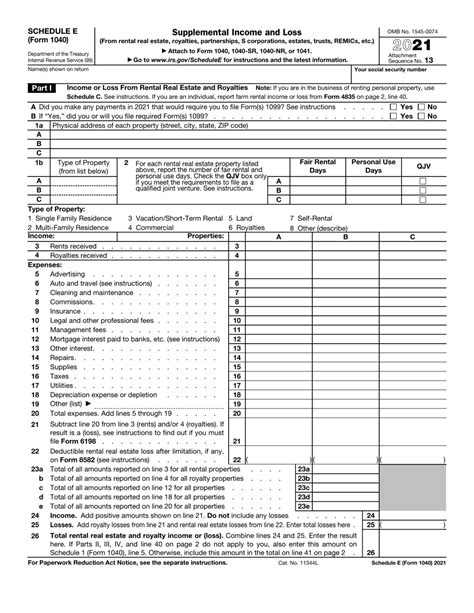

Form 1040, also known as the U.S. Individual Income Tax Return, is the primary form used by individuals to report their annual income and calculate their federal tax liability. When it comes to tax-exempt interest income, there are specific steps and considerations to keep in mind when completing this form.

Step-by-Step Guide to Reporting Tax-Exempt Interest

- Gather the Necessary Information: Before you begin, ensure you have all the relevant documents and information related to your tax-exempt interest income. This includes statements from your financial institutions, such as banks or brokerage firms, detailing the interest earned on your tax-exempt investments.

- Determine the Tax-Exempt Portion: Not all interest earned on tax-exempt investments is necessarily tax-exempt. You need to calculate the portion that qualifies for tax-exempt status. This typically involves understanding the tax rules associated with your specific investments and applying the appropriate calculations.

- Complete Schedule B: Schedule B, Interest and Ordinary Dividends, is where you report your interest income, including tax-exempt interest. On this schedule, you’ll list the total interest income from all sources, including tax-exempt interest. You’ll also indicate the amount of interest that is tax-exempt.

- Transfer to Form 1040: Once you’ve completed Schedule B, you’ll transfer the total interest income (including tax-exempt interest) to the appropriate line on Form 1040. This is typically Line 2a for tax year 2022 and beyond.

- Calculate Adjusted Gross Income (AGI): Tax-exempt interest income is included in your AGI calculation. AGI is an important figure as it determines your eligibility for various tax deductions and credits. Ensure you calculate AGI correctly by including tax-exempt interest in the appropriate section of Form 1040.

- Consider Additional Forms: In some cases, you might need to complete additional forms or schedules related to your tax-exempt interest income. For example, if you’ve earned interest from foreign financial institutions, you might need to file Form 8938, Statement of Specified Foreign Financial Assets.

Common Pitfalls and Best Practices

When reporting tax-exempt interest income, it’s crucial to avoid common pitfalls that could lead to errors or audits. Here are some best practices to keep in mind:

- Accuracy: Ensure that all the figures you report are accurate and match the documentation you have from your financial institutions. Any discrepancies could raise red flags with the IRS.

- Stay Informed: Tax laws and regulations can change frequently. Stay updated with the latest rules and guidelines related to tax-exempt interest to ensure you’re compliant with the current requirements.

- Seek Professional Advice: If you’re unsure about any aspect of reporting tax-exempt interest, consider seeking advice from a tax professional. They can provide guidance tailored to your specific situation and ensure you’re taking full advantage of the available benefits.

- Keep Records: Retain all your financial records related to tax-exempt interest for at least three years. This includes statements, receipts, and any other documentation that supports your reported income.

Maximizing Benefits and Minimizing Risks

Tax-exempt interest income can provide significant benefits, but it’s essential to navigate this area of taxation with caution. Here are some strategies to maximize your benefits while minimizing potential risks:

Strategies for Maximizing Benefits

- Diversify Your Portfolio: Diversifying your investments can help you take advantage of various tax-exempt opportunities while also reducing your overall risk. Consider a mix of municipal bonds, government securities, and other tax-exempt investments to optimize your returns.

- Understand Tax Brackets: Your tax bracket plays a significant role in determining the value of tax-exempt interest. By understanding your tax bracket and how it affects your overall tax liability, you can make more informed investment decisions.

- Explore Tax-Advantaged Accounts: Certain tax-advantaged accounts, such as 529 plans or Health Savings Accounts (HSAs), can offer tax-exempt benefits. Consider contributing to these accounts to further reduce your tax burden.

Mitigating Potential Risks

- Understand Limitations: While tax-exempt interest provides significant benefits, it’s essential to understand the limitations and restrictions associated with these investments. For instance, there might be limits on the amount of tax-exempt interest you can earn or restrictions on the types of investors who can benefit from tax-exempt status.

- Monitor Market Conditions: The tax treatment of certain investments can change based on market conditions and economic factors. Stay informed about these changes to ensure you’re not exposed to unexpected tax liabilities.

- Seek Professional Guidance: Complex tax scenarios, such as those involving tax-exempt interest, can be challenging to navigate alone. Consider working with a tax professional or financial advisor who can provide expert guidance and ensure you’re making the most of your investment opportunities while minimizing potential risks.

The Future of Tax-Exempt Interest

The landscape of tax-exempt interest is continually evolving, driven by changes in economic conditions, government policies, and market trends. While the fundamental benefits of tax-exempt interest are likely to remain, there might be shifts in the types of investments that qualify for tax-exempt status and the associated tax rules.

As we move forward, it's essential to stay informed about these changes and adapt our investment strategies accordingly. By staying ahead of the curve, we can continue to take advantage of the benefits of tax-exempt interest while navigating the potential challenges and complexities associated with this unique type of income.

Key Takeaways

In summary, tax-exempt interest income offers a range of benefits to investors, but it requires a thorough understanding of the associated tax rules and regulations. By carefully navigating the process of reporting tax-exempt interest on Form 1040, investors can maximize their benefits while minimizing potential risks.

This guide has provided a comprehensive overview of tax-exempt interest income, offering practical steps for reporting this income on Form 1040, along with strategies for maximizing benefits and mitigating risks. As you continue your financial journey, stay informed, seek professional guidance when needed, and make the most of the opportunities presented by tax-exempt interest.

How do I know if my interest income is tax-exempt?

+To determine if your interest income is tax-exempt, you need to understand the type of investment that generated the interest. Typically, interest from municipal bonds, certain government-issued securities, and some private activity bonds is tax-exempt. It’s essential to review the specific regulations associated with your investment to confirm its tax-exempt status.

Are there any limits on tax-exempt interest income?

+Yes, there are often limits on the amount of tax-exempt interest income you can earn in a given tax year. These limits can vary based on factors such as your filing status, adjusted gross income (AGI), and the specific type of investment. It’s crucial to understand these limits to ensure you remain compliant with the tax regulations.

Can I deduct tax-exempt interest from my taxable income?

+No, tax-exempt interest cannot be deducted from your taxable income. However, it’s included in your adjusted gross income (AGI), which can impact your eligibility for certain tax deductions and credits. It’s essential to understand how tax-exempt interest affects your AGI to ensure you’re optimizing your tax strategy.

What if I receive a 1099-INT for tax-exempt interest?

+If you receive a 1099-INT form from a financial institution, it’s essential to review the form carefully. While tax-exempt interest is typically not reported on a 1099-INT, there might be cases where a portion of the interest is taxable. Ensure you understand the breakdown of taxable and tax-exempt interest on the form and report it accurately on your tax return.

Can I claim tax-exempt interest on my state income tax return?

+The treatment of tax-exempt interest on state income tax returns can vary depending on your state’s tax laws. Some states may allow you to exclude tax-exempt interest from your state taxable income, while others might not. It’s crucial to consult your state’s tax guidelines or seek professional advice to understand the specific rules for your state.