St Louis City Sales Tax

Welcome to an in-depth exploration of the St. Louis City Sales Tax, a crucial aspect of doing business and living in the vibrant city of St. Louis, Missouri. As a complex and ever-evolving system, the sales tax landscape is an essential component of the city's economic framework, impacting both residents and businesses alike. In this comprehensive guide, we will delve into the intricacies of the St. Louis City Sales Tax, offering a clear understanding of its rates, rules, and regulations, and how they affect various industries and individuals.

Understanding the St. Louis City Sales Tax

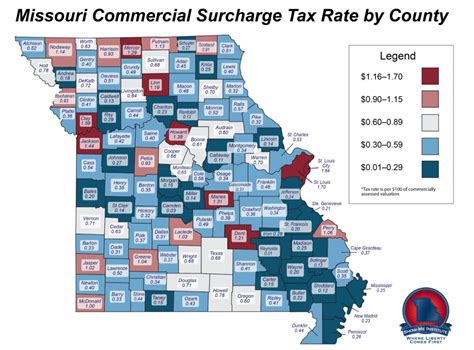

The sales tax in St. Louis City, Missouri, is a consumption tax levied on the purchase of goods and services within the city limits. It is an essential revenue stream for the city, contributing significantly to its budget and enabling the provision of public services, infrastructure development, and economic initiatives. The tax rate is a combination of state, county, and city taxes, each serving specific purposes and administered by different authorities.

Tax Rates and Structure

The sales tax rate in St. Louis City is composed of three primary components: the state sales tax, the county sales tax, and the city sales tax. As of the last official update, the state sales tax stands at 4.225%, while the county sales tax is 1.225%. However, the city sales tax, which is the focus of this article, varies depending on the specific location within the city.

| Sales Tax Jurisdiction | Sales Tax Rate |

|---|---|

| City of St. Louis | 3.25% |

| Other Cities in St. Louis County | 1.25% |

This variability in city sales tax rates is due to the city's unique position as an independent city, separate from St. Louis County. The city's higher sales tax rate is often used to fund specific city initiatives and services, providing an additional revenue stream to support the city's unique needs.

Taxable Items and Exemptions

In St. Louis City, like many other jurisdictions, not all goods and services are subject to the sales tax. Certain items, such as prescription medications, most non-prepared food items, and certain medical devices, are exempt from sales tax. Additionally, some services, like legal and accounting services, are generally not taxable. It’s important for businesses and consumers alike to understand these exemptions to ensure compliance and avoid unnecessary tax burdens.

Registration and Collection

For businesses operating within St. Louis City, sales tax registration is a crucial step. The Missouri Department of Revenue requires businesses to register for a sales tax permit if they meet certain criteria, such as having a physical presence in the state or conducting business that is considered taxable. Once registered, businesses are responsible for collecting and remitting the appropriate sales tax to the state on a regular basis, typically on a monthly or quarterly schedule.

The Impact on Businesses

The St. Louis City Sales Tax has a significant impact on local businesses, influencing their pricing strategies, competitive positioning, and overall financial health. Understanding the tax’s intricacies is crucial for businesses to maintain compliance, optimize their operations, and remain competitive in the local market.

Pricing and Profit Margins

When setting prices for their goods or services, businesses must consider the impact of sales tax. The sales tax rate directly affects the final price paid by consumers, influencing their purchasing decisions and, subsequently, a business’s revenue. Businesses must carefully calculate their profit margins to ensure they remain competitive while still generating sufficient revenue to cover their costs and expenses.

Compliance and Reporting

Compliance with sales tax regulations is a critical aspect of doing business in St. Louis City. Businesses must accurately collect and remit sales tax to the appropriate authorities, which involves a complex process of record-keeping, reporting, and payment. Failure to comply can result in penalties, interest charges, and even legal repercussions.

To ensure compliance, businesses often utilize sales tax software or outsourcing solutions to manage their sales tax obligations. These tools can automate tax calculation, filing, and payment processes, reducing the risk of errors and non-compliance.

Economic Development and Incentives

The sales tax revenue generated in St. Louis City plays a significant role in the city’s economic development initiatives. The city often utilizes these funds to invest in infrastructure, support local businesses, and attract new investments. This can create a more favorable business environment, leading to job creation, economic growth, and improved community well-being.

The Consumer Perspective

For residents and visitors to St. Louis City, understanding the sales tax is essential for making informed purchasing decisions and managing personal finances effectively. The tax can significantly impact the cost of living and consumer behavior, influencing where and how people shop.

Cost of Living and Budgeting

The sales tax is a significant component of the cost of living in St. Louis City. It directly affects the price of goods and services, impacting everything from groceries and clothing to dining out and entertainment. For residents, especially those on fixed incomes, understanding and budgeting for the sales tax is crucial to maintaining financial stability.

Shopping Decisions and Tax Avoidance

The sales tax can influence consumer behavior, with some individuals opting to shop in areas with lower tax rates or taking advantage of online shopping to avoid the tax altogether. This can impact local businesses and the city’s economy, highlighting the importance of a balanced and competitive tax structure.

Special Events and Tax Exemptions

St. Louis City often hosts special events and festivals, during which certain items may be exempt from sales tax. These tax-free events can provide significant savings for consumers and boost local businesses. It’s important for consumers to stay informed about these events and take advantage of the savings opportunities they offer.

Future Outlook and Potential Changes

The sales tax landscape in St. Louis City, like any other jurisdiction, is subject to change. As economic conditions evolve and new initiatives arise, the tax rates and regulations may be adjusted to meet the city’s evolving needs. Staying informed about potential changes is crucial for both businesses and consumers to adapt their strategies and ensure compliance.

Proposed Reforms and Initiatives

There are ongoing discussions and proposals for sales tax reforms in St. Louis City and Missouri as a whole. These reforms may include adjustments to tax rates, the introduction of new tax categories, or changes to the tax collection and reporting processes. It’s essential to stay updated on these potential changes to anticipate their impact on business operations and consumer behavior.

The Impact of Economic Trends

Economic trends, such as shifts in consumer spending patterns, the rise of e-commerce, and changes in the local business landscape, can influence the effectiveness and sustainability of the current sales tax system. As these trends evolve, the city may need to adapt its tax policies to maintain a stable revenue stream and support its economic goals.

How often are sales tax rates updated in St. Louis City?

+Sales tax rates in St. Louis City are typically updated annually or as needed to meet the city’s budgetary requirements. These updates are often tied to the city’s fiscal year, which runs from July 1st to June 30th. However, unexpected changes in economic conditions or city initiatives may prompt more frequent rate adjustments.

Are there any sales tax holidays in St. Louis City?

+Yes, St. Louis City, along with the rest of Missouri, observes several sales tax holidays throughout the year. These holidays typically occur around back-to-school season and offer consumers a tax-free period for purchasing certain items, such as school supplies, clothing, and shoes. These holidays provide significant savings for families and boost local retail sales.

How does St. Louis City’s sales tax compare to other major cities in Missouri?

+St. Louis City’s sales tax rate is relatively higher compared to other major cities in Missouri. For instance, Kansas City’s sales tax rate is 1.75%, while Springfield’s is 2.00%. This variability in tax rates across the state can influence consumer shopping behavior and business strategies, especially for businesses with operations in multiple cities.