Property Tax Exemptions In Texas

In the Lone Star State, property taxes are a significant concern for homeowners and businesses alike. The state's unique tax system and exemption laws can greatly impact an individual's or entity's financial planning and property ownership experience. Understanding the intricacies of Texas property tax exemptions is crucial for navigating this complex landscape effectively.

Navigating Texas Property Tax Exemptions: A Comprehensive Guide

Texas offers a range of property tax exemptions designed to provide relief to specific groups of taxpayers and promote certain social and economic goals. These exemptions can significantly reduce the taxable value of a property, leading to substantial savings on annual property tax bills. This guide will delve into the various types of exemptions available, the eligibility criteria, and the process of claiming them.

Residential Homestead Exemptions: A Cornerstone of Texas Property Tax Law

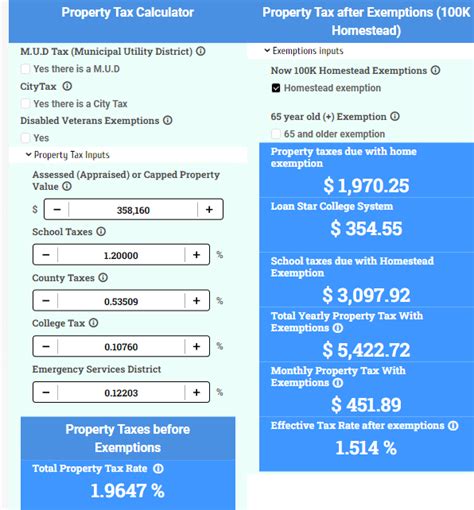

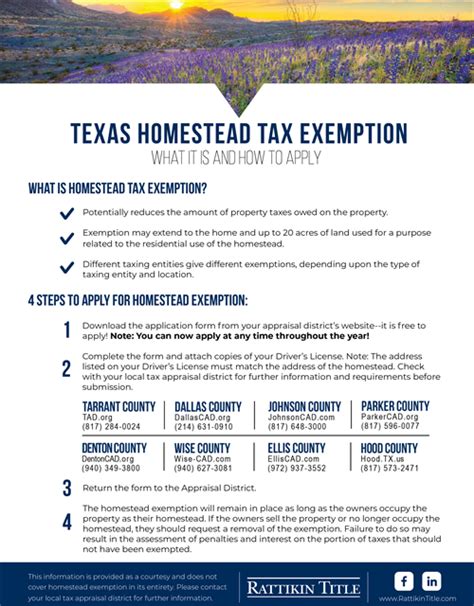

The Residential Homestead Exemption is perhaps the most well-known and widely utilized exemption in Texas. It applies to properties used as the primary residence of the homeowner. This exemption reduces the taxable value of the home by a fixed amount, which, as of 2023, is set at $25,000 for school taxes and $30,000 for other local taxing entities.

To qualify for this exemption, the homeowner must meet certain criteria, including occupying the property as their principal residence on January 1 of the tax year and maintaining ownership throughout the entire year. The exemption is automatically renewed each year unless there is a change in the property's ownership or use.

In addition to the standard residential exemption, Texas also offers an Enhanced Homestead Exemption for qualifying homeowners aged 65 or older. This exemption provides an additional reduction in taxable value, offering even greater savings for eligible seniors.

Exemptions for Veterans and Active Military Personnel

Texas shows its appreciation for those who have served in the military through a series of property tax exemptions. Texas Property Tax Code Chapter 31 offers a variety of benefits, including the Disability Exemption for veterans with service-connected disabilities and the Total Disability Exemption for veterans who are 100% disabled. These exemptions can result in a full or partial waiver of property taxes.

Active military personnel also benefit from tax relief. Texas provides a Military Exemption for those currently serving, which can be claimed in addition to other applicable exemptions. This exemption is particularly beneficial for military families who frequently relocate and may not qualify for the residential homestead exemption.

Property Tax Exemptions for Businesses and Non-Profit Organizations

Texas offers a range of exemptions for commercial properties and non-profit entities. The Freeport Exemption, for instance, provides a significant tax break for businesses that store, manufacture, or process goods in certain qualifying counties. This exemption can reduce the taxable value of the property by up to 100%, depending on the specific criteria met.

Non-profit organizations, including churches, schools, and charitable institutions, are also eligible for property tax exemptions. These entities must demonstrate that their property is used exclusively for the organization's purposes and not for private gain. The Non-Profit Organization Exemption can provide complete relief from property taxes, allowing these organizations to focus their resources on their missions.

| Exemption Type | Applicable Entity | Tax Reduction |

|---|---|---|

| Residential Homestead | Homeowners | $25,000-$30,000 |

| Enhanced Homestead | Seniors (Age 65+) | Additional Reduction |

| Disability Exemption | Veterans with Service-Connected Disabilities | Partial or Full Waiver |

| Military Exemption | Active Military Personnel | Additional Relief |

| Freeport Exemption | Businesses | Up to 100% |

| Non-Profit Organization Exemption | Charitable Institutions, Churches, Schools | Complete Relief |

The Application Process: How to Claim Property Tax Exemptions in Texas

Claiming property tax exemptions in Texas typically involves completing an application with the local appraisal district. The application process can vary depending on the type of exemption and the specific county. It's important to note that exemptions must be claimed annually, and missing the deadline could result in forfeiture of the exemption for that tax year.

For homeowners, the process usually involves submitting an Application for Residential Homestead Exemption form to the appraisal district by a specified deadline, typically around April or May. This form requires personal information, details about the property, and a declaration of the property's use as a primary residence.

Businesses and non-profit organizations may need to provide additional documentation to support their exemption claims. This could include articles of incorporation, proof of non-profit status, or details about the property's use and ownership.

The Impact of Property Tax Exemptions on Local Communities

Property tax exemptions in Texas have a significant impact on local communities and their ability to fund essential services. While exemptions provide much-needed relief to qualifying taxpayers, they also reduce the tax base, potentially impacting the availability of resources for schools, fire departments, and other vital public services.

To mitigate these effects, Texas has implemented various measures, including the School Tax Relief (STR) program, which provides additional funding to school districts to help offset the loss of revenue from homestead exemptions. Additionally, the Local Optional Homestead Exemption allows local taxing units to offer their own homestead exemptions, providing further relief to homeowners.

Future Implications and Ongoing Tax Reform Efforts

The landscape of property tax exemptions in Texas is continually evolving, with ongoing legislative efforts to reform and improve the system. Recent years have seen proposals for a flat tax rate, the expansion of certain exemptions, and the implementation of new relief programs.

One notable proposal is the Property Tax Reform and Relief Act, which aims to provide greater transparency and predictability in property tax assessments. This act would also introduce new homestead exemption levels and implement a cap on the increase in taxable value for homesteads. These reforms are designed to provide greater stability and relief for Texas homeowners.

As the state continues to grow and its population dynamics shift, the need for effective property tax exemptions and reform becomes increasingly crucial. Staying informed about these changes and understanding the specific exemptions available can empower Texans to make the most of the benefits offered by their state's tax system.

Conclusion: A Complex but Navigable Landscape

Texas' property tax exemption system is complex, but with the right knowledge and resources, it can be navigated effectively. By understanding the various exemptions, eligibility criteria, and application processes, homeowners, businesses, and non-profits can take advantage of the savings and relief these exemptions provide. As the state moves forward with tax reform initiatives, staying updated on these changes will be key to maximizing tax benefits and contributing to a fair and sustainable tax system.

Can I apply for multiple property tax exemptions simultaneously?

+Yes, it is possible to apply for multiple exemptions as long as you meet the eligibility criteria for each. For example, a homeowner who is also a veteran or active military member could potentially qualify for both the residential homestead exemption and the military exemption.

What happens if I move or sell my property during the tax year?

+If you sell or move out of your property during the tax year, you should notify the appraisal district as soon as possible. The homestead exemption will be prorated for the time you owned the property, and any overpayment will be refunded.

Are there any penalties for claiming an exemption I’m not eligible for?

+Yes, intentionally claiming an exemption for which you’re not eligible can result in penalties and interest. It’s crucial to accurately assess your eligibility and provide truthful information on your application to avoid these consequences.