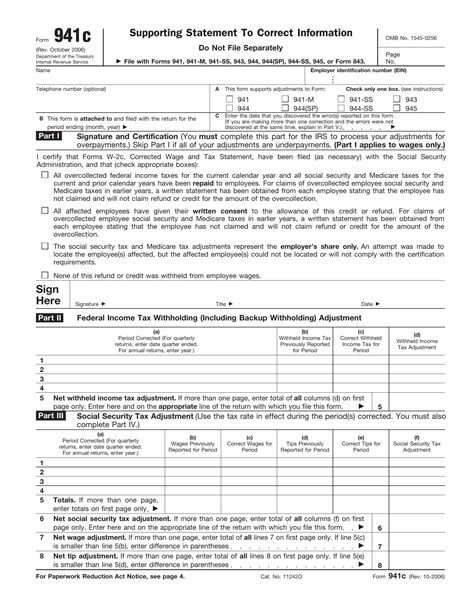

941C Tax Form

Welcome to a comprehensive guide on the 941C Tax Form, a critical document for employers in the United States. The 941C form is an essential tool for reporting and managing federal employment taxes, ensuring compliance with the Internal Revenue Service (IRS). In this article, we will delve into the intricacies of this form, providing you with a detailed understanding of its purpose, requirements, and best practices for completion.

Understanding the 941C Tax Form

The 941C Tax Form, officially known as the “Employer’s Federal Tax Return for COVID-19-Related Refund of Employment Tax Credits”, is a specialized tax form introduced by the IRS in response to the COVID-19 pandemic. It serves a vital role in helping employers claim tax credits and refunds related to certain employment tax provisions under the Coronavirus Aid, Relief, and Economic Security (CARES) Act and subsequent legislative packages.

This form is designed for employers who have paid qualified wages, health plan expenses, and certain other compensation to employees during periods when their operations were partially or fully suspended due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings due to COVID-19.

Key Features and Purpose

- Eligibility: The 941C form is intended for employers who meet specific eligibility criteria, including having experienced business disruptions or closures due to COVID-19 orders.

- Tax Credits: It allows eligible employers to claim tax credits for qualified wages, health plan expenses, and other eligible compensation paid during designated periods.

- Refund Option: Employers can use this form to request a refund of employment taxes paid in excess of the tax credits claimed.

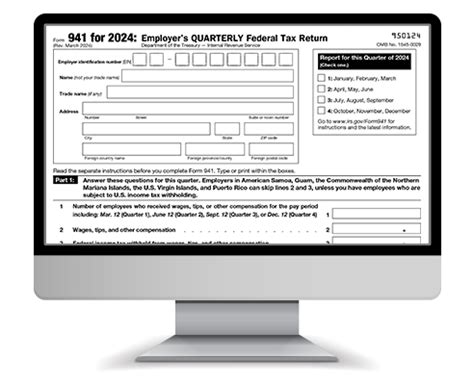

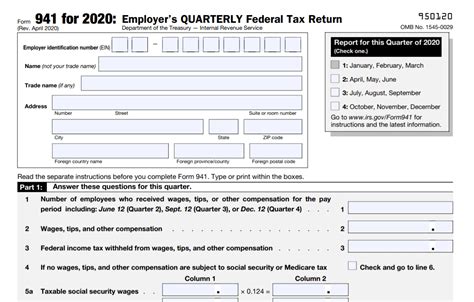

- Filing Frequency: The 941C form is typically filed quarterly, coinciding with the employer’s regular Form 941 filing schedule.

Eligibility and Qualifications

Not all employers are eligible to use the 941C Tax Form. The IRS has established specific criteria to determine eligibility, which primarily revolves around the impact of COVID-19 on an employer’s operations.

Key Eligibility Factors

- COVID-19 Impact: Employers must have experienced a significant decline in business operations due to COVID-19 orders. This includes full or partial suspensions of operations, reduced gross receipts, or other specified factors.

- Taxable Periods: The form applies to specific taxable periods designated by the IRS, typically corresponding to the periods of business disruption.

- Qualified Wages: To be eligible for tax credits, employers must have paid qualified wages during the designated periods. Qualified wages include compensation paid to employees who are not providing services due to COVID-19-related circumstances.

- Health Plan Expenses: Employers can also claim tax credits for health plan expenses related to employee group health plans.

| Eligibility Category | Qualifying Criteria |

|---|---|

| COVID-19 Impact | Full or partial suspension of operations, gross receipts reduction, or other specified factors. |

| Taxable Periods | Designated periods set by the IRS, typically coinciding with business disruptions. |

| Qualified Wages | Wages paid to employees not providing services due to COVID-19. |

| Health Plan Expenses | Expenses related to employee group health plans. |

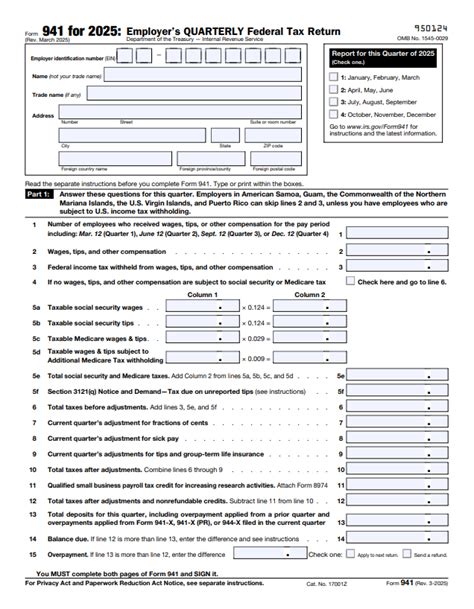

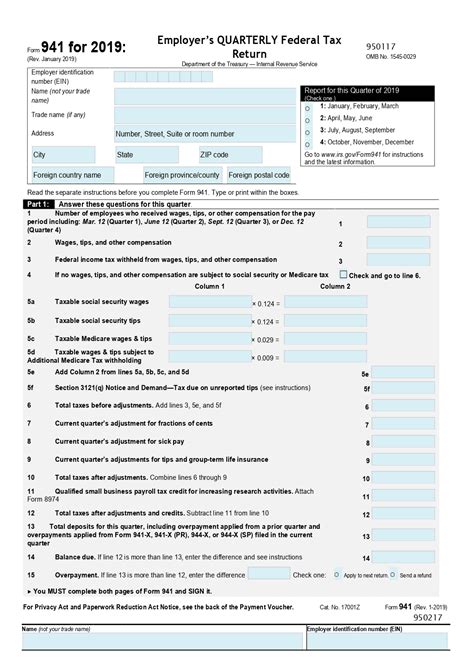

Completing the 941C Form

Completing the 941C Tax Form accurately is crucial to ensure employers receive the tax credits and refunds they are entitled to. Here’s a step-by-step guide to help you navigate the form:

Step 1: Gather Necessary Information

- Collect payroll records and employee data for the designated taxable periods.

- Identify qualified wages, health plan expenses, and other eligible compensation paid during these periods.

- Ensure you have accurate tax deposit information for the applicable periods.

Step 2: Calculate Tax Credits

Use the IRS guidelines and worksheets to calculate the tax credits you are eligible for. This involves determining the qualified wages, health plan expenses, and other eligible compensation that qualify for the credits.

Step 3: Complete the Form

- Fill out the form with accurate information, including employer identification numbers, taxable periods, and tax credits claimed.

- Provide detailed information about the qualified wages, health plan expenses, and any other eligible compensation.

- Calculate the total tax credits claimed and ensure it aligns with your calculations.

Step 4: Review and Submit

Double-check the completed form for accuracy. Ensure all fields are filled out correctly and all required information is included. Submit the form to the IRS according to the specified filing deadlines.

Filing Deadlines and Penalties

Meeting the filing deadlines for the 941C Tax Form is essential to avoid penalties and ensure timely processing of your tax credits and refunds.

Quarterly Filing Deadlines

The 941C form is typically filed quarterly, with deadlines aligned with the employer’s regular Form 941 filing schedule. The specific deadlines for each quarter are as follows:

- First Quarter: April 30th

- Second Quarter: July 31st

- Third Quarter: October 31st

- Fourth Quarter: January 31st (of the following year)

Late Filing Penalties

Failing to file the 941C form by the due date can result in penalties. The IRS imposes a late filing penalty of 5% of the unpaid tax amount for each month the form is late, up to a maximum of 25% of the unpaid tax.

Interest on Unpaid Taxes

In addition to late filing penalties, the IRS may also charge interest on any unpaid taxes. The interest accrues from the original due date of the tax payment until the date the payment is made.

Frequently Asked Questions

What are the tax credits available through the 941C form?

+The 941C form allows employers to claim tax credits for qualified wages, health plan expenses, and certain other eligible compensation paid during designated periods when their operations were disrupted by COVID-19 orders.

How do I determine if my business is eligible for the tax credits?

+To be eligible, your business must have experienced a significant decline in operations due to COVID-19 orders, such as full or partial suspensions, reduced gross receipts, or other specified factors. Additionally, you must have paid qualified wages or health plan expenses during the designated taxable periods.

Can I claim tax credits for all my employees, or only those affected by COVID-19 disruptions?

+Tax credits are generally available for qualified wages paid to employees who are not providing services due to COVID-19-related circumstances. However, specific eligibility criteria may vary depending on the taxable period and other factors.

What happens if I miss the filing deadline for the 941C form?

+Missing the filing deadline can result in late filing penalties and interest on any unpaid taxes. It’s important to stay updated on the filing deadlines and plan accordingly to avoid penalties.

Is there any assistance available for completing the 941C form accurately?

+Yes, you can seek professional assistance from tax advisors or accountants who specialize in employment taxes. Additionally, tax preparation software can help streamline the process and ensure accuracy.

The 941C Tax Form plays a crucial role in helping employers navigate the complex landscape of COVID-19-related tax credits and refunds. By understanding the eligibility criteria, accurately completing the form, and meeting the filing deadlines, employers can maximize their tax benefits and support their businesses during these challenging times.