State Of Nm Tax Refund

For residents of the Land of Enchantment, the state of New Mexico tax refund is an important topic, especially as the tax season approaches. Understanding the ins and outs of tax refunds in New Mexico can help individuals and businesses navigate the tax landscape effectively and ensure they receive the refunds they are entitled to.

Navigating the New Mexico Tax Refund Process

New Mexico, like many other states, offers tax refunds to its residents and businesses as a means to provide financial relief and stimulate the local economy. The tax refund process in New Mexico is governed by the New Mexico Taxation and Revenue Department, which oversees the collection and distribution of taxes and ensures compliance with state tax laws.

The tax refund process in New Mexico typically begins with the filing of tax returns. Residents and businesses are required to submit their tax returns within the specified deadlines, which usually fall in the early months of the year. These returns serve as the basis for determining the amount of tax refund an individual or entity is eligible for.

One of the key factors influencing the state of New Mexico tax refund is the type of tax being considered. New Mexico has various taxes, including income tax, gross receipts tax (similar to sales tax), compensating tax, and various other specialized taxes. The refund process and eligibility criteria may vary depending on the specific tax being filed.

Income Tax Refunds

For individual taxpayers, income tax refunds are a common occurrence. These refunds arise when the total taxes paid by an individual exceed their tax liability for the year. This can happen due to various reasons, such as overpayment of estimated taxes, tax credits, deductions, or changes in personal circumstances that affect taxable income.

To claim an income tax refund in New Mexico, taxpayers must file a Form PIT-1, which is the individual income tax return. This form allows individuals to report their income, deductions, and credits, and calculate their tax liability. If the calculated tax is less than the amount already paid, the difference is eligible for a refund.

New Mexico offers a convenient e-file option for income tax returns, which can expedite the refund process. E-filing not only reduces the likelihood of errors but also enables faster processing and refund issuance. The state aims to issue refunds within 45 days of receiving a complete and accurate tax return.

| Income Tax Refund Timeline | Estimated Timeframe |

|---|---|

| Electronic Filing with Direct Deposit | 2-3 weeks |

| Paper Filing with Direct Deposit | 4-6 weeks |

| Paper Filing with Check | 6-8 weeks |

Gross Receipts Tax (GRT) Refunds

Businesses operating in New Mexico are subject to the Gross Receipts Tax, which is similar to a sales tax. GRT is applied to the gross receipts or sales made by businesses within the state. In certain cases, businesses may be eligible for GRT refunds if they have overpaid their taxes or have qualifying deductions.

To claim a GRT refund, businesses must file a Form GRT-14, which is the Gross Receipts Tax refund application. This form requires businesses to provide detailed information about their sales, purchases, and any applicable deductions or exemptions. The Taxation and Revenue Department reviews these applications and, if valid, issues refunds accordingly.

New Mexico encourages businesses to utilize the e-filing system for GRT refunds, as it simplifies the process and reduces processing time. The state aims to process GRT refund applications within 30 days of receipt, ensuring a relatively quick turnaround for businesses.

Specialized Tax Refunds

New Mexico has a range of specialized taxes, such as the compensating tax, severance tax, and various excise taxes. Each of these taxes has its own refund process and eligibility criteria. For instance, the compensating tax is a use tax applied to out-of-state purchases, and refunds may be available for overpayments or specific exemptions.

Taxpayers claiming refunds for specialized taxes must use the appropriate forms and provide detailed information supporting their refund claim. The Taxation and Revenue Department has specific guidelines and requirements for each type of tax, and taxpayers are advised to consult these guidelines to ensure a successful refund claim.

Maximizing Your New Mexico Tax Refund

While the state of New Mexico tax refund process is straightforward, there are certain strategies and considerations that can help taxpayers maximize their refunds.

Understanding Tax Credits and Deductions

New Mexico offers various tax credits and deductions that can significantly reduce taxable income and increase the likelihood of a refund. These include credits for child and dependent care, education expenses, property taxes, and various industry-specific deductions.

Taxpayers should carefully review the available credits and deductions and ensure they meet the eligibility criteria. Claiming all applicable credits and deductions can result in a larger refund or a reduced tax liability, providing much-needed financial relief.

Staying Informed about Tax Changes

Tax laws and regulations are subject to change, and keeping up-to-date with these changes is crucial for maximizing refunds. New Mexico occasionally introduces new tax credits, modifies existing ones, or adjusts tax rates. Being aware of these changes can help taxpayers take advantage of new opportunities or adjust their tax strategies accordingly.

The New Mexico Taxation and Revenue Department provides regular updates and announcements regarding tax law changes. Taxpayers are encouraged to subscribe to their newsletters or follow their official communication channels to stay informed.

Utilizing Tax Preparation Services

For individuals and businesses unsure about the tax refund process or complex tax situations, utilizing tax preparation services can be beneficial. These services, provided by tax professionals or accounting firms, can help ensure accurate tax filings and maximize refunds.

Tax preparation services can assist with identifying applicable tax credits and deductions, navigating complex tax scenarios, and ensuring compliance with state tax laws. While there may be a cost associated with these services, the potential benefits in terms of increased refunds and peace of mind can outweigh the expenses.

Avoiding Common Pitfalls in the Tax Refund Process

While the state of New Mexico tax refund process is designed to be straightforward, there are some common pitfalls that taxpayers should be aware of to avoid delays or issues with their refunds.

Accurate and Complete Information

One of the most critical aspects of the tax refund process is providing accurate and complete information. Inaccurate or incomplete tax returns can lead to delays, additional inquiries, or even denial of refunds. Taxpayers should double-check their calculations, ensure all relevant information is included, and verify their personal and financial data.

It is particularly important to accurately report income, deductions, and credits. Mistakes in these areas can have significant financial implications and may require additional documentation or amendments, prolonging the refund process.

Avoiding Scams and Fraud

Tax season is often a target for scammers and fraudsters. Taxpayers should be vigilant and cautious when it comes to their personal and financial information. The New Mexico Taxation and Revenue Department advises taxpayers to be wary of unsolicited emails, phone calls, or text messages claiming to be from the department or other tax authorities.

It is important to verify the legitimacy of any communication regarding taxes and never provide personal or financial information to unknown sources. Taxpayers should also be cautious of tax refund scams, where fraudsters pose as tax authorities and offer false refunds in exchange for personal details or financial transactions.

Following Up on Refund Status

While the state of New Mexico aims to process tax refunds promptly, there may be instances where refunds are delayed due to various reasons. Taxpayers should be proactive in following up on the status of their refunds, especially if the expected timeframe has passed.

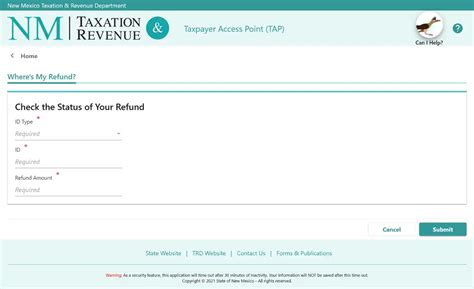

The New Mexico Taxation and Revenue Department provides online tools and resources for taxpayers to check the status of their refunds. By utilizing these tools, taxpayers can stay informed and take appropriate actions if their refund is delayed or requires additional documentation.

The Future of New Mexico Tax Refunds

As technology advances and tax landscapes evolve, the state of New Mexico tax refund process is likely to see improvements and changes. The department is continually working to enhance its systems and processes to provide a more efficient and user-friendly experience for taxpayers.

Digital Transformation

The trend towards digital transformation is likely to continue in New Mexico’s tax refund process. The state is investing in modernizing its systems, including online filing platforms and digital payment options. These improvements aim to streamline the refund process, reduce errors, and provide a more accessible experience for taxpayers.

Digital transformation also opens up opportunities for real-time data integration, enabling more accurate and efficient tax calculations. This can lead to quicker refunds and improved taxpayer satisfaction.

Enhanced Taxpayer Support

The New Mexico Taxation and Revenue Department is committed to providing excellent taxpayer support. As part of this commitment, the department is exploring ways to enhance its support services, including expanding its online resources, improving response times, and offering more personalized assistance.

By improving taxpayer support, the department aims to address common pain points and provide timely assistance to taxpayers, especially during peak tax seasons. This can help reduce taxpayer anxiety and ensure a smoother refund process.

Simplification of Tax Laws

Simplifying tax laws and regulations is a continuous effort for many states, including New Mexico. The state is exploring ways to make its tax code more straightforward and easier to understand for taxpayers. Simplification can lead to reduced compliance costs, increased taxpayer confidence, and a more efficient refund process.

Efforts to simplify tax laws may involve consolidating or eliminating certain taxes, streamlining tax forms, and providing clearer guidelines and instructions. These changes can benefit taxpayers by reducing the complexity of the tax refund process and making it more accessible.

Conclusion

The state of New Mexico tax refund process is a critical aspect of the state’s tax landscape. By understanding the process, utilizing available resources, and staying informed about tax laws and changes, taxpayers can navigate the refund process effectively and maximize their refunds.

As New Mexico continues to invest in digital transformation and taxpayer support, the tax refund process is expected to become even more efficient and user-friendly. With a combination of accurate tax filings, awareness of tax credits and deductions, and proactive follow-up, taxpayers can ensure a smooth and successful tax refund experience.

How do I check the status of my New Mexico tax refund?

+You can check the status of your New Mexico tax refund by visiting the Taxation and Revenue Department’s website and using their online refund status tool. You’ll need to provide your Social Security Number, date of birth, and the amount of your expected refund.

What if my tax refund is delayed or I haven’t received it within the expected timeframe?

+If your tax refund is delayed or you haven’t received it within the expected timeframe, you should contact the New Mexico Taxation and Revenue Department’s Refund Hotline. They will be able to provide you with an update on the status of your refund and assist you with any necessary follow-up actions.

Can I receive my tax refund as a direct deposit instead of a check?

+Yes, New Mexico offers the option of receiving your tax refund as a direct deposit. When filing your tax return, ensure you provide your banking information, including your routing and account numbers. Direct deposit is a faster and more secure way to receive your refund.

Are there any penalties for filing my tax return late in New Mexico?

+Yes, New Mexico imposes penalties for late filing of tax returns. The penalty amount varies based on the amount of tax owed and the length of the delay. It’s important to file your tax return on time to avoid these penalties and ensure a smooth refund process.