Mn Sales Tax On Cars

In the state of Minnesota, the sales tax on vehicles is an important consideration for car buyers and dealers alike. Understanding the tax implications can significantly impact the overall cost of purchasing a car and the associated financial obligations. This article delves into the intricacies of the Minnesota Sales Tax on Cars, providing a comprehensive guide for consumers and industry professionals.

Understanding the Minnesota Sales Tax

Minnesota, like many other states, imposes a sales tax on various goods and services, including the purchase of vehicles. The sales tax is a consumption tax, meaning it is levied on the sale of tangible personal property and certain services. The tax is calculated as a percentage of the purchase price and is added to the final cost of the vehicle.

The Minnesota Department of Revenue is responsible for administering and collecting the sales tax. The tax is applicable to both new and used vehicles, with specific rates and regulations that buyers should be aware of.

The Statewide Sales Tax Rate

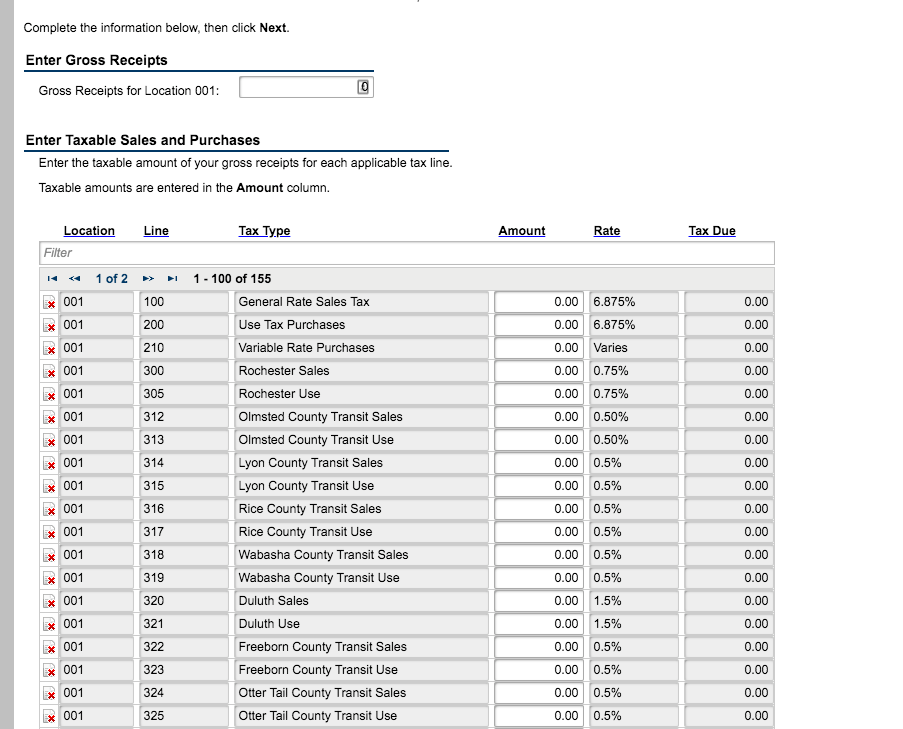

As of my last update in January 2023, the statewide sales tax rate in Minnesota is 6.875%. This rate is uniform across the state and is applied to most retail sales, including vehicles. However, it is important to note that local jurisdictions may impose additional taxes, resulting in a higher overall tax rate.

Local Sales Tax Variations

Minnesota allows local governments to levy their own sales taxes on top of the statewide rate. These local taxes can vary significantly, ranging from 0% to 1.25% depending on the county or municipality. For instance, the city of Minneapolis imposes an additional 0.5% sales tax, while certain suburban areas have their own unique rates.

These local variations can have a notable impact on the total sales tax paid, especially for residents living in areas with higher tax rates. It is crucial for car buyers to research the specific sales tax rates applicable to their location to understand the true cost of their vehicle purchase.

Calculating Sales Tax on Vehicles

To calculate the sales tax on a vehicle purchase in Minnesota, you can use the following formula:

| Vehicle Purchase Price | Sales Tax Rate | Sales Tax Amount |

|---|---|---|

| $[Vehicle Price] | 6.875% | $[Vehicle Price] * 0.06875 |

For example, if you are purchasing a car priced at $30,000, the sales tax calculation would be as follows:

$30,000 * 0.06875 = $2,062.50

So, the sales tax on a $30,000 vehicle would amount to $2,062.50 based on the statewide rate.

Exemptions and Special Considerations

While the general sales tax rate applies to most vehicle purchases, there are certain exemptions and special considerations that buyers should be aware of.

Trade-In Vehicles

If you are trading in your old vehicle as part of the purchase, the sales tax calculation can become more complex. Minnesota allows for a trade-in credit, which reduces the taxable value of the new vehicle. The trade-in credit is equal to the trade-in value of your old vehicle, up to the purchase price of the new vehicle.

For example, if you are trading in a vehicle valued at $5,000 towards the purchase of a $30,000 vehicle, the taxable value of the new vehicle would be $25,000 ($30,000 - $5,000). This can significantly reduce the sales tax owed.

Vehicle Registration and Title Fees

In addition to sales tax, buyers should also be aware of other fees associated with vehicle registration and titling. These fees vary depending on the type of vehicle and its weight class. The Minnesota Department of Public Safety provides detailed information on these fees, which are typically paid to the county where the vehicle will be registered.

Vehicle Purchase Incentives

Minnesota occasionally offers incentives or rebates for the purchase of certain vehicles, such as electric or hybrid cars. These incentives can reduce the overall cost of the vehicle and may impact the sales tax calculation. It is worth researching any available incentives before making a purchase.

Online Vehicle Purchases and Sales Tax

With the rise of online vehicle marketplaces, buyers often wonder how sales tax applies to online purchases. In Minnesota, the sales tax obligation still applies, even for online transactions. The seller is responsible for collecting and remitting the sales tax based on the buyer’s location.

If you purchase a vehicle online from an out-of-state dealer, the dealer is required to collect the sales tax at the time of sale. However, it is important to ensure that the dealer is properly licensed and compliant with Minnesota's tax laws to avoid any potential issues.

Sales Tax and Vehicle Financing

When financing a vehicle purchase, the sales tax is typically included in the overall loan amount. This means that the sales tax is paid upfront as part of the loan, rather than as a separate transaction. Buyers should carefully review their loan documentation to understand how the sales tax is incorporated into their financing terms.

Sales Tax for Business Purchases

Businesses purchasing vehicles in Minnesota may be eligible for certain tax exemptions or reduced rates. These exemptions typically apply to vehicles used exclusively for business purposes. It is advisable for businesses to consult with a tax professional to understand their specific tax obligations and potential savings.

Future Implications and Trends

The sales tax landscape in Minnesota is subject to change, and staying informed about any updates is crucial for both consumers and businesses. While the statewide rate remains stable, local jurisdictions may adjust their tax rates periodically. Additionally, changes in legislation or economic conditions can impact the tax structure.

As the automotive industry evolves, with a focus on electric and autonomous vehicles, tax policies may also adapt. For instance, some states are exploring road usage fees or mileage-based taxes as alternatives to traditional sales taxes. Minnesota may consider similar measures in the future to accommodate changing transportation trends.

Conclusion

Understanding the sales tax on cars in Minnesota is an essential aspect of the vehicle purchasing process. By being aware of the statewide and local tax rates, as well as any applicable exemptions or incentives, buyers can make more informed decisions and accurately budget for their vehicle acquisition. Staying up-to-date with tax regulations ensures a smoother and more transparent transaction for all parties involved.

How often are sales tax rates updated in Minnesota?

+Sales tax rates in Minnesota are generally updated annually, with any changes taking effect on January 1st of each year. However, local jurisdictions may adjust their rates more frequently, so it’s advisable to check with the specific county or municipality for the most current information.

Are there any online tools to estimate sales tax on vehicle purchases in Minnesota?

+Yes, the Minnesota Department of Revenue provides an online sales tax calculator that can help estimate the sales tax on vehicle purchases. This tool considers the statewide rate and allows users to input local tax rates to get a more accurate estimate.

What happens if I fail to pay the correct sales tax on my vehicle purchase?

+Failing to pay the correct sales tax can result in penalties and interest charges. It is important to accurately calculate and remit the sales tax to avoid legal consequences and ensure compliance with Minnesota’s tax laws.

Are there any resources for businesses to understand their sales tax obligations for vehicle purchases in Minnesota?

+The Minnesota Department of Revenue provides comprehensive resources and guidelines specifically for businesses. These resources cover sales tax registration, collection, and reporting requirements, ensuring businesses are aware of their obligations and potential exemptions.