New York State Tax Refund Status

Are you eagerly awaiting your New York State tax refund? Understanding the status of your refund can provide valuable insights and peace of mind. In this comprehensive guide, we will delve into the intricacies of tracking and managing your New York State tax refund. From the initial filing process to the various stages of refund processing, we will cover everything you need to know to stay informed and make the most of your refund.

The New York State Tax Refund Process

The journey of your tax refund begins with the timely filing of your New York State tax return. Whether you choose to file electronically or opt for traditional paper filing, the state's tax agency, the New York State Department of Taxation and Finance, is responsible for processing your return and issuing your refund.

Upon receiving your tax return, the Department of Taxation and Finance undergoes a meticulous review process to ensure accuracy and compliance with state tax laws. This review involves verifying your personal information, income details, deductions, and credits claimed. It is crucial to provide accurate and complete information to expedite the processing of your refund.

Key Stages of Refund Processing

The refund process can be divided into several stages, each with its own timeline and factors influencing the speed of refund issuance. Understanding these stages can help you manage your expectations and track the progress of your refund.

- Acceptance and Review: Once your tax return is received, it undergoes an initial acceptance check. The state tax agency verifies basic information, such as your identity and the validity of your social security number. If your return passes this initial check, it moves to the review stage.

- Review and Processing: During this stage, the Department of Taxation and Finance conducts a thorough review of your tax return. They examine your income, deductions, and credits to ensure compliance with state tax regulations. This stage may involve additional time if there are discrepancies or missing information.

- Refund Issuance: Once your tax return is approved and all necessary verifications are completed, the state tax agency proceeds with refund issuance. The method of refund payment, either by direct deposit or check, can influence the speed of receipt. Direct deposit refunds are typically faster, while check refunds may take additional time to process and deliver.

Tracking Your New York State Tax Refund

Staying informed about the status of your tax refund is essential. New York State provides convenient online tools and resources to help taxpayers track the progress of their refunds. By utilizing these resources, you can obtain up-to-date information and avoid unnecessary speculation or anxiety.

Online Refund Tracking Tools

The New York State Department of Taxation and Finance offers an online refund status lookup tool, accessible through their official website. This tool allows taxpayers to input their personal information, such as their social security number and tax year, to retrieve real-time refund status updates.

Additionally, the state tax agency provides a mobile app, My NY Tax, which offers convenient access to refund status updates and other tax-related services. The app is available for both iOS and Android devices, ensuring accessibility for taxpayers on the go.

Other Methods of Tracking

If online tracking is not feasible or preferred, alternative methods are available. Taxpayers can choose to receive refund status updates via phone or mail. The Department of Taxation and Finance provides a dedicated phone line for refund inquiries, where taxpayers can speak with customer service representatives and obtain the latest information.

Additionally, the state tax agency may send refund status updates through postal mail. These updates often include important details such as the expected refund amount, processing status, and any additional information taxpayers may need to know.

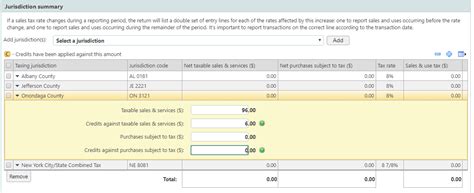

| Tracking Method | Description |

|---|---|

| Online Tool | Provides real-time refund status updates through the official website. |

| Mobile App | Offers convenient access to refund status and tax services on iOS and Android devices. |

| Phone | Dedicated phone line for refund inquiries and updates. |

| Postal Mail | Updates on refund status and relevant information sent through traditional mail. |

Factors Affecting Refund Speed

The speed at which your tax refund is processed and issued can vary based on several factors. Understanding these factors can help manage expectations and plan accordingly.

Filing Method and Timing

The method and timing of your tax filing can significantly impact the speed of your refund. Electronic filing, also known as e-filing, is generally faster than traditional paper filing. The state tax agency can process electronic returns more efficiently, resulting in quicker refunds.

Additionally, the timing of your tax filing can affect refund speed. Early filers often receive their refunds sooner, as the tax agency has more capacity to process returns during the initial stages of the tax season. However, it is important to note that even with early filing, various factors can influence the refund timeline.

Return Complexity and Errors

The complexity of your tax return and the presence of errors or discrepancies can also impact the speed of your refund. Returns with straightforward income, deductions, and credits are generally processed more quickly. On the other hand, returns with complex financial situations, multiple sources of income, or errors may require additional review, leading to delays in refund issuance.

Refund Payment Method

The method of refund payment you choose can influence the speed at which you receive your refund. Direct deposit is the fastest and most efficient way to receive your refund. By providing accurate banking information, your refund can be deposited directly into your account, typically within a few days of approval.

If you opt for a refund check, the processing and delivery time may be longer. The state tax agency must print and mail the check, which can take additional time. Once the check is issued, it may take several days to arrive at your mailing address.

Maximizing Your Tax Refund

Beyond understanding the refund process and tracking its status, there are strategies you can employ to maximize your tax refund. By taking advantage of available deductions, credits, and tax-saving opportunities, you can potentially increase the amount of your refund.

Common Deductions and Credits

New York State offers various deductions and credits that can reduce your tax liability and increase your refund. Some common deductions include those for medical expenses, state and local taxes, charitable contributions, and mortgage interest. It is important to carefully review your eligibility for these deductions and claim them accurately on your tax return.

Additionally, New York State provides credits for specific circumstances, such as the Child and Dependent Care Credit, the Education Credit, and the Low-Income Tax Credit. These credits can provide significant savings and contribute to a larger refund. Researching and understanding your eligibility for these credits is essential to maximizing your tax benefits.

Tax-Saving Strategies

Employing effective tax-saving strategies can further enhance your refund. One strategy is to maximize your retirement contributions. Contributions to tax-advantaged retirement accounts, such as 401(k)s or IRAs, can reduce your taxable income and potentially increase your refund. Consulting with a financial advisor or tax professional can provide personalized guidance on maximizing retirement savings and tax benefits.

Another strategy is to optimize your tax withholdings. Reviewing your W-4 form and adjusting your withholdings can ensure that you are neither overpaying nor underpaying taxes throughout the year. This can help strike a balance and potentially increase your refund or minimize your tax liability.

Addressing Refund Delays and Issues

Despite your best efforts, refund delays or issues may arise. Understanding the common causes of delays and knowing how to address them can help resolve potential problems efficiently.

Common Causes of Refund Delays

Refund delays can occur for a variety of reasons. Some common causes include errors or discrepancies in your tax return, missing or incomplete information, identity verification issues, or technical glitches in the tax agency's systems. Additionally, returns with complex financial situations or those requiring additional review may experience delays.

It is important to note that the current tax season may also impact refund timelines. During peak filing periods, the tax agency may experience a higher volume of returns, which can lead to longer processing times. Understanding these factors can help manage expectations and reduce frustration.

Resolving Refund Issues

If you encounter a refund delay or issue, there are steps you can take to resolve the problem. The first step is to verify the status of your refund using the online tracking tools or other methods mentioned earlier. This will provide you with up-to-date information and help identify the specific issue.

If your refund status indicates an error or discrepancy, review your tax return carefully. Compare the information you provided with your tax documents to identify any discrepancies. If necessary, amend your tax return to correct any errors or provide missing information.

In cases where your refund status shows that it is being held for further review, it is important to cooperate with the tax agency. Respond promptly to any requests for additional information or documentation. Providing the necessary details in a timely manner can help expedite the resolution process.

If you have exhausted all self-service options and are still experiencing refund delays or issues, it may be necessary to reach out to the New York State Department of Taxation and Finance directly. Their customer service representatives are trained to assist taxpayers and can provide further guidance and support.

Future Outlook and Improvements

The New York State tax refund process is continually evolving, with ongoing efforts to enhance efficiency and taxpayer experience. The state tax agency is committed to implementing technological advancements and process improvements to streamline refund issuance and provide better services to taxpayers.

Technological Advancements

The Department of Taxation and Finance is actively investing in technological upgrades to modernize its systems. These upgrades aim to improve the accuracy and speed of refund processing, as well as enhance the overall taxpayer experience. By leveraging advanced technologies, the state tax agency aims to reduce processing times and provide more efficient services.

Process Improvements

In addition to technological advancements, the state tax agency is also focused on process improvements. They are analyzing and refining various stages of the refund process to identify bottlenecks and areas for optimization. By streamlining procedures and implementing best practices, the agency aims to reduce refund delays and improve overall efficiency.

Taxpayer Education and Support

Recognizing the importance of taxpayer education, the New York State Department of Taxation and Finance is dedicated to providing comprehensive resources and support. They offer an extensive website with detailed information on tax laws, filing requirements, and refund status tracking. Additionally, the agency provides helplines and in-person assistance to address taxpayer inquiries and concerns.

By investing in taxpayer education and support, the state tax agency aims to empower taxpayers with the knowledge and tools they need to navigate the tax system effectively. This includes providing clear guidelines, easy-to-use resources, and accessible customer service to ensure a positive taxpayer experience.

Conclusion

Understanding the New York State tax refund process, tracking your refund status, and employing strategies to maximize your refund are essential steps in managing your finances effectively. By staying informed, utilizing available resources, and implementing tax-saving strategies, you can make the most of your tax refund and plan for your financial future.

Remember, the key to a smooth and timely refund process is accurate and complete tax filing, timely responses to any requests for information, and staying informed through the provided tracking tools. With a proactive approach and the right knowledge, you can navigate the New York State tax refund journey with confidence.

How long does it typically take to receive my New York State tax refund after filing?

+The timeline for receiving your refund can vary based on several factors, including the filing method, the complexity of your return, and the state’s tax season volume. Generally, electronic filers can expect to receive their refund within 2 to 4 weeks, while paper filers may take slightly longer, typically 4 to 6 weeks. However, it is important to note that these are estimated timelines, and actual processing times may vary.

Can I track my refund status if I filed my tax return electronically?

+Yes, you can track the status of your refund regardless of your filing method. The New York State Department of Taxation and Finance provides an online refund status lookup tool, accessible through their website. This tool allows you to input your personal information and retrieve real-time updates on the progress of your refund.

What should I do if I have not received my refund after the estimated timeline has passed?

+If you have not received your refund after the estimated timeline, it is recommended to verify the status of your refund using the online tracking tools or by contacting the Department of Taxation and Finance. They can provide you with specific information about your refund and assist in resolving any delays or issues.

Are there any deductions or credits available specifically for New York State taxpayers?

+Yes, New York State offers a range of deductions and credits to its taxpayers. Some common deductions include those for state and local taxes, real estate taxes, and certain medical expenses. Additionally, there are credits available for various circumstances, such as the Child and Dependent Care Credit, the Education Credit, and the Low-Income Tax Credit. It is important to review your eligibility and claim these deductions and credits accurately on your tax return.