Michigan Tax Payment

Michigan's tax system is a complex framework that impacts residents, businesses, and investors alike. Understanding the intricacies of tax payments in the Great Lakes State is crucial for financial planning and compliance. This comprehensive guide will delve into the specifics of Michigan tax payments, exploring the types of taxes, their calculation methods, payment options, and strategies for efficient management.

The Landscape of Michigan Taxes

Michigan’s tax system comprises a range of levies, each designed to fund various state initiatives and services. The primary taxes include:

- Income Tax: Levied on personal and business income, with rates varying based on earnings.

- Sales and Use Tax: Applied to the sale of goods and services, with some exemptions.

- Property Tax: Assessed on real estate and tangible personal property.

- Excise Taxes: Targeted taxes on specific goods like fuel, tobacco, and alcohol.

- Corporate Taxes: Imposed on business entities, with provisions for pass-through entities.

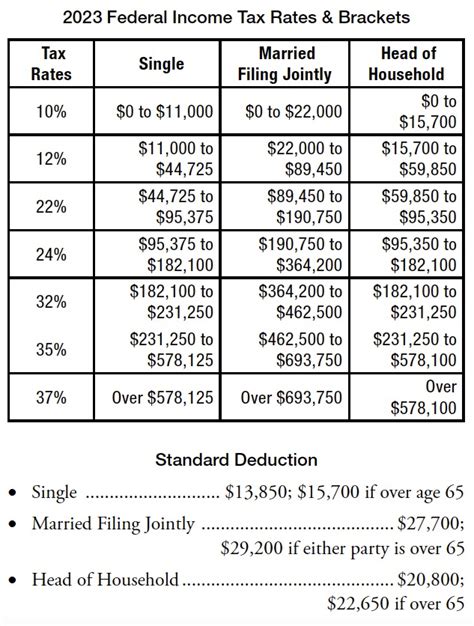

Income Tax: A Closer Look

Michigan’s income tax is a progressive tax, meaning rates increase with higher earnings. The state currently has a flat tax rate of 4.25% for individuals, trusts, and estates, while pass-through entities like partnerships and S-corporations have an additional 1.9% tax rate.

| Taxable Income | Tax Rate |

|---|---|

| $0 - $39,300 | 4.25% |

| $39,300 and above | 4.25% |

The income tax forms the backbone of Michigan's revenue stream, contributing significantly to state funds. However, navigating the nuances of tax brackets and deductions can be complex.

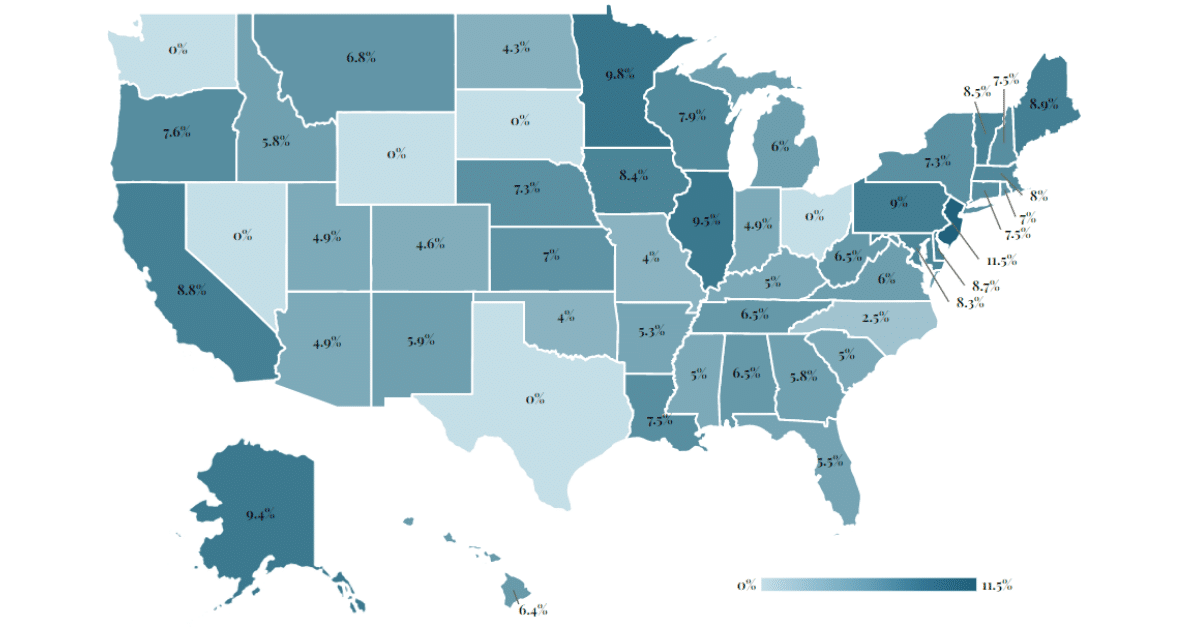

Sales and Use Tax: Understanding the Basics

Michigan’s sales and use tax is a consumption tax, applicable to the sale of most tangible personal property and some services. The current rate is 6%, with some local jurisdictions adding a 0.5% to 2% surcharge. This tax is a significant source of revenue for the state and local governments.

Use tax, often overlooked, is applied to purchases made outside Michigan but used within the state. This ensures that all purchases, regardless of origin, contribute to state revenue.

Strategies for Efficient Tax Payment

Managing Michigan’s tax landscape requires a strategic approach. Here are some tips to streamline the process:

- Online Filing and Payment: The Michigan Department of Treasury offers an online platform for tax filing and payment, making the process convenient and efficient.

- Timely Payments: Avoid penalties by ensuring all taxes are paid on time. The state offers a Payment Extension program for those who cannot pay their full tax liability by the due date.

- Tax Credits and Deductions: Research and utilize applicable tax credits and deductions to reduce your tax liability. Michigan offers a range of incentives for individuals and businesses.

- Professional Guidance: Consider seeking advice from tax professionals who can provide tailored strategies based on your financial situation.

Property Tax: A Complex Assessment

Property tax in Michigan is a significant consideration for homeowners and business owners. The tax is based on the assessed value of the property and is levied by local governments, including counties, cities, townships, and school districts.

The tax rate varies depending on the location and the type of property. For instance, residential properties may have different tax rates than commercial properties. Additionally, special assessments for services like water and sewer may be included in the property tax bill.

Navigating the property tax landscape requires an understanding of assessment procedures, appeal processes, and the impact of local millages. Staying informed about these aspects is crucial for property owners.

Excise Taxes: Targeted Levies

Michigan’s excise taxes are targeted taxes on specific goods and activities. These taxes are often used to discourage certain behaviors or fund specific programs. Some common excise taxes in Michigan include:

- Fuel Tax: Applied to the sale of gasoline and diesel fuel, with rates varying based on the type of fuel.

- Tobacco Tax: Levied on the sale of cigarettes and other tobacco products, with a separate tax for electronic smoking devices.

- Alcohol Tax: Imposed on the sale of beer, wine, and spirits, with rates differing for each category.

- Gaming Taxes: Applied to various forms of gambling, including casino gaming and online betting.

Understanding these excise taxes is crucial for businesses operating in these industries, as they can significantly impact profitability and compliance.

Corporate Taxes: Navigating Business Levies

Michigan’s corporate tax structure is designed to encourage business growth and investment. The state offers various tax incentives and credits for businesses, particularly those that create jobs and invest in the local economy.

For C-corporations, the tax rate is 6.9%, while S-corporations and other pass-through entities are taxed at 4.95%. This differential treatment aims to encourage certain business structures.

Businesses should also be aware of Michigan's Single Business Tax (SBT) and its impact on their operations. The SBT is a value-added tax on business activity, with rates varying based on factors like sales, payroll, and capital investments.

Future Outlook and Considerations

The Michigan tax landscape is subject to ongoing changes and reforms. As the state’s economy evolves, so too do its tax policies. Here are some key considerations for the future:

- Tax Reform: Michigan has been considering tax reform initiatives, including potential changes to income tax rates and structures. Staying updated on these proposals is crucial for financial planning.

- Economic Impact: Tax policies can significantly influence economic growth and investment. Businesses and individuals should monitor these impacts to make informed decisions.

- Legislative Changes: Keep an eye on legislative developments, as new laws and amendments can introduce changes to tax laws.

- Local Variations: Remember that Michigan's tax system can vary at the local level. Understanding these variations is essential for accurate tax planning.

What are the due dates for Michigan tax payments?

+Due dates vary based on the type of tax. For income tax, the deadline is typically April 15th, with extensions available. Sales tax returns are due on the 25th day of the month following the reporting period. Property taxes have varying due dates depending on the local government.

Are there any tax incentives or credits in Michigan?

+Yes, Michigan offers various tax incentives and credits to individuals and businesses. These include the Homestead Property Tax Credit, the Michigan Business Tax Credit, and the Michigan Economic Growth Authority (MEGA) Tax Credit. These incentives aim to promote economic growth and investment.

How can I stay updated on Michigan tax changes and reforms?

+Staying informed is crucial. Follow the Michigan Department of Treasury’s official website and social media channels for updates. Additionally, subscribe to tax newsletters and publications, and consider consulting tax professionals for personalized guidance.