San Bernardino County Sales Tax

In the vast and diverse landscape of San Bernardino County, California, the sales tax system plays a crucial role in the economic dynamics of the region. With its rich history, sprawling desert communities, and thriving metropolitan areas, understanding the intricacies of the sales tax is essential for both residents and businesses alike. This article delves into the specifics of San Bernardino County's sales tax, exploring its rates, applications, and implications for the local economy.

Unraveling the Sales Tax Structure in San Bernardino County

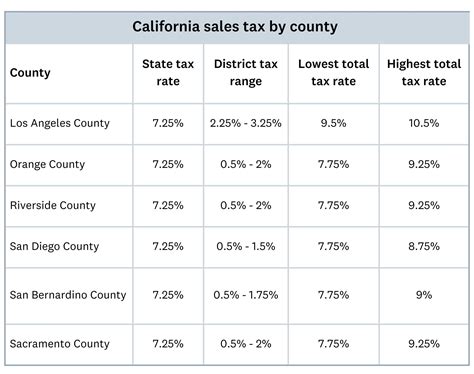

San Bernardino County boasts a unique sales tax structure that is both comprehensive and intricate. The county’s sales tax is composed of a combination of state, county, and city-specific taxes, each with its own designated rate. As of [current year], the state sales tax in California stands at 7.25%, providing a solid foundation for the county’s tax system. However, it is the additional local taxes that truly shape the sales tax landscape in San Bernardino County.

Countywide Sales Tax Rates

Across the county, a uniform 0.25% sales tax is levied on all transactions, ensuring a level playing field for businesses and a consistent revenue stream for local governments. This countywide tax is vital for funding essential services, infrastructure development, and community programs.

City-Specific Sales Taxes: A Varied Landscape

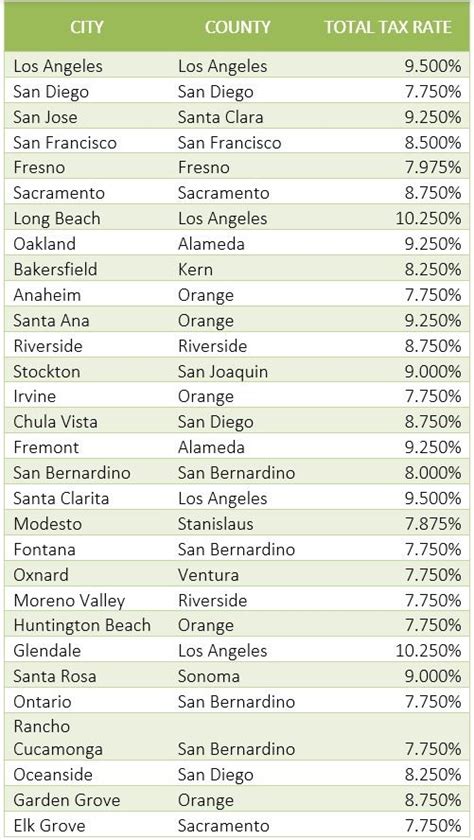

Venturing into the diverse cities and towns within San Bernardino County reveals a spectrum of sales tax rates. From the vibrant urban centers to the serene desert communities, each municipality has its own unique tax structure. Here’s a glimpse at the sales tax rates in some of the county’s prominent cities:

| City | Total Sales Tax Rate | City-Specific Tax Rate |

|---|---|---|

| San Bernardino | 9.25% | 2% |

| Ontario | 9% | 1.75% |

| Redlands | 8.75% | 1.5% |

| Rancho Cucamonga | 9% | 1.75% |

| Victorville | 8.25% | 1% |

| Apple Valley | 7.75% | 0.5% |

These varying tax rates reflect the diverse needs and priorities of each city. While some cities opt for higher taxes to fund ambitious development projects, others maintain lower rates to attract businesses and boost economic growth.

Sales Tax Exemptions: Navigating the Complexities

The sales tax system in San Bernardino County, like many other jurisdictions, offers a range of exemptions and special provisions. These exemptions are designed to promote certain industries, support specific community initiatives, and provide relief to targeted consumer groups. Understanding these exemptions is crucial for businesses and consumers alike, as they can significantly impact the overall tax burden.

Essential Goods and Services: Exemptions for the Community

San Bernardino County recognizes the importance of ensuring access to essential goods and services for its residents. As such, certain items are exempt from sales tax to make them more affordable and accessible. These include:

- Groceries and staple food items

- Prescription medications and certain medical devices

- Books and educational materials

- Clothing and footwear below a certain price threshold

- Certain agricultural supplies and equipment

By exempting these essential items, the county aims to reduce the financial burden on low-income households and promote access to basic necessities. This approach aligns with the county's commitment to fostering a thriving and inclusive community.

Industry-Specific Exemptions: Promoting Economic Growth

To encourage economic growth and innovation, San Bernardino County offers sales tax exemptions for specific industries. These exemptions aim to attract businesses, foster job creation, and stimulate the local economy. Some notable industry-specific exemptions include:

- Manufacturing equipment and machinery: Sales tax is often waived for businesses investing in new manufacturing facilities and equipment, promoting industrial growth.

- Research and development: Certain purchases related to research and development activities are exempt from sales tax, encouraging innovation and technological advancements.

- Energy-efficient technologies: To promote environmental sustainability, the county offers exemptions for energy-efficient appliances, solar panels, and other eco-friendly technologies.

These industry-specific exemptions not only benefit businesses but also contribute to the long-term economic health and sustainability of the county. By attracting businesses and fostering innovation, San Bernardino County positions itself as a competitive and forward-thinking region.

Sales Tax Collection and Compliance: A Critical Responsibility

With a complex sales tax system in place, ensuring compliance and accurate tax collection becomes a critical responsibility for both businesses and government entities. San Bernardino County has implemented robust measures to enforce sales tax regulations and promote fair taxation practices.

Tax Registration and Remittance

All businesses operating within San Bernardino County, regardless of their industry or size, are required to register with the California Department of Tax and Fee Administration (CDTFA). This registration process ensures that businesses obtain a valid tax permit and understand their tax obligations. The CDTFA provides comprehensive guidelines and resources to assist businesses in navigating the tax registration process.

Once registered, businesses are responsible for collecting the appropriate sales tax from customers and remitting it to the CDTFA on a regular basis. The frequency of tax remittance varies depending on the business's tax liability and sales volume. Some businesses may be required to remit taxes monthly, while others may have quarterly or annual remittance schedules.

Compliance Audits and Enforcement

To maintain a fair and transparent sales tax system, the CDTFA conducts regular compliance audits. These audits assess businesses’ compliance with tax regulations, including accurate tax collection, proper reporting, and timely remittance. The CDTFA employs a team of experienced auditors who review tax records, conduct on-site visits, and collaborate with businesses to ensure compliance.

In cases of non-compliance, the CDTFA has the authority to impose penalties and interest on businesses. These penalties can range from administrative fines to criminal charges, depending on the severity and nature of the violation. It is crucial for businesses to maintain accurate records, implement robust tax management systems, and seek professional guidance to ensure compliance and avoid potential penalties.

Impact on the Local Economy: A Balancing Act

The sales tax system in San Bernardino County plays a pivotal role in shaping the local economy. While it provides a steady revenue stream for essential services and infrastructure development, it also influences consumer behavior and business operations. Striking the right balance between taxation and economic growth is a delicate task that requires careful consideration and strategic planning.

Consumer Spending and Tax Burden

The sales tax directly impacts consumer spending habits and purchasing power. Higher tax rates can discourage consumers from making discretionary purchases, potentially impacting local businesses. On the other hand, lower tax rates can stimulate consumer spending, benefiting businesses and boosting the local economy.

San Bernardino County recognizes the delicate balance between taxation and consumer spending. By offering a range of sales tax rates across different cities, the county provides flexibility for businesses to cater to their target audience and optimize their pricing strategies. This approach allows for a diverse economic landscape, accommodating both high-end retailers and budget-friendly options.

Business Operations and Tax Management

For businesses operating in San Bernardino County, managing sales tax obligations is a critical aspect of their financial operations. The county’s diverse tax landscape, with its varying rates and exemptions, presents both opportunities and challenges. Businesses must navigate the complex tax system to ensure compliance, optimize tax liabilities, and maintain competitive pricing.

To streamline tax management, businesses often leverage technology and tax automation tools. These tools assist in calculating tax rates, generating accurate invoices, and ensuring timely tax remittance. By automating tax processes, businesses can reduce the risk of errors, improve efficiency, and focus on their core operations.

Infrastructure Development and Community Investments

The revenue generated from sales taxes is a significant source of funding for San Bernardino County’s infrastructure development and community initiatives. The county allocates these funds strategically to enhance public services, improve transportation networks, support education, and address social needs.

For instance, sales tax revenue may be directed towards:

- Upgrading roads, highways, and public transportation systems

- Expanding and modernizing schools and educational facilities

- Developing parks, recreational spaces, and cultural centers

- Investing in affordable housing initiatives

- Supporting social services and community programs

By allocating sales tax revenue effectively, San Bernardino County ensures the continuous improvement of its infrastructure and the overall well-being of its residents. This investment in community development fosters a sense of pride and contributes to the county's long-term economic prosperity.

Looking Ahead: Future Prospects and Challenges

As San Bernardino County continues to evolve and adapt to changing economic landscapes, the sales tax system will play a pivotal role in shaping its future. The county faces both opportunities and challenges as it navigates the complex dynamics of taxation, economic growth, and community development.

Potential Tax Reforms and Innovations

In response to evolving economic trends and community needs, San Bernardino County may consider tax reforms and innovations to enhance its sales tax system. These reforms could include:

- Exploring alternative tax structures, such as value-added tax (VAT) or a simplified flat tax rate, to streamline tax administration and reduce compliance burdens.

- Implementing targeted tax incentives or rebates to attract specific industries or promote economic diversification.

- Expanding sales tax exemptions to support emerging sectors, such as renewable energy or technology startups, to foster innovation and job creation.

By embracing tax reforms and innovations, San Bernardino County can position itself as a forward-thinking and competitive region, attracting investment and fostering long-term economic growth.

Addressing Economic Disparities and Social Inequalities

While the sales tax system provides a critical revenue stream for community development, it is essential to address economic disparities and social inequalities. San Bernardino County must ensure that the benefits of tax revenue are distributed equitably and reach those most in need.

To achieve this, the county can explore targeted initiatives, such as:

- Implementing progressive tax measures to alleviate the tax burden on low-income households and promote social equity.

- Investing in job training programs and workforce development initiatives to enhance employment opportunities for underserved communities.

- Collaborating with community organizations and social enterprises to address housing affordability, access to healthcare, and other social challenges.

By prioritizing social equity and community well-being, San Bernardino County can build a resilient and inclusive economy, ensuring that the benefits of economic growth are shared by all its residents.

How often are sales tax rates updated in San Bernardino County?

+

Sales tax rates in San Bernardino County are typically updated annually, with adjustments taking effect on January 1st. However, in certain exceptional circumstances, such as significant changes in state or local legislation, tax rates may be updated mid-year.

Are there any sales tax holidays in San Bernardino County?

+

San Bernardino County, along with the rest of California, does not observe sales tax holidays. However, the state may occasionally introduce specific tax exemptions or rebates for targeted items or periods to stimulate consumer spending.

How can businesses ensure they are compliant with San Bernardino County’s sales tax regulations?

+

Businesses can ensure compliance by registering with the California Department of Tax and Fee Administration (CDTFA), obtaining a valid tax permit, and staying updated on tax regulations. Regularly reviewing tax obligations, accurately collecting sales tax, and remitting taxes on time are essential for compliance. Utilizing tax management software and seeking professional advice can further support compliance efforts.