Pa Income Tax Rate

Welcome to a comprehensive guide on Pennsylvania's income tax system, designed to provide a detailed understanding of the state's tax rates and their implications for residents and businesses. Pennsylvania's tax landscape is an intricate one, with various rates and exemptions that can impact individual and corporate finances. This guide aims to demystify these complexities, offering a clear and concise breakdown of the state's income tax structure.

Understanding Pennsylvania’s Income Tax Rates

Pennsylvania’s income tax system operates on a flat rate basis, applying a consistent tax rate to all taxable income earned by individuals, trusts, and estates. This rate is set at 3.07% for the 2023 tax year, which is a slight increase from the previous year’s rate of 3.05%. This rate is applied to all taxable income, with no differentiation based on income brackets or tiers.

The flat tax rate simplifies the process for taxpayers, as they can calculate their tax liability by multiplying their taxable income by the tax rate. However, it's important to note that this flat rate does not account for federal income taxes or other deductions and credits that may be applicable.

Taxable Income Definition

In Pennsylvania, taxable income is defined as the net income derived from all sources within the state, including wages, salaries, business income, dividends, interest, and other forms of income. However, there are certain exemptions and deductions that can reduce the amount of income subject to taxation.

One notable exemption is for Social Security benefits. In Pennsylvania, Social Security benefits are exempt from state income tax, meaning they are not included in the calculation of taxable income. This exemption is a significant benefit for retirees and those receiving Social Security income.

| Income Category | Taxable Status |

|---|---|

| Wages and Salaries | Taxable |

| Business Income | Taxable |

| Dividends | Taxable |

| Interest Income | Taxable |

| Social Security Benefits | Exempt |

It's worth noting that Pennsylvania also offers various tax credits and deductions that can further reduce the tax burden for individuals and businesses. These include the Property Tax/Rent Rebate Program, which provides rebates to eligible taxpayers, and the Earned Income Tax Credit, which benefits low- to moderate-income working individuals and families.

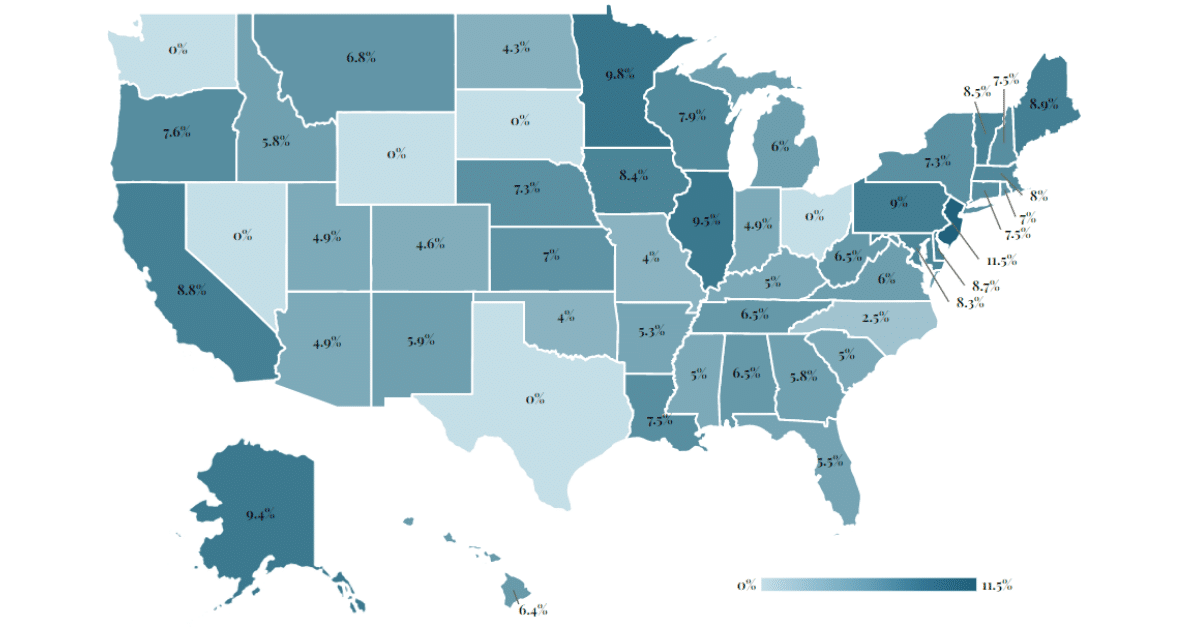

Comparative Analysis with Other States

When compared to other states, Pennsylvania’s flat tax rate of 3.07% positions it in the lower half of the spectrum. Many states have adopted progressive tax structures, where tax rates increase with higher income levels. Pennsylvania’s flat rate ensures a consistent tax burden across all income levels, which can be advantageous for those with lower or moderate incomes.

However, it's important to consider the overall tax climate of the state. Pennsylvania also levies local income taxes in addition to the state tax, which can significantly increase the overall tax burden. These local taxes can vary widely, with some municipalities imposing rates as high as 1.5%, bringing the total tax rate to 4.57% in certain areas.

| State | Income Tax Rate |

|---|---|

| California | 1-13.3% |

| New York | 4-8.82% |

| Florida | 0% |

| Texas | 0% |

| Pennsylvania | 3.07% |

While Pennsylvania's flat rate may seem competitive, the addition of local taxes can make it less attractive for businesses and individuals seeking a low-tax environment. It's crucial to consider the total tax burden, including both state and local taxes, when making financial and relocation decisions.

Impact on Businesses and Economic Development

The state’s income tax rate can have a significant impact on businesses operating within Pennsylvania. A relatively low tax rate can make the state more attractive for businesses, especially those with high payrolls or significant business income. It can lead to increased investment and job creation, benefiting the state’s economy.

However, the combination of state and local taxes can also deter businesses, particularly if the total tax burden becomes excessive. This is a delicate balance that Pennsylvania's policymakers must consider to ensure the state remains competitive in attracting and retaining businesses.

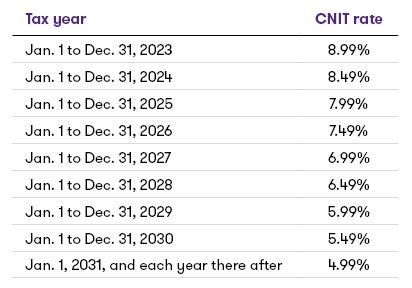

Future Implications and Potential Changes

The future of Pennsylvania’s income tax rate is subject to political and economic influences. While the state has maintained a relatively stable tax rate in recent years, there are ongoing debates about tax reform and potential changes to the tax structure.

Some proponents argue for a shift towards a progressive tax system, where higher income earners pay a higher tax rate. This could generate more revenue for the state, which could be used to fund essential services and infrastructure projects. However, such a change would require significant legislative action and may face opposition from those who prefer the simplicity and fairness of a flat tax.

Alternatively, there are discussions about reducing the flat tax rate to make Pennsylvania more competitive with neighboring states that have no income tax, like Delaware and Maryland. This could attract more businesses and individuals to the state, but it may also lead to a reduction in tax revenue, impacting the state's ability to fund public services.

The state's budgetary needs and economic climate will play a significant role in determining the future of its income tax rate. It's a complex decision that requires careful consideration of the state's financial health and its residents' and businesses' needs.

Potential Benefits and Challenges of Tax Reform

Implementing tax reform, whether it’s transitioning to a progressive tax system or reducing the flat tax rate, can bring both benefits and challenges. A progressive tax system could generate more revenue for the state, allowing for better funding of public services and infrastructure. It could also lead to a more equitable distribution of tax burdens, with higher-income earners contributing a greater share.

However, transitioning to a progressive system may face resistance from those who prefer a simpler tax structure. It could also result in higher taxes for some individuals, potentially leading to economic migration out of the state. On the other hand, reducing the flat tax rate could attract more businesses and individuals, but it may also reduce the state's revenue, impacting its ability to fund essential services.

Ultimately, the decision on tax reform will have significant implications for Pennsylvania's residents, businesses, and overall economic health. It's a delicate balance that requires thoughtful analysis and consideration of the state's unique circumstances.

Are there any income tax deductions or credits available in Pennsylvania?

+Yes, Pennsylvania offers various tax credits and deductions, including the Property Tax/Rent Rebate Program and the Earned Income Tax Credit. These can significantly reduce the tax burden for eligible individuals and businesses.

How does Pennsylvania’s income tax rate compare to neighboring states like New Jersey and Ohio?

+Pennsylvania’s flat tax rate of 3.07% is lower than New Jersey’s progressive tax rates (1.4-8.97%) but higher than Ohio’s flat tax rate of 2.8% (for 2023). The comparison can be complex due to varying tax structures and local tax rates.

What is the impact of local income taxes on Pennsylvania’s overall tax burden?

+Local income taxes can significantly increase the total tax burden in Pennsylvania. While the state tax rate is 3.07%, some municipalities impose additional rates, bringing the total tax rate to as high as 4.57% in certain areas.